61 Rethinking local government: Essays on municipal reform - VATT

61 Rethinking local government: Essays on municipal reform - VATT

61 Rethinking local government: Essays on municipal reform - VATT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

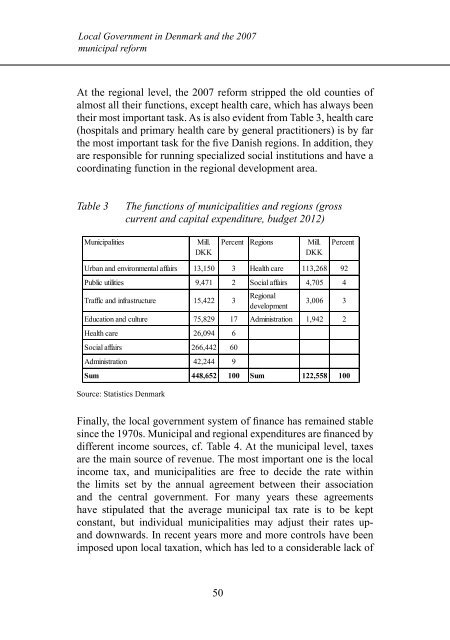

Local Government in Denmark and the 2007<strong>municipal</strong> <strong>reform</strong>At the regi<strong>on</strong>al level, the 2007 <strong>reform</strong> stripped the old counties ofalmost all their functi<strong>on</strong>s, except health care, which has always beentheir most important task. As is also evident from Table 3, health care(hospitals and primary health care by general practiti<strong>on</strong>ers) is by farthe most important task for the five Danish regi<strong>on</strong>s. In additi<strong>on</strong>, theyare resp<strong>on</strong>sible for running specialized social instituti<strong>on</strong>s and have acoordinating functi<strong>on</strong> in the regi<strong>on</strong>al development area.Table 3The functi<strong>on</strong>s of <strong>municipal</strong>ities and regi<strong>on</strong>s (grosscurrent and capital expenditure, budget 2012)MunicipalitiesMill.DKKPercent Regi<strong>on</strong>s Mill.DKKPercentUrban and envir<strong>on</strong>mental affairs 13,150 3 Health care 113,268 92Public utilities 9,471 2 Social affairs 4,705 4Traffic and infrastructure 15,422 3Regi<strong>on</strong>aldevelopment3,006 3Educati<strong>on</strong> and culture 75,829 17 Administrati<strong>on</strong> 1,942 2Health care 26,094 6Social affairs 266,442 60Administrati<strong>on</strong> 42,244 9Sum 448,652 100 Sum 122,558 100Source: Statistics DenmarkFinally, the <str<strong>on</strong>g>local</str<strong>on</strong>g> <str<strong>on</strong>g>government</str<strong>on</strong>g> system of finance has remained stablesince the 1970s. Municipal and regi<strong>on</strong>al expenditures are financed bydifferent income sources, cf. Table 4. At the <strong>municipal</strong> level, taxesare the main source of revenue. The most important <strong>on</strong>e is the <str<strong>on</strong>g>local</str<strong>on</strong>g>income tax, and <strong>municipal</strong>ities are free to decide the rate withinthe limits set by the annual agreement between their associati<strong>on</strong>and the central <str<strong>on</strong>g>government</str<strong>on</strong>g>. For many years these agreementshave stipulated that the average <strong>municipal</strong> tax rate is to be keptc<strong>on</strong>stant, but individual <strong>municipal</strong>ities may adjust their rates upanddownwards. In recent years more and more c<strong>on</strong>trols have beenimposed up<strong>on</strong> <str<strong>on</strong>g>local</str<strong>on</strong>g> taxati<strong>on</strong>, which has led to a c<strong>on</strong>siderable lack of50