September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

September - Tata AIA Life Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

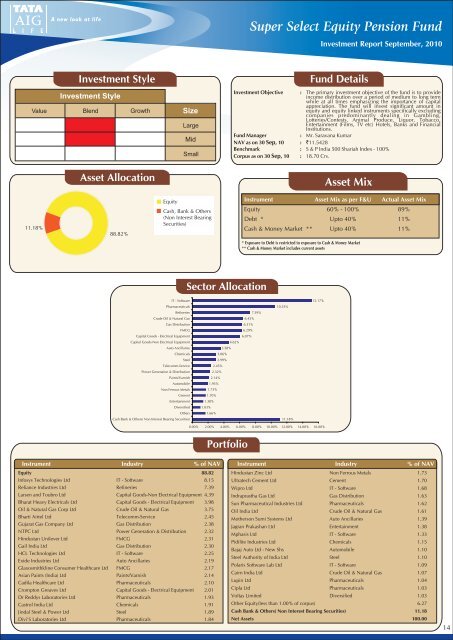

Super Select Equity Pension FundInvestment Report <strong>September</strong>, 2010Investment StyleInvestment StyleValue Blend GrowthAsset AllocationSizeLargeMidSmallFund DetailsInvestment Objective : The primary investment objective of the fund is to provideincome distribution over a period of medium to long termwhile at all times emphasizing the importance of capitalappreciation. The fund will invest significant amount inequity and equity linked instruments specifically excludingcompanies predominantly dealing in Gambling,Lotteries/Contests, Animal Produce, Liquor, Tobacco,Entertainment (Films, TV etc) Hotels, Banks and FinancialInstitutions.Fund Manager: Mr. Saravana KumarNAV as on 30 Sep, 10 : `11.5428Benchmark : S & P India 500 Shariah Index - 100%Corpus as on 30 Sep, 10 : 18.70 Crs.Asset Mix11.18%88.82%EquityCash, Bank & Others(Non Interest BearingSecurities)Instrument Asset Mix as per F&U Actual Asset MixEquity 60% - 100% 89%Debt * Upto 40% 11%Cash & Money Market ** Upto 40% 11%* Exposure to Debt is restricted to exposure to Cash & Money Market** Cash & Money Market includes current assetsSector AllocationIT - Software15.17%Pharmaceuticals10.55%Refineries7.39%Crude Oil & Natural Gas6.43%Gas Distribution6.31%FMCG6.29%Capital Goods - Electrical Equipment6.07%Capital Goods-Non Electrical Equipment4.62%Auto Ancillaries3.58%Chemicals3.06%Steel2.99%Telecomm-Service2.45%Power Generation & Distribution2.32%Paints/Varnish2.14%Automobile1.95%Non Ferrous Metals1.73%Cement1.70%Entertainment1.38%Diversified1.03%Others1.66%Cash Bank & Others( Non Interest Bearing Securities)11.18%0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%PortfolioInstrument Industry % of NAVEquity 88.82Infosys Technologies Ltd IT - Software 8.15Reliance Industries Ltd Refineries 7.39Larsen and Toubro Ltd Capital Goods-Non Electrical Equipment 4.39Bharat Heavy Electricals Ltd Capital Goods - Electrical Equipment 3.98Oil & Natural Gas Corp Ltd Crude Oil & Natural Gas 3.75Bharti Airtel Ltd Telecomm-Service 2.45Gujarat Gas Company Ltd Gas Distribution 2.38NTPC Ltd Power Generation & Distribution 2.32Hindustan Unilever Ltd FMCG 2.31Gail India Ltd Gas Distribution 2.30HCL Technologies Ltd IT - Software 2.25Exide Industries Ltd Auto Ancillaries 2.19Glaxosmithkline Consumer Healthcare Ltd FMCG 2.17Asian Paints (India) Ltd Paints/Varnish 2.14Cadila Healthcare Ltd Pharmaceuticals 2.10Crompton Greaves Ltd Capital Goods - Electrical Equipment 2.01Dr Reddys Laboratories Ltd Pharmaceuticals 1.93Castrol India Ltd Chemicals 1.91Jindal Steel & Power Ltd Steel 1.89Divi'S Laboratories Ltd Pharmaceuticals 1.84Instrument Industry % of NAVHindustan Zinc Ltd Non Ferrous Metals 1.73Ultratech Cement Ltd Cement 1.70Wipro Ltd IT - Software 1.68Indraprastha Gas Ltd Gas Distribution 1.63Sun Pharmaceutical Industries Ltd Pharmaceuticals 1.62Oil India Ltd Crude Oil & Natural Gas 1.61Motherson Sumi Systems Ltd Auto Ancillaries 1.39Jagran Prakashan Ltd Entertainment 1.38Mphasis Ltd IT - Software 1.33Pidilite Industries Ltd Chemicals 1.15Bajaj Auto Ltd - New Shs Automobile 1.10Steel Authority of India Ltd Steel 1.10Polaris Software Lab Ltd IT - Software 1.09Cairn India Ltd Crude Oil & Natural Gas 1.07Lupin Ltd Pharmaceuticals 1.04Cipla Ltd Pharmaceuticals 1.03Voltas Limited Diversified 1.03Other Equity(less than 1.00% of corpus) 6.27Cash Bank & Others( Non Interest Bearing Securities) 11.18Net Assets 100.0014