EMERGING

Emerging Markets:

Emerging Markets:

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EMERGING</strong> MARKETS:<br />

A Review of Business and Legal Issues<br />

called “slush funds/black money” (German Schwarze Kasse). Suspicions shared by<br />

prosecutor's offices of several countries include transfers of the illegal funds of Siemens to<br />

Egypt, Saudi Arabia, Kuwait, Indonesia, China, Hungary, Israel, Norway, France, Vietnam,<br />

Greece, Nigeria, Italy, Serbia, Caribbean countries, Russia, Poland, Libya and other countries.<br />

Neue Bank Lichtenstein, LGT Bank Group, Dresdner Bank Schweiz, Deutsche Bank<br />

Frankfurt, Societe General Hellad, Raiffeisen Bank and other banks have all cooperated with<br />

the police and prosecutors during the investigation.<br />

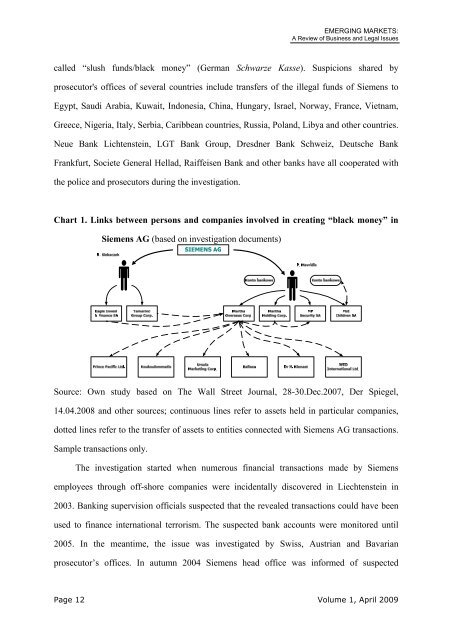

Chart 1. Links between persons and companies involved in creating “black money” in<br />

Siemens AG (based on investigation documents)<br />

Source: Own study based on The Wall Street Journal, 28-30.Dec.2007, Der Spiegel,<br />

14.04.2008 and other sources; continuous lines refer to assets held in particular companies,<br />

dotted lines refer to the transfer of assets to entities connected with Siemens AG transactions.<br />

Sample transactions only.<br />

The investigation started when numerous financial transactions made by Siemens<br />

employees through off-shore companies were incidentally discovered in Liechtenstein in<br />

2003. Banking supervision officials suspected that the revealed transactions could have been<br />

used to finance international terrorism. The suspected bank accounts were monitored until<br />

2005. In the meantime, the issue was investigated by Swiss, Austrian and Bavarian<br />

prosecutor’s offices. In autumn 2004 Siemens head office was informed of suspected<br />

Page 12 Volume 1, April 2009