Polish Strategy - PBG SA

Polish Strategy - PBG SA

Polish Strategy - PBG SA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

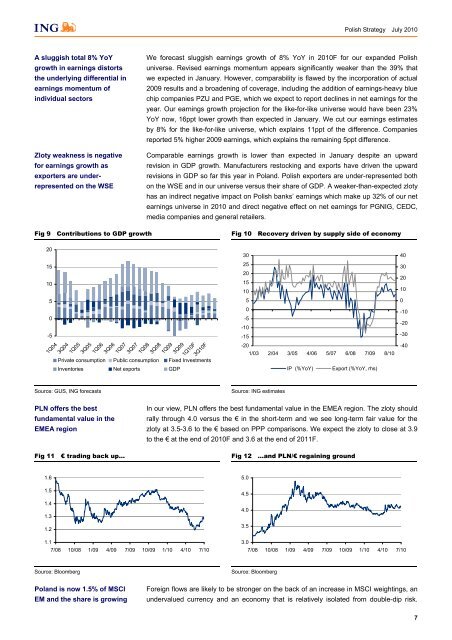

<strong>Polish</strong> <strong>Strategy</strong> July 2010A sluggish total 8% YoYgrowth in earnings distortsthe underlying differential inearnings momentum ofindividual sectorsZloty weakness is negativefor earnings growth asexporters are underrepresentedon the WSEWe forecast sluggish earnings growth of 8% YoY in 2010F for our expanded <strong>Polish</strong>universe. Revised earnings momentum appears significantly weaker than the 39% thatwe expected in January. However, comparability is flawed by the incorporation of actual2009 results and a broadening of coverage, including the addition of earnings-heavy bluechip companies PZU and PGE, which we expect to report declines in net earnings for theyear. Our earnings growth projection for the like-for-like universe would have been 23%YoY now, 16ppt lower growth than expected in January. We cut our earnings estimatesby 8% for the like-for-like universe, which explains 11ppt of the difference. Companiesreported 5% higher 2009 earnings, which explains the remaining 5ppt difference.Comparable earnings growth is lower than expected in January despite an upwardrevision in GDP growth. Manufacturers restocking and exports have driven the upwardrevisions in GDP so far this year in Poland. <strong>Polish</strong> exporters are under-represented bothon the WSE and in our universe versus their share of GDP. A weaker-than-expected zlotyhas an indirect negative impact on <strong>Polish</strong> banks’ earnings which make up 32% of our netearnings universe in 2010 and direct negative effect on net earnings for PGNIG, CEDC,media companies and general retailers.Fig 9 Contributions to GDP growthFig 10 Recovery driven by supply side of economy20151050-51Q043Q041Q053Q051Q063Q061Q073Q071Q083Q081Q093Q091Q10F3Q10FPrivate consumption Public consumption Fixed InvestmentsInventories Net exports GDPSource: GUS, ING forecastsPLN offers the bestfundamental value in theEMEA region302520151050-5-10-15-201/03 2/04 3/05 4/06 5/07 6/08 7/09 8/10Source: ING estimatesIP (%YoY)Export (%YoY, rhs)In our view, PLN offers the best fundamental value in the EMEA region. The zloty shouldrally through 4.0 versus the € in the short-term and we see long-term fair value for thezloty at 3.5-3.6 to the € based on PPP comparisons. We expect the zloty to close at 3.9to the € at the end of 2010F and 3.6 at the end of 2011F.403020100-10-20-30-40Fig 11 € trading back up...Fig 12 ...and PLN/€ regaining ground1.61.51.41.31.21.17/08 10/08 1/09 4/09 7/09 10/09 1/10 4/10 7/105.04.54.03.53.07/08 10/08 1/09 4/09 7/09 10/09 1/10 4/10 7/10Source: BloombergSource: BloombergPoland is now 1.5% of MSCIEM and the share is growingForeign flows are likely to be stronger on the back of an increase in MSCI weightings, anundervalued currency and an economy that is relatively isolated from double-dip risk.7