Research Institute

ekthsi_0

ekthsi_0

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

United States<br />

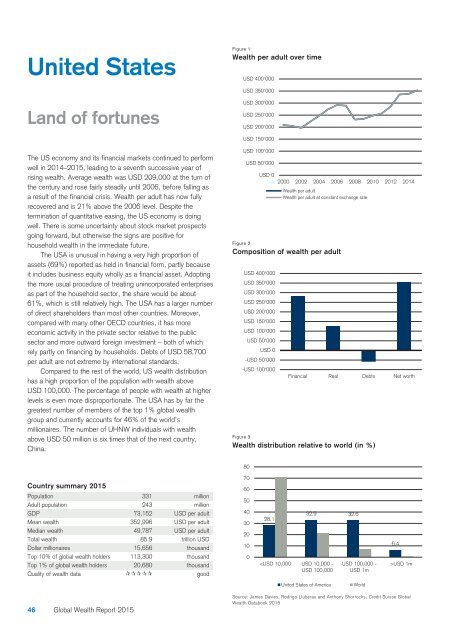

Figure 1<br />

Wealth per adult over time<br />

USD 400'000<br />

USD 350'000<br />

Land of fortunes<br />

USD 300'000<br />

USD 250'000<br />

USD 200'000<br />

USD 150'000<br />

The US economy and its financial markets continued to perform<br />

well in 2014–2015, leading to a seventh successive year of<br />

rising wealth. Average wealth was USD 209,000 at the turn of<br />

the century and rose fairly steadily until 2006, before falling as<br />

a result of the financial crisis. Wealth per adult has now fully<br />

recovered and is 21% above the 2006 level. Despite the<br />

termination of quantitative easing, the US economy is doing<br />

well. There is some uncertainty about stock market prospects<br />

going forward, but otherwise the signs are positive for<br />

household wealth in the immediate future.<br />

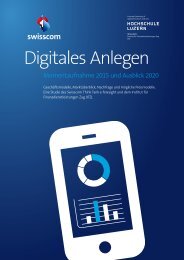

The USA is unusual in having a very high proportion of<br />

assets (69%) reported as held in financial form, partly because<br />

it includes business equity wholly as a financial asset. Adopting<br />

the more usual procedure of treating unincorporated enterprises<br />

as part of the household sector, the share would be about<br />

61%, which is still relatively high. The USA has a larger number<br />

of direct shareholders than most other countries. Moreover,<br />

compared with many other OECD countries, it has more<br />

economic activity in the private sector relative to the public<br />

sector and more outward foreign investment – both of which<br />

rely partly on financing by households. Debts of USD 58,700<br />

per adult are not extreme by international standards.<br />

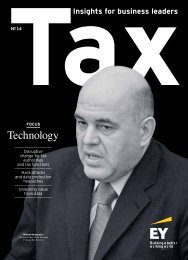

Compared to the rest of the world, US wealth distribution<br />

has a high proportion of the population with wealth above<br />

USD 100,000. The percentage of people with wealth at higher<br />

levels is even more disproportionate. The USA has by far the<br />

greatest number of members of the top 1% global wealth<br />

group and currently accounts for 46% of the world’s<br />

millionaires. The number of UHNW individuals with wealth<br />

above USD 50 million is six times that of the next country,<br />

China.<br />

USD 100'000<br />

USD 50'000<br />

USD 0<br />

2000 2002 2004 2006 2008 2010 2012 2014<br />

Wealth per adult<br />

Wealth per adult at constant exchange rate<br />

Figure 2<br />

Composition of wealth per adult<br />

USD 400'000<br />

USD 350'000<br />

USD 300'000<br />

USD 250'000<br />

USD 200'000<br />

USD 150'000<br />

USD 100'000<br />

USD 50'000<br />

USD 0<br />

-USD 50'000<br />

-USD 100'000<br />

Financial Real Debts Net worth<br />

Figure 3<br />

Wealth distribution relative to world (in %)<br />

80<br />

Country summary 2015<br />

Population 331 million<br />

Adult population 243 million<br />

GDP 73,152 USD per adult<br />

Mean wealth 352,996 USD per adult<br />

Median wealth 49,787 USD per adult<br />

Total wealth 85.9 trillion USD<br />

Dollar millionaires 15,656 thousand<br />

Top 10% of global wealth holders 113,300 thousand<br />

Top 1% of global wealth holders 20,680 thousand<br />

Quality of wealth data good<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

28.1<br />

32.9 32.6<br />

USD 1m<br />

United States of America<br />

World<br />

46 Global Wealth Report 2015<br />

Source: James Davies, Rodrigo Lluberas and Anthony Shorrocks, Credit Suisse Global<br />

Wealth Databook 2015