Is Equity-Financing Always Optimal for Innovative SMEs? --How ...

Is Equity-Financing Always Optimal for Innovative SMEs? --How ...

Is Equity-Financing Always Optimal for Innovative SMEs? --How ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

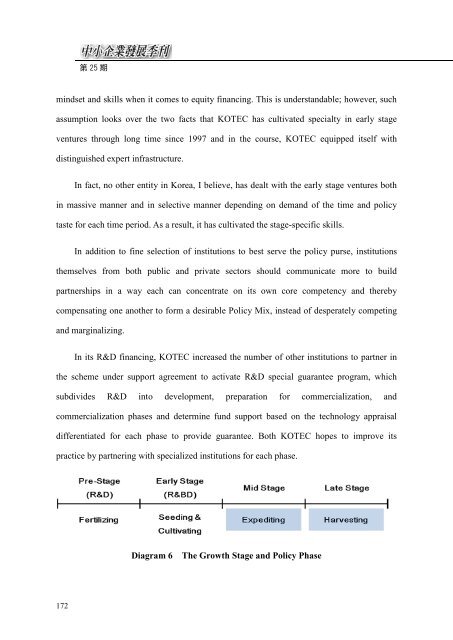

第 25 期mindset and skills when it comes to equity financing. This is understandable; however, suchassumption looks over the two facts that KOTEC has cultivated specialty in early stageventures through long time since 1997 and in the course, KOTEC equipped itself withdistinguished expert infrastructure.In fact, no other entity in Korea, I believe, has dealt with the early stage ventures bothin massive manner and in selective manner depending on demand of the time and policytaste <strong>for</strong> each time period. As a result, it has cultivated the stage-specific skills.In addition to fine selection of institutions to best serve the policy purse, institutionsthemselves from both public and private sectors should communicate more to buildpartnerships in a way each can concentrate on its own core competency and therebycompensating one another to <strong>for</strong>m a desirable Policy Mix, instead of desperately competingand marginalizing.In its R&D financing, KOTEC increased the number of other institutions to partner inthe scheme under support agreement to activate R&D special guarantee program, whichsubdivides R&D into development, preparation <strong>for</strong> commercialization, andcommercialization phases and determine fund support based on the technology appraisaldifferentiated <strong>for</strong> each phase to provide guarantee. Both KOTEC hopes to improve itspractice by partnering with specialized institutions <strong>for</strong> each phase.Diagram 6 The Growth Stage and Policy Phase172