2014/15 Annual Report

pzog4zx

pzog4zx

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2014</strong>/<strong>15</strong><br />

125<br />

Notes to the <strong>Annual</strong> Financial Statements<br />

as at 31 March 20<strong>15</strong> (continued)<br />

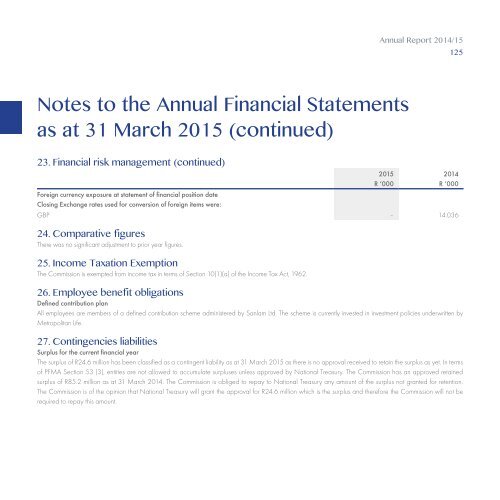

23. Financial risk management (continued)<br />

20<strong>15</strong><br />

R ‘000<br />

<strong>2014</strong><br />

R ‘000<br />

Foreign currency exposure at statement of financial position date<br />

Closing Exchange rates used for conversion of foreign items were:<br />

GBP – 14.036<br />

24. Comparative figures<br />

There was no significant adjustment to prior year figures.<br />

25. Income Taxation Exemption<br />

The Commission is exempted from income tax in terms of Section 10(1)(a) of the Income Tax Act, 1962.<br />

26. Employee benefit obligations<br />

Defined contribution plan<br />

All employees are members of a defined contribution scheme administered by Sanlam Ltd. The scheme is currently invested in investment policies underwritten by<br />

Metropolitan Life.<br />

27. Contingencies liabilities<br />

Surplus for the current financial year<br />

The surplus of R24.6 million has been classified as a contingent liability as at 31 March 20<strong>15</strong> as there is no approval received to retain the surplus as yet. In terms<br />

of PFMA Section 53 (3), entities are not allowed to accumulate surpluses unless approved by National Treasury. The Commission has an approved retained<br />

surplus of R85.2 million as at 31 March <strong>2014</strong>. The Commission is obliged to repay to National Treasury any amount of the surplus not granted for retention.<br />

The Commission is of the opinion that National Treasury will grant the approval for R24.6 million which is the surplus and therefore the Commission will not be<br />

required to repay this amount.