Keep Money Laundering and Fraud out - TONBELLER® AG

Keep Money Laundering and Fraud out - TONBELLER® AG

Keep Money Laundering and Fraud out - TONBELLER® AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

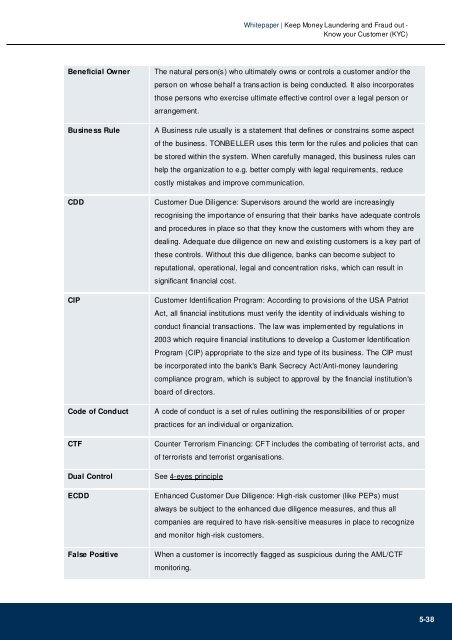

Whitepaper | <strong>Keep</strong> <strong>Money</strong> <strong>Laundering</strong> <strong>and</strong> <strong>Fraud</strong> <strong>out</strong> -<br />

Know your Customer (KYC)<br />

Beneficial Owner The natural person(s) who ultimately owns or controls a customer <strong>and</strong>/or the<br />

person on whose behalf a transaction is being conducted. It also incorporates<br />

those persons who exercise ultimate effective control over a legal person or<br />

arrangement.<br />

Business Rule A Business rule usually is a statement that defines or constrains some aspect<br />

of the business. TONBELLER uses this term for the rules <strong>and</strong> policies that can<br />

be stored within the system. When carefully managed, this business rules can<br />

help the organization to e.g. better comply with legal requirements, reduce<br />

costly mistakes <strong>and</strong> improve communication.<br />

CDD Customer Due Diligence: Supervisors around the world are increasingly<br />

recognising the importance of ensuring that their banks have adequate controls<br />

<strong>and</strong> procedures in place so that they know the customers with whom they are<br />

dealing. Adequate due diligence on new <strong>and</strong> existing customers is a key part of<br />

these controls. With<strong>out</strong> this due diligence, banks can become subject to<br />

reputational, operational, legal <strong>and</strong> concentration risks, which can result in<br />

significant financial cost.<br />

CIP Customer Identification Program: According to provisions of the USA Patriot<br />

Act, all financial institutions must verify the identity of individuals wishing to<br />

conduct financial transactions. The law was implemented by regulations in<br />

2003 which require financial institutions to develop a Customer Identification<br />

Program (CIP) appropriate to the size <strong>and</strong> type of its business. The CIP must<br />

be incorporated into the bank's Bank Secrecy Act/Anti-money laundering<br />

compliance program, which is subject to approval by the financial institution's<br />

board of directors.<br />

Code of Conduct A code of conduct is a set of rules <strong>out</strong>lining the responsibilities of or proper<br />

practices for an individual or organization.<br />

CTF Counter Terrorism Financing: CFT includes the combating of terrorist acts, <strong>and</strong><br />

of terrorists <strong>and</strong> terrorist organisations.<br />

Dual Control See 4-eyes principle<br />

ECDD Enhanced Customer Due Diligence: High-risk customer (like PEPs) must<br />

always be subject to the enhanced due diligence measures, <strong>and</strong> thus all<br />

companies are required to have risk-sensitive measures in place to recognize<br />

<strong>and</strong> monitor high-risk customers.<br />

False Positive When a customer is incorrectly flagged as suspicious during the AML/CTF<br />

monitoring.<br />

5-38