AHMEDABAD - Gbic.co.in

AHMEDABAD - Gbic.co.in

AHMEDABAD - Gbic.co.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

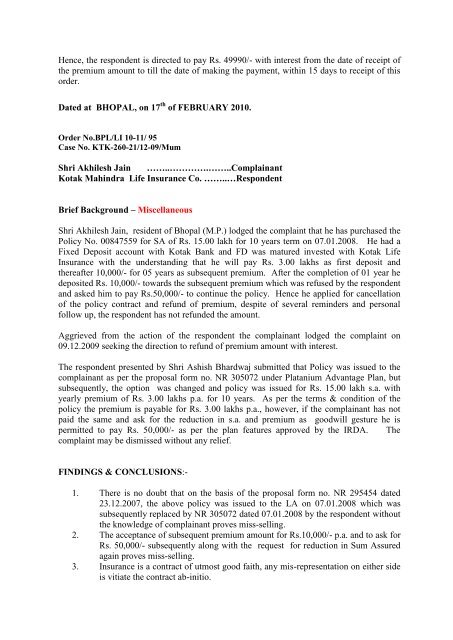

Hence, the respondent is directed to pay Rs. 49990/- with <strong>in</strong>terest from the date of receipt ofthe premium amount to till the date of mak<strong>in</strong>g the payment, with<strong>in</strong> 15 days to receipt of thisorder.Dated at BHOPAL, on 17 th of FEBRUARY 2010.Order No.BPL/LI 10-11/ 95Case No. KTK-260-21/12-09/MumShri Akhilesh Ja<strong>in</strong> ……..………….……..Compla<strong>in</strong>antKotak Mah<strong>in</strong>dra Life Insurance Co. ……..…RespondentBrief Background – MiscellaneousShri Akhilesh Ja<strong>in</strong>, resident of Bhopal (M.P.) lodged the <strong>co</strong>mpla<strong>in</strong>t that he has purchased thePolicy No. 00847559 for SA of Rs. 15.00 lakh for 10 years term on 07.01.2008. He had aFixed Deposit ac<strong>co</strong>unt with Kotak Bank and FD was matured <strong>in</strong>vested with Kotak LifeInsurance with the understand<strong>in</strong>g that he will pay Rs. 3.00 lakhs as first deposit andthereafter 10,000/- for 05 years as subsequent premium. After the <strong>co</strong>mpletion of 01 year hedeposited Rs. 10,000/- towards the subsequent premium which was refused by the respondentand asked him to pay Rs.50,000/- to <strong>co</strong>nt<strong>in</strong>ue the policy. Hence he applied for cancellationof the policy <strong>co</strong>ntract and refund of premium, despite of several rem<strong>in</strong>ders and personalfollow up, the respondent has not refunded the amount.Aggrieved from the action of the respondent the <strong>co</strong>mpla<strong>in</strong>ant lodged the <strong>co</strong>mpla<strong>in</strong>t on09.12.2009 seek<strong>in</strong>g the direction to refund of premium amount with <strong>in</strong>terest.The respondent presented by Shri Ashish Bhardwaj submitted that Policy was issued to the<strong>co</strong>mpla<strong>in</strong>ant as per the proposal form no. NR 305072 under Platanium Advantage Plan, butsubsequently, the option was changed and policy was issued for Rs. 15.00 lakh s.a. withyearly premium of Rs. 3.00 lakhs p.a. for 10 years. As per the terms & <strong>co</strong>ndition of thepolicy the premium is payable for Rs. 3.00 lakhs p.a., however, if the <strong>co</strong>mpla<strong>in</strong>ant has notpaid the same and ask for the reduction <strong>in</strong> s.a. and premium as goodwill gesture he ispermitted to pay Rs. 50,000/- as per the plan features approved by the IRDA. The<strong>co</strong>mpla<strong>in</strong>t may be dismissed without any relief.FINDINGS & CONCLUSIONS:-1. There is no doubt that on the basis of the proposal form no. NR 295454 dated23.12.2007, the above policy was issued to the LA on 07.01.2008 which wassubsequently replaced by NR 305072 dated 07.01.2008 by the respondent withoutthe knowledge of <strong>co</strong>mpla<strong>in</strong>ant proves miss-sell<strong>in</strong>g.2. The acceptance of subsequent premium amount for Rs.10,000/- p.a. and to ask forRs. 50,000/- subsequently along with the request for reduction <strong>in</strong> Sum Assuredaga<strong>in</strong> proves miss-sell<strong>in</strong>g.3. Insurance is a <strong>co</strong>ntract of utmost good faith, any mis-representation on either sideis vitiate the <strong>co</strong>ntract ab-<strong>in</strong>itio.