China

WcEiA

WcEiA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

92<br />

Country starter pack<br />

Business practicalities in <strong>China</strong><br />

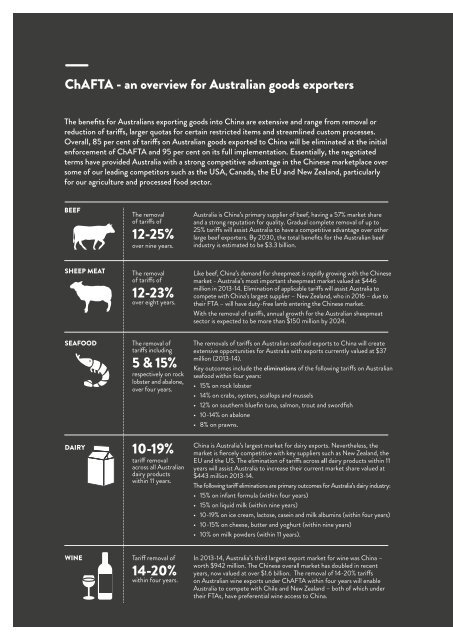

ChAFTA - an overview for Australian goods exporters<br />

The benefits for Australians exporting goods into <strong>China</strong> are extensive and range from removal or<br />

reduction of tariffs, larger quotas for certain restricted items and streamlined custom processes.<br />

Overall, 85 per cent of tariffs on Australian goods exported to <strong>China</strong> will be eliminated at the initial<br />

enforcement of ChAFTA and 95 per cent on its full implementation. Essentially, the negotiated<br />

terms have provided Australia with a strong competitive advantage in the Chinese marketplace over<br />

some of our leading competitors such as the USA, Canada, the EU and New Zealand, particularly<br />

for our agriculture and processed food sector.<br />

BEEF<br />

The removal<br />

of tariffs of<br />

12-25%<br />

over nine years.<br />

Australia is <strong>China</strong>’s primary supplier of beef, having a 57% market share<br />

and a strong reputation for quality. Gradual complete removal of up to<br />

25% tariffs will assist Australia to have a competitive advantage over other<br />

large beef exporters. By 2030, the total benefits for the Australian beef<br />

industry is estimated to be $3.3 billion.<br />

SHEEP MEAT<br />

The removal<br />

of tariffs of<br />

12-23%<br />

over eight years.<br />

Like beef, <strong>China</strong>’s demand for sheepmeat is rapidly growing with the Chinese<br />

market - Australia’s most important sheepmeat market valued at $446<br />

million in 2013-14. Elimination of applicable tariffs will assist Australia to<br />

compete with <strong>China</strong>’s largest supplier – New Zealand, who in 2016 – due to<br />

their FTA – will have duty-free lamb entering the Chinese market.<br />

With the removal of tariffs, annual growth for the Australian sheepmeat<br />

sector is expected to be more than $150 million by 2024.<br />

SEAFOOD<br />

DAIRY<br />

The removal of<br />

tariffs including<br />

5 & 15%<br />

respectively on rock<br />

lobster and abalone,<br />

over four years.<br />

10-19%<br />

tariff removal<br />

across all Australian<br />

dairy products<br />

within 11 years.<br />

The removals of tariffs on Australian seafood exports to <strong>China</strong> will create<br />

extensive opportunities for Australia with exports currently valued at $37<br />

million (2013-14).<br />

Key outcomes include the eliminations of the following tariffs on Australian<br />

seafood within four years:<br />

• 15% on rock lobster<br />

• 14% on crabs, oysters, scallops and mussels<br />

• 12% on southern bluefin tuna, salmon, trout and swordfish<br />

• 10-14% on abalone<br />

• 8% on prawns.<br />

<strong>China</strong> is Australia’s largest market for dairy exports. Nevertheless, the<br />

market is fiercely competitive with key suppliers such as New Zealand, the<br />

EU and the US. The elimination of tariffs across all dairy products within 11<br />

years will assist Australia to increase their current market share valued at<br />

$443 million 2013-14.<br />

The following tariff eliminations are primary outcomes for Australia’s dairy industry:<br />

• 15% on infant formula (within four years)<br />

• 15% on liquid milk (within nine years)<br />

• 10-19% on ice cream, lactose, casein and milk albumins (within four years)<br />

• 10-15% on cheese, butter and yoghurt (within nine years)<br />

• 10% on milk powders (within 11 years).<br />

WINE<br />

Tariff removal of<br />

14-20%<br />

within four years.<br />

In 2013-14, Australia’s third largest export market for wine was <strong>China</strong> –<br />

worth $942 million. The Chinese overall market has doubled in recent<br />

years, now valued at over $1.6 billion. The removal of 14-20% tariffs<br />

on Australian wine exports under ChAFTA within four years will enable<br />

Australia to compete with Chile and New Zealand – both of which under<br />

their FTAs, have preferential wine access to <strong>China</strong>.