Life Partners Holdings, Inc., Brian D. Pardo, R. Scott Peden, and ...

Life Partners Holdings, Inc., Brian D. Pardo, R. Scott Peden, and ...

Life Partners Holdings, Inc., Brian D. Pardo, R. Scott Peden, and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

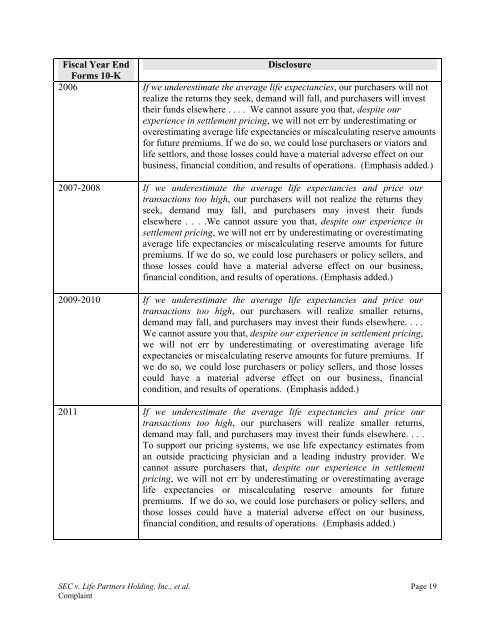

Fiscal Year EndDisclosureForms 10-K2006 If we underestimate the average life expectancies, our purchasers will notrealize the returns they seek, dem<strong>and</strong> will fall, <strong>and</strong> purchasers will investtheir funds elsewhere . . . . We cannot assure you that, despite ourexperience in settlement pricing, we will not err by underestimating oroverestimating average life expectancies or miscalculating reserve amountsfor future premiums. If we do so, we could lose purchasers or viators <strong>and</strong>life settlors, <strong>and</strong> those losses could have a material adverse effect on ourbusiness, financial condition, <strong>and</strong> results of operations. (Emphasis added.)2007-2008 If we underestimate the average life expectancies <strong>and</strong> price ourtransactions too high, our purchasers will not realize the returns theyseek, dem<strong>and</strong> may fall, <strong>and</strong> purchasers may invest their fundselsewhere . . . .We cannot assure you that, despite our experience insettlement pricing, we will not err by underestimating or overestimatingaverage life expectancies or miscalculating reserve amounts for futurepremiums. If we do so, we could lose purchasers or policy sellers, <strong>and</strong>those losses could have a material adverse effect on our business,financial condition, <strong>and</strong> results of operations. (Emphasis added.)2009-2010 If we underestimate the average life expectancies <strong>and</strong> price ourtransactions too high, our purchasers will realize smaller returns,dem<strong>and</strong> may fall, <strong>and</strong> purchasers may invest their funds elsewhere. . . .We cannot assure you that, despite our experience in settlement pricing,we will not err by underestimating or overestimating average lifeexpectancies or miscalculating reserve amounts for future premiums. Ifwe do so, we could lose purchasers or policy sellers, <strong>and</strong> those lossescould have a material adverse effect on our business, financialcondition, <strong>and</strong> results of operations. (Emphasis added.)2011 If we underestimate the average life expectancies <strong>and</strong> price ourtransactions too high, our purchasers will realize smaller returns,dem<strong>and</strong> may fall, <strong>and</strong> purchasers may invest their funds elsewhere. . . .To support our pricing systems, we use life expectancy estimates froman outside practicing physician <strong>and</strong> a leading industry provider. Wecannot assure purchasers that, despite our experience in settlementpricing, we will not err by underestimating or overestimating averagelife expectancies or miscalculating reserve amounts for futurepremiums. If we do so, we could lose purchasers or policy sellers, <strong>and</strong>those losses could have a material adverse effect on our business,financial condition, <strong>and</strong> results of operations. (Emphasis added.)SEC v. <strong>Life</strong> <strong>Partners</strong> Holding, <strong>Inc</strong>., et al. Page 19Complaint