Getting With the Program - Carlson Wagonlit Travel

Getting With the Program - Carlson Wagonlit Travel

Getting With the Program - Carlson Wagonlit Travel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Insights into Effective <strong>Travel</strong> ManagementIssue 3January 2008Global Edition<strong>Getting</strong> <strong>With</strong> <strong>the</strong> <strong>Program</strong>:How Companies CanImprove <strong>Travel</strong> Policyand Compliance| 7Priorities for Mobility| 17Open Skies:Opening Up Opportunities| 27Lower Costs, Higher Value:Asia-Pacific <strong>Travel</strong> ManagersWelcome “New World” Airlines| 33Ten Business <strong>Travel</strong> Trends for 2010| 41

Insights into Effective <strong>Travel</strong> ManagementIssue 3January 2008Global EditionEditor-in-ChiefChristophe RenardManaging EditorsKim DerderianKate MosesEditorial Advisors/ContributorsGuillaume BizetShannon CoughlinDale EastlundStefan FallertHubert JolyHervé Joseph-AntoinePascal JungferDave KilduffIsabelle KochMike KoettingMichael MannixNicolas PierretPeggy TemkinBerthold TrenkelNicholas VournakisFloyd WidenerArt DirectorAshley IttooProductionNicolas AlquiéCéline GuertonEmailcwtvision@carlsonwagonlit.comWebwww.cwtvision.comwww.carlsonwagonlit.comPhotos/ArtworkAll photos and artwork by CWT except:Page 6 - © istockphoto.comPage 24 - © stock.xchngPages 28, 40, 52 and 53 - © fotoliaPages 57 and 59 - Getty ImagesCWT Vision - Global Edition is published by <strong>the</strong> CWT <strong>Travel</strong> Management Institute31 rue du Colonel Avia75904 Paris Cedex 15FrancePrinted on PEFC-certified paper produced from sustainably managed forestsCopyright © 2007-2008 CWT

2 ContentsEDITORIAL5 Looking AheadHubert Joly, President and CEOINSIGHTS7 <strong>Getting</strong> <strong>With</strong> <strong>the</strong> <strong>Program</strong>: How Companies CanImprove <strong>Travel</strong> Policy and ComplianceThe latest in-depth research by <strong>the</strong> CWT <strong>Travel</strong> ManagementInstitute reveals considerable scope for companies to improve<strong>the</strong>ir travel policy and traveler compliance. Doing so will help<strong>the</strong>m realize double-digit savingsPascal Jungfer, Vice President, CWT Solutions Group GlobalChristophe Renard, Senior Director, CWT <strong>Travel</strong> Management Institute17 Priorities for MobilityIn an exclusive meeting with CWT clients, Jacques Barrot, VicePresident of <strong>the</strong> European Commission and Commissioner forTransport, highlighted <strong>the</strong> Commission’s priorities as <strong>the</strong>y relateto air and rail travel.27 Open Skies: Opening Up OpportunitiesWhat changes will <strong>the</strong> EU-U.S. “Open Skies” agreement bringto airlines and what benefits can travel managers expect?Dale Eastlund, Director CWT Air Solutions, North America33 Lower Costs, Higher Value: Asia-Pacific <strong>Travel</strong> ManagersWelcome “New World” AirlinesBudget carriers are steadily gaining ground within corporatetravel programs in Asia Pacific thanks to <strong>the</strong>ir efforts to tailorservice to business travel.Michael Mannix, Vice President CWT Solutions Group Asia PacificNicolas Pierret, Director, Global Accounts Asia Pacific, CWT

CWTvIsIon Issue 3 - January 2008341 Ten Business <strong>Travel</strong> Trends for 2010How is <strong>the</strong> business travel industry likely to evolve over <strong>the</strong> nextfew years? A CWT survey of global clients and suppliers identified10 major trends.Mike Koetting, Executive Vice President,Global Supplier Management, CWTFloyd Widener, Vice President Sales, Europe, Middle East and Africa, CWTSMART SOLUTIONS46 “If People Are Aware of Price Differences, They Care”Birgit Schenscher, Global Purchasing Director, Services, at Henkel,explains how her company saved nearly US$6 million(€4 million) in one year by updating <strong>the</strong> travel policy andreinforcing compliance.INTERVIEW50 Ground Transportation: Worth Ano<strong>the</strong>r LookDave Kilduff, Managing Director of <strong>the</strong> new ground transportationpractice within <strong>the</strong> CWT Solutions Group, explains howcompanies can benefit from revisiting <strong>the</strong>ir strategy in this area,which is often a low priority for travel managers.IN BRIEF54 Snapshot: Top methods for reducing travel costs56 Soundbite: Mary Peters, U.S. Secretary of Transportation,on airport congestion57 Industry News Highlights: New developments inregulation, airlines, hotels, ground transportation,technology and sustainable travel59 News from CWT: Corporate update60 Indicators: Evolution of air ticket prices

2008

CWTvIsIon Issue 3 - January 2008Looking AheadThis issue of CWT Vision looks at some of <strong>the</strong> trends inbusiness travel that our clients and suppliers are focusing onas <strong>the</strong>y look at 2008 and beyond. We at CWT are committedto continuing to address <strong>the</strong>se developments and helping ourclients derive greater value from <strong>the</strong>ir travel program in anevolving market.The business travel management industry has significantlyevolved in <strong>the</strong> last few years. Business travel has grownconsiderably—it now represents US$300 billion worldwide—driven primarily byglobalization and economic growth. The multiplicity of distribution channels (from globaldistribution systems to suppliers’ own Websites), coupled with complex pricing models,has made managing business travel challenging. The most advanced companies haveresponded by consolidating <strong>the</strong>ir travel programs, using technology to drive efficienciesand performance, and outsourcing travel management services. And yet <strong>the</strong> demandsare increasing, in terms of service, savings, security and now sustainable development.In this context, effectively managing business travel has evolved into a professionalservices activity that delivers measurable value.As <strong>the</strong> article “Effective <strong>Travel</strong> Management 2010” indicates, our industry will not standstill. Greater segmentation of services will appear. Companies will look for additionalsavings through several means: demand management, consolidation, outsourcing, awell-defined travel policy, increased compliance and incorporating meetings and eventsinto <strong>the</strong> travel program. Service will be increasingly centered on enhancing <strong>the</strong> traveler’sexperience from <strong>the</strong> planning stage through post-trip expense reporting. Security willalso be stepped up as duty of care toward employees becomes not only a moralobligation but a legal one. New emphasis on sustainable development and corporatesocial responsibility will also become a permanent concern.Dialogue and cooperation among industry players are essential to moving <strong>the</strong> businessof business travel forward. As <strong>the</strong> journey continues, we look forward to hearing fromand working with you.On behalf of everyone at <strong>Carlson</strong> <strong>Wagonlit</strong> <strong>Travel</strong>, I would like to wish you a happy newyear, filled with great accomplishments.Hubert JolyPresident and CEO

CWTvIsIon Issue 3 - January 2008INSIGHTS7 <strong>Getting</strong> <strong>With</strong> <strong>the</strong> <strong>Program</strong>:How Companies Can Improve <strong>Travel</strong> Policy and Compliance17 Priorities for Mobility27 Open Skies: Opening Up Opportunities33 Lower Costs, Higher Values:Asia Pacific <strong>Travel</strong> Managers Welcome “New World” Carriers41 Ten Business <strong>Travel</strong> Trends for 2010<strong>Getting</strong> <strong>With</strong> <strong>the</strong> <strong>Program</strong>:How Companies Can Improve<strong>Travel</strong> Policy and ComplianceThe latest in-depth research by <strong>the</strong> CWT <strong>Travel</strong> Management Institutereveals considerable scope for companies to improve <strong>the</strong>ir travel policy andtraveler compliance. Doing so will help <strong>the</strong>m realize double-digit savings.Pascal JungferVice PresidentCWT Solutions Group GlobalChristophe RenardSenior DirectorCWT <strong>Travel</strong> Management InstituteA corporate travel policy is <strong>the</strong> basic tool of travel management and sharpening that toolcan have a major impact on how well <strong>the</strong> travel program performs, particularly in termsof savings. It is little wonder that travel managers are increasingly revising <strong>the</strong>ir policyand in particular, integrating key travel rules such as advance purchase of airfare. Butprecisely which policy items present <strong>the</strong> greatest savings opportunities? And how cancompanies maximize traveler compliance to realize those savings?These are among <strong>the</strong> questions <strong>the</strong> CWT <strong>Travel</strong> Management Institute asked in its latestin-depth research, which focuses on travel policy and traveler compliance. Five key findingsare detailed in a booklet which will be published this quarter and are summarized in thisarticle.Key finding 1: By optimizing travel policy and traveler compliance, companies canrealistically save on average 20 percent of total travel spendCWT calculated this savings potential by comparing <strong>the</strong> average market performance ofclients with best practices observed on five main policy items. (See <strong>the</strong> sidebar on Page15 for a summary of <strong>the</strong> methodology.) A typical spend ratio of 70 percent air and 30percent hotel was used.

8 How Companies Can Improve <strong>Travel</strong> Policy and ComplianceThe results show that rules pertaining to travel class/category and preferred suppliers,which are typically <strong>the</strong> main focus of cost-saving efforts, are not <strong>the</strong> only source ofsignificant savings. In fact, savings opportunities are spread over four key travel rules(advance air booking, restricted airfares, preferred suppliers and class/category of travel),as well as preferred booking channels. These savings come from a well designed travelpolicy that addresses <strong>the</strong>se items and from increased traveler compliance, as shown in<strong>the</strong> chart below.Companies can reduce total spend by 20 percent on average by improving performanceon five main policy items% of total air and hotel spend20153.9%2.5%5.1% 1.4%17.9%2.8%2.4%0.4%20.7%12.3%2.6%9.9%105.0% 2.5%55.7%3.5%2.5%2.5%8.0%8.4%02.2%AdvancebookingOverlap -2%RestrictedfaresPrefferedsuppliersClass/categoryof travelTotaltravel rulesBookingchannelTotalCompliance impact: 60% of total savingsPolicy impact: 40% of total savingsSource: CWT <strong>Travel</strong> Management InstituteNote: Advance booking is generally required for restricted fares, explaining <strong>the</strong> overlap in savings potential between <strong>the</strong> two policy items.Key finding 2: Four key travel rules provide significant savings opportunitiesAnalysis of CWT client transactions provides insights into <strong>the</strong> importance of each of <strong>the</strong>four key travel rules:Advance air booking. Booking two or three weeks in advance enables travelers toaccess significantly lower fares. Discounts can exceed 50 percent of <strong>the</strong> ticket price(as shown in <strong>the</strong> example below), especially on highly competitive routes or ineconomy class. In some extremely regulated markets such as India and China,however, <strong>the</strong>re is no price advantage to booking in advance.

CWTvIsIon Issue 3 - January 2008The earlier travelers book, <strong>the</strong> lower <strong>the</strong> fareAverage price (€)London-Madrid, UK point of sale-58%30 20 10 0Days booked in advanceSource: CWT <strong>Travel</strong> Management InstituteBased on data from 2,311 CWT client transactions (January-March 2007)Restricted airfares. A company’s use of restricted airfares usually brings savings, as<strong>the</strong> upfront discounts generally outweigh <strong>the</strong> cost of changes or cancellations madeby travelers. (These typically represent 20-40 percent of all air bookings). As a result,companies can save on average 24 percent of <strong>the</strong> price of fully flexible tickets.Preferred suppliers. Companies that require travelers to use preferred supplierscan save an estimated 16 percent on hotel rates and 18 percent on airfares. Thesesavings come from lower upfront prices and better back-end rebates, <strong>the</strong> latterbased on a company’s ability to deliver <strong>the</strong> volume agreed upon with suppliers. 1 Forthis reason, it can be more cost-effective to require travelers to systematically use apreferred airline ra<strong>the</strong>r than take a “best buy” approach (i.e., choosing <strong>the</strong> lowestavailable fare on <strong>the</strong> day, regardless of <strong>the</strong> airline).<strong>Travel</strong> class/category. In setting travel policy, companies aim to find <strong>the</strong> rightbalance between traveler comfort—in terms of seating classes or hotel categories—and savings. Some changes in <strong>the</strong> authorized comfort level can have a significantimpact on savings: depending on a company’s travel pattern, <strong>the</strong>se can reach 30percent of air spend and 20 percent of hotel spend.Key finding 3: Companies need to focus on both policy and compliance to achieve<strong>the</strong>ir full savings potentialCWT estimates that 40 percent of potential savings can be realized throughimprovements to policy and 60 percent through increased compliance. To that end,companies still have considerable room to improve <strong>the</strong> content and wording of <strong>the</strong>irtravel policy and an even longer way to go to raise compliance among travelers. This40/60 ratio applies to each of <strong>the</strong> four key travel rules, while <strong>the</strong> savings potentiallinked to <strong>the</strong> use of preferred booking channels mainly comes from improvedcompliance (discussed in key finding 4).1This is explained in detail in <strong>the</strong> CWT research booklet Global Horizons: Consolidating a <strong>Travel</strong> <strong>Program</strong> (2007)

10 How Companies Can Improve <strong>Travel</strong> Policy and ComplianceCurrently, travel policies vary widely in terms of coverage (<strong>the</strong> key travel rules which areincluded) and precision (how clear and detailed instructions are for travelers):Advance booking for airfares: well covered but not precise enough. Companiesgenerally recommend advance booking in <strong>the</strong>ir air travel policy but rarely specify aclear timeline.Restricted fares: too often forgotten. Only 4 percent of policies require travelersto use restricted fares, compared with 59 percent that recommend <strong>the</strong>ir use and 37percent that do not mention <strong>the</strong>m at all.Preferred suppliers: well covered and precise. Ninety percent of companies referto preferred airlines and 89 percent mention preferred hotels. But <strong>the</strong>re isconsiderable room for improvement. For example, only 29 percent of companiesrequire travelers to always use preferred airlines, which appears to be <strong>the</strong> beststrategy for savings.<strong>Travel</strong> class/category: well covered and precise. Ninety-nine percent of policieshave class rules for air travel, mainly based on flight duration, but fine-tuning <strong>the</strong>serules can often bring fur<strong>the</strong>r savings. For hotel bookings, <strong>the</strong> category is implicit in<strong>the</strong> choice of preferred properties, but policies often omit guidelines on what to dowhen properties are unavailable.In addition to better defining <strong>the</strong>ir travel policy, companies have significant scope forimproving compliance with <strong>the</strong> key rules, except class of air travel, which travelersgenerally respect. In fact, at least 45 percent of <strong>the</strong> transactions analyzed by CWT breakone or more of <strong>the</strong> rules.Non-compliance is a problem across <strong>the</strong> traveler population, although <strong>the</strong> majority ofcases are linked to a small minority of frequent travelers. (In one company studied, 25percent of all travelers—frequent travelers—make 60 percent of all late bookings.)Although travel managers generally believe that personal preference is <strong>the</strong> main reasonfor non-compliance (i.e., travelers want to exploit a frequent flyer program or have <strong>the</strong>freedom to choose <strong>the</strong>ir hotel), <strong>the</strong> travelers <strong>the</strong>mselves say that practicality and pricingcome first, as shown in <strong>the</strong> chart below. This implies a problem of perception for bothparties and/or a poor fit between travelers’ needs and <strong>the</strong> travel policy, whichcompanies should investigate fur<strong>the</strong>r.

CWTvIsIon Issue 3 - January 200811<strong>Travel</strong>ers rate practicality and pricing before personal preference as reasons for noncompliancewith travel rulesImportance of reasons behindchoice of non-preferred airlineImportance of reasons behindchoice of non-preferred hotel<strong>Travel</strong>ers'view<strong>Travel</strong> managers'view<strong>Travel</strong>ers'view<strong>Travel</strong> managers'viewHighPracticalityPersonalpreferencePracticalityPersonalpreferenceMediumBetterpricingBetterpricingBetterpricingPracticalityLowPersonalpreferencePracticalityPersonalpreferenceBetterpricingSource: CWT <strong>Travel</strong> Management Institute - Based on a survey of travel managers (50 responses) and travelers (4,879 responses) in 2007.Note: Personal preference includes use of frequent flyer card, comfort and overall preference. Practicality includes proximity ofhotel to business destination, scheduling and flights availability.Key finding 4: Companies can maximize benefits by requiring travelers to bookthrough <strong>the</strong> travel management companyResearch shows that booking through <strong>the</strong> travel management company offers tangiblebenefits in terms of savings, service and security.Savings. Prices obtained by booking through <strong>the</strong> TMC are significantly lower thanthose obtained through Web intermediaries. A 20 percent difference in hotel rateswas observed in <strong>the</strong> CWT study, while a 15 percent difference in average air ticketprices was found by corporate travel consultancy Topaz International in a pricebenchmark published in 2007. 2 In addition, TMC agents can help companiesmaximize savings by promoting traveler compliance at <strong>the</strong> point of sale. For example,CWT reported 6-12 percent more compliance with preferred airlines and 15 percentmore compliance with preferred hotels for travelers using <strong>the</strong> TMC instead of o<strong>the</strong>rchannels. Online booking can fur<strong>the</strong>r enhance savings, as explained in <strong>the</strong> CWTresearch booklet Toward Excellence in Online Booking.Service and security. <strong>Travel</strong> managers recognize <strong>the</strong> service and security benefitsbrought by booking through <strong>the</strong> TMC. The majority of those surveyed by CWT statethat using alternative channels causes travelers to waste <strong>the</strong>ir own time and makestracking less effective in <strong>the</strong> event of an emergency.2Topaz International publishes regular comparative studies of corporate travel airfares booked by TMCs and those available onpublic Websites and airlines’ own Websites.

12 How Companies Can Improve <strong>Travel</strong> Policy and ComplianceIt follows that most policies require travelers to book through <strong>the</strong> TMC (87 percent forair travel and 79 percent for hotels). Few companies, however, mandate <strong>the</strong> use of<strong>the</strong>ir online booking tool, with only 26 percent and 2 percent of those that haveimplemented a tool doing so for air and hotels respectively.<strong>Travel</strong>er compliance with regard to authorized booking channels can be improved upon,especially among occasional travelers and a small proportion of frequent travelers.Alternative channels are currently in use for 2-20 percent of air transactions and 23-66percent of hotel transactions, depending on <strong>the</strong> company.Like non-compliance with travel rules, booking channel non-compliance is usuallyexplained by travel managers as a question of personal preference, whereas travelersmore often cite price, booking convenience or suitability of <strong>the</strong> offering.Key finding : A four-step approach can help companies improve policy andcomplianceThe CWT analysis of best practices among clients suggests that a four-step approach canbe <strong>the</strong> most effective for improving policy and compliance. This is a process ofcontinuous improvement, as shown in <strong>the</strong> chart below.A four-step approach to improving travel policy and complianceOptimize travelpolicy designMonitorcomplianceand takecorrectiveaction4132Carry outeffectivecommunicationsand trainingImplementa booking process thatpromotes complianceSource: CWT <strong>Travel</strong> Management Institute

CWTvIsIon Issue 3 - January 200813Step 1: Optimize travel policy design.Each company needs to adapt its policy to<strong>the</strong> needs of its travelers, business andcorporate culture. But it should also base itsdecisions on a solid understanding of howpolicy items affect savings, as well as arealistic appreciation of traveler compliance,as explained above. Once defined, <strong>the</strong>policy should be worded in clear, conciseand practical terms to avoid anymisunderstanding, particularly regardingmandates.Step 2: Carry out effective communicationsand training. The CWT research indicatestravelers are insufficiently aware of <strong>the</strong>ircompany’s travel policy. Ensuring that allemployees are well-informed and aware of<strong>the</strong> latest changes is a challenge, particularlyas travel policies affect a large and diversepopulation and are subject to regular revision.Companies can rise to this challenge bycommunicating through top management,ensuring <strong>the</strong> policy document is easilyaccessible (e.g., via <strong>the</strong> corporate intranet)and conducting compulsory training for alltravelers.Step 3: Implement a booking process that promotes compliance. The bookingprocess plays a key role in promoting compliance. TMC agents should be instructedto inform <strong>the</strong> traveler if his or her request breaks a travel rule or be authorized torefuse <strong>the</strong> request. In addition, online booking tools can be set up to clearly identifyvalid options and prevent bookings that do not meet authorized criteria. To dealeffectively with exceptions, companies can fine-tune <strong>the</strong>ir pre-trip approval and posttripcontrol procedures.Step 4: Monitor compliance and take corrective action. <strong>Travel</strong> managers arealmost unanimous that reporting is valuable for managing compliance. Among <strong>the</strong>most useful indicators are: overall air booking compliance, compliance with each of<strong>the</strong> key travel rules, lists of non-compliant travelers, missed savings opportunitiesthrough non-compliance and online adoption. Based on this information, companiesmay decide to focus on changing traveler behavior and/or updating <strong>the</strong> travelprogram.

14 How Companies Can Improve <strong>Travel</strong> Policy and Compliance<strong>Travel</strong> managers are confident that compliance can be improved: according to <strong>the</strong> CWTsurvey, <strong>the</strong>y already report progress compared to three years ago and have <strong>the</strong> goal offur<strong>the</strong>r raising compliance over <strong>the</strong> next three years, as shown in <strong>the</strong> chart below.Estimated levels of compliance with travel rules% Compliance100908070605046667851938877 7559718386 857676676192 9481 82695440393020100AdvancebookingOnlinebooking<strong>Travel</strong>classLowestfarePreferredsuppliersCity capconstraintPreferredhotelsClassrulesGeneral Air Hotel Rail3 years agoTodayIn 3 yearsSource: CWT <strong>Travel</strong> Management Institute - Based on a survey of travel managers (2007)<strong>Travel</strong> managers are clearly motivated to identify <strong>the</strong> major policy and compliance issuesthat affect <strong>the</strong>ir travel program, understand industry best practices and effectively adapt<strong>the</strong>m to meet <strong>the</strong>ir company’s needs. They may find that a little change can go a longway. For more information on how CWT experts can help your company optimizetravel policy and traveler compliance, please contact your CWT sales or programmanager or email: tmi@carlsonwagonlit.fr. The full report will soon be availableon www.carlsonwagonlit.com.

CWTvIsIon Issue 3 - January 20081Actionable insightsThe CWT <strong>Travel</strong> Management Institute designed its latest research to provide an indepthunderstanding of policy and compliance issues, with actionable insights intohow companies can best address <strong>the</strong>m.The research has two main features:A range of research techniques: CWT conducted benchmarks of corporatetravel policies and hotel pricing per booking channel, surveys of travel managersand travelers, analyses of client transactions and credit card transaction data,and case studies.A broad sample: <strong>the</strong> study involved 87 companies in Europe, North Americaand Asia Pacific with diverse profiles in terms of industry and travel spend.This is <strong>the</strong> latest in a series of in-depth studies into <strong>the</strong> eight key levers that CWThas identified for effective travel management. 33The eight levers to effective travel management are: provide <strong>the</strong> right services and assistance to travelers, and optimize transactionprocessing; tackle hotel spend in a disciplined and professional manner; continue to drive air and ground transportation savings;increase policy compliance and optimize demand management; fur<strong>the</strong>r consolidate travel programs; address security needs andcorporate social responsibility; integrate meetings and events into <strong>the</strong> travel program to control and optimize <strong>the</strong> related spend; anddevelop executive dashboards and actionable performance measures.

CWTvIsIon Issue 3 - January 20081Priorities for MobilityIn an exclusive meeting with CWT clients, Jacques Barrot, Vice President of <strong>the</strong>European Commission and Commissioner for Transport, highlighted <strong>the</strong>Commission’s priorities as <strong>the</strong>y relate to air and rail travel.Jacques Barrot, Vice President of <strong>the</strong> European Commission and Commissioner forTransport, was a keynote speaker at <strong>the</strong> CWT global client seminar last September.Addressing an audience of more than 80 clients, suppliers and CWT professionals, Mr.Barrot underlined <strong>the</strong> need for politicians to hear <strong>the</strong> concerns of business travelprofessionals and invited travel managers to participate in an open, ongoing dialoguewith <strong>the</strong> Commission.Before answering questions from <strong>the</strong> audience (see Pages 22-25), Mr. Barrot providedan overview of European transport policy and <strong>the</strong> Commission’s priorities for mobility.Boost competition in aviation“Europe has successfully created a single aviation market by restricting any governmentaid that distorts competition. If a state subsidizes an airline for a certain time, we candemand <strong>the</strong> reimbursement of this subsidy as a sanction in order to promote faircompetition. We have come a long way, because all airlines used to be national carriers.Through measures taken in 1992 and in 1997 [see <strong>the</strong> chart below], we created asingle aviation market, which has led <strong>the</strong> way to competitive, solid airlines. We still haveproblems, however, with certain member states and certain legacy carriers, whom Ihave to remind of <strong>the</strong> European “one time, last time” policy on state aid.EU aviation policy: key milestonesPre-19871987-1992199720042008Protected, fragmented national markets, with legacy carriers only andbilateral agreements governing international routesStart of liberalization: three successive packages of measures covering aircarrier licensing, market access and faresFull cabotage: EU carriers can operate domestic routes in EU countries outside<strong>the</strong>ir home baseSingle European Sky: initiative to improve <strong>the</strong> structure of air traffic control in<strong>the</strong> EUTransatlantic Open Skies (Phase One): any EU carrier can fly to any U.S. cityand vice versaSource: CWT <strong>Travel</strong> Management InstituteBased on information from <strong>the</strong> EU Directorate-General Energy and Transport/Air Transport Directorate

18 Priorities for MobilityWe have also developed cooperation with our neighbors. Today, we have agreementswith Morocco, <strong>the</strong> Balkan States, soon Ukraine and of course <strong>the</strong> United States, withwhich we signed an Open Skies agreement this year. I hope to sign a similar agreementwith Canada. The negotiations with <strong>the</strong> United States were difficult and lasted morethan five years. It was important for us that <strong>the</strong> United States accept we no longer havenational airlines but European airlines. Consequently, any European airline can connectany American city to any European city. We used to have a system of bilateralagreements, but we will now have a single agreement that covers <strong>the</strong> whole of <strong>the</strong>European Union. This will enable us to significantly boost transatlantic traffic. In addition,a few member states that had no bilateral agreement with <strong>the</strong> United States will nowbe able to fly to U.S. cities. Just as <strong>the</strong> single aviation market has enabled low-costcarriers to emerge, this liberalization of <strong>the</strong> transatlantic skies will pave <strong>the</strong> way for newentrants. You should find greater opportunities over <strong>the</strong> next few years.”The 2 member states of <strong>the</strong> European UnionSwedenFinlandEstoniaUnited KingdomDenmarkLatviaLithuaniaIrelandPortugalSpainNe<strong>the</strong>rlandsPolandGermanyBelgiumCzech RepublicLuxembourg SlovakiaAustriaHungaryFrance Slovenia RomaniaItalyBulgariaGreeceMaltaCyprus

CWTvIsIon Issue 3 - January 20081Improve air traffic control to manage growth“Of course, this leads to ano<strong>the</strong>r problem, which is ensuring that <strong>the</strong> skies are managedto allow for growth in air traffic. We have a problem in Europe, as air traffic is largely stillmanaged within national boundaries. We have been working toward a Single EuropeanSky with more efficient cooperation among air traffic controllers. This will enable us tosignificantly improve air traffic management, especially since we are preparing a highlysophisticated system called SESAR (Single European Sky ATM Research), which willcompletely modernize air traffic control over <strong>the</strong> next 10 years.”Make air traffic safer“We now have a European Aviation Safety Agency which harmonizes safety rules, andI have created <strong>the</strong> black list of airlines that are deemed unsafe and banned from <strong>the</strong>European Union. This list is updated every three months. I think it has been successfulin preventing numerous accidents because airlines are so afraid of being on <strong>the</strong> list, <strong>the</strong>ytake <strong>the</strong> necessary safety measures. And it is not just a question of airlines but of states,and in particular, some states that do not have sufficiently competent authorities. Inthose cases, we provide technical assistance. I would like to add that some o<strong>the</strong>rcountries have now adopted <strong>the</strong> same system as we have in Europe. I think we havemade significant progress in making air traffic safer.We sometimes have security regulations that travelers find difficult to put up with, inparticular <strong>the</strong> recent rules banning liquids in hand baggage. Experts from all 27 memberstates were adamant that it is best to take this precaution after <strong>the</strong> discovery in <strong>the</strong> U.K.of plans to attack airliners crossing <strong>the</strong> Atlantic, so I am maintaining it. At <strong>the</strong> same time,I hope that over <strong>the</strong> next two years, we will have machines to detect explosives inbottles.We also have <strong>the</strong> problem of duty-free bottles, which can be confiscated whenpassengers take a connecting flight. To solve this, we are developing a network ofairports in different countries that meet our standards so that travelers will not have torelinquish <strong>the</strong>ir duty-free purchases. But I have to admit, it is difficult. In addition, thanksto <strong>the</strong> Open Skies agreement, Washington and Brussels will now consult each o<strong>the</strong>rbefore taking any new safety measures.”Help tackle global warming“You can all sense that <strong>the</strong> fight against global warming is becoming everybody’sbusiness. Aviation is often unfairly held to blame. Some believe a solution lies in taxingkerosene, but in Europe, we prefer to use an Emissions Trading Scheme. 1 This willencourage airlines to buy increasingly energy-efficient, less polluting aircraft. Theproblem is that <strong>the</strong> United States and some o<strong>the</strong>r countries are strongly opposed to <strong>the</strong>system. Never<strong>the</strong>less, <strong>the</strong> European Union believes that <strong>the</strong> right way for aviation to1Aviation will be included in Europe’s Emissions Trading Scheme as of 2011. The scheme sets annual CO 2 emission allowancesfor industries and allows companies to buy or sell surplus credits.

20 Priorities for Mobilitycontribute to <strong>the</strong> fight against global warming is to integrate aviation into <strong>the</strong> EmissionsTrading Scheme. Doing so will undoubtedly produce some extra costs for air transport,but it will also provide an incentive for airlines to move toward more energy-efficientaircraft. We should not let air traffic be accused of being one of <strong>the</strong> main causes ofclimate change. I support ‘sustainable mobility’: mobility is an opportunity and weshould not limit it, but we must be careful to address major environmental issues.”Reinforce passenger rights and fair access to transport“Europe has created passenger rights. We now have rules to ensure that if overbookingis excessive, passengers have a right to compensation. There are also rules to helppassengers when flights are cancelled or delayed. Of course, <strong>the</strong> problem is ensuringthat airlines respect <strong>the</strong>se rights. I have received too many letters from passengers whohave not received a response from airlines to <strong>the</strong>ir complaints. Each member stateshould normally investigate complaints—<strong>the</strong>re is a special body in each of <strong>the</strong> 27 statesto do this. We are now working with <strong>the</strong>se bodies and <strong>the</strong> airlines to ensure <strong>the</strong> rulesare properly enforced. Never<strong>the</strong>less, I believe we have made progress by creatingpassenger rights. We have included rights for disabled passengers as well, which Iconsider very important. From now on, no airline or airport may deny boarding to adisabled person.”Create a single European market for rail and boost competition“We also need a single European market for rail. We started by denationalizing <strong>the</strong> railnetwork, which was not only national but, quite frankly, nationalistic. In fact, <strong>the</strong>re areeven a number of different rail gauges across <strong>the</strong> EU,how could you possibly expect to have high-speed linksin Europe? Today, we are in <strong>the</strong> process of creating asingle European rail market. How? First of all, bybuilding new lines, especially for high-speed rail. Wehave chosen 30 corridors in which to build <strong>the</strong> linksthat will enable people to travel more easily and quicklyin Europe. We are also hoping to free up conventional railway lines to allow <strong>the</strong>m to beused for freight. Unfortunately, we are still faced with a rail system that even has troubleimagining integrated ticketing across member states. So it is up to us to encourage <strong>the</strong>rail companies to make progress. There is already some progress with <strong>the</strong> Railteamalliance, 2 which is starting to offer seamless service to travelers. At <strong>the</strong> same time, weare obliged to standardize control and signaling systems for trains, which are verycomplex. Today, <strong>the</strong> Thalys high-speed train between Paris and Cologne needs sevendifferent pieces of equipment to interpret signals and control speed. You can see wehave a lot of work to do.2Seven European operators of high-speed trains in Austria, Belgium, France, Germany, <strong>the</strong> Ne<strong>the</strong>rlands, Switzerland and <strong>the</strong> U.K.launched Railteam last summer. The goal of Railteam, which is styled like an airline alliance, is to make international high-speed railtravel easier, faster and more seamless, providing a true alternative to intra-European air travel.

CWTvIsIon Issue 3 - January 200821I have some good news: I have obtained from <strong>the</strong> European Parliament and Council adefinitive approval of <strong>the</strong> “Third Rail Package.” This includes <strong>the</strong> opening up of <strong>the</strong>passenger rail market to all international competition in Europe in 2010, which isimportant, as it will gradually enable real competition. This will take longer than in <strong>the</strong>aviation sector for obvious reasons but it will happen. We have also standardized rulesfor train driving so that drivers will all have <strong>the</strong> same training, and we have created railpassenger rights. Of course, we now have to apply <strong>the</strong>se rules, but it is a first and verysignificant victory. I am aware that it is still difficult to get a single ticket for travel betweenEuropean cities. We also need to teach rail and air operators to combine <strong>the</strong>ir tickets.In fact, <strong>the</strong>re will be a whole series of issues but I think we are on <strong>the</strong> right track.”EU rail policy: key milestones1996Definition of interoperability standards2001-2003(First Rail Package)Partial liberalization of international rail freight transportRequirement for each state to set up a national regulatory bodyCreation of a European Railway Agency2004-2007(Second Rail Package)Full liberalization of international freight transportLiberalization of national freight transport (cabotage)Introduction of EU rail safety standards and licensesUpdated legislation on technical interoperabilityIntroduction of rail passenger rights2009-2010(Third Rail Package)Introduction of a European license for train driversFull liberalization of international passenger service marketRules to improve freight qualitySource: CWT <strong>Travel</strong> Management Institute

22 Priorities for Mobility“The more people travel, <strong>the</strong> morewe can reconcile interests”Jacques Barrot, Vice President of <strong>the</strong> European Commission and Commissionerfor Transport, answers questions from travel managers and CWT professionals.Question: Is <strong>the</strong>re any way to segment business travelers through <strong>the</strong> securityprocess to make it more efficient for <strong>the</strong>m?Jacques Barrot: I have seen a few interesting attempts where airports have created aVIP service for business people to avoid long lines. The problem is to convince airportsto create systems that will enable all business travelers to save time. Airports have to dealwith a significant increase in traffic so <strong>the</strong>y tend to think mainly in terms of how tomanage aircraft capacity, but <strong>the</strong>y should also think in terms of quality of service. I amgoing to try to work toward this with a few airports.Question: Companies have no direct access to <strong>the</strong> European Commission, unlikeairlines and travel agencies. What can be done to ensure that companies areconsulted on important issues?Jacques Barrot: You are right: <strong>the</strong> voice of companies that use transport is not heardenough in <strong>the</strong> Commission and we need to improve on that. Please write to me topoint out any situation that seems to harm <strong>the</strong> interests of companies with businesstravelers. You really should not hesitate. We are <strong>the</strong>re to supervise what is happeningand it is much less problematic for us than for member states. Since <strong>the</strong> EuropeanCommission is independent, we can arbitrate without having to consider partisan politics.I have sworn to serve <strong>the</strong> European general interest and that means fair competition.

CWTvIsIon Issue 3 - January 200823Question: You have talked about eliminating state subsidies in <strong>the</strong> EU. What doyou think about Chapter 11 and how it helps American carriers?Jacques Barrot: This was one of <strong>the</strong> problems we had with signing <strong>the</strong> Open Skiesagreement: <strong>the</strong> fact that, in some cases, American authorities have lent significant helpto companies. In fact, Chapter 11 has helped prevent some American companies frombeing liquidated. <strong>With</strong>in <strong>the</strong> Open Skies agreement, we have agreed that Europe wouldbe rigorous on public subsidies and that <strong>the</strong> United States would make a similar effort.There is one point that we did not settle in <strong>the</strong> first phase of <strong>the</strong> Open Skies agreementand that is ownership. We would like <strong>the</strong>re to be more freedom to invest, so thatEuropeans can buy American companies and vice versa. The U.S. Congress refused,with support from <strong>the</strong> trade unions. The unions were afraid European buyouts wouldlead to <strong>the</strong> closure of certain routes and job cuts. I think this is a short-term view and,in reality, everyone would benefit if investments were liberalized on both sides of <strong>the</strong>Atlantic.Question: Based on <strong>the</strong> experience of emissions trading in o<strong>the</strong>r regions ando<strong>the</strong>r industries, how can Europe avoid <strong>the</strong> drawbacks?Jacques Barrot: There are real drawbacks to emissions trading schemes but <strong>the</strong>advantages outweigh <strong>the</strong>m considerably. This said, it all depends on quotas. If you fixrelatively limited quotas, <strong>the</strong>re is a much smaller risk of negative effects. We are leaningtoward limited quotas to avoid too much trading and provide airlines with an incentiveto buy cleaner aircraft. We also have a major research program across <strong>the</strong> aviationindustry and we have seen real progress. In just a few years, emissions from kerosenehave dropped by 30 percent thanks to lighter planes and better engines. In addition,we have a program with <strong>the</strong> U.S. Federal Aviation Administration to develop pilotingand landing techniques that are much more energy-efficient. We have also seenconsiderable progress here. It is in our interest to act because, as you will see,environmental issues will become increasingly urgent. Aviation needs to accept a certainamount of discipline and airlines have understood this. It is <strong>the</strong> price to pay so thatpeople can continue to fly without a guilty conscience.Question: Do you think it will be necessary to limit <strong>the</strong> number of airlines entering<strong>the</strong> market to help stabilize <strong>the</strong> industry, balancing competition with survivability?Jacques Barrot: We need to leave <strong>the</strong> market open. We need new airlines, given <strong>the</strong>growth forecasts for worldwide traffic. But we need to be very strict not just about <strong>the</strong>quality of planes and <strong>the</strong> quality of pilots but about airline management. Air transportis too important and has too much impact for us to authorize badly run airlines. In o<strong>the</strong>rwords, we need to let airlines enter a booming market but we need to firmly endorsesafety requirements. The European Aviation Safety Agency needs to be unbendingabout safety and we need competent administrations to monitor it. We have seen howimportant this is in new, fast-growing member states. Competition is necessary but weneed to be fully attentive to quality and we are obliged to regulate.

24 Priorities for MobilityQuestion: Could you provide an update on regulation regarding global distributionsystems (GDSs) in Europe? Can <strong>the</strong> situation change if European airlines maintaina stake in Amadeus?Jacques Barrot: We are reviewing our guidelines on <strong>the</strong> relations between airlines andGDSs. The current rules are quite complex. We do not want to get rid of <strong>the</strong> rules butwe do want to make <strong>the</strong>m more operational so we can ensure <strong>the</strong>y are applied. Thequestion is whe<strong>the</strong>r we need to cut <strong>the</strong> ownership link between airlines and GDSs.That is a real issue and we need to weigh how difficult that would be. I propose that,in my conversations with <strong>the</strong> presidents of companies that hold major stakes in GDSs,and in one GDS in particular, I see whe<strong>the</strong>r <strong>the</strong>y could withdraw in order to provide faircompetition among <strong>the</strong> GDSs. For me, this is an extension of everything we are doingto promote fair competition.Question: What power do you have to limit <strong>the</strong> growing number of air taxes?Jacques Barrot: We are making a proposal that will bring greater transparency for airportcharges—airports and airlines need to talk on a clear and transparent basis. We have told<strong>the</strong>m that if <strong>the</strong>y cannot manage this, we will require <strong>the</strong>m to call in a mediator. Underour proposal, each member state will have to have a mediator to reach an agreementbetween airlines and airports. This is only part of <strong>the</strong> story, however, as <strong>the</strong>re is ano<strong>the</strong>rdebate continuing over payment for security measures. We have a major problem withmember states because <strong>the</strong> European Parliament wants clear rules on who pays forsecurity: <strong>the</strong> state, <strong>the</strong> airline, <strong>the</strong> airport or <strong>the</strong> traveler? There is real conflict betweenmember states, who say that Europe should not interfere with <strong>the</strong>ir business, and <strong>the</strong>European Parliament, which wants <strong>the</strong> state to take on more of <strong>the</strong> cost. We will finda solution, but it is complex because each member state has its own way of managingsecurity. Finally, all <strong>the</strong> different taxes should be clearly indicated on each ticket. 11At <strong>the</strong> end of November, <strong>the</strong> European Union agreed to oblige companies to include all taxes and charges in advertised air ticketprices to customers. The European Parliament is expected to approve <strong>the</strong>ses measures.

CWTvIsIon Issue 3 - January 20082Question: Are you working on increasing service from Europe to China?Jacques Barrot: I have asked <strong>the</strong> member states for a mandate to start negotiationswith China, not to arrive at exactly <strong>the</strong> same model as <strong>the</strong> Open Skies agreement with<strong>the</strong> United States but at least to liberalize routes between Europe and China. We shouldreach an agreement but we are not <strong>the</strong>re yet. The rapid development of this marketrequires liberalization and greater competition so we are pursuing it. I also have somehopes for <strong>the</strong> Indian market because <strong>the</strong> Indian minister is very concerned aboutliberalizing air traffic. But we are having difficulties with China. Some member statesthat I will not name are very happy with <strong>the</strong>ir existing bilateral relations with Chinabecause it prevents new entrants. It is a real problem and I am not sure I have verystrong support from all <strong>the</strong> airlines. All <strong>the</strong> same, I hope that, from <strong>the</strong> Chinese side aswell, <strong>the</strong> desire to create more numerous, competitive relations will take <strong>the</strong> upperhand and we will sign an agreement one day. At a time when growth in China and Asiaare exploding, it is paradoxical to be a bit limited in terms of mobility.A final word…Jacques Barrot: In closing, I would like to say: please do not hesitate to contact me. Iinsist. I am a politician and I am here to advance mobility in Europe and worldwide.Because mobility is <strong>the</strong> symbol of freedom. It is <strong>the</strong> means for exchange andconsequently a great virtue. It would be paradoxical if, as globalization accelerates, goodscirculate easily but not people. So please do not hesitate to tell me if you noticediscrepancies that could undermine free movement. And thank you for everything youare doing, because <strong>the</strong> more people travel, <strong>the</strong> more we can reconcile our interests. Inever forget that if I have a European vocation, it is because I consider Europe to be<strong>the</strong> testing ground for mutual understanding. We cannot build our future if we do notunderstand each o<strong>the</strong>r, and we cannot understand each o<strong>the</strong>r if we do not meet. Thatis why you are doing <strong>the</strong> most noble of jobs and so am I. To contact Jacques Barrot, please write to:Mr. Jacques BarrotVice President of <strong>the</strong> EuropeanCommission and Commissioner for TransportRue de la Loi/Wetstraat 2001049 BrusselsBelgium

CWTvIsIon Issue 3 - January 20082Open Skies:Opening Up OpportunitiesWhat changes will <strong>the</strong> EU-U.S. “Open Skies” agreement bring to airlines andwhat benefits can travel managers expect?Dale EastlundDirectorCWT Air Solutions, North America“A good start” is how many experts have described <strong>the</strong> EU-U.S. Open Skies agreement, dueto come into effect at <strong>the</strong> end of March. Although it falls short of full liberalization, <strong>the</strong> dealopens up significant opportunities for airlines on both sides of <strong>the</strong> Atlantic. A morecompetitive marketplace—at least in <strong>the</strong> short- to medium-term—will undoubtedly producebenefits for customers.What <strong>the</strong> EU-U.S. Open Skies deal will changeImplementation will take place in two phases. The first marks <strong>the</strong> end of highly restrictivebilateral agreements between individual EU nations and <strong>the</strong> United States. Previousregulation limited traffic rights on international routes and at airports, providing an unfaircompetitive advantage to some airlines. Notably, American Airlines, British Airways,United Airlines and Virgin Atlantic have held a comfortable oligopoly on Europe’s busiestand most profitable transatlantic route, London Heathrow to New York JFK. Removingsuch barriers already represents a major step forward.What will happen in <strong>the</strong> second phase is less clear. Negotiations must start before <strong>the</strong>end of May this year and conclude before <strong>the</strong> end of November 2010. Europe has,however, reserved <strong>the</strong> right to withdraw from <strong>the</strong> agreement. This may happen if <strong>the</strong>United States does not provide “cabotage” rights to EU carriers (discussed below) or ifo<strong>the</strong>r contentious issues are not resolved.Main changes in Phase 1 (starting March 30, 2008):All EU and U.S. airlines will have <strong>the</strong> right to fly transatlantic routes to andfrom <strong>the</strong> airports of <strong>the</strong>ir choice without restrictions on capacity, frequencies andtypes of aircraft. Airlines may propose transatlantic services that originate and/orterminate outside <strong>the</strong> open aviation area as long as <strong>the</strong>y include a stop-over in <strong>the</strong>home region (EU or U.S.). The deal also provides for unlimited code-sharingbetween EU, U.S. and third-country airlines.

CWTvIsIon Issue 3 - January 20082Benefits for travel managers and corporate travelersIndustry leaders have almost unanimously welcomed <strong>the</strong> agreement, recognizing <strong>the</strong>benefits it will bring for customers, as well as for <strong>the</strong> economy as a whole. EuropeanCommission Vice President and Transport Commissioner Jacques Barrot predicts thattransatlantic passenger numbers will increase by 26 million, with 80,000 new jobs andbillions of euros in economic benefits within five years. For travel managers, a numberof concrete improvements are likely:A wider choice of routes and schedules. In <strong>the</strong>ory, <strong>the</strong> Open Skies agreement willincrease <strong>the</strong> number of transatlantic routes available to customers, in terms of citypairs and airports. In particular, direct flights to secondary cities may increase.Likewise, frequency of service may rise. In practice, this will depend on carriers’ability to secure <strong>the</strong> relevant runway slots, which are already scarce at many airportssuch as London Heathrow and Gatwick, Paris Orly, Frankfurt, Dusseldorf and MilanLinate.Alliance members are likely to share some of <strong>the</strong>ir existing slots, while o<strong>the</strong>r airlineswill attempt to acquire new take-off and landing slots at a high price—up to €15million (US$20 million) per pair by some estimates. Already, numerous carriers andairline alliances have announced plans to launch new services or expressed interestin doing so. (See <strong>the</strong> table on Pages 30-31.)New opportunities for negotiations with preferred providers. As carriers reshuffle<strong>the</strong>ir networks, companies may be able to reconsider airlines or alliances previouslyexcluded from negotiations for failing to offer a key destination or airport like LondonHeathrow. In <strong>the</strong> future, <strong>the</strong>y should have a wider choice of European airlines to fit<strong>the</strong>ir traffic pattern—currently U.S. airlines dominate <strong>the</strong> major transatlantic routes.Lower fares. As <strong>the</strong> regulatory barriers to market entry go down, <strong>the</strong> number ofplayers competing on key routes is expected to rise. In <strong>the</strong> short- to medium-term,competition will increase from traditional airlines expanding or reorganizing <strong>the</strong>irservices, as well as new niche players offering business-only or low-cost services.Although transatlantic fares are already low for many routes and classes (e.g., LHR-JFK in economy), evolving market conditions could still see fares drop, especially inbusiness class—some analysts predict savings of 5-10 percent. In <strong>the</strong> longer term,however, accelerating consolidation and increased cooperation among alliancemembers could lead to less competition on some routes and <strong>the</strong>refore higherprices.Improved service. More intense competition is likely to encourage airlines to fur<strong>the</strong>rimprove service for business travelers. This may lead to faster check-in procedures,enhanced airport lounge comfort and better on-board features such as fullyhorizontal flat beds. As airports continue to struggle with overcapacity, however,congestion and delays are unlikely to improve significantly in <strong>the</strong> foreseeable future.

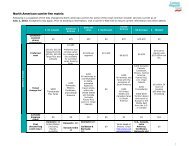

30 Open Skies: Opening up OpportunitiesOpportunities on <strong>the</strong> horizonA bumpy ride may be ahead for airlines as <strong>the</strong> industry reshuffles with new services,new players, consolidation and ultimately a shake-out of weaker competitors—fromspecific routes or from <strong>the</strong> market altoge<strong>the</strong>r. Some experts predict that just half <strong>the</strong>number of international airlines will survive in Europe and <strong>the</strong> United States.In addition, <strong>the</strong> route to full liberalization is by no means clear: phase two negotiationsbetween <strong>the</strong> two sides are likely to be tough. Yet <strong>the</strong>re are high hopes that <strong>the</strong> currentOpen Skies framework will lead to a fully competitive global market, as well as bringdeeper transatlantic cooperation on o<strong>the</strong>r key issues impacting aviation.Until <strong>the</strong>n, companies should keep an eye on alternate carriers and evolving fares onkey routes. Although <strong>the</strong> full impact of Open Skies on <strong>the</strong> travel program may not befelt for some years to come, new opportunities are bound to appear on <strong>the</strong> horizon forthose carefully watching. New services coming up…The following are a selection of announcements made by airlines since <strong>the</strong>EU-U.S. Open Skies agreement was signed.Airline/AllianceAer LingusAir FranceandDelta Air LinesBritish AirwaysContinentalAirlinesPlansNew long-haul services from Dublin to San Francisco, Orlandoand Washington Dulles.Formal joint venture to share costs and revenues on flights betweenEurope and America, including Canada and Mexico.In <strong>the</strong> first phase, beginning April, <strong>the</strong> two carriers’ combined 19 flightsare expected to increase <strong>the</strong>ir current seats by 45%.New Delta service from London Heathrow using Air France slots.New non-stop flights from New York JFK to Lyon, JFK to Paris Orlyand Salt Lake City to Paris CDG.Reorganization of flights from London Gatwick and Heathrow,as <strong>the</strong> airline moves into <strong>the</strong> new LHR Terminal 5 (e.g., flights toDallas and Algiers will depart from Heathrow, while flights to Warsawwill shift to Gatwick).More frequent flights between London and New York, Seattle,Washington and Orlando.New non-stop service to <strong>the</strong> U.S. from key European destinationsoutside <strong>the</strong> U.K., starting with flights to New York from two or threecities.New twice-daily direct services from London Heathrow to New YorkNewark and Houston George Bush Intercontinental.

CWTvIsIon Issue 3 - January 200831Delta Air LinesNonstop services between Edinburgh and New York JFK startingMay 1, as part of a major route expansion (20% more available seatmiles) from <strong>the</strong> airline’s U.S. East Coast hub.Eos AirlinesNew services between London Stanstead and New York Newarkstarting in spring 2008, and between Paris (airport not yet announced)and New York JFK starting next autumn.KLMNew daily direct services from Amsterdam Schiphol to Dallas FortWorth starting March 30.Ryanaironeworld partnersBritish Airwaysand AmericanAirlinesSkyTeam partnersAir France, Alitalia,CSA Czech Airlines,Delta Air Lines,KLM andNorthwest AirlinesStar Alliancepartners bmi andUnited AirlinesA new transatlantic airline serving five or six U.S. cities, includingBaltimore and Providence, starting in 2010.No plans to file for anti-trust immunity, according to British Airways,given <strong>the</strong> expected concessions required for a successful application(including giving up Heathrow slots).New or expanded services on 24 transatlantic routes, if anti-trustimmunity is granted by <strong>the</strong> United States.Code-sharing on transatlantic services, pending U.S. authorization(bmi does not plan to operate its own transatlantic flights fromHeathrow, where it already owns slots, in order to focus on expansionin o<strong>the</strong>r markets).United AirlinesNew daily flight between Denver and London Heathrow startingMarch 30.US AirwaysNew service between Philadelphia and London Heathrow startingMarch 29.Virgin AtlanticPotential investments of up to £100m (US$135 million) to add dailyflights to New York from several European cities, includingAmsterdam, Frankfurt, Milan, Paris and Zurich. The carrier is alsoseeking permission to code-share with U.S. airlines.Source: CWT <strong>Travel</strong> Management Institute, based on airline announcements

CWTvIsIon Issue 3 - January 200833Lower Costs, Higher Value:Asia-Pacific <strong>Travel</strong> ManagersWelcome “New World” AirlinesBudget carriers are steadily gaining ground within corporate travel programsin Asia Pacific thanks to <strong>the</strong>ir efforts to tailor service to business travelers.Michael MannixVice PresidentCWT Solutions Group Asia PacificNicolas PierretDirector, Global AccountsAsia Pacific, CWTAs <strong>the</strong> global aviation market evolves, many budget carriers are adding services that make<strong>the</strong>ir flights more attractive to business customers, particularly on mid- and long-haul routes.In addition, a growing number of low-cost airlines are launching business-class fares andcorporate deals. The shift toward higher value offerings has been particularly marked in AsiaPacific, where low-cost carriers command an impressive, growing share of <strong>the</strong> travel marketin some countries.This article looks at <strong>the</strong> success of low-cost carriers in <strong>the</strong> region and answers <strong>the</strong>following questions:How has <strong>the</strong> low-cost model been adapted to attract business customers?How can travel managers make <strong>the</strong> most of budget carriers in <strong>the</strong>ir travel program?How much can companies save by shifting market share to low-cost carriers?What impact are new entrants having on <strong>the</strong> market as a whole?According to CWT data, budget carriers already represent 20 percent of client airtransactions in Asia Pacific. This mirrors strong growth in <strong>the</strong> region’s low-cost marketoverall, which accounts for more than half of all new capacity. Global transportinformation company OAG reports that budget airlines accounted for 12 percent ofavailable seats on all intra-Asian flights in 2007, up from less than 1 percent in 2001.Looking ahead, <strong>the</strong> Center for Asia Pacific Aviation predicts that low-cost carriers willrepresent 20 percent of seats by 2010 and 25 percent by 2025.

4%3%2% 2%1%2%34 Lower Costs, Higher Value: “New World” AirlinesGrowth in low-cost airlines worldwide as a percentage of available passenger seatsAll flightsworldwide30%Flights within a regionFlights to o<strong>the</strong>r regions27%26%24%20%17%18%14%12%10%6%20072006EuropeNorthAmericaCentral &SouthAmericaAsiaPacificCentral &SouthAmericaNorthAmericaAsiaPacificEuropeSource: CWT <strong>Travel</strong> Management Institute - Based on figures published by OAG Back Aviation Solutions, September 2007

CWTvIsIon Issue 3 - January 20083Asia-Pacific carriers were among <strong>the</strong> first to move low-cost services up-market, creatinga hybrid “low fares + services” approach or in some cases, a “low fares + full service”model that competes head-on with legacy carriers. Notably, Australia’s Virgin Bluecoined <strong>the</strong> term “new world carrier” to make <strong>the</strong> distinction between its full-serviceoffering and <strong>the</strong> “no frills” product of carriers such as AirAsia. O<strong>the</strong>r carriers that fallinto this “new world” category include Virgin Blue’s sister operations Pacific Blue(Australia and New Zealand) and Polynesian Blue (Pacific Islands), as well as JetstarAirlines (Australia and Singapore), Kingfisher Airlines (India) and Oasis Hong Kong.Typically, <strong>the</strong> hybrid approach breaks away from <strong>the</strong> original low-cost model byintegrating most, if not all, of <strong>the</strong> following features:In-flight service quality is close to that of traditional airlines, with meals andentertainment bundled into <strong>the</strong> fare. Carriers also propose business class or“premium” cabins with designated seating.Primary airports are used, with priority check-in and special lounges for businesstravelers. (This said, <strong>the</strong> use of secondary airports is not always a disadvantage, as<strong>the</strong>y can be less congested and in some cases more conveniently located for <strong>the</strong>traveler.)Interlining and codeshare agreements on international segments offer travelersseamless connecting flights, as well as a larger choice of destinations and schedules.Although only a handful of low-cost carriers (e.g., Jetstar and Virgin Blue) codeshareat present, <strong>the</strong> practice is likely to become more common, especially if low-costcarriers join alliances.Reservations via global distribution systems (GDSs) are possible, instead ofthrough airline Websites only. This is a key service for companies, who can accessflight information efficiently, reserve flights, receive invoices for payment at a laterdate, refer to traveler profiles and better track travelers.Corporate deals can be negotiated, with special payment options andcomprehensive reward programs available. For example, Virgin Blue offersvolume-based pricing, combined with a range of “soft” benefits for companies.Ano<strong>the</strong>r example is Qantas enabling companies to include traffic with its subsidiaryJetstar in overall market share targets.(See <strong>the</strong> sidebar on Page 39 for specific examples of corporate offerings.)At <strong>the</strong> same time, low-cost fares can be 25-40 percent lower than comparable fullserviceeconomy fares, especially when <strong>the</strong>y are booked in advance.

36 Lower Costs, Higher Value: “New World” AirlinesNot surprisingly, <strong>the</strong>se higher-value packages are attractive to corporate travelers. In fact,a number of travel programs now grant “preferred supplier” status to new world carriers.In India notably, corporate deals with new world carriers and o<strong>the</strong>r low-cost carriershave become commonplace. Kingfisher has attracted nearly one-third of <strong>the</strong> businesstravel market only 18 months after adopting <strong>the</strong> new world model, according to CWTestimations. In Australia, CWT estimates that new world budget carriers now attractmore than 15 percent of <strong>the</strong> business travel market.Markets such as Hong Kong or Singapore have been slower to introduce low-cost, fullserviceflights, due to <strong>the</strong> importance of international routes for business travel and <strong>the</strong>higher barriers to entry on <strong>the</strong>se routes for low-cost competitors. While a plethora ofleisure-oriented carriers are in service in <strong>the</strong>se markets, only a few airlines offersignificant business deals.The trend is never<strong>the</strong>less toward upgraded service that better caters to corporate needs,even if die-hard “no frills” carriers are adding features such as seat selection, meals andin-flight entertainment as optional extras. Notably, AirAsia, one of <strong>the</strong> region’s leadinglow-cost carriers, recently announced that it will introduce a choice of economy andlarger “XL” seats on its new Airbus A330s.

CWTvIsIon Issue 3 - January 20083How can travel managers make <strong>the</strong> most of <strong>the</strong>se low-cost carriers in <strong>the</strong>ir travelprogram?Carefully compare providers. Apart from <strong>the</strong> choice of routes and schedules, lowcostcarriers can vary widely in terms of <strong>the</strong> amenities and level of service <strong>the</strong>y offer.It can be a good idea to start small with one or two carriers that fit <strong>the</strong> company’sneeds. Ideally, those carriers should provide <strong>the</strong>ir inventory to a GDS. If not, a travelmanagement company like CWT can provide a Webfare booking interface on acase-by-case basis.Consider moving to a “best buy” policy on routes where price competition isstrong between preferred providers. In Australia and India, <strong>the</strong> fact that air supplyoutweighs demand makes spot buying a logical, cost-effective approach. In fact, itaccounts for 60 percent of companies’ domestic transactions in Australia.Recommend advance booking and communicate on <strong>the</strong> potential savings.Studies show that significant savings are possible even if travelers exchange a largeproportion of tickets. Contrary to popular belief, low-cost fares can be more flexiblethan full-service economy as <strong>the</strong>y are often exchangeable and do not carryrestrictions such as a compulsory Saturday-night stay.If no hard mandate is in place, consider providing incentives for employees touse low-cost airlines. For example, with each trip, <strong>the</strong> traveler could enter a prizedrawing sponsored by <strong>the</strong> airline. Combined with communications on <strong>the</strong> financialbenefits for <strong>the</strong> company, incentives can help boost compliance with travel policy.Exploit potential synergies with an online booking campaign as part of <strong>the</strong>company’s drive to better manage costs.Impressive savings potentialCWT clients who are willing to shift market share in Asia Pacific to low-cost carriers haveidentified impressive savings potential.In Australia, for example, a leading international energy company identified 10 percentsavings (US$100,000 on total national air spend of US$1 million) by switching 30percent of traffic to a low-cost carrier. This involved a best-buy approach on routes whichwould not require any compromise in terms of flight frequency.In India, an international consulting company calculated that it could save 5 percent onair spend by moving some volume to low-cost alternatives and consolidating travel withpreferred airlines. The company had evaluated its domestic air spend at US$8.2 million,having seen its payroll multiply by 100 over <strong>the</strong> previous three years. As a number oflocal contracts with airlines were expiring, <strong>the</strong> organization reviewed its strategy both ata national and regional level, including an in-depth analysis of <strong>the</strong> Indian airline marketand different market share scenarios. This indicated savings of US$400,000.

38 Lower Costs, Higher Value: “New World” AirlinesBenefits for all playersEven companies that do not source low-cost carriers can benefit from <strong>the</strong> way in which<strong>the</strong>se new players have shaken up <strong>the</strong> market. In reaction to aggressive low fares,traditional airlines have generally kept prices stable, avoiding <strong>the</strong> major price hikesobserved in o<strong>the</strong>r industries across <strong>the</strong> region. Many legacy airlines are also relaxingrestrictions on economy fares in order to maintain business. In addition, carriers likeQantas (owner of Jetstar) are upgrading <strong>the</strong>ir services by offering <strong>the</strong>ir own premiumeconomy class, with features such as dedicated check-in and flat beds.More competition in <strong>the</strong> market is clearly a cause for celebration among buyers, whocan use <strong>the</strong> possibility of reallocating market share as a major lever in negotiations. Inaddition, companies may benefit from <strong>the</strong> influence low-cost carriers are having ontraveler perceptions. By providing an acceptable alternative to travel with traditionalairlines, budget airlines might be making full-service economy seem a high-priced luxury,which becomes more attractive to travelers who are used to using business class. Thismay help travel managers who are trying to convert travelers from business class toeconomy with legacy preferred partners—often <strong>the</strong> single largest source of savings ina travel program.As <strong>the</strong> market continues to evolve, corporate-friendly budget carriers in Asia Pacific arepresenting growing opportunities for travel managers—indeed, a whole new world ofopportunities for companies willing to give <strong>the</strong>m a try.

CWTvIsIon Issue 3 - January 20083Examples of “new world” features for corporate customersAirlineHomecountry/regionNetworkKey featuresJetstar AirwaysAustraliaand Singapore33 destinationsin Asia Pacific“StarClass”“At <strong>the</strong> price of o<strong>the</strong>r airlines’ standardeconomy fares”Premium cabin with meals, amenitiesand in-flight entertainment(including video on demand)Priority check-in and lounge accesswhere available30 kg allowance for checked baggageLoyalty points for Qantas frequentflyersKingfisher AirlinesIndia34 cities in India,including 13by business class“Kingfisher First”“Redefining business”Volume discounts“King Club” frequent flyer program,in alliance with Air France-KLMFirst class seats with in-flight mealsand entertainmentPersonal valet for first class customersMeet and Assist airport services for VIPsOasis Hong KongHong KongHong Kong toLondon andVancouver“Business Oasis”“Best Business Class Carrier”at <strong>the</strong> 2007 World Low-Cost AirlineAwards (September 2007)In-flight meals and entertainmentSleeper seats with 50-60 inch(127-152 cm) pitchOasis Virgin Blue,Pacific Blue andPolynesian Blue(Soon to includenew carrierV-Australia forlong-haulinternational flights)Australia,New Zealandand Samoa30 destinationsin Australia,New Zealand,<strong>the</strong> Cook Islands,Fiji, Samoa,Tonga andVanuatu“Corporate Plus” flexible faresOption to book and hold faresfor 48 hoursFully refundable tickets (fee: AUS$30)Cancellation or flight changes allowedup to 24 hours after <strong>the</strong> scheduleddeparturePriority check-in and lounge accessfor Australian domestic flights32 kg allowance for checked baggageSource: CWT <strong>Travel</strong> Management InstituteBased on carrier Websites, October 2007

CWTvIsIon Issue 3 - January 200841Ten Business <strong>Travel</strong> Trendsfor 2010How is <strong>the</strong> business travel industry likely to evolve over <strong>the</strong> next few years?A CWT survey of global clients and suppliers identified 10 major trends.Mike KoettingExecutive Vice PresidentGlobal Supplier Management, CWTFloyd WidenerVice President Sales, Europe,Middle East and Africa, CWTThe next few years promise significant change in <strong>the</strong> business travel industry, accordingto CWT clients and suppliers who participated in a qualitative survey on “effective travelmanagement in 2010.” Presented at <strong>the</strong> 2007 CWT global client seminar lastSeptember, <strong>the</strong> findings provoked some lively discussion among participants fromacross <strong>the</strong> industry. This article provides an overview of <strong>the</strong> 10 major trends identifiedin <strong>the</strong> survey.1. Companies will increasingly focus on managing demand and minimizing travelNo one argues that face-to-face meetings will remain essential to business andespecially client relationships. As one participant put it: “Look into my eyes, not myfiles.” None<strong>the</strong>less, companies will increasingly examine how <strong>the</strong>y can get <strong>the</strong> bestreturn on investment from travel and eliminate any unnecessary trips. <strong>Travel</strong>managers will seek creative solutions and will increasingly look to technology for newways to keep people connected wherever <strong>the</strong>y are. Videoconferencing in particular willplay a more important role as technology continues to improve. The latest “halo rooms,”which enable meetings around a virtual conference room, have already proved popularat some companies. In addition, <strong>the</strong> use of laptop Web cameras may replace sometravel, especially for internal meetings or training, allowing organizers to reach out to alarger audience than might be feasible at face-to-face events. One global company, forexample, recently switched an annual marketing conference to a digital format, reaching25,000 participants instead of 1,000.