BL Magazine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business<br />

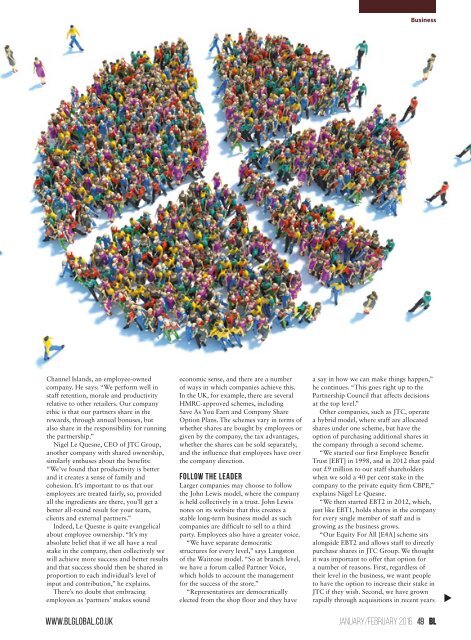

Channel Islands, an employee-owned<br />

company. He says: “We perform well in<br />

staff retention, morale and productivity<br />

relative to other retailers. Our company<br />

ethic is that our partners share in the<br />

rewards, through annual bonuses, but<br />

also share in the responsibility for running<br />

the partnership.”<br />

Nigel Le Quesne, CEO of JTC Group,<br />

another company with shared ownership,<br />

similarly enthuses about the benefits:<br />

“We’ve found that productivity is better<br />

and it creates a sense of family and<br />

cohesion. It’s important to us that our<br />

employees are treated fairly, so, provided<br />

all the ingredients are there, you’ll get a<br />

better all-round result for your team,<br />

clients and external partners.”<br />

Indeed, Le Quesne is quite evangelical<br />

about employee ownership. “It’s my<br />

absolute belief that if we all have a real<br />

stake in the company, then collectively we<br />

will achieve more success and better results<br />

and that success should then be shared in<br />

proportion to each individual’s level of<br />

input and contribution,” he explains.<br />

There’s no doubt that embracing<br />

employees as ‘partners’ makes sound<br />

economic sense, and there are a number<br />

of ways in which companies achieve this.<br />

In the UK, for example, there are several<br />

HMRC-approved schemes, including<br />

Save As You Earn and Company Share<br />

Option Plans. The schemes vary in terms of<br />

whether shares are bought by employees or<br />

given by the company, the tax advantages,<br />

whether the shares can be sold separately,<br />

and the influence that employees have over<br />

the company direction.<br />

FOLLOW THE LEADER<br />

Larger companies may choose to follow<br />

the John Lewis model, where the company<br />

is held collectively in a trust. John Lewis<br />

notes on its website that this creates a<br />

stable long-term business model as such<br />

companies are difficult to sell to a third<br />

party. Employees also have a greater voice.<br />

“We have separate democratic<br />

structures for every level,” says Langston<br />

of the Waitrose model. “So at branch level,<br />

we have a forum called Partner Voice,<br />

which holds to account the management<br />

for the success of the store.”<br />

“Representatives are democratically<br />

elected from the shop floor and they have<br />

a say in how we can make things happen,”<br />

he continues. “This goes right up to the<br />

Partnership Council that affects decisions<br />

at the top level.”<br />

Other companies, such as JTC, operate<br />

a hybrid model, where staff are allocated<br />

shares under one scheme, but have the<br />

option of purchasing additional shares in<br />

the company through a second scheme.<br />

“We started our first Employee Benefit<br />

Trust [EBT] in 1998, and in 2012 that paid<br />

out £9 million to our staff shareholders<br />

when we sold a 40 per cent stake in the<br />

company to the private equity firm CBPE,”<br />

explains Nigel Le Quesne.<br />

“We then started EBT2 in 2012, which,<br />

just like EBT1, holds shares in the company<br />

for every single member of staff and is<br />

growing as the business grows.<br />

“Our Equity For All [E4A] scheme sits<br />

alongside EBT2 and allows staff to directly<br />

purchase shares in JTC Group. We thought<br />

it was important to offer that option for<br />

a number of reasons. First, regardless of<br />

their level in the business, we want people<br />

to have the option to increase their stake in<br />

JTC if they wish. Second, we have grown<br />

rapidly through acquisitions in recent years<br />

▼<br />

www.blglobal.co.uk january/february 2016 49