April 1st 2009 to March 31st 2010

The Annual Report and Accounts April 1st 2009 to March 31st 2010

The Annual Report and Accounts April 1st 2009 to March 31st 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

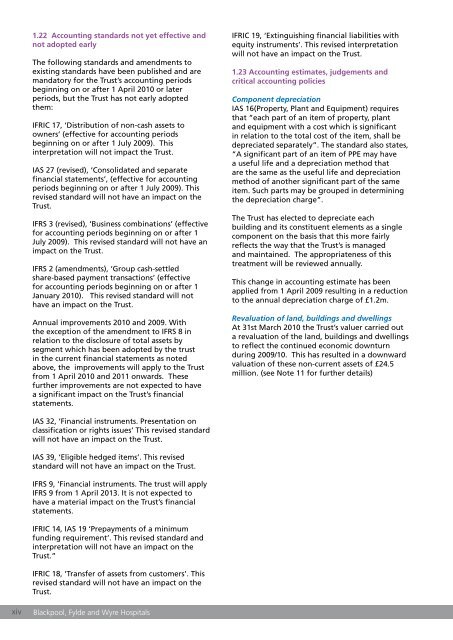

1.22 Accounting standards not yet effective andnot adopted earlyThe following standards and amendments <strong>to</strong>existing standards have been published and aremanda<strong>to</strong>ry for the Trust’s accounting periodsbeginning on or after 1 <strong>April</strong> <strong>2010</strong> or laterperiods, but the Trust has not early adoptedthem:IFRIC 17, ‘Distribution of non-cash assets <strong>to</strong>owners’ (effective for accounting periodsbeginning on or after 1 July <strong>2009</strong>). Thisinterpretation will not impact the Trust.IAS 27 (revised), ‘Consolidated and separatefinancial statements’, (effective for accountingperiods beginning on or after 1 July <strong>2009</strong>). Thisrevised standard will not have an impact on theTrust.IFRS 3 (revised), ‘Business combinations’ (effectivefor accounting periods beginning on or after 1July <strong>2009</strong>). This revised standard will not have animpact on the Trust.IFRS 2 (amendments), ‘Group cash-settledshare-based payment transactions’ (effectivefor accounting periods beginning on or after 1January <strong>2010</strong>). This revised standard will nothave an impact on the Trust.Annual improvements <strong>2010</strong> and <strong>2009</strong>. Withthe exception of the amendment <strong>to</strong> IFRS 8 inrelation <strong>to</strong> the disclosure of <strong>to</strong>tal assets bysegment which has been adopted by the trustin the current financial statements as notedabove, the improvements will apply <strong>to</strong> the Trustfrom 1 <strong>April</strong> <strong>2010</strong> and 2011 onwards. Thesefurther improvements are not expected <strong>to</strong> havea significant impact on the Trust’s financialstatements.IFRIC 19, ‘Extinguishing financial liabilities withequity instruments’. This revised interpretationwill not have an impact on the Trust.1.23 Accounting estimates, judgements andcritical accounting policiesComponent depreciationIAS 16(Property, Plant and Equipment) requiresthat “each part of an item of property, plantand equipment with a cost which is significantin relation <strong>to</strong> the <strong>to</strong>tal cost of the item, shall bedepreciated separately”. The standard also states,“A significant part of an item of PPE may havea useful life and a depreciation method thatare the same as the useful life and depreciationmethod of another significant part of the sameitem. Such parts may be grouped in determiningthe depreciation charge”.The Trust has elected <strong>to</strong> depreciate eachbuilding and its constituent elements as a singlecomponent on the basis that this more fairlyreflects the way that the Trust’s is managedand maintained. The appropriateness of thistreatment will be reviewed annually.This change in accounting estimate has beenapplied from 1 <strong>April</strong> <strong>2009</strong> resulting in a reduction<strong>to</strong> the annual depreciation charge of £1.2m.Revaluation of land, buildings and dwellingsAt 3<strong>1st</strong> <strong>March</strong> <strong>2010</strong> the Trust’s valuer carried outa revaluation of the land, buildings and dwellings<strong>to</strong> reflect the continued economic downturnduring <strong>2009</strong>/10. This has resulted in a downwardvaluation of these non-current assets of £24.5million. (see Note 11 for further details)IAS 32, ‘Financial instruments. Presentation onclassification or rights issues’ This revised standardwill not have an impact on the Trust.IAS 39, ‘Eligible hedged items’. This revisedstandard will not have an impact on the Trust.IFRS 9, ‘Financial instruments. The trust will applyIFRS 9 from 1 <strong>April</strong> 2013. It is not expected <strong>to</strong>have a material impact on the Trust’s financialstatements.IFRIC 14, IAS 19 ‘Prepayments of a minimumfunding requirement’. This revised standard andinterpretation will not have an impact on theTrust.”IFRIC 18, ‘Transfer of assets from cus<strong>to</strong>mers’. Thisrevised standard will not have an impact on theTrust.xivBlackpool, Fylde and Wyre Hospitals