2014/15 Annual Report

pzog4zx

pzog4zx

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2014</strong>/<strong>15</strong><br />

39<br />

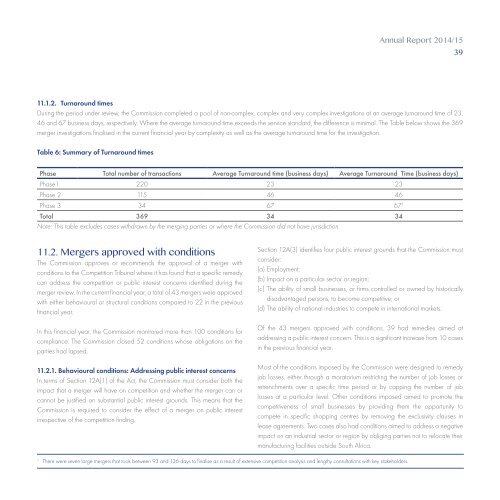

11.1.2. Turnaround times<br />

During the period under review, the Commission completed a pool of non-complex, complex and very complex investigations at an average turnaround time of 23,<br />

46 and 67 business days, respectively. Where the average turnaround time exceeds the service standard, the difference is minimal. The Table below shows the 369<br />

merger investigations finalised in the current financial year by complexity as well as the average turnaround time for the investigation.<br />

Table 6: Summary of Turnaround times<br />

Phase Total number of transactions Average Turnaround time (business days) Average Turnaround Time (business days)<br />

Phase1 220 23 23<br />

Phase 2 1<strong>15</strong> 46 46<br />

Phase 3 34 67 67 1<br />

Total 369 34 34<br />

Note: This table excludes cases withdrawn by the merging parties or where the Commission did not have jurisdiction.<br />

11.2. Mergers approved with conditions<br />

The Commission approves or recommends the approval of a merger with<br />

conditions to the Competition Tribunal where it has found that a specific remedy<br />

can address the competition or public interest concerns identified during the<br />

merger review. In the current financial year, a total of 43 mergers were approved<br />

with either behavioural or structural conditions compared to 22 in the previous<br />

financial year.<br />

In this financial year, the Commission monitored more than 100 conditions for<br />

compliance. The Commission closed 52 conditions whose obligations on the<br />

parties had lapsed.<br />

11.2.1. Behavioural conditions: Addressing public interest concerns<br />

In terms of Section 12A(1) of the Act, the Commission must consider both the<br />

impact that a merger will have on competition and whether the merger can or<br />

cannot be justified on substantial public interest grounds. This means that the<br />

Commission is required to consider the effect of a merger on public interest<br />

irrespective of the competition finding.<br />

Section 12A(3) identifies four public interest grounds that the Commission must<br />

consider:<br />

(a) Employment;<br />

(b) Impact on a particular sector or region;<br />

(c) The ability of small businesses, or firms controlled or owned by historically<br />

disadvantaged persons, to become competitive; or<br />

(d) The ability of national industries to compete in international markets.<br />

Of the 43 mergers approved with conditions, 39 had remedies aimed at<br />

addressing a public interest concern. This is a significant increase from 10 cases<br />

in the previous financial year.<br />

Most of the conditions imposed by the Commission were designed to remedy<br />

job losses, either through a moratorium restricting the number of job losses or<br />

retrenchments over a specific time period or by capping the number of job<br />

losses at a particular level. Other conditions imposed aimed to promote the<br />

competitiveness of small businesses by providing them the opportunity to<br />

compete in specific shopping centres by removing the exclusivity clauses in<br />

lease agreements. Two cases also had conditions aimed to address a negative<br />

impact on an industrial sector or region by obliging parties not to relocate their<br />

manufacturing facilities outside South Africa.<br />

1<br />

There were seven large mergers that took between 93 and 136 days to finalise as a result of extensive competition analysis and lengthy consultations with key stakeholders.