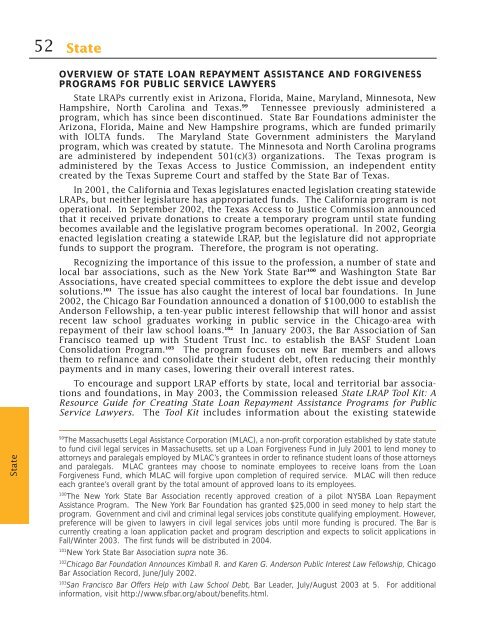

Lifting the Burden: Law Student Debt as a Barrier to Public Service

Lifting the Burden: Law Student Debt as a Barrier to Public Service

Lifting the Burden: Law Student Debt as a Barrier to Public Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

52 StateOVERVIEW OF STATE LOAN REPAYMENT ASSISTANCE AND FORGIVENESSPROGRAMS FOR PUBLIC SERVICE LAWYERSState LRAPs currently exist in Arizona, Florida, Maine, Maryland, Minnesota, NewHampshire, North Carolina and Tex<strong>as</strong>. 99 Tennessee previously administered aprogram, which h<strong>as</strong> since been discontinued. State Bar Foundations administer <strong>the</strong>Arizona, Florida, Maine and New Hampshire programs, which are funded primarilywith IOLTA funds. The Maryland State Government administers <strong>the</strong> Marylandprogram, which w<strong>as</strong> created by statute. The Minnesota and North Carolina programsare administered by independent 501(c)(3) organizations. The Tex<strong>as</strong> program isadministered by <strong>the</strong> Tex<strong>as</strong> Access <strong>to</strong> Justice Commission, an independent entitycreated by <strong>the</strong> Tex<strong>as</strong> Supreme Court and staffed by <strong>the</strong> State Bar of Tex<strong>as</strong>.In 2001, <strong>the</strong> California and Tex<strong>as</strong> legislatures enacted legislation creating statewideLRAPs, but nei<strong>the</strong>r legislature h<strong>as</strong> appropriated funds. The California program is no<strong>to</strong>perational. In September 2002, <strong>the</strong> Tex<strong>as</strong> Access <strong>to</strong> Justice Commission announcedthat it received private donations <strong>to</strong> create a temporary program until state fundingbecomes available and <strong>the</strong> legislative program becomes operational. In 2002, Georgiaenacted legislation creating a statewide LRAP, but <strong>the</strong> legislature did not appropriatefunds <strong>to</strong> support <strong>the</strong> program. Therefore, <strong>the</strong> program is not operating.Recognizing <strong>the</strong> importance of this issue <strong>to</strong> <strong>the</strong> profession, a number of state andlocal bar <strong>as</strong>sociations, such <strong>as</strong> <strong>the</strong> New York State Bar 100 and W<strong>as</strong>hing<strong>to</strong>n State BarAssociations, have created special committees <strong>to</strong> explore <strong>the</strong> debt issue and developsolutions. 101 The issue h<strong>as</strong> also caught <strong>the</strong> interest of local bar foundations. In June2002, <strong>the</strong> Chicago Bar Foundation announced a donation of $100,000 <strong>to</strong> establish <strong>the</strong>Anderson Fellowship, a ten-year public interest fellowship that will honor and <strong>as</strong>sistrecent law school graduates working in public service in <strong>the</strong> Chicago-area withrepayment of <strong>the</strong>ir law school loans. 102 In January 2003, <strong>the</strong> Bar Association of SanFrancisco teamed up with <strong>Student</strong> Trust Inc. <strong>to</strong> establish <strong>the</strong> BASF <strong>Student</strong> LoanConsolidation Program. 103 The program focuses on new Bar members and allows<strong>the</strong>m <strong>to</strong> refinance and consolidate <strong>the</strong>ir student debt, often reducing <strong>the</strong>ir monthlypayments and in many c<strong>as</strong>es, lowering <strong>the</strong>ir overall interest rates.To encourage and support LRAP efforts by state, local and terri<strong>to</strong>rial bar <strong>as</strong>sociationsand foundations, in May 2003, <strong>the</strong> Commission rele<strong>as</strong>ed State LRAP Tool Kit: AResource Guide for Creating State Loan Repayment Assistance Programs for <strong>Public</strong><strong>Service</strong> <strong>Law</strong>yers. The Tool Kit includes information about <strong>the</strong> existing statewideState99The M<strong>as</strong>sachusetts Legal Assistance Corporation (MLAC), a non-profit corporation established by state statute<strong>to</strong> fund civil legal services in M<strong>as</strong>sachusetts, set up a Loan Forgiveness Fund in July 2001 <strong>to</strong> lend money <strong>to</strong>at<strong>to</strong>rneys and paralegals employed by MLAC’s grantees in order <strong>to</strong> refinance student loans of those at<strong>to</strong>rneysand paralegals. MLAC grantees may choose <strong>to</strong> nominate employees <strong>to</strong> receive loans from <strong>the</strong> LoanForgiveness Fund, which MLAC will forgive upon completion of required service. MLAC will <strong>the</strong>n reduceeach grantee’s overall grant by <strong>the</strong> <strong>to</strong>tal amount of approved loans <strong>to</strong> its employees.100The New York State Bar Association recently approved creation of a pilot NYSBA Loan RepaymentAssistance Program. The New York Bar Foundation h<strong>as</strong> granted $25,000 in seed money <strong>to</strong> help start <strong>the</strong>program. Government and civil and criminal legal services jobs constitute qualifying employment. However,preference will be given <strong>to</strong> lawyers in civil legal services jobs until more funding is procured. The Bar iscurrently creating a loan application packet and program description and expects <strong>to</strong> solicit applications inFall/Winter 2003. The first funds will be distributed in 2004.101New York State Bar Association supra note 36.102Chicago Bar Foundation Announces Kimball R. and Karen G. Anderson <strong>Public</strong> Interest <strong>Law</strong> Fellowship, ChicagoBar Association Record, June/July 2002.103San Francisco Bar Offers Help with <strong>Law</strong> School <strong>Debt</strong>, Bar Leader, July/August 2003 at 5. For additionalinformation, visit http://www.sfbar.org/about/benefits.html.