REPORT 2013

Half Year Report 2013 - Fiji Revenue & Customs Authority

Half Year Report 2013 - Fiji Revenue & Customs Authority

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7<br />

Critical Success Factor: Financial<br />

• Fiscally responsible management.<br />

• Strengthen risk management.<br />

FRCA has recorded solid revenue collections as at June<br />

<strong>2013</strong> with a massive positive variance over the forecast and<br />

2012 actual. The $829.1m collection as at 30 June, <strong>2013</strong> has<br />

exceeded the:<br />

• Forecast by $31.8m (or 4.0% over the forecast); and<br />

• Actual collection by $88.6m (or 12.0% over last year same<br />

period).<br />

The variance over the forecast of over $31.8m has been<br />

phenomenal as such resounding performance has rarely been<br />

recorded in FRCA’s history. Cumulative collections to June in<br />

the past have never recorded a variance of such magnitude.<br />

Between 2004 and 2012, FRCA’s January to June collection has<br />

exceeded the forecast by an average of $1.9m; hence the <strong>2013</strong><br />

performance was 16 times better than the average. Refer to<br />

Table 1.<br />

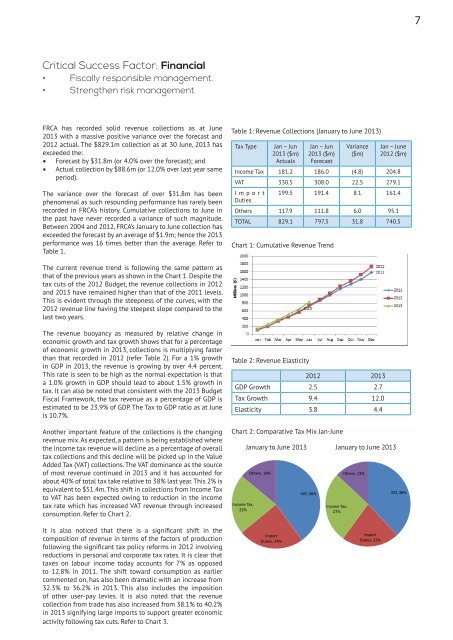

Table 1: Revenue Collections (January to June <strong>2013</strong>)<br />

Tax Type<br />

Jan – Jun<br />

<strong>2013</strong> ($m)<br />

Actuals<br />

Jan – Jun<br />

<strong>2013</strong> ($m)<br />

Forecast<br />

Variance<br />

($m)<br />

Jan – June<br />

2012 ($m)<br />

Income Tax 181.2 186.0 (4.8) 204.8<br />

VAT 330.5 308.0 22.5 279.1<br />

Import<br />

Duties<br />

199.5 191.4 8.1 161.4<br />

Others 117.9 111.8 6.0 95.1<br />

TOTAL 829.1 797.3 31.8 740.5<br />

Chart 1: Cumulative Revenue Trend<br />

The current revenue trend is following the same pattern as<br />

that of the previous years as shown in the Chart 1. Despite the<br />

tax cuts of the 2012 Budget, the revenue collections in 2012<br />

and <strong>2013</strong> have remained higher than that of the 2011 levels.<br />

This is evident through the steepness of the curves, with the<br />

2012 revenue line having the steepest slope compared to the<br />

last two years.<br />

The revenue buoyancy as measured by relative change in<br />

economic growth and tax growth shows that for a percentage<br />

of economic growth in <strong>2013</strong>, collections is multiplying faster<br />

than that recorded in 2012 (refer Table 2). For a 1% growth<br />

in GDP in <strong>2013</strong>, the revenue is growing by over 4.4 percent.<br />

This rate is seen to be high as the normal expectation is that<br />

a 1.0% growth in GDP should lead to about 1.5% growth in<br />

tax. It can also be noted that consistent with the <strong>2013</strong> Budget<br />

Fiscal Framework, the tax revenue as a percentage of GDP is<br />

estimated to be 23.9% of GDP. The Tax to GDP ratio as at June<br />

is 10.7%.<br />

Another important feature of the collections is the changing<br />

revenue mix. As expected, a pattern is being established where<br />

the income tax revenue will decline as a percentage of overall<br />

tax collections and this decline will be picked up in the Value<br />

Added Tax (VAT) collections. The VAT dominance as the source<br />

of most revenue continued in <strong>2013</strong> and it has accounted for<br />

about 40% of total tax take relative to 38% last year. This 2% is<br />

equivalent to $51.4m. This shift in collections from Income Tax<br />

to VAT has been expected owing to reduction in the income<br />

tax rate which has increased VAT revenue through increased<br />

consumption. Refer to Chart 2.<br />

Table 2: Revenue Elasticity<br />

2012 <strong>2013</strong><br />

GDP Growth 2.5 2.7<br />

Tax Growth 9.4 12.0<br />

Elasticity 3.8 4.4<br />

Chart 2: Comparative Tax Mix Jan-June<br />

Income Tax,<br />

22%<br />

January to June <strong>2013</strong> January to June <strong>2013</strong><br />

Others, 14%<br />

VAT, 40%<br />

Income Tax,<br />

27%<br />

Others, 13%<br />

VAT, 38%<br />

It is also noticed that there is a significant shift in the<br />

composition of revenue in terms of the factors of production<br />

following the significant tax policy reforms in 2012 involving<br />

reductions in personal and corporate tax rates. It is clear that<br />

taxes on labour income today accounts for 7% as opposed<br />

to 12.8% in 2011. The shift toward consumption as earlier<br />

commented on, has also been dramatic with an increase from<br />

32.3% to 36.2% in <strong>2013</strong>. This also includes the imposition<br />

of other user-pay levies. It is also noted that the revenue<br />

collection from trade has also increased from 38.1% to 40.2%<br />

in <strong>2013</strong> signifying large imports to support greater economic<br />

activity following tax cuts. Refer to Chart 3.<br />

Import<br />

Duties, 24%<br />

Import<br />

Duties, 22%