sercdp0172

sercdp0172

sercdp0172

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

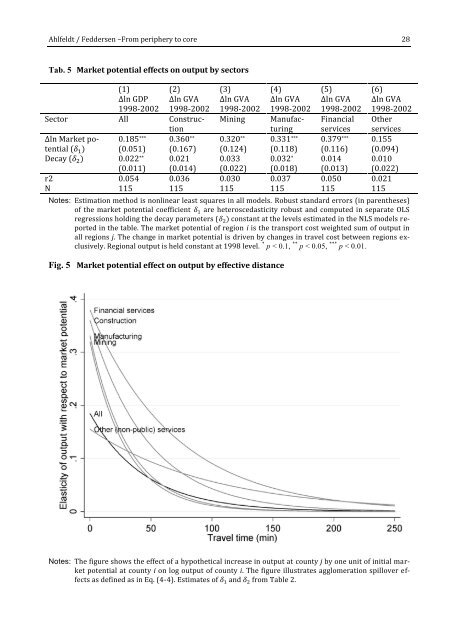

Ahlfeldt / Feddersen –From periphery to core 28Tab. 5 Market potential effects on output by sectors(1) (2) (3) (4) (5) (6)Δln GDP1998-2002Δln GVA1998-2002Δln GVA1998-2002Δln GVA1998-2002Δln GVA1998-2002Δln GVA1998-2002Sector All ConstructionMining ManufacturingFinancialservicesOtherservicesΔln Market potential(δ 1 )0.185 ***(0.051)0.360 **(0.167)0.320 **(0.124)0.331 ***(0.118)0.379 ***(0.116)0.155(0.094)Decay (δ 2 ) 0.022 ** 0.021 0.033 0.032 * 0.014 0.010(0.011) (0.014) (0.022) (0.018) (0.013) (0.022)r2 0.054 0.036 0.030 0.037 0.050 0.021N 115 115 115 115 115 115Notes: Estimation method is nonlinear least squares in all models. Robust standard errors (in parentheses)of the market potential coefficient δ 1 are heteroscedasticity robust and computed in separate OLSregressions holding the decay parameters (δ 2 ) constant at the levels estimated in the NLS models reportedin the table. The market potential of region i is the transport cost weighted sum of output inall regions j. The change in market potential is driven by changes in travel cost between regions exclusively.Regional output is held constant at 1998 level. * p < 0.1, ** p < 0.05, *** p < 0.01.Fig. 5 Market potential effect on output by effective distanceNotes: The figure shows the effect of a hypothetical increase in output at county j by one unit of initial marketpotential at county i on log output of county i. The figure illustrates agglomeration spillover effectsas defined as in Eq. (4-4). Estimates of δ 1 and δ 2 from Table 2.