2014/15 Annual Report

pzog4zx

pzog4zx

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2014</strong>/<strong>15</strong><br />

111<br />

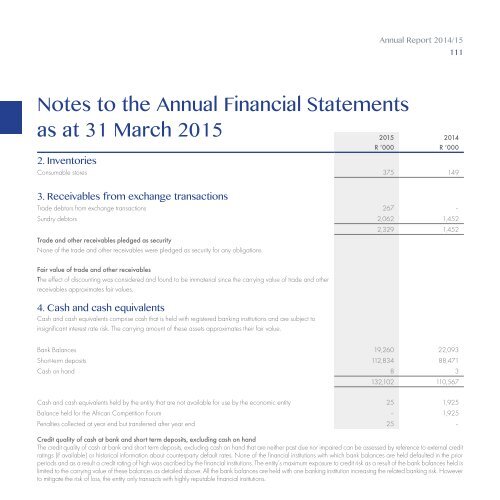

Notes to the <strong>Annual</strong> Financial Statements<br />

as at 31 March 20<strong>15</strong><br />

20<strong>15</strong><br />

R ‘000<br />

<strong>2014</strong><br />

R ‘000<br />

2. Inventories<br />

Consumable stores 375 149<br />

3. Receivables from exchange transactions<br />

Trade debtors from exchange transactions 267 –<br />

Sundry debtors 2,062 1,452<br />

Trade and other receivables pledged as security<br />

None of the trade and other receivables were pledged as security for any obligations.<br />

Fair value of trade and other receivables<br />

The effect of discounting was considered and found to be immaterial since the carrying value of trade and other<br />

receivables approximates fair values.<br />

4. Cash and cash equivalents<br />

Cash and cash equivalents comprise cash that is held with registered banking institutions and are subject to<br />

insignificant interest rate risk. The carrying amount of these assets approximates their fair value.<br />

2,329 1,452<br />

Bank Balances 19,260 22,093<br />

Short-term deposits 112,834 88,471<br />

Cash on hand 8 3<br />

132,102 110,567<br />

Cash and cash equivalents held by the entity that are not available for use by the economic entity 25 1,925<br />

Balance held for the African Competition Forum – 1,925<br />

Penalties collected at year end but transferred after year end 25 –<br />

Credit quality of cash at bank and short term deposits, excluding cash on hand<br />

The credit quality of cash at bank and short term deposits, excluding cash on hand that are neither past due nor impaired can be assessed by reference to external credit<br />

ratings (if available) or historical information about counterparty default rates. None of the financial institutions with which bank balances are held defaulted in the prior<br />

periods and as a result a credit rating of high was ascribed by the financial institutions. The entity’s maximum exposure to credit risk as a result of the bank balances held is<br />

limited to the carrying value of these balances as detailed above. All the bank balances are held with one banking institution increasing the related banking risk. However<br />

to mitigate the risk of loss, the entity only transacts with highly reputable financial institutions.