P&G 2009 Annual Report – AnnualReports.com - Procter & Gamble

P&G 2009 Annual Report – AnnualReports.com - Procter & Gamble

P&G 2009 Annual Report – AnnualReports.com - Procter & Gamble

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management’s Discussion and Analysis The <strong>Procter</strong> & <strong>Gamble</strong> Company 35<br />

related to general overhead and workforce optimization. Successfully<br />

managing these changes, including identifying, developing and<br />

retaining key employees, is critical to our success.<br />

Global Economic Conditions. Economic changes, terrorist activity and<br />

political unrest may result in business interruption, inflation, deflation<br />

or decreased demand for our products. Our success will depend, in<br />

part, on our ability to manage continued global political and/or<br />

economic uncertainty, especially in our significant geographic markets,<br />

as well as any political or economic disruption due to terrorist and<br />

other hostile activities.<br />

Regulatory Environment. Changes in laws, regulations and the related<br />

interpretations may alter the environment in which we do business.<br />

This includes changes in environmental, <strong>com</strong>petitive and productrelated<br />

laws, as well as changes in accounting standards and taxation<br />

requirements. Our ability to manage regulatory, tax and legal matters<br />

(including product liability, patent, intellectual property, <strong>com</strong>petition<br />

law matters and tax policy) and to resolve pending legal matters<br />

within current estimates may impact our results.<br />

RESULTS OF OPERATIONS<br />

Net Sales<br />

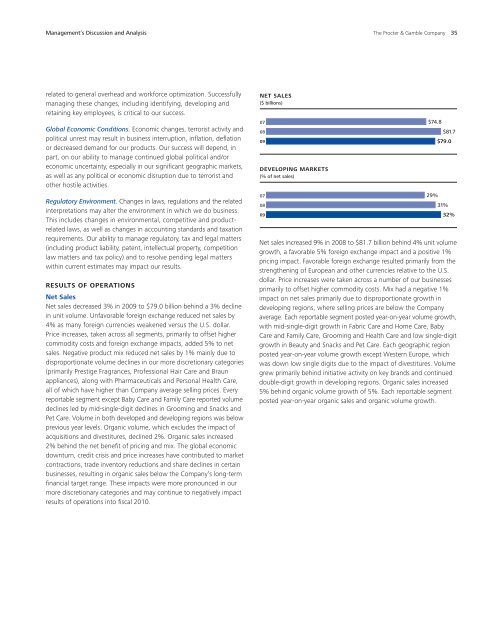

Net sales decreased 3% in <strong>2009</strong> to $79.0 billion behind a 3% decline<br />

in unit volume. Unfavorable foreign exchange reduced net sales by<br />

4% as many foreign currencies weakened versus the U.S. dollar.<br />

Price increases, taken across all segments, primarily to offset higher<br />

<strong>com</strong>modity costs and foreign exchange impacts, added 5% to net<br />

sales. Negative product mix reduced net sales by 1% mainly due to<br />

disproportionate volume declines in our more discretionary categories<br />

(primarily Prestige Fragrances, Professional Hair Care and Braun<br />

appliances), along with Pharmaceuticals and Personal Health Care,<br />

all of which have higher than Company average selling prices. Every<br />

reportable segment except Baby Care and Family Care reported volume<br />

declines led by mid-single-digit declines in Grooming and Snacks and<br />

Pet Care. Volume in both developed and developing regions was below<br />

previous year levels. Organic volume, which excludes the impact of<br />

acquisitions and divestitures, declined 2%. Organic sales increased<br />

2% behind the net benefit of pricing and mix. The global economic<br />

downturn, credit crisis and price increases have contributed to market<br />

contractions, trade inventory reductions and share declines in certain<br />

businesses, resulting in organic sales below the Company’s long-term<br />

financial target range. These impacts were more pronounced in our<br />

more discretionary categories and may continue to negatively impact<br />

results of operations into fiscal 2010.<br />

NET SALES<br />

($ billions)<br />

07<br />

08<br />

09<br />

DEVELOPING MARKETS<br />

(% of net sales)<br />

07<br />

08<br />

09<br />

$74.8<br />

29%<br />

$81.7<br />

$79.0<br />

31%<br />

32%<br />

Net sales increased 9% in 2008 to $81.7 billion behind 4% unit volume<br />

growth, a favorable 5% foreign exchange impact and a positive 1%<br />

pricing impact. Favorable foreign exchange resulted primarily from the<br />

strengthening of European and other currencies relative to the U.S.<br />

dollar. Price increases were taken across a number of our businesses<br />

primarily to offset higher <strong>com</strong>modity costs. Mix had a negative 1%<br />

impact on net sales primarily due to disproportionate growth in<br />

developing regions, where selling prices are below the Company<br />

average. Each reportable segment posted year-on-year volume growth,<br />

with mid-single-digit growth in Fabric Care and Home Care, Baby<br />

Care and Family Care, Grooming and Health Care and low single-digit<br />

growth in Beauty and Snacks and Pet Care. Each geographic region<br />

posted year-on-year volume growth except Western Europe, which<br />

was down low single digits due to the impact of divestitures. Volume<br />

grew primarily behind initiative activity on key brands and continued<br />

double-digit growth in developing regions. Organic sales increased<br />

5% behind organic volume growth of 5%. Each reportable segment<br />

posted year-on-year organic sales and organic volume growth.