INTSOK Annual Market Report (2011-2014) ANGOLA

INTSOK Annual Market Report (2011-2014) ANGOLA

INTSOK Annual Market Report (2011-2014) ANGOLA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>INTSOK</strong> <strong>Annual</strong> <strong>Market</strong> <strong>Report</strong> 2010<br />

Main <strong>Market</strong>s - Angola<br />

1.2 Field Development<br />

CUBEAUTO Chart<br />

S(ChartType:ColumnStacked<br />

;Legend:Custom;GridLinesX:off;GridLinesY:off;LegendX:0;LegendY:0;Legend<br />

Cols:1;LegendRows:3;Palette:Default;PaletteText:off)<br />

F(Country:Angola;On Off Shore:Offshore;<strong>INTSOK</strong> Category:Field<br />

Development)<br />

C(<strong>INTSOK</strong> <strong>Market</strong> Definition)<br />

R(Year:2004-<strong>2014</strong>)<br />

V(Value:USD million)<br />

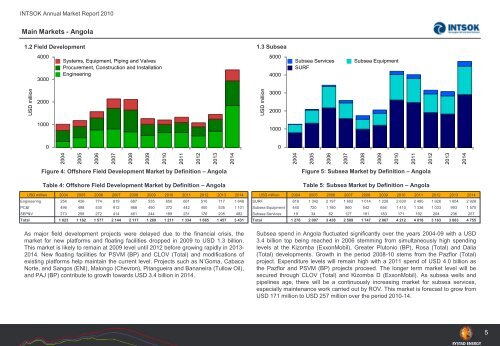

Figure 4: Offshore Field Development <strong>Market</strong> by Definition – Angola<br />

Table 4: Offshore Field Development <strong>Market</strong> by Definition – Angola<br />

CUBEAUTO USD million<strong>Report</strong> 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong> 2012 2013 <strong>2014</strong><br />

Engineering S(FontSize:6;Format:#,##0) 254 426 774 819 687 535<br />

F(Country:Angola;On Off Shore:Offshore;<strong>INTSOK</strong> Category:Field Development)<br />

PC&I<br />

C(Year:2004-<strong>2014</strong>)<br />

496 498 530 912 968 490<br />

650<br />

372<br />

661<br />

442<br />

510<br />

400<br />

717<br />

535<br />

1 848<br />

1 101<br />

SEP&V R(<strong>INTSOK</strong> <strong>Market</strong> Definition 273 Table) 258 272 414 461 244 189 231 176 205 482<br />

Total<br />

V(Value:USD million)<br />

1 023 1 182 1 577 2 144 2 117 1 269 1 211 1 334 1 085 1 457 3 431<br />

As major field development projects were delayed due to the financial crisis, the<br />

market for new platforms and floating facilities dropped in 2009 to USD 1.3 billion.<br />

This market is likely to remain at 2009 level until 2012 before growing rapidly in 2013-<br />

<strong>2014</strong>. New floating facilities for PSVM (BP) and CLOV (Total) and modifications of<br />

existing platforms help maintain the current level. Projects such as N’Goma, Cabaca<br />

Norte, and Sangos (ENI), Malongo (Chevron), Pitangueira and Bananeira (Tullow Oil),<br />

and PAJ (BP) contribute to growth towards USD 3.4 billion in <strong>2014</strong>.<br />

1.3 Subsea<br />

CUBEAUTO Chart<br />

S(ChartType:ColumnStacked<br />

;Legend:Custom;GridLinesX:off;GridLinesY:off;LegendX:0;LegendY:0;Palette<br />

:Default;PaletteText:off)<br />

F(Country:Angola;On Off Shore:Offshore;<strong>INTSOK</strong> Category:Subsea)<br />

C(<strong>INTSOK</strong> <strong>Market</strong> Definition)<br />

R(Year:2004-<strong>2014</strong>)<br />

V(Value:USD million)<br />

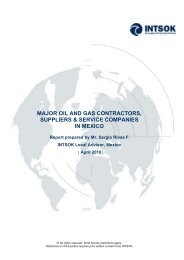

Figure 5: Subsea <strong>Market</strong> by Definition – Angola<br />

Table 5: Subsea <strong>Market</strong> by Definition – Angola<br />

CUBEAUTO USD million<strong>Report</strong> 2004 2005 2006 2007 2008 2009 2010 <strong>2011</strong> 2012 2013 <strong>2014</strong><br />

SURF S(FontSize:6;Format:#,##0) 819 1 342 2 197 1 602 1 014<br />

F(Country:Angola;On Off Shore:Offshore;<strong>INTSOK</strong> Category:Subsea)<br />

Subsea<br />

C(Year:2004-<strong>2014</strong>)<br />

Equipment 440 720 1 180 860 542<br />

1 228<br />

656<br />

2 630<br />

1 410<br />

2 490<br />

1 336<br />

1 926<br />

1 033<br />

1 854<br />

993<br />

2 928<br />

1 570<br />

Subsea R(<strong>INTSOK</strong> Services <strong>Market</strong> Definition 19 Table) 34 62 127 191 183 171 192 204 236 257<br />

Total<br />

V(Value:USD million)<br />

1 278 2 097 3 438 2 589 1 747 2 067 4 212 4 018 3 163 3 083 4 755<br />

Subsea spend in Angola fluctuated significantly over the years 2004-09 with a USD<br />

3.4 billion top being reached in 2006 stemming from simultaneously high spending<br />

levels at the Kizomba (ExxonMobil), Greater Plutonio (BP), Rosa (Total) and Dalia<br />

(Total) developments. Growth in the period 2008-10 stems from the Pazflor (Total)<br />

project. Expenditure levels will remain high with a <strong>2011</strong> spend of USD 4.0 billion as<br />

the Pazflor and PSVM (BP) projects proceed. The longer term market level will be<br />

secured through CLOV (Total) and Kizomba D (ExxonMobil). As subsea wells and<br />

pipelines age, there will be a continuously increasing market for subsea services,<br />

especially maintenance work carried out by ROV. This market is forecast to grow from<br />

USD 171 million to USD 257 million over the period 2010-14.<br />

5