You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AUGUST <strong>2016</strong><br />

ECONOMIC REVIEW<br />

The state of the banking sector has been a matter of<br />

great concern for all stakeholders involved as much of the<br />

government’s. The government has actually blamed the<br />

RBI for deteriorating financials of banks. RBI governor<br />

Raghuram Rajan had once said that ‘band-aids’ would no<br />

longer work and banks need deep surgery. Band-aids here<br />

were referred to the restructuring of loans on more<br />

lenient terms to the ailing corporate loans which have<br />

already turned non-performing advances (NPA). The asset<br />

quality review (AQR) initiated by the RBI has actually<br />

thrown up unpleasant surprises, however for good. Post<br />

AQR which was initiated in the <strong>August</strong>-November period<br />

last year, this has resulted in huge losses for the banks<br />

(particularly PSBs) in the December 2015 as well as in<br />

March <strong>2016</strong> quarters. Although, most banks have come<br />

clean and the majority of the provisions have been done<br />

with, nevertheless few of them including private sector<br />

banks continue to throw unpleasant surprises as reported<br />

in the ongoing earning season. The Financial stability<br />

report (FSR) released by RBI last month has actually<br />

highlighted the deep impact to the banking sector.<br />

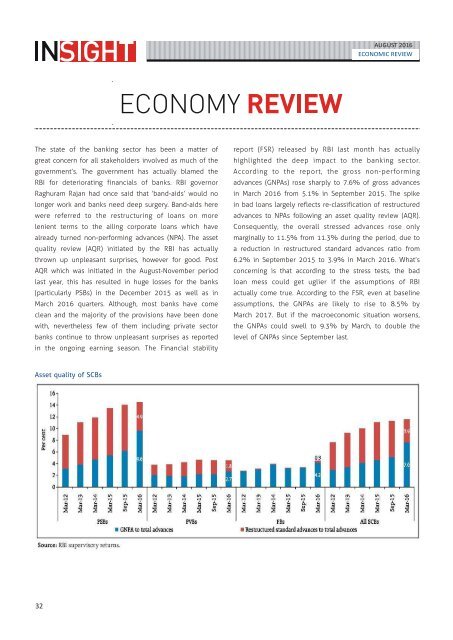

According to the report, the gross non-performing<br />

advances (GNPAs) rose sharply to 7.6% of gross advances<br />

in March <strong>2016</strong> from 5.1% in September 2015. The spike<br />

in bad loans largely reflects re-classification of restructured<br />

advances to NPAs following an asset quality review (AQR).<br />

Consequently, the overall stressed advances rose only<br />

marginally to 11.5% from 11.3% during the period, due to<br />

a reduction in restructured standard advances ratio from<br />

6.2% in September 2015 to 3.9% in March <strong>2016</strong>. What’s<br />

concerning is that according to the stress tests, the bad<br />

loan mess could get uglier if the assumptions of RBI<br />

actually come true. According to the FSR, even at baseline<br />

assumptions, the GNPAs are likely to rise to 8.5% by<br />

March 2017. But if the macroeconomic situation worsens,<br />

the GNPAs could swell to 9.3% by March, to double the<br />

level of GNPAs since September last.<br />

Asset quality of SCBs<br />

32