INTSOK Annual Market Report (2011-2014) ANGOLA

INTSOK Annual Market Report (2011-2014) ANGOLA

INTSOK Annual Market Report (2011-2014) ANGOLA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>INTSOK</strong> <strong>Annual</strong> <strong>Market</strong> <strong>Report</strong> 2010<br />

Main <strong>Market</strong>s - Angola<br />

1 Angola offshore market<br />

The surge in Angolan crude production over the past few years was driven by<br />

technologically complex deepwater developments, helmed by many of the largest<br />

IOCs. The coming years are expected to bring another upward production surge to<br />

2.5-3.0 mbblpd by the end of the decade, with the newest crude oil production<br />

additions coming from a mix of deepwater and ultra-deepwater projects.<br />

Natural gas production in Angola is primarily associated gas production, and is in<br />

most cases vented, flared or re-injected. Plans are underway to capture and export<br />

most of the wasted gas as LNG, and some gas is also being earmarked for domestic<br />

electricity generation.<br />

Sanctioned projects expected to start up by the end of 2012 include Pazflor (Total) in<br />

deepwater Block 17, PSVM (BP) in ultra-deep water Block 31, and Kizomba Satellites<br />

Phase I (ExxonMobil) in deep water Block 15. Block 17 is expected to see FID on the<br />

CLOV project (Total) during 2010, while BP expects FIDs on its deep water Block 18<br />

West project and the PAJ project in Block 31 during <strong>2011</strong>, and Chevron also plans a<br />

<strong>2011</strong> FID for Mafumeira Sul in the shallow water Block 0 concession. Chevron figures<br />

highly in the list of projects in FEED or pre-FEED stage, with several projects pending<br />

within deepwater Block 14: Lucapa, Lianzi and Negage. ENI is reportedly fast-tracking<br />

its Sangos & N’Goma discoveries in deep water Block 15/06, with plans to shift the<br />

Xikomba FPSO once that field has reached economic cut-off. Later phases of<br />

ExxonMobil’s Block 15 Kizomba satellites will add further production growth.<br />

Thus, Angola offshore continues to develop in a rapid pace. Questions are being<br />

raised whether the service industry has the capacity to handle all the developments<br />

planned by the operators. The past years have seen schedules sliding for several<br />

Angolan offshore projects, and the future will probably bring similar delays. One<br />

should also note that as an OPEC member Angola is nominally bound to OPECmandated<br />

production cuts. During 2009, Angola complied with about 40% of its<br />

mandated OPEC-cuts.<br />

The Angolan offshore market is characterized by large field development projects.<br />

The market saw a slight reduction in 2009 as the field development and subsea<br />

expenditure dropped. The market grew steadily over the period 2004-08 with large<br />

projects such as Benguela-Belize (Chevron), Dalia (Total), Rosa (Total), the phased<br />

Kizomba development (ExxonMobil), and Greater Plutonio (BP) being executed. As<br />

these projects moved from the investment to the production phase, Pazflor (Total) and<br />

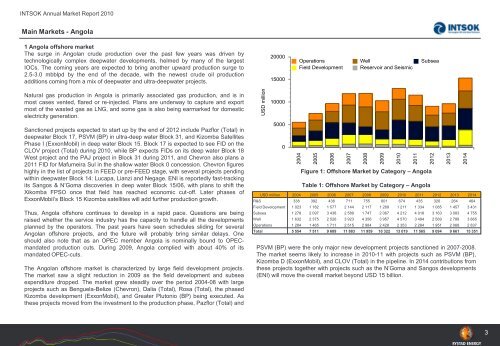

CUBEAUTO Chart<br />

S(ChartType:ColumnStacked<br />

;Legend:Custom;GridLinesX:off;GridLinesY:off;LegendX:0;LegendY:0;Palette<br />

:Default;PaletteText:off)<br />

F(Country:Angola;On Off Shore:Offshore)<br />

C(<strong>INTSOK</strong> Category:Reservoir and Seismic,Field<br />

Development,Subsea,Well,Operations,Non E&P Expenditure)<br />

R(Year:2004-<strong>2014</strong>)<br />

V(Value:USD million)<br />

Figure 1: Offshore <strong>Market</strong> by Category – Angola<br />

Table 1: Offshore <strong>Market</strong> by Category – Angola<br />

CUBEAUTO <strong>Report</strong><br />

S(FontSize:6;Format:#,##0)<br />

F(Country:Angola;On Off Shore:Offshore)<br />

C(Year:2004-<strong>2014</strong>)<br />

R(<strong>INTSOK</strong> Category Table:R&S,Field Development,Subsea,Well,Operations,Non E&P)<br />

V(Value:USD million)<br />

USD million 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong> 2012 2013 <strong>2014</strong><br />

R&S 338 392 438 711 755 601 674 435 326 264 464<br />

Field Development 1 023 1 182 1 577 2 144 2 117 1 269 1 211 1 334 1 085 1 457 3 431<br />

Subsea 1 278 2 097 3 438 2 589 1 747 2 067 4 212 4 018 3 163 3 083 4 755<br />

Well 1 632 2 375 2 526 3 923 4 356 3 957 4 570 3 494 2 569 2 788 3 865<br />

Operations 1 284 1 465 1 711 2 515 2 984 2 428 2 353 2 284 1 951 2 068 2 837<br />

Total 5 554 7 511 9 689 11 883 11 959 10 322 13 019 11 565 9 094 9 661 15 351<br />

PSVM (BP) were the only major new development projects sanctioned in 2007-2008.<br />

The market seems likely to increase in 2010-11 with projects such as PSVM (BP),<br />

Kizomba D (ExxonMobil), and CLOV (Total) in the pipeline. In <strong>2014</strong> contributions from<br />

these projects together with projects such as the N’Goma and Sangos developments<br />

(ENI) will move the overall market beyond USD 15 billion.<br />

3