Life Partners Holdings, Inc., Brian D. Pardo, R. Scott Peden, and ...

Life Partners Holdings, Inc., Brian D. Pardo, R. Scott Peden, and ...

Life Partners Holdings, Inc., Brian D. Pardo, R. Scott Peden, and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

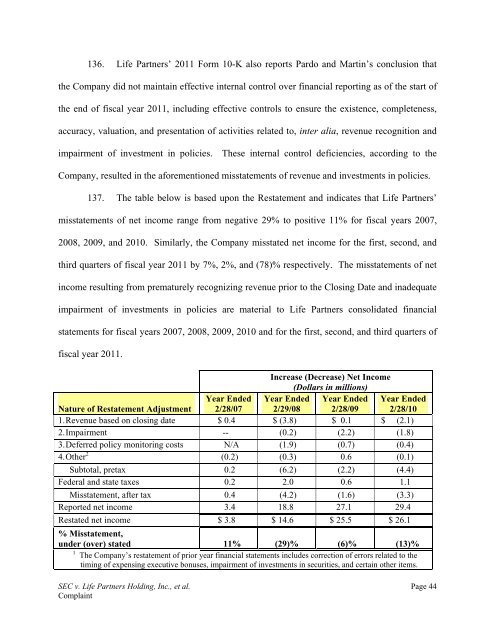

136. <strong>Life</strong> <strong>Partners</strong>’ 2011 Form 10-K also reports <strong>Pardo</strong> <strong>and</strong> Martin’s conclusion thatthe Company did not maintain effective internal control over financial reporting as of the start ofthe end of fiscal year 2011, including effective controls to ensure the existence, completeness,accuracy, valuation, <strong>and</strong> presentation of activities related to, inter alia, revenue recognition <strong>and</strong>impairment of investment in policies. These internal control deficiencies, according to theCompany, resulted in the aforementioned misstatements of revenue <strong>and</strong> investments in policies.137. The table below is based upon the Restatement <strong>and</strong> indicates that <strong>Life</strong> <strong>Partners</strong>’misstatements of net income range from negative 29% to positive 11% for fiscal years 2007,2008, 2009, <strong>and</strong> 2010. Similarly, the Company misstated net income for the first, second, <strong>and</strong>third quarters of fiscal year 2011 by 7%, 2%, <strong>and</strong> (78)% respectively. The misstatements of netincome resulting from prematurely recognizing revenue prior to the Closing Date <strong>and</strong> inadequateimpairment of investments in policies are material to <strong>Life</strong> <strong>Partners</strong> consolidated financialstatements for fiscal years 2007, 2008, 2009, 2010 <strong>and</strong> for the first, second, <strong>and</strong> third quarters offiscal year 2011.<strong>Inc</strong>rease (Decrease) Net <strong>Inc</strong>ome(Dollars in millions)Nature of Restatement AdjustmentYear Ended2/28/07Year Ended2/29/08Year Ended2/28/09Year Ended2/28/101.Revenue based on closing date $ 0.4 $ (3.8) $ 0.1 $ (2.1)2. Impairment -- (0.2) (2.2) (1.8)3. Deferred policy monitoring costs N/A (1.9) (0.7) (0.4)4. Other 2 (0.2) (0.3) 0.6 (0.1)Subtotal, pretax 0.2 (6.2) (2.2) (4.4)Federal <strong>and</strong> state taxes 0.2 2.0 0.6 1.1Misstatement, after tax 0.4 (4.2) (1.6) (3.3)Reported net income 3.4 18.8 27.1 29.4Restated net income $ 3.8 $ 14.6 $ 25.5 $ 26.1% Misstatement,under (over) stated 11% (29)% (6)% (13)%1 The Company’s restatement of prior year financial statements includes correction of errors related to thetiming of expensing executive bonuses, impairment of investments in securities, <strong>and</strong> certain other items.SEC v. <strong>Life</strong> <strong>Partners</strong> Holding, <strong>Inc</strong>., et al. Page 44Complaint