Performance!

Performance!

Performance!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

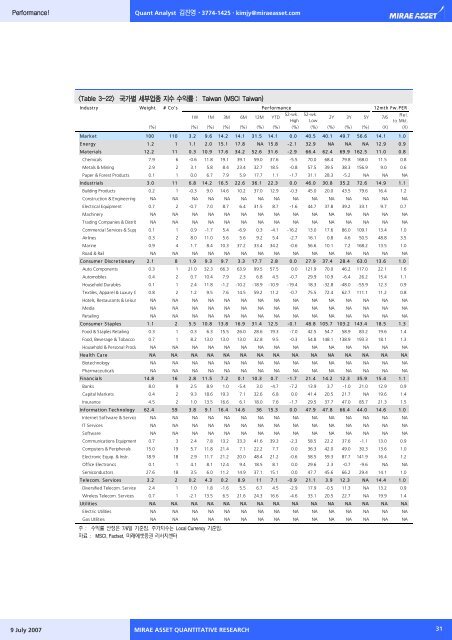

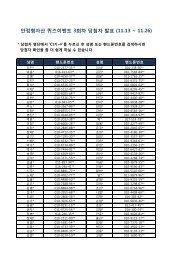

<strong>Performance</strong>!Quant Analyst 김진영 • 3774-1425 • kimjy@miraeasset.com 국가별 세부업종 지수 수익률 : Taiwan (MSCI Taiwan)Industry Weight # Co's <strong>Performance</strong> 12mth Fw.PER1W 1M 3M 6M 12M YTD 52-wk.High52-wk.Low2Y 3Y 5Y 7/6Rel.to Mkt.(%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (%) (X) (X)Market 100 110 3.2 9.6 14.2 14.1 31.5 14.1 0.0 40.5 40.1 49.7 56.6 14.1 1.0Energy 1.2 1 1.1 2.0 15.1 17.8 NA 15.8 -2.1 32.9 NA NA NA 12.9 0.9Materials 12.2 11 0.3 10.9 17.6 34.2 52.6 31.6 -2.9 66.4 62.4 69.9 162.5 11.0 0.8Chemicals 7.9 6 -0.6 11.8 19.1 39.1 59.0 37.6 -5.5 70.0 68.4 79.8 168.0 11.5 0.8Metals & Mining 2.9 2 3.1 5.8 8.4 23.4 32.7 18.5 -0.8 57.5 39.5 38.3 156.9 9.0 0.6Paper & Forest Products 0.1 1 0.0 6.7 7.9 5.9 17.7 1.1 -1.7 31.1 28.3 -5.2 NA NA NAIndustrials 3.0 11 6.8 14.2 16.5 22.6 36.1 22.3 0.0 46.0 30.8 35.2 72.6 14.9 1.1Building Products 0.2 1 -0.3 9.0 14.6 10.2 37.0 12.9 -0.3 45.0 20.0 43.5 79.6 16.4 1.2Construction & Engineering NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectrical Equipment 0.7 2 -0.7 7.0 8.7 6.4 31.5 8.7 -1.6 44.7 37.8 39.2 33.1 9.7 0.7Machinery NA NA NA NA NA NA NA NA NA NA NA NA NA NA NATrading Companies & Distrib NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommercial Services & Supp 0.1 1 0.9 -1.7 5.4 -6.9 0.3 -4.1 -16.2 13.0 17.6 86.0 109.1 13.4 1.0Airlines 0.3 2 8.0 11.0 5.6 5.6 9.2 5.4 -2.7 16.1 0.8 4.6 50.5 48.8 3.5Marine 0.9 4 1.7 8.4 10.3 37.2 33.4 34.2 -0.6 56.6 10.1 7.2 168.2 13.5 1.0Road & Rail NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConsumer Discretionary 2.1 8 1.9 9.3 9.7 3.3 17.7 2.8 0.0 27.9 37.4 28.4 63.0 13.6 1.0Auto Components 0.3 1 21.0 32.3 66.3 63.9 99.5 57.5 0.0 121.9 70.0 46.2 117.0 22.1 1.6Automobiles 0.4 2 0.7 10.4 7.9 2.3 6.8 4.5 -0.7 29.9 10.9 -6.4 26.2 15.4 1.1Household Durables 0.1 1 2.4 11.8 -1.2 -10.2 -18.9 -10.9 -19.4 18.3 -32.8 -48.0 -55.9 12.3 0.9Textiles, Apparel & Luxury G 0.8 2 1.2 9.5 7.6 14.5 59.2 11.2 -0.7 75.5 72.4 62.7 111.1 11.2 0.8Hotels, Restaurants & Leisur NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAMedia NA NA NA NA NA NA NA NA NA NA NA NA NA NA NARetailing NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAConsumer Staples 1.1 2 5.5 10.8 13.8 16.9 31.4 12.5 -0.1 48.8 105.7 103.2 143.4 18.5 1.3Food & Staples Retailing 0.3 1 0.3 6.3 15.5 26.0 28.6 19.3 -7.0 42.5 54.7 58.9 83.2 19.6 1.4Food, Beverage & Tobacco 0.7 1 8.2 13.0 13.0 13.0 32.8 9.5 -0.3 54.8 148.1 138.9 193.3 18.1 1.3Household & Personal Produ NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAHealth Care NA NA NA NA NA NA NA NA NA NA NA NA NA NA NABiotechnology NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAPharmaceuticals NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAFinancials 14.8 16 2.8 11.5 7.2 0.1 10.3 0.7 -1.7 21.4 14.2 12.3 35.9 15.4 1.1Banks 8.0 9 2.5 8.9 1.0 -5.4 3.0 -4.7 -7.2 13.9 3.7 -1.0 21.0 12.9 0.9Capital Markets 0.4 2 9.3 18.6 19.3 7.1 32.6 6.8 0.0 41.4 20.5 21.7 NA 19.6 1.4Insurance 4.5 2 1.0 13.5 16.6 6.1 18.0 7.6 -1.7 29.5 37.7 47.0 85.7 21.3 1.5Information Technology 62.4 59 3.8 9.1 16.4 14.6 36 15.3 0.0 47.9 47.8 66.4 44.0 14.6 1.0Internet Software & Service NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAIT Services NA NA NA NA NA NA NA NA NA NA NA NA NA NA NASoftware NA NA NA NA NA NA NA NA NA NA NA NA NA NA NACommunications Equipment 0.7 3 2.4 7.8 13.2 33.3 41.6 39.3 -2.3 58.5 22.2 37.6 -1.1 13.0 0.9Computers & Peripherals 15.0 19 5.7 11.8 21.4 7.1 22.2 7.7 0.0 36.3 42.0 49.0 30.3 13.6 1.0Electronic Equip. & Instr. 18.9 18 2.9 11.7 21.2 20.0 48.4 21.2 -0.6 58.5 59.3 87.7 141.9 16.4 1.2Office Electronics 0.1 1 4.1 8.1 12.4 9.4 18.5 8.1 0.0 29.6 2.3 -0.7 -9.6 NA NASemiconductors 27.6 18 3.5 6.0 11.2 14.9 37.1 15.1 0.0 47.7 45.6 66.2 29.4 14.1 1.0Telecom. Services 3.2 2 0.2 4.3 0.2 8.9 11 7.1 -0.9 21.1 3.9 12.3 NA 14.4 1.0Diversified Telecom. Service 2.4 1 1.0 1.8 -1.6 5.5 6.7 4.5 -2.9 17.9 -0.5 11.3 NA 13.2 0.9Wireless Telecom. Services 0.7 1 -2.1 13.5 6.5 21.6 24.3 16.6 -4.6 33.1 20.5 22.7 NA 19.9 1.4Utilities NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAElectric Utilities NA NA NA NA NA NA NA NA NA NA NA NA NA NA NAGas Utilities NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA주 : 수익률 산정은 7/6일 기준임. 주가지수는 Local Currency 기준임.자료 : MSCI, Factset, 미래에셋증권 리서치센터9 July 2007 MIRAE ASSET QUANTITATIVE RESEARCH31