Myanmar

1WZPRL1Jj

1WZPRL1Jj

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MYANMAR BUSINESS SURVEY: DATA ANALYSIS AND POLICY IMPLICATIONS<br />

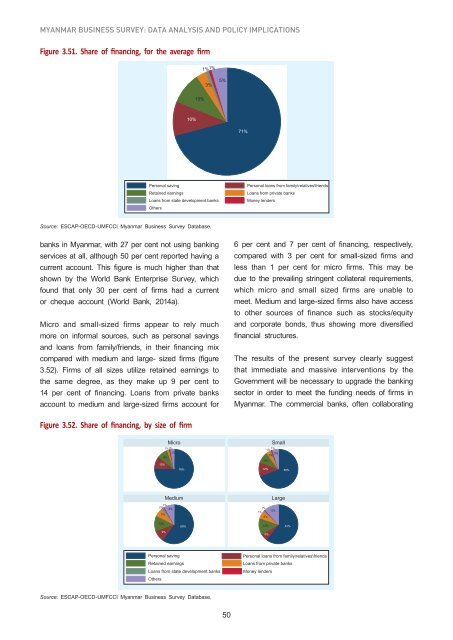

Figure 3.51. Share of financing, for the average firm<br />

1% 1% 5%<br />

3%<br />

10%<br />

10%<br />

71%<br />

Personal saving<br />

Retained earnings<br />

Loans from state development banks<br />

Others<br />

Personal loans from family\relatives\friends<br />

Loans from private banks<br />

Money lenders<br />

Source: ESCAP-OECD-UMFCCI <strong>Myanmar</strong> Business Survey Database.<br />

banks in <strong>Myanmar</strong>, with 27 per cent not using banking<br />

services at all, although 50 per cent reported having a<br />

current account. This figure is much higher than that<br />

shown by the World Bank Enterprise Survey, which<br />

found that only 30 per cent of firms had a current<br />

or cheque account (World Bank, 2014a).<br />

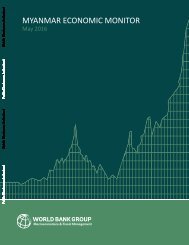

Micro and small-sized firms appear to rely much<br />

more on informal sources, such as personal savings<br />

and loans from family/friends, in their financing mix<br />

compared with medium and large- sized firms (figure<br />

3.52). Firms of all sizes utilize retained earnings to<br />

the same degree, as they make up 9 per cent to<br />

14 per cent of financing. Loans from private banks<br />

account to medium and large-sized firms account for<br />

6 per cent and 7 per cent of financing, respectively,<br />

compared with 3 per cent for small-sized firms and<br />

less than 1 per cent for micro firms. This may be<br />

due to the prevailing stringent collateral requirements,<br />

which micro and small sized firms are unable to<br />

meet. Medium and large-sized firms also have access<br />

to other sources of finance such as stocks/equity<br />

and corporate bonds, thus showing more diversified<br />

financial structures.<br />

The results of the present survey clearly suggest<br />

that immediate and massive interventions by the<br />

Government will be necessary to upgrade the banking<br />

sector in order to meet the funding needs of firms in<br />

<strong>Myanmar</strong>. The commercial banks, often collaborating<br />

Figure 3.52. Share of financing, by size of firm<br />

Micro<br />

1%1%<br />

3%<br />

9%<br />

10%<br />

76%<br />

Small<br />

1%<br />

1%<br />

5%<br />

3%<br />

9%<br />

12%<br />

69%<br />

Medium<br />

Large<br />

2% 1% 8%<br />

7%<br />

1%<br />

1%<br />

12%<br />

6%<br />

13%<br />

60%<br />

14%<br />

61%<br />

9%<br />

6%<br />

Personal saving<br />

Retained earnings<br />

Loans from state development banks<br />

Others<br />

Personal loans from family\relatives\friends<br />

Loans from private banks<br />

Money lenders<br />

Source: ESCAP-OECD-UMFCCI <strong>Myanmar</strong> Business Survey Database.<br />

50