Keep Money Laundering and Fraud out - TONBELLER® AG

Keep Money Laundering and Fraud out - TONBELLER® AG

Keep Money Laundering and Fraud out - TONBELLER® AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

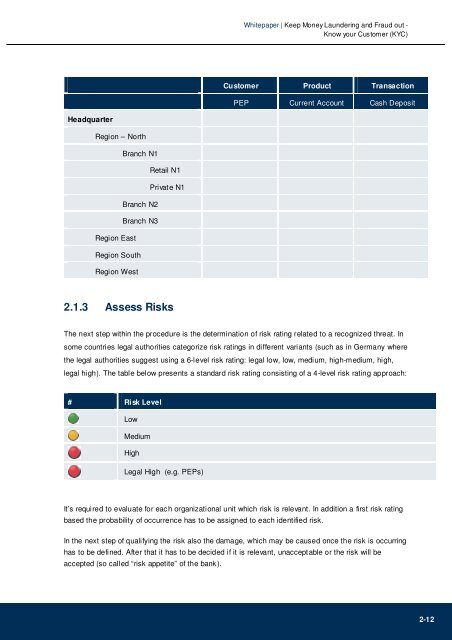

Headquarter<br />

Region – North<br />

Region East<br />

Branch N1<br />

Branch N2<br />

Branch N3<br />

Region S<strong>out</strong>h<br />

Region West<br />

Retail N1<br />

Private N1<br />

2.1.3 Assess Risks<br />

Whitepaper | <strong>Keep</strong> <strong>Money</strong> <strong>Laundering</strong> <strong>and</strong> <strong>Fraud</strong> <strong>out</strong> -<br />

Know your Customer (KYC)<br />

Customer Product Transaction<br />

PEP Current Account Cash Deposit<br />

The next step within the procedure is the determination of risk rating related to a recognized threat. In<br />

some countries legal authorities categorize risk ratings in different variants (such as in Germany where<br />

the legal authorities suggest using a 6-level risk rating: legal low, low, medium, high-medium, high,<br />

legal high). The table below presents a st<strong>and</strong>ard risk rating consisting of a 4-level risk rating approach:<br />

# Risk Level<br />

Low<br />

Medium<br />

High<br />

Legal High (e.g. PEPs)<br />

It’s required to evaluate for each organizational unit which risk is relevant. In addition a first risk rating<br />

based the probability of occurrence has to be assigned to each identified risk.<br />

In the next step of qualifying the risk also the damage, which may be caused once the risk is occurring<br />

has to be defined. After that it has to be decided if it is relevant, unacceptable or the risk will be<br />

accepted (so called “risk appetite” of the bank).<br />

2-12