Polish Strategy - PBG SA

Polish Strategy - PBG SA

Polish Strategy - PBG SA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

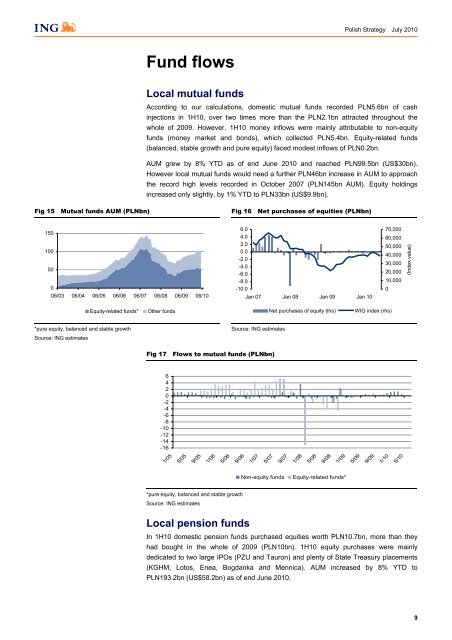

<strong>Polish</strong> <strong>Strategy</strong> July 2010Fund flowsLocal mutual fundsAccording to our calculations, domestic mutual funds recorded PLN5.6bn of cashinjections in 1H10, over two times more than the PLN2.1bn attracted throughout thewhole of 2009. However, 1H10 money inflows were mainly attributable to non-equityfunds (money market and bonds), which collected PLN5.4bn. Equity-related funds(balanced, stable growth and pure equity) faced modest inflows of PLN0.2bn.AUM grew by 8% YTD as of end June 2010 and reached PLN99.5bn (US$30bn).However local mutual funds would need a further PLN46bn increase in AUM to approachthe record high levels recorded in October 2007 (PLN145bn AUM). Equity holdingsincreased only slightly, by 1% YTD to PLN33bn (US$9.9bn).Fig 15 Mutual funds AUM (PLNbn)Fig 16 Net purchases of equities (PLNbn)15010050006/03 06/04 06/05 06/06 06/07 06/08 06/09 06/106.04.02.00.0-2.0-4.0-6.0-8.0-10.0Jan 07 Jan 08 Jan 09 Jan 1070,00060,00050,00040,00030,00020,00010,0000(Index value)Equity-related funds*Other fundsNet purchases of equity (lhs)WIG index (rhs)*pure equity, balanced and stable growthSource: ING estimatesSource: ING estimatesFig 17 Flows to mutual funds (PLNbn)6420-2-4-6-8-10-12-14-161/055/059/051/065/069/061/075/079/071/085/089/081/095/099/091/105/10Non-equity fundsEquity-related funds**pure equity, balanced and stable growthSource: ING estimatesLocal pension fundsIn 1H10 domestic pension funds purchased equities worth PLN10.7bn, more than theyhad bought in the whole of 2009 (PLN10bn). 1H10 equity purchases were mainlydedicated to two large IPOs (PZU and Tauron) and plenty of State Treasury placements(KGHM, Lotos, Enea, Bogdanka and Mennica). AUM increased by 8% YTD toPLN193.2bn (US$58.2bn) as of end June 2010.9