Registrars' Conference Resolutions - Centre for Conveyancing ...

Registrars' Conference Resolutions - Centre for Conveyancing ...

Registrars' Conference Resolutions - Centre for Conveyancing ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

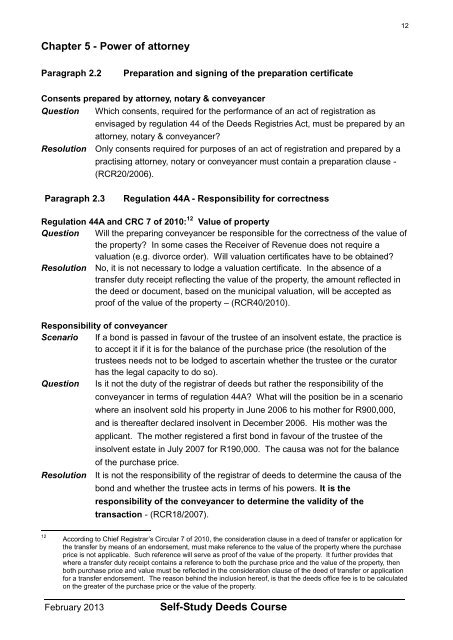

12Chapter 5 - Power of attorneyParagraph 2.2Preparation and signing of the preparation certificateConsents prepared by attorney, notary & conveyancerQuestion Which consents, required <strong>for</strong> the per<strong>for</strong>mance of an act of registration asenvisaged by regulation 44 of the Deeds Registries Act, must be prepared by anattorney, notary & conveyancer?Resolution Only consents required <strong>for</strong> purposes of an act of registration and prepared by apractising attorney, notary or conveyancer must contain a preparation clause -(RCR20/2006).Paragraph 2.3Regulation 44A - Responsibility <strong>for</strong> correctnessRegulation 44A and CRC 7 of 2010: 12 Value of propertyQuestion Will the preparing conveyancer be responsible <strong>for</strong> the correctness of the value ofthe property? In some cases the Receiver of Revenue does not require avaluation (e.g. divorce order). Will valuation certificates have to be obtained?Resolution No, it is not necessary to lodge a valuation certificate. In the absence of atransfer duty receipt reflecting the value of the property, the amount reflected inthe deed or document, based on the municipal valuation, will be accepted asproof of the value of the property – (RCR40/2010).Responsibility of conveyancerScenario If a bond is passed in favour of the trustee of an insolvent estate, the practice isto accept it if it is <strong>for</strong> the balance of the purchase price (the resolution of thetrustees needs not to be lodged to ascertain whether the trustee or the curatorhas the legal capacity to do so).Question Is it not the duty of the registrar of deeds but rather the responsibility of theconveyancer in terms of regulation 44A? What will the position be in a scenariowhere an insolvent sold his property in June 2006 to his mother <strong>for</strong> R900,000,and is thereafter declared insolvent in December 2006. His mother was theapplicant. The mother registered a first bond in favour of the trustee of theinsolvent estate in July 2007 <strong>for</strong> R190,000. The causa was not <strong>for</strong> the balanceof the purchase price.Resolution It is not the responsibility of the registrar of deeds to determine the causa of thebond and whether the trustee acts in terms of his powers. It is theresponsibility of the conveyancer to determine the validity of thetransaction - (RCR18/2007).12According to Chief Registrar’s Circular 7 of 2010, the consideration clause in a deed of transfer or application <strong>for</strong>the transfer by means of an endorsement, must make reference to the value of the property where the purchaseprice is not applicable. Such reference will serve as proof of the value of the property. It further provides thatwhere a transfer duty receipt contains a reference to both the purchase price and the value of the property, thenboth purchase price and value must be reflected in the consideration clause of the deed of transfer or application<strong>for</strong> a transfer endorsement. The reason behind the inclusion hereof, is that the deeds office fee is to be calculatedon the greater of the purchase price or the value of the property.February 2013Self-Study Deeds Course