April 1st 2009 to March 31st 2010

The Annual Report and Accounts April 1st 2009 to March 31st 2010

The Annual Report and Accounts April 1st 2009 to March 31st 2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

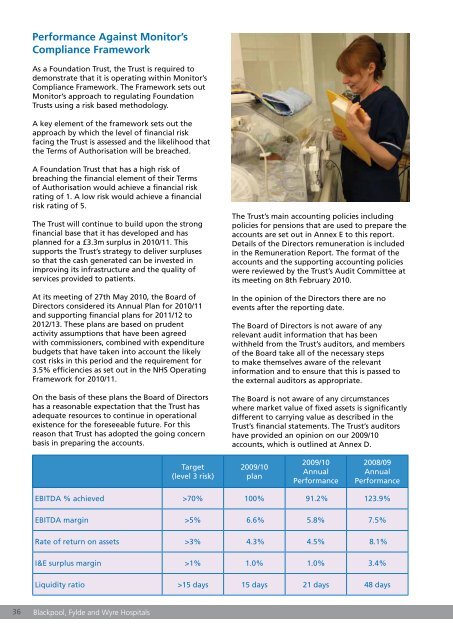

Performance Against Moni<strong>to</strong>r’sCompliance FrameworkAs a Foundation Trust, the Trust is required <strong>to</strong>demonstrate that it is operating within Moni<strong>to</strong>r’sCompliance Framework. The Framework sets outMoni<strong>to</strong>r’s approach <strong>to</strong> regulating FoundationTrusts using a risk based methodology.A key element of the framework sets out theapproach by which the level of financial riskfacing the Trust is assessed and the likelihood thatthe Terms of Authorisation will be breached.A Foundation Trust that has a high risk ofbreaching the financial element of their Termsof Authorisation would achieve a financial riskrating of 1. A low risk would achieve a financialrisk rating of 5.The Trust will continue <strong>to</strong> build upon the strongfinancial base that it has developed and hasplanned for a £3.3m surplus in <strong>2010</strong>/11. Thissupports the Trust’s strategy <strong>to</strong> deliver surplusesso that the cash generated can be invested inimproving its infrastructure and the quality ofservices provided <strong>to</strong> patients.At its meeting of 27th May <strong>2010</strong>, the Board ofDirec<strong>to</strong>rs considered its Annual Plan for <strong>2010</strong>/11and supporting financial plans for 2011/12 <strong>to</strong>2012/13. These plans are based on prudentactivity assumptions that have been agreedwith commissioners, combined with expenditurebudgets that have taken in<strong>to</strong> account the likelycost risks in this period and the requirement for3.5% efficiencies as set out in the NHS OperatingFramework for <strong>2010</strong>/11.On the basis of these plans the Board of Direc<strong>to</strong>rshas a reasonable expectation that the Trust hasadequate resources <strong>to</strong> continue in operationalexistence for the foreseeable future. For thisreason that Trust has adopted the going concernbasis in preparing the accounts.The Trust’s main accounting policies includingpolicies for pensions that are used <strong>to</strong> prepare theaccounts are set out in Annex E <strong>to</strong> this report.Details of the Direc<strong>to</strong>rs remuneration is includedin the Remuneration Report. The format of theaccounts and the supporting accounting policieswere reviewed by the Trust’s Audit Committee atits meeting on 8th February <strong>2010</strong>.In the opinion of the Direc<strong>to</strong>rs there are noevents after the reporting date.The Board of Direc<strong>to</strong>rs is not aware of anyrelevant audit information that has beenwithheld from the Trust’s audi<strong>to</strong>rs, and membersof the Board take all of the necessary steps<strong>to</strong> make themselves aware of the relevantinformation and <strong>to</strong> ensure that this is passed <strong>to</strong>the external audi<strong>to</strong>rs as appropriate.The Board is not aware of any circumstanceswhere market value of fixed assets is significantlydifferent <strong>to</strong> carrying value as described in theTrust’s financial statements. The Trust’s audi<strong>to</strong>rshave provided an opinion on our <strong>2009</strong>/10accounts, which is outlined at Annex D.Target(level 3 risk)<strong>2009</strong>/10plan<strong>2009</strong>/10AnnualPerformance2008/09AnnualPerformanceEBITDA % achieved >70% 100% 91.2% 123.9%EBITDA margin >5% 6.6% 5.8% 7.5%Rate of return on assets >3% 4.3% 4.5% 8.1%I&E surplus margin >1% 1.0% 1.0% 3.4%Liquidity ratio >15 days 15 days 21 days 48 days36Blackpool, Fylde and Wyre Hospitals