Review of the regulatory environment relative to Money Transfer ...

Review of the regulatory environment relative to Money Transfer ...

Review of the regulatory environment relative to Money Transfer ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

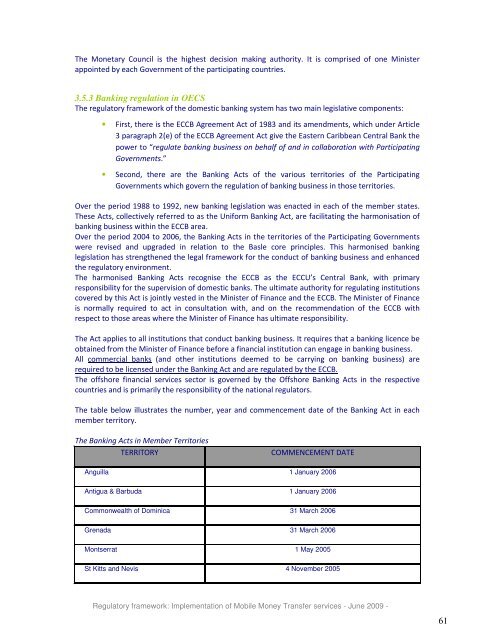

The Monetary Council is <strong>the</strong> highest decision making authority. It is comprised <strong>of</strong> one Ministerappointed by each Government <strong>of</strong> <strong>the</strong> participating countries.3.5.3 Banking regulation in OECSThe <strong>regula<strong>to</strong>ry</strong> framework <strong>of</strong> <strong>the</strong> domestic banking system has two main legislative components:• First, <strong>the</strong>re is <strong>the</strong> ECCB Agreement Act <strong>of</strong> 1983 and its amendments, which under Article3 paragraph 2(e) <strong>of</strong> <strong>the</strong> ECCB Agreement Act give <strong>the</strong> Eastern Caribbean Central Bank <strong>the</strong>power <strong>to</strong> “regulate banking business on behalf <strong>of</strong> and in collaboration with ParticipatingGovernments.”• Second, <strong>the</strong>re are <strong>the</strong> Banking Acts <strong>of</strong> <strong>the</strong> various terri<strong>to</strong>ries <strong>of</strong> <strong>the</strong> ParticipatingGovernments which govern <strong>the</strong> regulation <strong>of</strong> banking business in those terri<strong>to</strong>ries.Over <strong>the</strong> period 1988 <strong>to</strong> 1992, new banking legislation was enacted in each <strong>of</strong> <strong>the</strong> member states.These Acts, collectively referred <strong>to</strong> as <strong>the</strong> Uniform Banking Act, are facilitating <strong>the</strong> harmonisation <strong>of</strong>banking business within <strong>the</strong> ECCB area.Over <strong>the</strong> period 2004 <strong>to</strong> 2006, <strong>the</strong> Banking Acts in <strong>the</strong> terri<strong>to</strong>ries <strong>of</strong> <strong>the</strong> Participating Governmentswere revised and upgraded in relation <strong>to</strong> <strong>the</strong> Basle core principles. This harmonised bankinglegislation has streng<strong>the</strong>ned <strong>the</strong> legal framework for <strong>the</strong> conduct <strong>of</strong> banking business and enhanced<strong>the</strong> <strong>regula<strong>to</strong>ry</strong> <strong>environment</strong>.The harmonised Banking Acts recognise <strong>the</strong> ECCB as <strong>the</strong> ECCU’s Central Bank, with primaryresponsibility for <strong>the</strong> supervision <strong>of</strong> domestic banks. The ultimate authority for regulating institutionscovered by this Act is jointly vested in <strong>the</strong> Minister <strong>of</strong> Finance and <strong>the</strong> ECCB. The Minister <strong>of</strong> Financeis normally required <strong>to</strong> act in consultation with, and on <strong>the</strong> recommendation <strong>of</strong> <strong>the</strong> ECCB withrespect <strong>to</strong> those areas where <strong>the</strong> Minister <strong>of</strong> Finance has ultimate responsibility.The Act applies <strong>to</strong> all institutions that conduct banking business. It requires that a banking licence beobtained from <strong>the</strong> Minister <strong>of</strong> Finance before a financial institution can engage in banking business.All commercial banks (and o<strong>the</strong>r institutions deemed <strong>to</strong> be carrying on banking business) arerequired <strong>to</strong> be licensed under <strong>the</strong> Banking Act and are regulated by <strong>the</strong> ECCB.The <strong>of</strong>fshore financial services sec<strong>to</strong>r is governed by <strong>the</strong> Offshore Banking Acts in <strong>the</strong> respectivecountries and is primarily <strong>the</strong> responsibility <strong>of</strong> <strong>the</strong> national regula<strong>to</strong>rs.The table below illustrates <strong>the</strong> number, year and commencement date <strong>of</strong> <strong>the</strong> Banking Act in eachmember terri<strong>to</strong>ry.The Banking Acts in Member Terri<strong>to</strong>riesTERRITORYCOMMENCEMENT DATEAnguilla 1 January 2006Antigua & Barbuda 1 January 2006Commonwealth <strong>of</strong> Dominica 31 March 2006Grenada 31 March 2006Montserrat 1 May 2005St Kitts and Nevis 4 November 2005Regula<strong>to</strong>ry framework: Implementation <strong>of</strong> Mobile <strong>Money</strong> <strong>Transfer</strong> services - June 2009 -61