Game Theory with Applications to Finance and Marketing

Game Theory with Applications to Finance and Marketing

Game Theory with Applications to Finance and Marketing

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

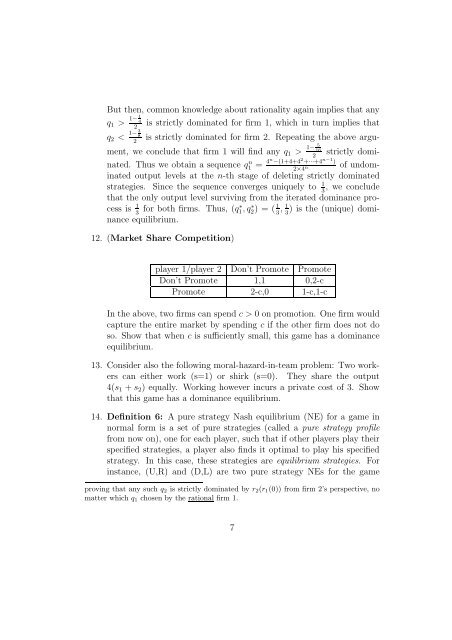

But then, common knowledge about rationality again implies that anyq 1 > 1− 1 4is strictly dominated for firm 1, which in turn implies that2q 2 < 1− 3 8is strictly dominated for firm 2. Repeating the above argument,we conclude that firm 1 will find any q 1 > 1− 5162strictly dominated.Thus we obtain a sequence q1 n = 4n −(1+4+4 2 +···+4 n−1 )2of undominatedoutput levels at the n-th stage of deleting strictly dominated2×4 nstrategies. Since the sequence converges uniquely <strong>to</strong> 1 , we conclude3that the only output level surviving from the iterated dominance processis 1 for both firms. Thus, 3 (q∗ 1, q2) ∗ = ( 1, 1 ) is the (unique) dominance3 3equilibrium.12. (Market Share Competition)player 1/player 2 Don’t Promote PromoteDon’t Promote 1,1 0,2-cPromote 2-c,0 1-c,1-cIn the above, two firms can spend c > 0 on promotion. One firm wouldcapture the entire market by spending c if the other firm does not doso. Show that when c is sufficiently small, this game has a dominanceequilibrium.13. Consider also the following moral-hazard-in-team problem: Two workerscan either work (s=1) or shirk (s=0). They share the output4(s 1 + s 2 ) equally. Working however incurs a private cost of 3. Showthat this game has a dominance equilibrium.14. Definition 6: A pure strategy Nash equilibrium (NE) for a game innormal form is a set of pure strategies (called a pure strategy profilefrom now on), one for each player, such that if other players play theirspecified strategies, a player also finds it optimal <strong>to</strong> play his specifiedstrategy. In this case, these strategies are equilibrium strategies. Forinstance, (U,R) <strong>and</strong> (D,L) are two pure strategy NEs for the gameproving that any such q 2 is strictly dominated by r 2 (r 1 (0)) from firm 2’s perspective, nomatter which q 1 chosen by the rational firm 1.7