Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

STRONG ON CONSUMPTION<br />

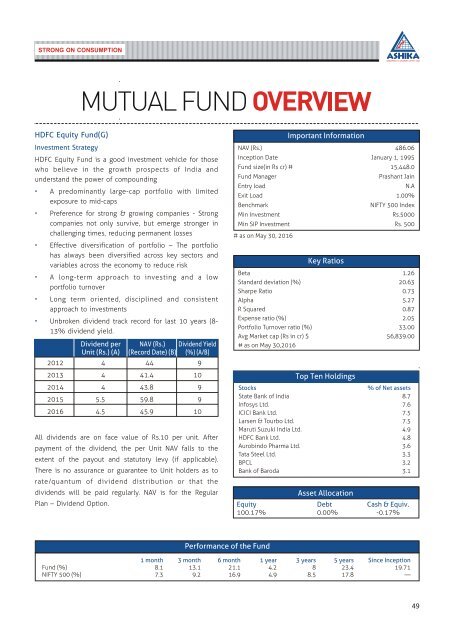

HDFC Equity Fund(G)<br />

Investment Strategy<br />

HDFC Equity Fund is a good investment vehicle for those<br />

who believe in the growth prospects of India and<br />

understand the power of compounding<br />

•<br />

•<br />

•<br />

•<br />

•<br />

•<br />

A predominantly large-cap portfolio with limited<br />

exposure to mid-caps<br />

Preference for strong & growing companies - Strong<br />

companies not only survive, but emerge stronger in<br />

challenging times, reducing permanent losses<br />

Effective diversification of portfolio – The portfolio<br />

has always been diversified across key sectors and<br />

variables across the economy to reduce risk<br />

A long-term approach to investing and a low<br />

portfolio turnover<br />

Long term oriented, disciplined and consistent<br />

approach to investments<br />

Unbroken dividend track record for last 10 years (8-<br />

13% dividend yield.<br />

Dividend per<br />

Unit (Rs.) (A)<br />

NAV (Rs.) Dividend Yield<br />

(Record Date) (B) (%) (A/B)<br />

2012 4 44 9<br />

2013 4 41.4 10<br />

2014 4 43.8 9<br />

2015 5.5 59.8 9<br />

<strong>2016</strong> 4.5 45.9 10<br />

All dividends are on face value of Rs.10 per unit. After<br />

payment of the dividend, the per Unit NAV falls to the<br />

extent of the payout and statutory levy (if applicable).<br />

There is no assurance or guarantee to Unit holders as to<br />

rate/quantum of dividend distribution or that the<br />

dividends will be paid regularly. NAV is for the Regular<br />

Plan – Dividend Option.<br />

NAV (Rs.) 486.06<br />

Inception Date January 1, 1995<br />

Fund size(in Rs cr) # 15,448.0<br />

Fund Manager Prashant Jain<br />

Entry load<br />

N.A<br />

Exit Load 1.00%<br />

Benchmark<br />

Min Investment<br />

NIFTY 500 Index<br />

Rs.5000<br />

Min SIP Investment Rs. 500<br />

# as on May 30, <strong>2016</strong><br />

Beta 1.26<br />

Standard deviation (%) 20.63<br />

Sharpe Ratio 0.73<br />

Alpha 5.27<br />

R Squared 0.87<br />

Expense ratio (%) 2.05<br />

Portfolio Turnover ratio (%) 33.00<br />

Avg Market cap (Rs in cr) $ 56,839.00<br />

# as on May 30,<strong>2016</strong><br />

Important Information<br />

Key Ratios<br />

Top Ten Holdings<br />

Stocks<br />

% of Net assets<br />

State Bank of India 8.7<br />

Infosys Ltd. 7.6<br />

ICICI Bank Ltd. 7.5<br />

Larsen & Tourbo Ltd. 7.5<br />

Maruti Suzuki India Ltd. 4.9<br />

HDFC Bank Ltd. 4.8<br />

Aurobindo Pharma Ltd. 3.6<br />

Tata Steel Ltd. 3.3<br />

BPCL 3.2<br />

Bank of Baroda 3.1<br />

Asset Allocation<br />

Equity Debt Cash & Equiv.<br />

100.17% 0.00% -0.17%<br />

Performance of the Fund<br />

1 month 3 month 6 month 1 year 3 years 5 years Since Inception<br />

Fund (%) 8.1 13.1 21.1 4.2 8 23.4 19.71<br />

NIFTY 500 (%) 7.3 9.2 16.9 4.9 8.5 17.8 —<br />

49