Review of the regulatory environment relative to Money Transfer ...

Review of the regulatory environment relative to Money Transfer ...

Review of the regulatory environment relative to Money Transfer ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

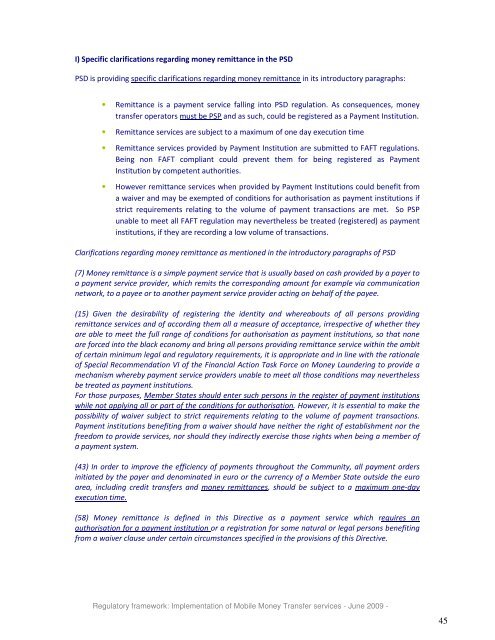

I) Specific clarifications regarding money remittance in <strong>the</strong> PSDPSD is providing specific clarifications regarding money remittance in its introduc<strong>to</strong>ry paragraphs:• Remittance is a payment service falling in<strong>to</strong> PSD regulation. As consequences, moneytransfer opera<strong>to</strong>rs must be PSP and as such, could be registered as a Payment Institution.• Remittance services are subject <strong>to</strong> a maximum <strong>of</strong> one day execution time• Remittance services provided by Payment Institution are submitted <strong>to</strong> FAFT regulations.Being non FAFT compliant could prevent <strong>the</strong>m for being registered as PaymentInstitution by competent authorities.• However remittance services when provided by Payment Institutions could benefit froma waiver and may be exempted <strong>of</strong> conditions for authorisation as payment institutions ifstrict requirements relating <strong>to</strong> <strong>the</strong> volume <strong>of</strong> payment transactions are met. So PSPunable <strong>to</strong> meet all FAFT regulation may never<strong>the</strong>less be treated (registered) as paymentinstitutions, if <strong>the</strong>y are recording a low volume <strong>of</strong> transactions.Clarifications regarding money remittance as mentioned in <strong>the</strong> introduc<strong>to</strong>ry paragraphs <strong>of</strong> PSD(7) <strong>Money</strong> remittance is a simple payment service that is usually based on cash provided by a payer <strong>to</strong>a payment service provider, which remits <strong>the</strong> corresponding amount for example via communicationnetwork, <strong>to</strong> a payee or <strong>to</strong> ano<strong>the</strong>r payment service provider acting on behalf <strong>of</strong> <strong>the</strong> payee.(15) Given <strong>the</strong> desirability <strong>of</strong> registering <strong>the</strong> identity and whereabouts <strong>of</strong> all persons providingremittance services and <strong>of</strong> according <strong>the</strong>m all a measure <strong>of</strong> acceptance, irrespective <strong>of</strong> whe<strong>the</strong>r <strong>the</strong>yare able <strong>to</strong> meet <strong>the</strong> full range <strong>of</strong> conditions for authorisation as payment institutions, so that noneare forced in<strong>to</strong> <strong>the</strong> black economy and bring all persons providing remittance service within <strong>the</strong> ambit<strong>of</strong> certain minimum legal and <strong>regula<strong>to</strong>ry</strong> requirements, it is appropriate and in line with <strong>the</strong> rationale<strong>of</strong> Special Recommendation VI <strong>of</strong> <strong>the</strong> Financial Action Task Force on <strong>Money</strong> Laundering <strong>to</strong> provide amechanism whereby payment service providers unable <strong>to</strong> meet all those conditions may never<strong>the</strong>lessbe treated as payment institutions.For those purposes, Member States should enter such persons in <strong>the</strong> register <strong>of</strong> payment institutionswhile not applying all or part <strong>of</strong> <strong>the</strong> conditions for authorisation. However, it is essential <strong>to</strong> make <strong>the</strong>possibility <strong>of</strong> waiver subject <strong>to</strong> strict requirements relating <strong>to</strong> <strong>the</strong> volume <strong>of</strong> payment transactions.Payment institutions benefiting from a waiver should have nei<strong>the</strong>r <strong>the</strong> right <strong>of</strong> establishment nor <strong>the</strong>freedom <strong>to</strong> provide services, nor should <strong>the</strong>y indirectly exercise those rights when being a member <strong>of</strong>a payment system.(43) In order <strong>to</strong> improve <strong>the</strong> efficiency <strong>of</strong> payments throughout <strong>the</strong> Community, all payment ordersinitiated by <strong>the</strong> payer and denominated in euro or <strong>the</strong> currency <strong>of</strong> a Member State outside <strong>the</strong> euroarea, including credit transfers and money remittances, should be subject <strong>to</strong> a maximum one-dayexecution time.(58) <strong>Money</strong> remittance is defined in this Directive as a payment service which requires anauthorisation for a payment institution or a registration for some natural or legal persons benefitingfrom a waiver clause under certain circumstances specified in <strong>the</strong> provisions <strong>of</strong> this Directive.Regula<strong>to</strong>ry framework: Implementation <strong>of</strong> Mobile <strong>Money</strong> <strong>Transfer</strong> services - June 2009 -45