Travel Management Priorities for 2013 - Carlson Wagonlit Travel

Travel Management Priorities for 2013 - Carlson Wagonlit Travel

Travel Management Priorities for 2013 - Carlson Wagonlit Travel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Executive summarySurvey on travel management priorities <strong>for</strong> <strong>2013</strong>Large and mid-sized companies share the same travel priorities, according to CWT’s latest global client survey on travelmanagement priorities. In <strong>2013</strong>, companies of all profiles will continue to make driving air and ground savings their top focus,followed by improving traveler compliance and optimizing hotel spend. As areas that offer major savings opportunities, itis no surprise they dominate the rankings in these economically challenging times. Other recognized sources of hard savings,optimizing online adoption and optimizing the travel policy, come next, while “softer” ways to enhance program per<strong>for</strong>mancetake on less importance overall.Figure 1<strong>Travel</strong> managers’ priorities <strong>for</strong> <strong>2013</strong>p<strong>2013</strong>RankingPriority1 Driving air and ground transportation savings2 Improving traveler compliance3 Optimizing hotel spendNotes:4567891011Optimizing online adoptionOptimizing the travel policyEnhancing the traveler experienceFurther consolidating the travel programDeveloping key per<strong>for</strong>mance indicatorsAddressing safety and security needsTackling meetings and eventsMaking the program more environmentally friendlyRespondentsCWT asked travel managers to select their top five travel management priorities <strong>for</strong> <strong>2013</strong> and rank them in order of importance. The responses were weightedto take into account how often each priority was ranked 1st, 2nd, 3rd, 4th or 5th. The “Respondents” column shows the proportion of travel managers whoincluded the priority in their top five.“Driving air and ground transportation savings” was identified as a priority by fewer travel managers than “improving traveler compliance” (61% compared to64%) but ranked higher overall because it figured higher in travel managers’ top five.61%64%59%55%49%43%33%34%25%16%8%Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 706 travel managers worldwide (November 2012)This year’s results also reveal some differences between regions, reflecting the market conditions faced by respondents aswell as program maturity. For example, while driving air and ground savings remains the top priority <strong>for</strong> country/regionaltravel managers in Europe, the Middle East and Africa, and Latin America, improving traveler compliance is considered moreimportant by travel managers in Asia Pacific and North America, as well as those responsible <strong>for</strong> global programs. Compared tothe total sample, optimizing online adoption is also a stronger focus <strong>for</strong> country/regional travel managers in EMEA and globaltravel managers (who rank it 3rd instead of 4th). As could be expected, global travel managers accord a higher priority thantheir regional colleagues to further consolidating the travel program. <strong>Travel</strong> managers in Asia Pacific, on the other hand, ranksafety and security higher (7th vs. 9th in the total sample), while in Latin America, more importance is attached to developingkey per<strong>for</strong>mance indicators (4th vs. 8th) and enhancing the traveler experience (5th vs. 6th).<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 5

Regulatory changes will have a varied impact. For example in China (“Zhng Guó” in transliteration), new rules allowinginternational airlines to ticket via <strong>for</strong>eign global distribution systems will be slow to take effect, partly due to lengthy approvalprocedures. On the other hand, relaxed visa regulations in some countries should bring good news <strong>for</strong> the impacted passportholders. Meanwhile, the European Union’s controversial new carbon emission trading system will likely see higher airlinecosts passed on in fuel surcharges. On this “green” theme, more companies will be tracking their carbon footprints in their keyper<strong>for</strong>mance indicators.Finally, all eyes will be on the growing debate surrounding “unmanaged” business travel or “open booking,” which someindustry observers are advocating as an alternative to travel booked through travel counselors and online booking tools. Lackingsufficient proof of real cost savings and traveler satisfaction, this <strong>for</strong>m of “travel management 2.0” seems to be weighed downby disadvantages. However, much awaited further research should be published by the Global Business <strong>Travel</strong> Association, aswell as by the CWT <strong>Travel</strong> <strong>Management</strong> Institute later this year…Figure 3Business travel trends in <strong>2013</strong>Source: CWT <strong>Travel</strong> <strong>Management</strong> Institute<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 7

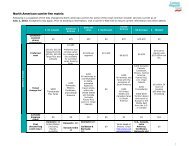

<strong>2013</strong> priorities and planned measuresGlobal annual surveyCWT conducts an annual online survey of travel managers to benchmark their priorities and the measures they plan to implementover the year to come.This year, the sample more than doubled to 706 travel managers, up from 290 last year. Further, the scope of the surveywas extended to include companies with mid-sized national programs (representing at least US$2 million of travel spend) inaddition to those with the largest international programs (more than US$100 million of travel spend over at least 2 regions).<strong>2013</strong> prioritiesIn <strong>2013</strong>, the overall ranking of priorities remains fairly stable compared to 2012. As can be expected, travel managers intend tofocus most on areas representing the greatest savings opportunities rather than those linked more to the traveler experience.What is more surprising perhaps is that the ranking of priorities is identical <strong>for</strong> companies with major global programs and thosewith mid-sized national programs that may not have reached the same levels of maturity. Also worth highlighting are a numberof regional variations:Driving air and ground savings is the top priority overall but an especially high priority <strong>for</strong> travel managers in LatinAmerica, 82 percent of whom ranked this area in their top five.Improving traveler compliance is the top priority <strong>for</strong> travel managers with global responsibilities, 75 percent of whomranked the area in their top five, as well as respondents in Asia Pacific (66 percent) and North America (65 percent).Optimizing hotel spend is highly ranked by all categories of travel managers (53-60 percent, depending on the region).Optimizing online adoption is accorded more importance by travel managers in Europe, the Middle East and Africa, andtravel managers with global responsibilities (ranked by both as the number three priority).Optimizing the travel policy is a priority <strong>for</strong> 49 percent of respondents overall, although the percentage per region variesquite considerably—from 32 percent in Latin America to 53 percent in North America.Enhancing the traveler experience is a top five priority <strong>for</strong> more travel managers in North America and Latin America(51 percent and 50 percent respectively) than in Europe, the Middle East and Africa (34 percent).Further consolidating the travel program is a high priority <strong>for</strong> more global travel managers (46 percent) than the overallsample (33 percent).Developing key per<strong>for</strong>mance indicators is ranked higher by travel managers in Latin America (in 4th position, comparedto 8th overall).Addressing safety and security needs is a stronger focus <strong>for</strong> Asia Pacific (32 percent of respondents, ranking 7th) thanthe overall sample (25 percent, ranking 9th).Tackling meetings and events is cited more often by global travel managers than the overall sample (21 percent and16 percent respectively).Making the program more environmentally friendly is almost always the lowest-ranking priority <strong>for</strong> the differentcategories of travel managers.8

Figure 4<strong>Travel</strong> managers’ priorities <strong>for</strong> <strong>2013</strong><strong>2013</strong>Ranking1234567891011Driving air and ground transportation savingsImproving traveler complianceOptimizing hotel spendOptimizing online adoptionOptimizing the travel policyEnhancing the traveler experienceFurther consolidating the travel programDeveloping key per<strong>for</strong>mance indicatorsAddressing safety and security needsTackling meetings and eventsMaking the program more environmentally friendlySample size: 706 travel managersTotal samplePriorityRespondents61%64%59%55%49%43%33%34%25%16%8%Industrial manufacturing3%Aerospace,defense, oil, gas& construction27%Banking, consulting& insurance18%Breakdown by travel managers’ scope of responsibilitySurveyed companies by sectorMedia, hotels, restaurants & transportation6%Asia PacificEurope, Middle Eastand AfricaLatin AmericaNorth AmericaGlobalPriority Respondents Priority Respondents Priority Respondents Priority Respondents Priority RespondentsOther7%Consumer products, food & retail16%Chemicals, pharmaceuticals& healthcare8%IT & telecommunications15%Compliance66%Air & ground64%Air & ground82%Compliance65%Compliance75%Air & ground59%Compliance62%Hotel59%Air & ground57%Air & ground56%Hotel53%Online adoption59%Compliance57%Hotel60%Online adoption57%<strong>Travel</strong> policy51%Hotel60%KPIs50%Online adoption54%Hotel56%Online adoption49%<strong>Travel</strong> policy51%<strong>Travel</strong>er experience50%<strong>Travel</strong> policy53%Consolidation46%<strong>Travel</strong>er experience47%KPIs35%Online adoption48%<strong>Travel</strong>er experience51%<strong>Travel</strong>er experience41%Safety & security32%<strong>Travel</strong>er experience34%<strong>Travel</strong> policy32%Consolidation35%<strong>Travel</strong> policy35%Consolidation27%Consolidation31%Consolidation32%KPIs32%KPIs38%KPIs22%Safety & security23%Safety & security25%Safety & security28%Safety & security17%Environment7%Meetings & events15%Meetings & events14%Meetings & events18%Meetings & events21%Meetings & events7%Environment13%Environment2%Environment6%Environment2%Sample size: 59 travel managers 287 travel managers 44 travel managers 253 travel managers63 travel managersNotes:CWT asked travel managers to select their top five travel management priorities <strong>for</strong> <strong>2013</strong> and rank them in order of importance. The responses were weightedto take into account how often each priority was ranked 1st, 2nd, 3rd, 4th or 5th. The “Respondents” column shows the proportion of travel managers whoincluded the priority in their top five.“Driving air and ground transportation savings” was identified as a priority by fewer travel managers than “improving traveler compliance” (61% compared to64%) but ranked higher overall because it figured higher in travel managers’ top five.Regional results include country/regional travel managers.Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 706 travel managers worldwide (November 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 9

Asia PacificIn Asia Pacific, the number one priority <strong>for</strong> travel managers is improving traveler compliance, with driving air and groundsavings falling to 2nd place. Optimizing hotel spend remains the third priority, while optimizing the travel policy comesfurther up the rankings (4th rather than 5th), swapping places with optimizing online adoption. Another area that is givenmore importance is addressing safety and security needs, which ranks 7th in Asia Pacific, compared to 9th in the total sample.In contrast, developing key per<strong>for</strong>mance indicators ranks slightly lower (9th vs. 8th). (See Figure 4 on Page 9.)Compared with other regions, travel managers in Asia Pacific intend to place more focus on:Communicating/providing training on the travel policy and empowering travel counselors to en<strong>for</strong>ce rules (to improvecompliance)Tightening air and ground travel policy while finding the right balance between negotiated and restricted fares, as well asexploring low-cost carrier opportunities (to drive air savings)Mandating preferred booking channels and consolidating hotel spend on fewer properties to leverage larger volumes innegotiations (to optimize hotel spend)Increasing the scope of online booking tool (OBT) implementation and mandating OBT usage (to optimize online adoption)And less focus on:Negotiating fuel surcharges and ancillary fees (to drive air and ground savings)Globalizing volumes and contracts (to further consolidate the travel program)Figure 5Asia Pacific key indicators (air)Average ticket price in economy classDomesticContinentalIntercontinentalAverage ticket price in business classContinentalIntercontinentalUS$283US$503US$1,242US$1,775US$4,667Intercontinental flights booked in business class 34%Flights booked at least 14 days in advanceDomesticContinentalIntercontinental21%41%57%Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on tickets booked by CWT clients (Q3 2012)10

Figure 6Top priorities and planned measures <strong>for</strong> travel managers in Asia Pacific<strong>2013</strong>Ranking PriorityPlanned measures Respondents *Communicate and provide training on travel policy72%1ImprovingtravelercomplianceActively remind employees of policyEngage management throughout the organizationTrack and communicate compliance levels67%59%56%Empower travel counselors to en<strong>for</strong>ce compliance49%2Driving airand groundtransportationsavingsFind the right balance between negotiated and restricted fare usageTighten air policy (class of travel, use of connecting flights, advance booking, etc.)Work with airline alliancesNegotiate point-of-origin pricing57%51%43%40%Concentrate volume on a limited number of suppliers40%Consolidate hotel spend on fewer properties to leverage larger volumes in negotiations61%3Optimizinghotel spendMandate preferred booking channelsMandate the use of preferred hotels58%58%Consolidate multiple sources of hotel data52%4Optimizingthe travel policyAddress advance purchase behaviorStandardize the policy regionally or globallyAim <strong>for</strong> best-in-class travel policy guidelines57%50%37%5OptimizingonlineadoptionEnhance communication/trainingTrack and communicate online booking tool (OBT) usageIncrease scope of OBT implementationMandate OBT usage76%69%45%45%* Percentage of respondents who selected the planned measure having cited the corresponding priority in their top fiveSource: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 59 travel managers in Asia Pacific (November 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 11

Europe,In Europe, the Middle East and Africa, driving air and ground transportation savings and improving traveler complianceremain the top two priorities <strong>for</strong> travel managers. Compared to the total sample, optimizing online adoption comes higherin the ranking, switching places with optimizing hotel spend (ranking 3rd and 4th respectively). Optimizing the travelpolicy remains in 5th place, while enhancing the traveler experience ranks slightly lower (7th vs. 6th in the total sample).(See Figure 4 on Page 9.)Compared with other regions, travel managers in Europe, the Middle East and Africa intend to place more focus on:Tightening air and rail policy (to drive air and ground transportation savings)Addressing advance purchase behavior (to optimize the travel policy)And less focus on:Negotiating point-of-origin pricing (to drive air and ground transportation savings)Implementing an expense management tool (to improve traveler compliance)Implementing social media tools/apps (to improve the traveler experience)Figure 7Europe, Middle East and Africa key indicators (air)Average ticket price in economy classDomesticContinentalIntercontinentalAverage ticket price in business classContinentalIntercontinentalUS$447US$577US$1,617US$1,689US$6,523Intercontinental flights booked in business class 39%Flights booked at least 14 days in advanceDomesticContinentalIntercontinental36%46%64%Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on tickets booked by CWT clients (Q3 2012)12

Middle East and AfricaFigure 8Top priorities and planned measures <strong>for</strong> travel managers in Europe, Middle East and Africa<strong>2013</strong>Ranking PriorityPlanned measures Respondents *1Driving airand groundtransportationsavingsTighten air policyFind the right balance between negotiated and restricted fare usageConcentrate volume on a limited number of suppliers40%40%38%2ImprovingtravelercomplianceActively remind employees of policyEngage management throughout the organizationCommunicate and provide training on travel policy71%56%47%3OptimizingonlineadoptionEnhance communication/trainingTrack and communicate online booking tool (OBT) usageEncourage travel counselors to steer travelers to the OBT58%44%40%4Optimizinghotel spendMandate the use of preferred hotelsNegotiate amenities (e.g., Internet, breakfast and parking)Consolidate hotel spend on fewer properties to leverage larger volumes in negotiations54%39%39%5Optimizing thetravel policyAddress advance purchase behaviorStandardize the policy regionally or globallyAim <strong>for</strong> best-in-class travel policy guidelines61%38%30%* Percentage of respondents who selected the planned measure having cited the corresponding priority in their top fiveSource: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 287 travel managers in Europe, Middle East and Africa (November 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 13

Latin AmericaDriving air and ground transportation savings also remains the top priority when looking at the survey results <strong>for</strong> LatinAmerica. Optimizing hotel spend and improving traveler compliance switch places, ranking 2nd and 3rd respectively.However, optimizing online adoption and the travel policy drop to 7th and 8th place as travel managers in this region makea higher priority of developing key per<strong>for</strong>mance indicators and enhancing the traveler experience (in 4th and 5th place).(See Figure 4 on Page 9.)Compared with other regions, travel managers in Latin America intend to place more focus on:Implementing advance booking rules and tightening rental car policy (to drive air and ground savings)Introducing mandates on preferred hotels (to optimize hotel spend)Tracking changed/cancelled bookings and related costs (as key per<strong>for</strong>mance indicators)Offering traveler profile management tools (to enhance the traveler experience)And less focus on:Introducing measures to optimize the rail program, in view of the limited offering in this region (to drive ground savings)Implementing social media tools (to enhance the traveler experience)Figure 9Latin America key indicators (air)Average ticket price in economy classDomesticContinentalIntercontinentalAverage ticket price in business classContinentalIntercontinentalUS$269US$824US$1,403US$1,857US$4,581Intercontinental flights booked in business class 25%Flights booked at least 14 days in advanceDomesticContinentalIntercontinental22%36%55%Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on tickets booked by CWT clients (Q3 2012)14

Figure 10Top priorities and planned measures <strong>for</strong> travel managers in Latin America<strong>2013</strong>Ranking PriorityPlanned measures Respondents *Driving airConcentrate volume on a limited number of suppliers58%and ground1 transportationsavingsWork with airline alliancesImplement advance booking rules47%42%2Optimizinghotel spendMandate the use of preferred hotelsConsolidate hotel spend on fewer properties to leverage larger volumes in negotiationsNegotiate amenities (e.g., Internet, breakfast and parking)77%50%50%3ImprovingtravelercomplianceActively remind employees of policyCommunicate and provide training on travel policyEngage management throughout the organization72%64%60%4DevelopingKPIsModified/cancelled booking and related costsMissed air savings (vs. lowest logical airfares)Average ticket price evolution and benchmarking77%46%41%5Enhancing thetraveler experienceOffer mobile servicesOffer traveler profile management tool55%41%* Percentage of respondents who selected the planned measure having cited the corresponding priority in their top fiveSource: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 44 travel managers in Latin America (November 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 15

North AmericaIn North America, travel managers’ top priority is improving traveler compliance, which pushes driving air and groundtransportation savings to 2nd place. Their 3rd, 4th and 5th priorities match the results of the total sample: optimizing hotelspend, online adoption and the travel policy. (See Figure 4 on Page 9.)Compared with other regions, travel managers in North America intend to place more focus on:Negotiating multi-year contracts and implementing flexible, dynamic negotiations with suppliers throughout the year(to drive air savings)Extending the geographical scope of the travel program and standardizing processes (to further consolidate the travelprogram)Leveraging technology (to tackle meetings and events)And less focus on:Finding the right balance between negotiated and restricted fare usage (to optimize air and ground savings)Implementing advance booking rules (to optimize hotel spend)Defining criteria <strong>for</strong> using travel alternatives (to optimize the travel policy)Figure 11North America key indicators (air)Average ticket price in economy classDomesticContinentalIntercontinentalAverage ticket price in business classContinentalIntercontinentalUS$562US$761US$1,567US$2,410US$6,055Intercontinental flights booked in business class 37%Flights booked at least 14 days in advanceDomesticContinentalIntercontinental47%56%66%Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on tickets booked by CWT clients (Q3 2012)16

Figure 12Top priorities and planned measures <strong>for</strong> travel managers in North America<strong>2013</strong>Ranking PriorityPlanned measures Respondents *1ImprovingtravelercomplianceActively remind employees of policyEngage management throughout the organizationCommunicate and provide training on travel policyTrack and communicate compliance levels76%64%58%58%2Driving airand groundtransportationsavingsConcentrate volume on a limited number of suppliersNegotiate multi-year contracts and implement flexible, dynamic negotiations withsuppliers throughout yearTighten the air policy (class of travel, connecting flights, advance booking, etc.)46%46%42%Negotiate amenities (e.g., Internet, breakfast and parking)49%3Optimizinghotel spendConsolidate hotel spend on fewer properties to leverage larger volumes in negotiationsMandate the use of preferred hotels47%45%Request last-room availability (LRA) agreements from hoteliers41%4OptimizingonlineadoptionEnhance communication/trainingTrack and communicate online booking tool (OBT) usageEncourage travel counselors to steer travelers to the OBT71%60%44%5Optimizingthe travel policyAddress advance purchase behaviorStandardize the policy regionally or globallyAim <strong>for</strong> best-in-class travel policy guidelines52%50%47%6Enhancingthe travelerexperienceOffer mobile services 62%* Percentage of respondents who selected the planned measure having cited the corresponding priority in their top fiveSource: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 253 travel managers in North America (November 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 17

Global travel managersLike travel managers in North America and Asia Pacific, global travel managers make improving traveler compliance their toppriority <strong>for</strong> <strong>2013</strong>, followed by driving air and ground transportation savings. Online adoption and hotel spend are theirnext main areas of focus, followed by consolidation, which comes higher in their list of priorities compared to the total sample(5th vs. 7th). (See Figure 4 on Page 9.)Compared with country/regional travel managers, global travel managers intend to place more focus on:Implementing traveler messaging tools (to improve compliance)Negotiating point-of-origin pricing and introducing more mandates (to drive air transportation savings)Globalizing volumes and contracts, and consolidating sourcing (to further consolidate the travel program)Implementing a wider range of measures (to support all priorities)And less focus on:Tightening the travel policy (to optimize air and ground savings)Tracking changed/cancelled bookings and the related costs (to drive air savings)18

Figure 13Top priorities and planned measures <strong>for</strong> global travel managers<strong>2013</strong>Ranking PriorityPlanned measures Respondents *Engage management throughout the organization79%1Improvingtraveler complianceTrack & communicate compliance levelsActively remind employee of policyCommunicate & provide trainings on travel policy75%66%53%Implement traveler messaging tool (CWT Program Messenger)53%2Driving airand groundtransportationsavingsConcentrate volume on a limited number of suppliersWork with airline alliancesNegotiate point-of-origin pricingNegotiate multi-year contracts and implement flexible, dynamic negotiations with suppliersthroughout year69%63%46%46%Review and update online booking tool (OBT) configuration/settings periodically75%3OptimizingonlineadoptionEnhance communication/trainingEnhance OBT featuresTrack and communicate OBT usage72%64%64%4Optimizinghotel spendConsolidate hotel spend on fewer properties to leverage larger volumes in negotiationsMandate the use of preferred hotelsNegotiate amenities (e.g., Internet, breakfast and parking)51%49%49%* Percentage of respondents who selected the planned measure having cited the corresponding priority in their top fiveSource: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on a survey of 63 global travel managers (November 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 19

<strong>2013</strong> business travel trends from A to ZThe following table shows the cross-over between travel managers’ priorities and key market trends <strong>for</strong> <strong>2013</strong>.Survey results and commentary are included in the A-Z of trends as described on Pages 21-72.Figure 14<strong>Travel</strong> managers’ priorities and key industry trends at a glanceTrends<strong>Priorities</strong>Air & groundComplianceHotelOnline adoption<strong>Travel</strong> policyConsolidation<strong>Travel</strong>er experienceKPIsSafety & securityMeetings & eventsEnvironmentPageA- Ancillary fees21B- Brazil, India and China24C- Carbon emission trading30D- Duty of care32E- Expense management34F- Foggy economic outlook35G- Game techniques37H- Hotel reviews39I- Inflation41J- Joint agreements44K- KPIs47L- Low-cost carriers49M- Meetings and events52N- New virtual agents54O- Online usage55P - Packed planesQ - Quick quizR - Rail travelS - Social mediaT - TechnologyU - Unmanaged travel programsV - Visa regulationsW - Well-beingX Y- Gen X&YZ - Zhōng Guó (China)56575861626467697072Source: CWT <strong>Travel</strong> <strong>Management</strong> Institute20

ncillary fees on top of fares and rates will bewatched closely by travel managers in all areas of theAtravel program and leveraged in negotiations.Air & ground Compliance Hotel <strong>Travel</strong> policy KPIsCWT estimates that ancillary fees account <strong>for</strong> 5-10 percent of the corporate air budget 2 and can add up to 33 percent to the cost ofa hotel stay. 3 Car rental “extras” on top of daily or weekly rates can also be significant. More travel managers are there<strong>for</strong>e lookingbeyond fares and rates to effectively manage the total cost of travel.How to tackle ancillary spend?Three main areas are likely to capture more attention:Clarifying the policy on ancillary fees. In a previous CWT survey 4 only 35 percent of surveyed travel managers said theirtravel policy included a special section on ancillary fees. At the very least, companies need to let travelers know which fees arereimbursable, but they can also distinguish between different traveler categories (e.g., by allowing frequent travelers to claimreimbursement <strong>for</strong> airport lounge access). These policy items should be supported by regular communications to travelers.Tracking ancillary spend. CWT’s survey of travel managers’ priorities reveals that nearly one in two global travel managers(46 percent) intend to monitor ancillary spend. But how? Until more ancillary fees are booked through global distribution systems(see Page 23), expense reports and credit card figures will remain the best sources of data on ancillary spend. <strong>Travel</strong> managementcompanies can provide support with tracking, spend estimates and data analysis, enabling clients to monitor program per<strong>for</strong>manceon both the traveler and airline sides.Negotiating ancillary fees with suppliers. Forty-four percent of all surveyed travel managers intend to negotiate hotel amenitiesto optimize spend, while 34 percent of global travel managers plan to negotiate fuel surcharges and other ancillary fees to drivesavings in air and ground transportation. Companies can ask suppliers to provide in<strong>for</strong>mation on ancillary fees so they can moreaccurately compare competing offers, and this can lead to better discounts or even waived fees and improved conditions <strong>for</strong>travelers. For example, some CWT clients with large spend volumes have successfully negotiated frequent flyer perks (e.g., loungeaccess and priority boarding) <strong>for</strong> all their travelers.A major source of revenues <strong>for</strong> suppliersThis focus on ancillary fees is particular important given that suppliers seem in no hurry to reintegrate them into basic prices.Some airlines have introduced fare bundles that include selected ancillary services. (One of the latest examples is AmericanAirlines, which in December 2012 launched optional “Choice Essential” and “Choice Plus” packages offering one free checkedbag and waived ticket change fees along with other services.) Generally speaking, however, ancillary fees continue to be a majorsource of revenues <strong>for</strong> suppliers:The U.S. hotel industry is expected to record a 3.5 percent year-on-year increase in 2012 revenues from amenityfees (e.g., Internet, telephone, business center access and resort fees), reaching an estimated US$1.95 billion accordingto a <strong>for</strong>ecast by New York University. 5 The report suggests the increase comes less from new types of fees than highercharges <strong>for</strong> the same services and increased volume.2CWT <strong>Travel</strong> <strong>Management</strong> Institute, Mastering the Maze: A Practical Guide to Air and Ground Savings (2012)3CWT <strong>Travel</strong> <strong>Management</strong> Institute, Room <strong>for</strong> Savings: Optimizing Hotel Spend (2009)4See Footnote 25Bjorn Hanson, Divisional Dean of New York University’s Preston Robert Tisch Center <strong>for</strong> Hospitality, Tourism and Sports <strong>Management</strong>, Trend Analysis Report (August 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 21

Global airline ancillary revenues are also increasing but holding quite steady as a proportion of all revenues, at 5.4percent in 2012 vs. 5.6 percent in 2011 according to a <strong>for</strong>ecast by global distribution system provider Amadeus. 6 Globally,ancillary fees are expected to bring in US$36.1 billion in 2012, with the strongest revenue increases in Latin America andthe Caribbean; the Middle East and Africa; and Asia Pacific.Airlines continue to evolve their offering by adding new ancillary services, with recent announcements includingonboard Wi-Fi on some U.S. carriers’ international flights, and a “no-show fee” reportedly in the works <strong>for</strong> Southwest’srestricted tickets.Two “classic” fees (checked bags and cancellation fees) still represent airlines’ largest ancillary revenues. Amadeusreports <strong>for</strong> example, that these two charges represented 65 percent of total ancillary revenue at Delta Air Lines and52 percent at American Airlines in 2011.Fuel surcharges appear to be a new source of revenue <strong>for</strong> many airlines, having become disconnected from actual fuelcosts. According to CWT transaction data, fuel surcharges have risen on all kinds of flights, especially intercontinental, sincefirst quarter 2012, even when oil prices have dropped or stabilized. The trend is particularly marked on domestic routes, asshown in Figure 15. As yet, few companies consider fuel surcharges a negotiable item, but they may want to bring them tothe negotiating table with airlines. Their travel management company can help in tracking fuel surcharges and ancillary feesin general.Figure 15Fuel surcharges appear somewhat disconnected to oil price trendsNotes:This chart encompasses all classes of service <strong>for</strong> network carriers based in every region of the world. 12 carriers were included in 2011 and 19 in 2012.Values have been recalculated using flat exchange rates to eliminate artificial price variations.Source: CWT, based on Amadeus and U.S. Energy In<strong>for</strong>mation Administration data6Amadeus/IdeaWorks, Amadeus Worldwide Estimate of Ancillary Revenue <strong>for</strong> 2012 (August 2012)22

Airline ancillary fee distribution: still a work in progressTwo problems typically faced in the corporate air travel program are knowing how ancillary fees compare between airlinesand impact the cost of travel, and how to track traveler spend on ancillary fees when they are paid as separate expensesrather than included in the fare.For the moment, airlines do not systematically make ancillary fees and packages available in global distribution systems(GDSs). The issue is not so much that the technology is unavailable but that the industry needs to agree on standards,and in particular, airlines need to provide the content without discrimination across all distribution channels.A number of initiatives look promising although the desired changes will not happen overnight:More airlines will be equipped technologically to enable e-ticketing of ancillary services via an “electronicmiscellaneous document” (EMD). This system, developed under the leadership of the International Air TransportAssociation (IATA), enables ancillary fee data to be included in IATA’s billing and settlement system. IATA’s objectiveis <strong>for</strong> all commercial carriers to be EMD-capable by the end of <strong>2013</strong>. However, to be useful to corporate buyers,this system must be adopted <strong>for</strong> airline sales through GDSs. Carriers are only just starting to use the capability. (Seebelow.)Airlines have begun to provide more ancillary products through GDSs. For example, in 2012, Delta Air Linesreached agreements to sell Economy Com<strong>for</strong>t (extra legroom) through the Amadeus and <strong>Travel</strong>port GDSs, whileUS Airways began selling ChoiceSeats (preferred seating assignments) through Sabre, initially without enablingEMDs. Air France adopted Amadeus’s solution to distribute its SeatPlus seating on long-haul flights and enable travelcounselors to use EMD <strong>for</strong> tracking and fulfillment.U.S. airlines may be required by law to display ancillary fees through all sales channels if the U.S. Departmentof Transportation includes this measure in new rules expected in May <strong>2013</strong>. Its controversial “Enhancing AirlinePassenger Protections III” regulation has already been postponed several times.IATA is pushing ahead with a New Distribution Capability (NDC) aimed at providing airlines with identicalcapabilities across all sales channels and greater consistency <strong>for</strong> clients. Basically, the system would involveGDSs accessing content directly from participating airlines through shared application programming interface (API)technology. Although this technology already exists—it is used, <strong>for</strong> example, to access content from some low-costairlines—the aim is to implement a more powerful and efficient industry-wide standard that would support productdifferentiation and customization (e.g., optional service packages). Participation is optional, but airlines and GDSsmust choose to cooperate <strong>for</strong> IATA to achieve its aims.<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 23

azil, India and China will continue driving growthin business travel spend, at around twice the worldBaverage.Air & ground Hotel Online adoptionGlobal business travel spending is expected to grow by 8.1 percent 7 in <strong>2013</strong>, at just over twice the <strong>for</strong>ecast rate of economic growth(3.6 percent). 8 However, business travel spending will grow at two speeds: slower overall in developed countries (mostly wellunder 5 percent), and much faster (double-digit growth) in some developing countries. Three countries in particular stand out: India(21.5 percent <strong>for</strong>ecast growth), China (14.7 percent) and Brazil (12.6 percent). Some of their key features are described here.Figure 16Forecast global business travel spending (US$ billions)123456789101112131415United StatesChinaJapanGermanyUnited KingdomFranceItalyKoreaBrazilCanadaIndiaAustraliaRussiaSpainNetherlands2012 <strong>2013</strong> % change254.9194.866.250.840.235.732.931.130.122.522.421.722.117.918.5266.7223.667.452.541.336.132.534.733.923.127.222.723.817.618.9+4.6%+14.7%+1.8%+3.3%+2.8%+1.1%-1.2%+11.8%+12.6%+2.3%+21.5%+4.6%+7.8%-1.6%+2.2%Source: GBTA Foundation, GBTA BTI Outlook ( July 2012, September 2012, October 2012, January <strong>2013</strong>)7GBTA Foundation, GBTA BTI Outlook Annual Global Report and Forecast, Prospects <strong>for</strong> Global Business <strong>Travel</strong> 2012-2016 (July 2012)8International Monetary Fund, World Economic Outlook (October 2012)24

BrazilProjected business travel spend in <strong>2013</strong>: US$ 33.9 billion (+12.6 percent vs. 2012)The world’s 6th largest economyPopulation: 199 million16 cities with more than 1 million inhabitants24 percent of the population aged under 156.5 percent estimated unemployment (<strong>2013</strong>)Sources: International Monetary Fund, World Economic Outlook (October 2012), Central Intelligence Agency, World Factbook (January <strong>2013</strong>), Brazilian Instituteof Geography and Statistics (2012), Population Reference Bureau, World Population Data Sheet (2012)Brazil’s economy is <strong>for</strong>ecast to grow by 4 percent in <strong>2013</strong>, resuming faster growth after slower per<strong>for</strong>mancein 2012 and 2011 (1.5 percent and 2.7 percent respectively, compared to 7.5 percent in 2010, according to theInternational Monetary Fund).The country boasts a highly dynamic airline industry, with many recent mergers and changes in global alliancemembership:Avianca-TACA merged in 2009 and entered Star Alliance in 2012GOL announced the decision to drop the Webjet brand name in 2012 after receiving final approval <strong>for</strong> itsmerger with the carrierAzul and Trip announced their intended merger in 2012TAM, newly merged with LAN, announced it would leave Star Alliance (without confirming it would join LAN inoneworld)Figure 17Market share in Brazil’s domestic aviation market1% 5% 5% 9% 5% 35% 40%PassaredoAviancaTRIPAzulWebjetGOLTAMSource: ANAC – National Civil Aviation Agency of Brazil (October 2012)Capacity and traffic are set to grow in <strong>2013</strong> especially in the domestic market, despite a slowdown in the secondhalf of 2012. New entrants will continue to expand rapidly although perhaps taking less market share away from newlymergedleaders TAM and GOL than in previous years.<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 25

There is no strong distinction between low-cost carriers and network carriers in Brazil.Hotels are experiencing an upward trend in occupancy despite a slowdown in 2012. Brazil reportedly has themost rooms under construction (3,831) in the Central/South America region. 9 About 50 percent of available hotelsare independent.A high proportion of travel content is unavailable in global distribution systems, although airlines are progressivelyreintroducing content. (In 2005, the country’s two largest carriers, TAM and GOL, pulled all of their domestic contentout of GDSs, in effect removing 90 percent of Brazil’s inventory.)Online adoption among Brazilian companies is being driven by online booking tools specifically developed <strong>for</strong> themarket, given the fragmentation of content.Credit cards are widely accepted <strong>for</strong> travel in Brazil, which is not the case of all Latin American countries.A high-speed rail network is in the pipeline, with several routes planned: Campinas–Sao Paulo–Rio de Janeiro,Brasilia–Goiania, Belo Horizonte–Curitiba, and Ribeirao Preto–Uberlandia. The project is still in the planning stage,however, with no firm launch dates yet.CWT <strong>for</strong>ecasts low to high price increases <strong>for</strong> Brazilian business travel in <strong>2013</strong>, depending on the category:Air: +1.6 percent to +6.1 percentHotel: +13.1 percent to +14.8 percentCar: +2.3 percent to +3.4 percent9STR Global, Global Development Pipeline Report (September 2012)26

IndiaProjected business travel spend in <strong>2013</strong>: US$27.2 billion (+21.5 percent vs. 2012)The world’s 10th largest economyPopulation: 1.20 billion53 cities with more than 1 million inhabitants31 percent of the population aged under 159.8 percent estimated unemployment (2011)Sources: International Monetary Fund, World Economic Outlook (October 2012), Central Intelligence Agency, World Factbook (January <strong>2013</strong>), PopulationReference Bureau, World Population Data Sheet (2012), Office of the Registrar General and Census Commissioner, India (2011)India’s GDP is expected to grow by 6 percent in <strong>2013</strong>, compared to 4.9 percent (<strong>for</strong>ecast) in 2012, 6.8 percent in2011 and 10.1 percent in 2010.Given this strong GDP growth, combined with a young population and expanding middle class, the country’saviation market is likely to remain among the world’s fastest growing over the coming decades. However,carriers such as Kingfisher and Air India are struggling to maintain profitability in a predominately low-cost market.(Budget airlines account <strong>for</strong> more than 60 percent of domestic business.) One key issue is fuel prices being keptartificially high by government regulation.Figure 18Indian carriers’ share of the domestic market3%6% 7% 18% 19% 19% 28%KingfisherJetliteGo AirAir IndiaJet AirwaysSpice JetIndigoSource: CWTAlso worth noting:India’s hotels are expanding faster than in any other Asia Pacific country, with 54,738 rooms 10 in the pipeline.Although India’s rail network is one of the world’s largest in the world, it currently has no high-speed lines.Several projects are under review <strong>for</strong> possible construction within the next few years.The first section of Mumbai Metro, a new mass rapid transit system, is due to open in <strong>2013</strong>. Running on adedicated elevated rail corridor, the system will link the northern and southern parts of the city, as well as itssuburbs.Although drivers are not required to hold an Indian driving license, <strong>for</strong>eigners renting vehicles tend to preferhiring a chauffeur to get round the country’s busy roads.CWT <strong>for</strong>ecasts varied price trends <strong>for</strong> Indian business travel in <strong>2013</strong>:Air: +0.3 percent to +1.7 percentCar: +2.6 percent to +4.6 percentHotel: -3.6 percent to -5.1 percent10STR Global, Global Development Pipeline Report (September 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 27

ChinaProjected business travel spend in <strong>2013</strong>: US$223.5 billion (+14.7 percent vs. 2012)The world’s 2nd largest economyPopulation: 1.34 billion (July 2012)90 cities with more than 1 million inhabitants16 percent of the population aged under 154 percent estimated unemployment (<strong>2013</strong>)Sources: International Monetary Fund, World Economic Outlook (October 2012), Central Intelligence Agency, World Factbook (January <strong>2013</strong>), PopulationReference Bureau, World Population Data Sheet (2012)China’s economic growth is likely to accelerate again in <strong>2013</strong> at a <strong>for</strong>ecast 8.2 percent, after slowing slightly overthe last few years (from 10.4 percent in 2010 to 9.2 percent in 2011 and a <strong>for</strong>ecast 7.8 percent in 2012).In line with its booming economy, China’s aviation industry is growing rapidly. More than 90 percent of thedomestic market is shared by four airlines (Figure 19). Three of these (China Airlines, China Eastern and ChinaSouthern, all members of SkyTeam) will fly as a regional alliance in January 2012. SkyTeam remains the largest alliancein China with 44 percent of the market, compared with Star Alliance’s 20 percent. Chinese low-cost carriers offer flightsmainly on sub-routes with the exception of Spring Airlines, which operates primary domestic routes from its base atShanghai Hongqiao International airport.Figure 19Chinese airlines’ share of the domestic market9% 11% 24% 25% 31%OthersHainan Airlines GroupChina Eastern GroupChina Southern GroupAir China GroupSource: CWTChinese high-speed rail has been developing at a remarkable rate, providing an alternative to many air routes<strong>for</strong> business travelers. According to the International Union of Railways, 11 China will have 742 miles of high-speedrail in operation and 5,612 miles under construction by 2012, making its network the world’s largest.11Source: International Union of Railways, High-Speed Lines in the World (July 2012)28

Also worth noting:China has the world’s second largest pipeline of hotel rooms under development (214,971 rooms) after theUnited States (299,201 rooms). 12Most <strong>for</strong>eigners renting a car in China also hire a chauffeur since a Chinese driver’s license is required.Online booking continues to rise.Credit cards are widely accepted in the region.Foreign global distribution systems (GDSs) are now authorized to sell non-Chinese airline content, followingthe government’s decision in October 2012 to relax regulation. (See Page 72.)CWT <strong>for</strong>ecasts low price increases <strong>for</strong> Chinese business travel in <strong>2013</strong>:Air: +0.6 percent to +1.7 percentHotel: +0.3 percent to +1.2 percentCar: +2.1 percent to +3.9 percent12STR Global, Global Development Pipeline Report (September 2012)See Pages 41-43 on inflation in travel prices worldwide.<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 29

Carbon emission trading: non-European carriers will beexempt from the controversial EU Emissions TradingScheme until the fall, pending a global agreementthrough the International Civil Aviation Organization.Air & groundMuch has been written about the European Union’s Emissions Trading Scheme (EU ETS) and whether or not airlines from outsidethe region should participate, but what does it mean in practice? What impact can travel managers expect to air travel costs in <strong>2013</strong>?What the EU ETS is and why it was introducedIn a nutshell:The European Commission describes the EU ETS as “a cornerstone of the European Union’s policy to combat climate changeand its key tool <strong>for</strong> reducing greenhouse gas emissions cost-effectively.”It is a “cap and trade” system that works by fixing an annual allowance <strong>for</strong> the total emissions emitted by companies in specificindustries, and requiring any companies exceeding this limit to buy surplus credits from those emitting less.Companies can trade credits or “bank” them <strong>for</strong> use at a later date, but the main aim is to encourage businesses to reduce theircarbon footprints by associating them with a financial cost.From <strong>2013</strong>, there will be a single EU-wide cap on emissions and the system of free allowances will gradually be replaced byauctions.In January 2012, the scheme opened up to aviation, or more specifically, all airlines operating domestic or international flights arrivingat or departing from EU airports. After a good deal of controversy, however, the European Commission announced in November 2012that “as a gesture of goodwill” it would defer application of the scheme to flights into and out of Europe until after the fall, pending newproposals by the International Civil Aviation Organization (ICAO). Meanwhile, the EU ETS will continue to apply to flights in and between30 European countries (the 27 EU Member States plus Iceland, Liechtenstein and Norway).Why it is controversial: unfair and illegal or a step in the right direction?The EU ETS has met with strong reactions from airlines, industry groups and governments:Opponents argue that the European Commission has unilaterally imposed an extraterritorial tax and that the rulesdiscriminate against certain airlines (e.g., those operating more carbon-intensive shorter routes, older fleets or flights with lowerpassenger occupancy levels). Reportedly, a group of 29 countries lobbied the European Union in 2012 to suspend the EU ETS,including China, India, Russia and the United States—with an underlying threat of trade war and retaliatory measures such asreviewing bilateral air agreements, suspending discussions on EU airlines’ operating or landing rights, and imposing additionalcharges on EU airlines. The Obama Administration even introduced the “European Union Emissions Trading Scheme Prohibition Actof 2011” to prevent U.S. airlines from participating in the scheme.On the other hand, the European Commission maintains that its action does not constitute a tax, which would be in breachof the EU-U.S. Air Transport Agreement, and that it is compatible with international law, as confirmed by the European Court ofJustice in a case brought by some U.S. airlines and trade associations. Moreover, it is “committed to finding a comprehensive andnon-discriminatory multilateral agreement within the ICAO, and the EU legislation is designed to be amended in the light of such anagreement.” The European Commission insists that it will reinstate the rules <strong>for</strong> <strong>for</strong>eign airlines if “suitable progress” is not made atthe ICAO’s fall General Assembly.30

Some airlines have acknowledged support <strong>for</strong> the EU ETS. For example, U.K.-based Flybe has stated that “a well-designedemissions trading scheme rewards airlines who have invested in new aircraft and incentivizes those who haven’t,” while “it is unfairand discriminatory that long-haul airlines, who are the biggest polluters, would not have to pay the cost of their emissions.” Thecompany notes that limiting the scope to intra-EU flights captures only 20 percent of EU carbon emissions from aviation, or 0.5percent of total EU emissions.What kind of international agreement is likelyThe International Air Transport Association has said that the European Commission’s decision to “stop the clock” on the implementationof the EU ETS to flights to and from non-EU countries represents “a significant step in the right direction and creates an opportunity<strong>for</strong> the international community.” For the moment, there is little visibility on the kind of solution that could be proposed if membercountries reach an agreement.The impact on air travel: higher fuel surcharges?The immediate impact of the EU ETS will be limited to airlines operating intra-European flights, at least until the fall. But what will thatimpact be?The actual costs to airlines will be unknown until the first accounting period (January to December 2012) is closed.By March 31, <strong>2013</strong>, airlines must surrender the correct number of allowances (1 per ton of CO 2), including any bought to coversurplus emissions. Failure to do so will generate a fine of €100 (approximately US$133) per allowance. Crucially, it is estimatedthat only about 60 percent of airlines’ emissions will be covered by free allowances, meaning that costs will rise, varying withairlines’ fuel efficiency and carbon trading conditions.Over the past year or so, a number of airlines have stated that the extra costs associated with the system will run intobillions of dollars <strong>for</strong> the industry, and that these costs will be passed on to travelers as higher fuel surcharges. In 2012,<strong>for</strong> example, the announced increases linked to EU ETS have ranged from less than €3 (US$4) to more than €10 (US$13) <strong>for</strong>European and long-haul flights.<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 31

uty of care to employees: awareness of the businessresponsibilities will rise worldwide, although markedDregional differences are likely to remain.Safety & securityWestern companies have long been aware of their duty of care to employees but increasingly they are addressing how thisresponsibility extends to their business travelers. More and more, their concerns go beyond understanding and respectingcomplex regulation in different countries to implementing voluntary duty of care initiatives as an integral part of corporate socialresponsibility.Awareness driven by diverse national lawsLegally speaking, duty of care covers the employer’s responsibility to ensure the safety and well-being of employees, althoughthe precise definitions and applications vary significantly between countries. A few highlights of different legislation 13 illustratethis diversity:The United Kingdom’s Corporate Manslaughter Act of 2007 makes the country’s regulation one of the most stringentworldwide. Companies operating there can be prosecuted <strong>for</strong> negligence even if specific decision-makers are not identified.Moreover, they can be held liable <strong>for</strong> an employee’s death abroad if due to the negligence of management in the U.K.Under Australia’s Workplace Health and Safety laws, companies or individual supervisors can be prosecuted <strong>for</strong> negligenceif reasonable employee protection measures have not been taken.France’s Labor Code is another particularly strict law that can lead to criminal penalties. Employees are considered to be atwork at all times during a trip, meaning that any injuries incurred by business travelers are work-related in the eyes of the law.The Netherlands requires Dutch employers to provide travelers with advance written in<strong>for</strong>mation on possible risks linkedto <strong>for</strong>eign assignments.United States laws on duty of care vary between states. In general, Workers’ Compensation laws, which require companiesto pay indemnities to employees injured during work, do not apply outside U.S. territory, although some states make anexception <strong>for</strong> employees on <strong>for</strong>eign business travel.So far, duty of care regulation has been introduced mainly by the most developed countries and clearly drives companies’awareness of their responsibilities to employees. According to a study carried out by International SOS, 14 unsurprisingly,awareness of the legal and moral responsibilities is greatest in regions that impose strict regulation.However, the situation is changing in countries like China, where global companies are influencing local standards and helpingto raise awareness of corporate social responsibility issues. This is reflected in the CWT survey of travel management priorities,which shows that 32 percent of travel managers in Asia Pacific will prioritize safety and security in <strong>2013</strong>, compared to only25 percent of all respondents on the total sample.13See the International SOS white paper, Duty of Care of Employers <strong>for</strong> Protecting International Assignees, their Dependents, and International Business <strong>Travel</strong>ers(2009) and iJet’s Duty of Care: Are you covered? (March 2012)14International SOS, Duty of Care and <strong>Travel</strong> Risk <strong>Management</strong> Global Benchmarking Study (2011)32

Addressing duty of care risks in business travelSo what are the areas involved in ensuring duty of care <strong>for</strong> travelers? These can range from preventing and dealing with<strong>for</strong>eseeable “mundane” accidents in a company’s offices, to keeping travelers safe in the event of unexpected and hugescalenatural disasters. The risks associated with travelers’ health, safety and well-being are numerous, including administrativeproblems (e.g., lack of visa); inadequate in<strong>for</strong>mation on local destinations; illness or death while traveling; loss or theft ofpersonal items; lack of personal data security; cultural and linguistic isolation; accidents in transportation, accommodation andvisited offices; contact with violence or crime; and exposure to infectious diseases, unstable geopolitical contexts or naturaldisasters.When assessing these risks, it can be useful <strong>for</strong> travel managers to focus on key elements identified by iJet International, whichinclude:Adequate, tailored insuranceClearly written and communicated corporate travel policiesLimited out-of-policy bookings (those not going through the travel management company, which do not benefit from travelertracking and other services)Up-to-date destination intelligenceIn<strong>for</strong>mation on airline safetyLimited numbers of employees on any given flightCarefully selected preferred hotelsWell-managed use of ground transportation (self-drive vs. other options)Availability of hotlinesBenchmarking of standards of care in their industriesAccording to the CWT survey, the most popular planned measures <strong>for</strong> tackling safety and security are providing destinationin<strong>for</strong>mation to travelers, and implementing traveler tracking and real-time notifications. (Notably, 82 percent of theglobal travel managers who prioritize safety and security plan to implement tracking/notifications, and 73 percent destinationin<strong>for</strong>mation.) The next most popular measures are providing a 24/7 security hotline, implementing a disaster/crisisresponse plan, and providing medical assistance and security services (identified by at least 32 percent of all respondentseach time).Given that companies can be held to account by local and/or <strong>for</strong>eign laws, it is advisable <strong>for</strong> them to apply the highest possiblestandards of duty of care in all the countries in which they operate.<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 33

E thexpense management: companies will increasinglyfocus on this area to improve data consolidation anduser experience.Air & ground Hotel <strong>Travel</strong>er experience<strong>Travel</strong> managers juggle a wide range of data from many different sources to serve both day-to-day tactics and long-term strategy.However, getting accurate, comprehensive and workable data often remains a challenge. As companies are focusing more onmanaging the total cost of travel (including hotel amenity fees, additional airline costs, car rental extra fees, meals and so on), theyare naturally turning their attention to expense management. The economic downturn has been another key driver <strong>for</strong> companies tomaster this area.Sizeable benefitsWith improvements in expense management, companies can consolidate all-important data and increase control over spend whileaccessing a number of other benefits:Increased compliance. A strong travel and expenses policy and enhanced reporting capabilities can improve visibility and reducesystem abuses or outright fraud. This helps companies to meet regulatory requirements <strong>for</strong> accountability while supporting strategicobjectives. As an example, online expense claim tools can show out-of-policy spend items and send a reminder to travelers whileflagging non-compliance to auditors. In CWT’s survey of travel management priorities, 12 percent of travel managers intend toimplement an expense management tool to improve traveler compliance.Reduced expense management costs. Directsavings are possible when improvements aremade in areas such as policy, reporting andnegotiations with expense management providers.In addition, indirect savings can be achieved byimplementing more efficient processes, bothin terms of the technological systems usedand the way expense management teams areorganized. For example, an automated expensemanagement system can reduce the costof processing expense claims by more than30-40 percent, according to industry experts.Figure 20Three main areas are involved in expense managementExpensemanagementPolicyProcessesAuthorized expenses and amountsEmployee’s roles, cost centers andhierarchy in the expense approval processFiling of expense claims and invoicesProcessing and reconciliation of expense claimsApproval and reimbursement of expense claimsVAT reclaim and reimbursementAuditing34Web-based software, hosted softwareEnhanced traveler experience. Filing expensemanagement reports can be a heavy administrativetask that lowers productivity and can be a sourceof stress <strong>for</strong> employees. Companies can there<strong>for</strong>eenhance the traveler experience by improvingexpense management tools and processes,SystemSource: CWT <strong>Travel</strong> <strong>Management</strong> Instituteor manual spreadsheetsensuring that the system in place is user-friendly and efficient. As a general rule, the more automated and integrated the system,the greater the time savings <strong>for</strong> everyone involved. Among the features worth considering are electronic reports (including scannedreceipts), mobile apps <strong>for</strong> on-the-go expense claims, easy-to-use expense categories, currency conversion, pre-populated claims<strong>for</strong>ms (integrating data from online booking tools and corporate payment cards), automated compliance checks, integration withfinance systems and automatic reimbursement.More detailed in<strong>for</strong>mation on expense management can be found in an in-depth report by the CWT <strong>Travel</strong> <strong>Management</strong> Institute,Business <strong>Travel</strong>er Services: Finding the Right Fit (2011).

Foggy economic outlook: the European debt crisis,U.S. policy on taxes/public spending and downgradedglobal growth <strong>for</strong>ecasts are among the factorsproducing economic uncertainty <strong>for</strong> <strong>2013</strong>.KPIsWhat impact will the economy have on business travel in <strong>2013</strong>? As the GBTA Foundation put it in their 2012 annual <strong>for</strong>ecast, 15“navigating the current path of the global economy can be likened to driving a foggy road […] with alternating patches of clear drivingand clouded vision.” However it would appear likely that GDP growth will pick up slightly in <strong>2013</strong>, led by developing economies. Incompanies, the mood will be “business travel as usual“ but at the more cautious end of the scale.Growth in GDP and business travel spend despite downgraded <strong>for</strong>ecastsVarious sources predict a slight improvement in <strong>2013</strong> leading up to faster growth in 2014, “when the [economic] mist will clear.” At thetime of publication, the latest <strong>for</strong>ecast by the International Monetary Fund dating from October 2012 pointed to 3.6 percent growthin <strong>2013</strong>, compared to 3.3 percent in 2012. Results were downgraded from the previous <strong>for</strong>ecast largely due to uncertain conditions,not only <strong>for</strong> the most advanced economies but leading emerging markets such as China, India, Russia and Brazil.Figure 21Forecast GDP growth* Includes China, India, Indonesia, Malaysia, Philippines, Thailand and VietnamSource: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on data from the International Monetary Fund, World Economic Outlook (October 2012)15GBTA Foundation, GBTA BTI Outlook Annual Global Report and Forecast, Prospects <strong>for</strong> Global Business <strong>Travel</strong> 2012-2016 (July 2012)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 35

Among the sources of uncertainty are the euro area crisis and U.S. policy on taxes and public spending now that the immediate“fiscal cliff” scenario has been averted. (This would have meant sweeping tax hikes combined with spending cuts to reduce the publicdeficit, leading to a possible mild recession. However, President Obama introduced a law extending tax relief measures on January 1,<strong>2013</strong>.) Austerity policies, high unemployment and weak consumer confidence are likely to continue in developed economies.On the other hand, high employment growth and solid consumption should continue to drive many emerging and developingmarkets, even if growth is likely to be slower than pre-crisis levels.Against this backdrop, the business travel market should continue growing at a faster pace than the economy, according to <strong>for</strong>ecastsmade by the GBTA Foundation.Figure 22Year-on-year <strong>for</strong>ecast growth in global business travel spend (%)(<strong>2013</strong> vs. 2012)Source: CWT <strong>Travel</strong> <strong>Management</strong> InstituteBased on data from the GBTA Foundation, GBTA BTI Outlook (July 2012, September 2012, October 2012 and January <strong>2013</strong>)CWT expects this context to produce modest inflation in travel prices across all regions—typically of just a few percent, as discussedon Pages 41-43.36

ame techniques will become popular as a way toGrein<strong>for</strong>ce compliance with the travel program.ComplianceWhich works best: the carrot or the stick? While many companies successfully use sanctions against “rogue” employees to addresscompliance issues (e.g., non-reimbursement of out-of-policy expenses), more and more are looking at positive ways to rein<strong>for</strong>ce thedesired traveler behavior while educating and engaging travelers in a managed travel program. In particular, game techniques arebecoming more popular as travel managers turn to both tried-and-tested and newer methods to boost compliance—one of their topconcerns.Compliance: a top priorityIn the CWT survey, compliance was cited as a top five priority by 64 percent of all respondents, making this the most common focus<strong>for</strong> <strong>2013</strong>. (It ranks 2nd overall, since driving savings in air and ground transportation tended to rank higher in the top five.)To address compliance, travel managers intend to focus largely on communications tactics such as actively reminding employees ofthe travel policy (72 percent), communicating and providing training (55 percent), and tracking and communicating compliance levels(54 percent). <strong>Travel</strong> managers clearly understand the importance of communication to travelers, who mostly want to do the right thingbut often are unfamiliar with the policy or think they can find better deals on their own. Although only 8 percent of travel managersplan to motivate travelers through game techniques, this can be seen as a quite significant figure considering that the approach is stillquite new.Encouraging friendly competitionOver the last few years, game techniques have crept into many fields as a way to motivate people to act in certain ways or per<strong>for</strong>mbetter. Some cultures are more inclined to participate in such initiatives (China, Brazil, Russia, the United Kingdom and the UnitedStates, according to the Newzoo 2011 National Gamers Survey).In business travel, a well-known example is the frequent flyer “miles” awarded by airlines that can be redeemed to reward loyaltravelers. Within business travel programs, some companies are instituting similar points systems to reward bookings that respect agiven budget or other compliant behavior such as:Booking in advanceTaking restricted airfares and/or lowest logical faresBooking hotel rooms at the same time as flightsChoosing preferred hotelsUsing the corporate online booking toolOther companies are encouraging friendly competition between travelers or business units by communicating their per<strong>for</strong>mance oncompliance metrics. For this, they may use traveler-centric travel management tools such as the traveler scorecard produced byCWT Solutions Group (Figure 23).<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 37

Figure 23<strong>Travel</strong>er-centric tools such as a traveler scorecard can motivate employees to comply with the travel policythrough friendly competitionObjective: provide travelers with visibility on their travel spend and buying behavior, with the related savings or losses<strong>for</strong> the companyBenefits: traveler ownership of the savings/loss impact drives the desired behavior in non-mandated programenvironments, stimulated by friendly competition between individual travelers or business unitsSource: CWT Solutions Group38

otel reviews by corporate travelers will improvethe travel experience and boost negotiations withHhoteliers.Compliance Hotel <strong>Travel</strong>er experienceIncreasingly, social reviews are holding sway among business travelers when booking accommodations. According to a Google/IPSOSsurvey, 16 one in three business travelers already post reviews online of properties they stay at, while 57 percent enjoy reading aboutother travelers’ experience. Rather than ignore the influence of social media, savvy travel managers are integrating them into the travelprogram.Relevant in<strong>for</strong>mation from trusted colleaguesIn practical terms, the travel management company provides a client with a dedicated plat<strong>for</strong>m <strong>for</strong> its travelers to share reviews onpreferred hotels. Reviews can only be made by travelers who have stayed at the properties in question: after a business trip, travelersreceive an automatic email alert asking them to comment on their experience. <strong>Travel</strong>ers who are selecting a hotel <strong>for</strong> an upcomingtrip can see the relevant reviews from trusted colleagues, in addition to up-to-date details about the properties in the hotel program.When managed as part of the corporate travel program through a dedicated plat<strong>for</strong>m provided by the travel management company,hotel reviews can bring significant benefits:Increased compliance, since the reviews focus on preferred hotelsGreater negotiating power with hoteliers thanks to feedback from travelers, which can be integrated into per<strong>for</strong>mance dashboardsAn enhanced traveler experience, since travelers can more easily choose hotels to suit their preferences, having access to trustedin<strong>for</strong>mation on the location, quality of amenities, etc.In the CWT survey, more than 50 percent of travel managers said they plan to mandate the use of preferred hotels in <strong>2013</strong>, makingthis the most popular measure <strong>for</strong> driving hotel spend optimization. Corporate hotel review sites can be an attractive solution <strong>for</strong> them,as well as <strong>for</strong> travel managers in a non-mandated environment, since these tools channel travelers toward preferred hotels (unlikecommercial review sites that can motivate travelers to book outside the program).16Google and IPSOS OTX Media, <strong>Travel</strong>ers’ Road to Decision (July 2011)<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 39

Case study: new hotel review feature visited by more than 900 travelers in the firstsix months of implementationL’Oréal Group was one of the first CWT clients to implement CWT Hotel Intel, a dedicated plat<strong>for</strong>m that enables travelers tofind in<strong>for</strong>mation on preferred hotels and share their feedback with colleagues inside their company.After the first six months in operation, more than 900 travelers had visited the plat<strong>for</strong>m, generating more than 750 reviews.Further, 90 percent of those travelers recommended the hotels they had visited to their colleagues.Apart from providing travelers with a user-friendly interface to L’Oréal’s global hotel program, the company wanted togather feedback on different properties. This was <strong>for</strong> two reasons: to improve traveler satisfaction and to increase L’Oréal’snegotiating power with hoteliers. The company is using the in<strong>for</strong>mation it has gathered to help build its <strong>2013</strong> hotel program.Corinne Delbreil, travel, meetings and events manager <strong>for</strong> L’Oréal Global Procurement, has shared her feedback on the toolitself:“We are extremely happy with the tool. It is smart, innovative and perfectly adapted to our environment. It’svery easy to use and the feedback based on actual bookings has been very constructive and valuable.”Her colleague Marion Carroy, Social Media Manager at L’Oréal’s Global Innovation department added,“CWT Hotel Intel has really changed the way we prepare our business trips. The site is really pleasantto navigate and in a few clicks we know what our L’Oréal colleagues have recommended, if the hotel isavailable and what our company has negotiated <strong>for</strong> us.”L’Oréal includes more than 550 hotels in the review tool, enabling travelers to search <strong>for</strong> approved accommodation by cityand office location. The hotels appear on a map with the approved rate, amenities included, ranking, reviews and photos.Users can access the tool via the corporate intranet, customizing the display by language and currency.Figure 24Example of in<strong>for</strong>mation displayed to travelers in CWT Hotel Intel40

Inflation may hit travel prices modestly overall, withincreases of well under 5 percent in most categoriesand regions.Air & ground Hotel KPIs Meetings & eventsCWT’s <strong>2013</strong> <strong>Travel</strong> Price Forecast predicts moderate price inflation across all travel categories and in every region of the world,led by Asia Pacific and Latin America. A number of likely developments are pinpointed to help travel managers with the year’sbudgeting.Here are some of the main highlights:Asia Pacific: economic growth should stabilize, bringing modest price increasesThis region has experienced strong economic growth over the past several years, driving prices upward. In <strong>2013</strong>, growth isexpected to stabilize with modest price increases overall but wide variations between countries.Air ticket prices should increase by about 2.5 percent in the region during <strong>2013</strong>, largely due to the number of low-costcarriers entering the market and keeping prices lower than typically seen in this part of the world.Average daily hotel rates will likely increase by about 3.5 percent in <strong>2013</strong>. Singapore will lead the way with an 8 percentincrease amid strong travel demand and lagging supply. Meanwhile, prices in Hong Kong will also increase more than theregional average as clients shift to lower-category properties.Car rental rates will likely experience the highest inflation of anywhere in the world, with a 5.9 percent increase in<strong>2013</strong>. Rates in Australia and New Zealand will rise quite sharply due to increased demand and more tightly managed fleets.Meetings and events spending is likely to increase by about 6 percent. Group sizes are expected to decrease by around3.8 percent as organizations attempt to mitigate rising supplier prices by holding smaller, shorter meetings.Europe, Middle East and Africa: continued economic uncertainty will limit priceincreasesWhile Europe is facing continued economic uncertainty, most Middle Eastern and African economies are faring reasonably well.The region should there<strong>for</strong>e experience moderate travel price increases overall in <strong>2013</strong>, although economic volatility couldprompt significant changes at any point.Airfares will likely climb 2.5 percent during <strong>2013</strong>, as carriers have been diligent in controlling capacity and yielding highload factors despite economic concerns.Average daily hotel rates will likely increase 1.3 percent overall during <strong>2013</strong>, with differences between cities. A decreasein post-Olympic demand <strong>for</strong> rooms in London will bring rates down there. Meanwhile, increased interest in mid-rangeproperties is expected throughout France as brands invest in upgrading those offerings.Car rental rates may increase 1.2 percent in <strong>2013</strong>. Recent consolidation in the region, combined with aggressive growthplans of low-cost providers, is creating increased competition that should hold down prices.High-speed rail prices will likely increase by 4.3 percent as this mode of transportation continues to offer a competitivealternative to air travel in key markets. Notably, increases of up to 9 percent are expected in premium-class carriages, wherecorporate travelers typically ride to access free Wi-Fi and other amenities.Meetings and events spending will increase less than in other regions, with an expected 1 percent rise in costs perattendee per day. As a result, there will be less pressure on organizations in the region to reduce group sizes to offset higherprices and spend is likely to increase by about 3 percent.<strong>Travel</strong> <strong>Management</strong> <strong>Priorities</strong> <strong>for</strong> <strong>2013</strong> | 41