Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AUGUST <strong>2016</strong><br />

TECHNICAL OVERVIEW<br />

To sum up according to classical theory of Technical<br />

analysis market seems stretched for the time being and<br />

correction seems due in the market in the overall higher<br />

degree uptrend. In the forthcoming month market is likely<br />

to remain rangebound and new trading range for the<br />

market exist within 8250-8850.<br />

consolidation mode against which the Index had been<br />

slowly dripping towards its mid band. On the daily time<br />

frame immediate support from the said study exist around<br />

8400 while in weekly time frame the mid band exist<br />

around 8050. Present setup indicates that Nifty is in<br />

uptrend and intermediate correction would be temporary<br />

in nature which need to be utilized to enter long<br />

Modern approach in Technical Analysis<br />

The strong rally during the month lead to a reading in<br />

oscillator near to its overbought territory with slight<br />

divergence is also being observed through RSI which calls<br />

for a cautious approach in the market though current<br />

reading of 68 indicates room for further upside remains.<br />

MACD in both daily and weekly time frame has been in a<br />

rising trajectory, highlights the underlying strength in the<br />

ongoing trend and might augur well for the Index. ADX<br />

too seems positive as +DI continues to remain<br />

comfortably above the –DI however ADX line lies below<br />

20 level mark in weekly chart indicating clear uptrend<br />

still need to be explored. To sum up, with divergent view<br />

point market might remain rangebound in the forthcoming<br />

month as well.<br />

Nifty throughout the month had been clinging at the<br />

upper band of the Bollinger band. Now Nifty entered into<br />

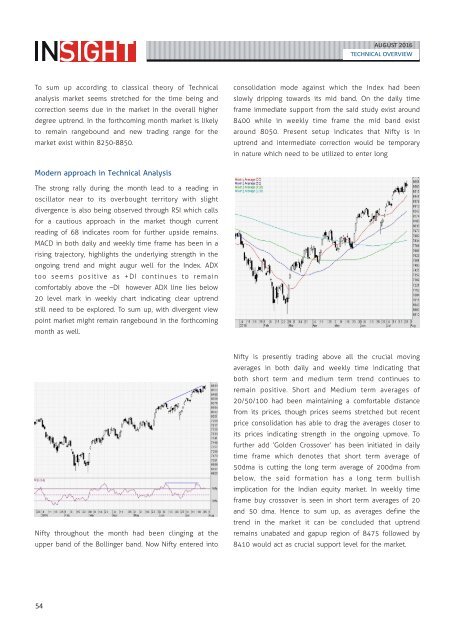

Nifty is presently trading above all the crucial moving<br />

averages in both daily and weekly time indicating that<br />

both short term and medium term trend continues to<br />

remain positive. Short and Medium term averages of<br />

20/50/100 had been maintaining a comfortable distance<br />

from its prices, though prices seems stretched but recent<br />

price consolidation has able to drag the averages closer to<br />

its prices indicating strength in the ongoing upmove. To<br />

further add ‘Golden Crossover’ has been initiated in daily<br />

time frame which denotes that short term average of<br />

50dma is cutting the long term average of 200dma from<br />

below, the said formation has a long term bullish<br />

implication for the Indian equity market. In weekly time<br />

frame buy crossover is seen in short term averages of 20<br />

and 50 dma. Hence to sum up, as averages define the<br />

trend in the market it can be concluded that uptrend<br />

remains unabated and gapup region of 8475 followed by<br />

8410 would act as crucial support level for the market.<br />

54