You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AUGUST <strong>2016</strong><br />

DESCRETIONARY SPENDING<br />

product (GDP) growth by up to 70 basis points over two<br />

quarters. According to the report, the direct impact of an<br />

increase in rural growth is between 45 and 50 bps, the<br />

higher impact would have positive spillover effects<br />

through the urban economy. There are eight indicators to<br />

sense the rural growth which includes two-wheeler &<br />

passenger car sales, household kerosene consumption,<br />

tractor sales, agriculture loans, power demand, yarn<br />

production, agriculture exports and government<br />

expenditure on rural areas. Further, the report also stated<br />

that there is an expectation, consumption to grow steadily<br />

once the proceeds of the Pay Commission and the effects<br />

of good monsoon play out. Higher rural growth could also<br />

cool down headline inflation by 40 bps, due to easing of<br />

supply constraints. Though in the interim period inflation<br />

may edge upwards owing to demand pressures. A good<br />

well spread monsoon across the country would bolster<br />

farm income and boost rural discretionary spending.<br />

Consecutive droughts in a row have also meant that rural<br />

demand has declined significantly, leaving urban demand<br />

and public investment to drive the economy in the<br />

absence of pick-up in private investment. A normal to<br />

above normal monsoon is positive news for rural demand<br />

and for food prices. A bumper crop production would<br />

help to keep the prices of pulses and vegetables under<br />

check which in turn reduce headline inflation and would<br />

encourage RBI to lower down interest rate further, thus<br />

helping to revive the demand in economy. Even,<br />

government is very proactive in boosting rural<br />

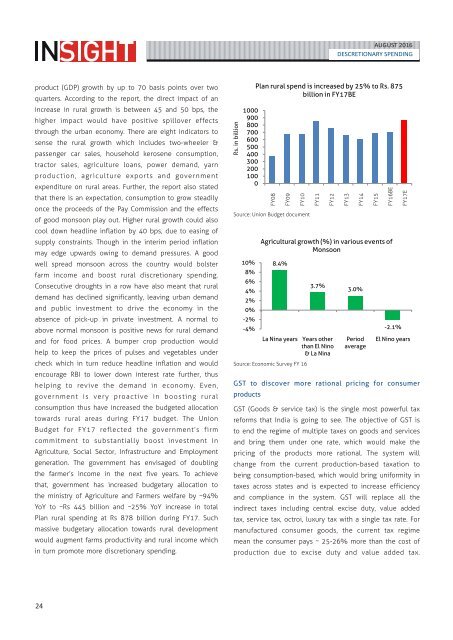

consumption thus have increased the budgeted allocation<br />

towards rural areas during FY17 budget. The Union<br />

Budget for FY17 reflected the government’s firm<br />

commitment to substantially boost investment in<br />

Agriculture, Social Sector, Infrastructure and Employment<br />

generation. The government has envisaged of doubling<br />

the farmer’s income in the next five years. To achieve<br />

that, government has increased budgetary allocation to<br />

the ministry of Agriculture and Farmers welfare by ~94%<br />

YoY to ~Rs 445 billion and ~25% YoY increase in total<br />

Plan rural spending at Rs 878 billion during FY17. Such<br />

massive budgetary allocation towards rural development<br />

would augment farms productivity and rural income which<br />

in turn promote more discretionary spending.<br />

Rs. in billion<br />

FY08<br />

FY09<br />

FY10<br />

FY11<br />

FY12<br />

FY13<br />

FY14<br />

FY15<br />

FY16BE<br />

FY17E<br />

Source: Union Budget document<br />

Source: Economic Survey FY 16<br />

GST to discover more rational pricing for consumer<br />

products<br />

GST (Goods & service tax) is the single most powerful tax<br />

reforms that India is going to see. The objective of GST is<br />

to end the regime of multiple taxes on goods and services<br />

and bring them under one rate, which would make the<br />

pricing of the products more rational. The system will<br />

change from the current production-based taxation to<br />

being consumption-based, which would bring uniformity in<br />

taxes across states and is expected to increase efficiency<br />

and compliance in the system. GST will replace all the<br />

indirect taxes including central excise duty, value added<br />

tax, service tax, octroi, luxury tax with a single tax rate. For<br />

manufactured consumer goods, the current tax regime<br />

mean the consumer pays ~ 25-26% more than the cost of<br />

production due to excise duty and value added tax.<br />

24