Exhibit 10.2 NewPage - Executed ABL Agreement

Exhibit 10.2 NewPage - Executed ABL Agreement

Exhibit 10.2 NewPage - Executed ABL Agreement

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

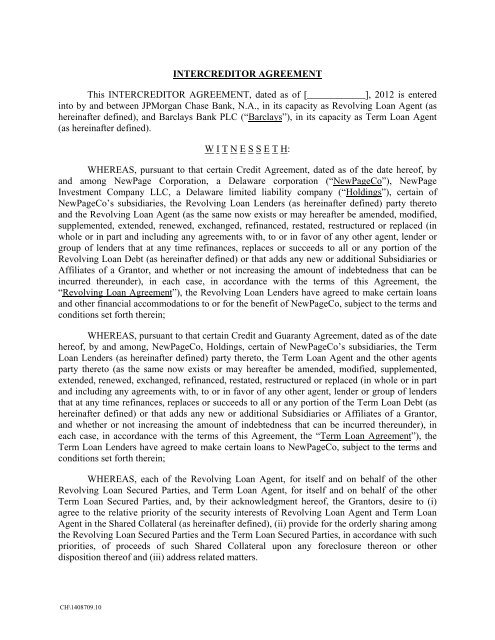

INTERCREDITOR AGREEMENT<br />

This INTERCREDITOR AGREEMENT, dated as of [____________], 2012 is entered<br />

into by and between JPMorgan Chase Bank, N.A., in its capacity as Revolving Loan Agent (as<br />

hereinafter defined), and Barclays Bank PLC (“Barclays”), in its capacity as Term Loan Agent<br />

(as hereinafter defined).<br />

W I T N E S S E T H:<br />

WHEREAS, pursuant to that certain Credit <strong>Agreement</strong>, dated as of the date hereof, by<br />

and among <strong>NewPage</strong> Corporation, a Delaware corporation (“<strong>NewPage</strong>Co”), <strong>NewPage</strong><br />

Investment Company LLC, a Delaware limited liability company (“Holdings”), certain of<br />

<strong>NewPage</strong>Co’s subsidiaries, the Revolving Loan Lenders (as hereinafter defined) party thereto<br />

and the Revolving Loan Agent (as the same now exists or may hereafter be amended, modified,<br />

supplemented, extended, renewed, exchanged, refinanced, restated, restructured or replaced (in<br />

whole or in part and including any agreements with, to or in favor of any other agent, lender or<br />

group of lenders that at any time refinances, replaces or succeeds to all or any portion of the<br />

Revolving Loan Debt (as hereinafter defined) or that adds any new or additional Subsidiaries or<br />

Affiliates of a Grantor, and whether or not increasing the amount of indebtedness that can be<br />

incurred thereunder), in each case, in accordance with the terms of this <strong>Agreement</strong>, the<br />

“Revolving Loan <strong>Agreement</strong>”), the Revolving Loan Lenders have agreed to make certain loans<br />

and other financial accommodations to or for the benefit of <strong>NewPage</strong>Co, subject to the terms and<br />

conditions set forth therein;<br />

WHEREAS, pursuant to that certain Credit and Guaranty <strong>Agreement</strong>, dated as of the date<br />

hereof, by and among, <strong>NewPage</strong>Co, Holdings, certain of <strong>NewPage</strong>Co’s subsidiaries, the Term<br />

Loan Lenders (as hereinafter defined) party thereto, the Term Loan Agent and the other agents<br />

party thereto (as the same now exists or may hereafter be amended, modified, supplemented,<br />

extended, renewed, exchanged, refinanced, restated, restructured or replaced (in whole or in part<br />

and including any agreements with, to or in favor of any other agent, lender or group of lenders<br />

that at any time refinances, replaces or succeeds to all or any portion of the Term Loan Debt (as<br />

hereinafter defined) or that adds any new or additional Subsidiaries or Affiliates of a Grantor,<br />

and whether or not increasing the amount of indebtedness that can be incurred thereunder), in<br />

each case, in accordance with the terms of this <strong>Agreement</strong>, the “Term Loan <strong>Agreement</strong>”), the<br />

Term Loan Lenders have agreed to make certain loans to <strong>NewPage</strong>Co, subject to the terms and<br />

conditions set forth therein;<br />

WHEREAS, each of the Revolving Loan Agent, for itself and on behalf of the other<br />

Revolving Loan Secured Parties, and Term Loan Agent, for itself and on behalf of the other<br />

Term Loan Secured Parties, and, by their acknowledgment hereof, the Grantors, desire to (i)<br />

agree to the relative priority of the security interests of Revolving Loan Agent and Term Loan<br />

Agent in the Shared Collateral (as hereinafter defined), (ii) provide for the orderly sharing among<br />

the Revolving Loan Secured Parties and the Term Loan Secured Parties, in accordance with such<br />

priorities, of proceeds of such Shared Collateral upon any foreclosure thereon or other<br />

disposition thereof and (iii) address related matters.<br />

CH\1408709.10