Impact of Crime on Small Businesses Report 2008 - Gauteng Online

Impact of Crime on Small Businesses Report 2008 - Gauteng Online

Impact of Crime on Small Businesses Report 2008 - Gauteng Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

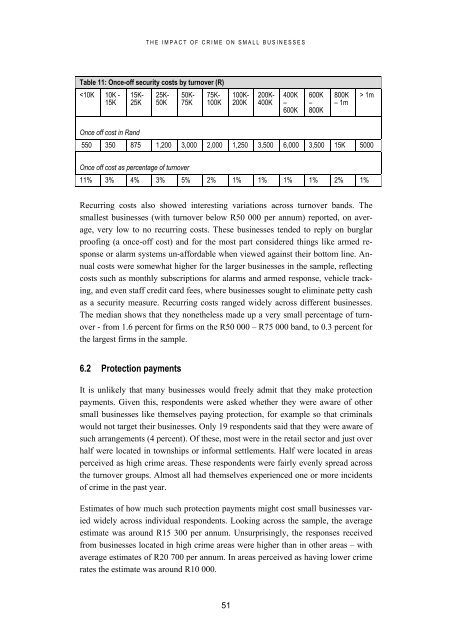

THE IMPACT OF CRIME ON SMALL BUSINESSESTable 11: Once-<str<strong>on</strong>g>of</str<strong>on</strong>g>f security costs by turnover (R) 1mOnce <str<strong>on</strong>g>of</str<strong>on</strong>g>f cost in Rand550 350 875 1,200 3,000 2,000 1,250 3,500 6,000 3,500 15K 5000Once <str<strong>on</strong>g>of</str<strong>on</strong>g>f cost as percentage <str<strong>on</strong>g>of</str<strong>on</strong>g> turnover11% 3% 4% 3% 5% 2% 1% 1% 1% 1% 2% 1%Recurring costs also showed interesting variati<strong>on</strong>s across turnover bands. Thesmallest businesses (with turnover below R50 000 per annum) reported, <strong>on</strong> average,very low to no recurring costs. These businesses tended to reply <strong>on</strong> burglarpro<str<strong>on</strong>g>of</str<strong>on</strong>g>ing (a <strong>on</strong>ce-<str<strong>on</strong>g>of</str<strong>on</strong>g>f cost) and for the most part c<strong>on</strong>sidered things like armed resp<strong>on</strong>seor alarm systems un-affordable when viewed against their bottom line. Annualcosts were somewhat higher for the larger businesses in the sample, reflectingcosts such as m<strong>on</strong>thly subscripti<strong>on</strong>s for alarms and armed resp<strong>on</strong>se, vehicle tracking,and even staff credit card fees, where businesses sought to eliminate petty cashas a security measure. Recurring costs ranged widely across different businesses.The median shows that they n<strong>on</strong>etheless made up a very small percentage <str<strong>on</strong>g>of</str<strong>on</strong>g> turnover- from 1.6 percent for firms <strong>on</strong> the R50 000 – R75 000 band, to 0.3 percent forthe largest firms in the sample.6.2 Protecti<strong>on</strong> paymentsIt is unlikely that many businesses would freely admit that they make protecti<strong>on</strong>payments. Given this, resp<strong>on</strong>dents were asked whether they were aware <str<strong>on</strong>g>of</str<strong>on</strong>g> othersmall businesses like themselves paying protecti<strong>on</strong>, for example so that criminalswould not target their businesses. Only 19 resp<strong>on</strong>dents said that they were aware <str<strong>on</strong>g>of</str<strong>on</strong>g>such arrangements (4 percent). Of these, most were in the retail sector and just overhalf were located in townships or informal settlements. Half were located in areasperceived as high crime areas. These resp<strong>on</strong>dents were fairly evenly spread acrossthe turnover groups. Almost all had themselves experienced <strong>on</strong>e or more incidents<str<strong>on</strong>g>of</str<strong>on</strong>g> crime in the past year.Estimates <str<strong>on</strong>g>of</str<strong>on</strong>g> how much such protecti<strong>on</strong> payments might cost small businesses variedwidely across individual resp<strong>on</strong>dents. Looking across the sample, the averageestimate was around R15 300 per annum. Unsurprisingly, the resp<strong>on</strong>ses receivedfrom businesses located in high crime areas were higher than in other areas – withaverage estimates <str<strong>on</strong>g>of</str<strong>on</strong>g> R20 700 per annum. In areas perceived as having lower crimerates the estimate was around R10 000.51