Myanmar

1WZPRL1Jj

1WZPRL1Jj

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

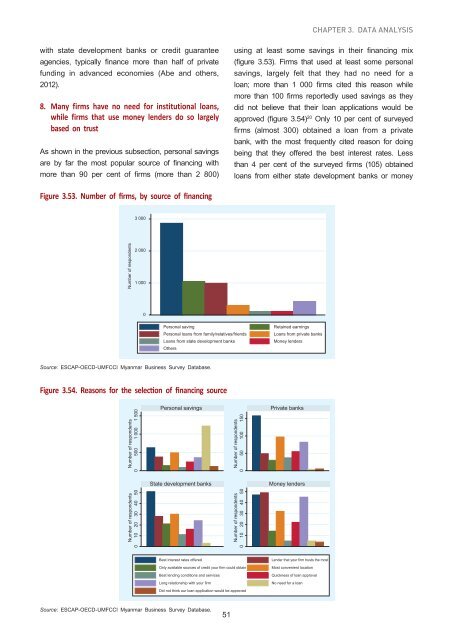

CHAPTER 3. Data analysis<br />

with state development banks or credit guarantee<br />

agencies, typically finance more than half of private<br />

funding in advanced economies (Abe and others,<br />

2012).<br />

8. Many firms have no need for institutional loans,<br />

while firms that use money lenders do so largely<br />

based on trust<br />

As shown in the previous subsection, personal savings<br />

are by far the most popular source of financing with<br />

more than 90 per cent of firms (more than 2 800)<br />

using at least some savings in their financing mix<br />

(figure 3.53). Firms that used at least some personal<br />

savings, largely felt that they had no need for a<br />

loan; more than 1 000 firms cited this reason while<br />

more than 100 firms reportedly used savings as they<br />

did not believe that their loan applications would be<br />

approved (figure 3.54) 20 Only 10 per cent of surveyed<br />

firms (almost 300) obtained a loan from a private<br />

bank, with the most frequently cited reason for doing<br />

being that they offered the best interest rates. Less<br />

than 4 per cent of the surveyed firms (105) obtained<br />

loans from either state development banks or money<br />

Figure 3.53. Number of firms, by source of financing<br />

3 000<br />

Number of respondents<br />

2 000<br />

1 000<br />

0<br />

Personal saving<br />

Personal loans from family/relatives/friends<br />

Loans from state development banks<br />

Others<br />

Retained earnings<br />

Loans from private banks<br />

Source: ESCAP-OECD-UMFCCI <strong>Myanmar</strong> Business Survey Database.<br />

Figure 3.54. Reasons for the selection of financing source<br />

Number of respondents<br />

0 500 1 000 1 500<br />

Personal savings<br />

Number of respondents<br />

0 50 100 150<br />

Private banks<br />

State development banks<br />

Money lenders<br />

Number of respondents<br />

0 10 20 30 40 50<br />

Number of respondents<br />

0 10 20 30 40 50<br />

Money lenders<br />

Best interest rates offered<br />

Only available sources of credit your firm could obtain<br />

Best lending conditions and services<br />

Long relationship with your firm<br />

Did not think our loan application would be approved<br />

Lender that your firm trusts the most<br />

Most convenient location<br />

Quickness of loan approval<br />

No need for a loan<br />

Source: ESCAP-OECD-UMFCCI <strong>Myanmar</strong> Business Survey Database.<br />

51