Caribbean Times 65th Issue - Friday 5th August 2016

Caribbean Times 65th Issue - Friday 5th August 2016

Caribbean Times 65th Issue - Friday 5th August 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8 c a r i b b e a n t i m e s . a g<br />

<strong>Friday</strong> <strong>5th</strong> <strong>August</strong> <strong>2016</strong><br />

IMF: Light up its darker crannies<br />

The International Monetary Fund<br />

(IMF), which has tormented small <strong>Caribbean</strong><br />

economies for five decades<br />

with austerity measures and fierce<br />

conditionalities, has been exposed as<br />

adopting utterly different standards towards<br />

Europe, especially the countries<br />

of the European Currency Union. That<br />

is except for Greece, which, throughout<br />

its economic crisis, the IMF treated like<br />

a third-world country.<br />

According to a report, published on<br />

28 th July by the IMF’s watchdog, the<br />

Independent Evaluation Office (IEO),<br />

the Fund’s top staff worked in cahoots<br />

with the European Commission and the<br />

European Central Bank to misrepresent<br />

the situation in Greece to their own<br />

Executive Board; laboured diligently<br />

to protect the Eurozone in the interests<br />

of its larger members, such as France<br />

and Germany (which, incidentally, are<br />

also the main controllers of the IMF);<br />

and punished Greece with the burden<br />

of alone carrying the cost of a bailout<br />

– something that had not been done to<br />

any other European Union country.<br />

In a revealing and telling sentence<br />

in the executive summary of its report,<br />

the IEO declared that: “In general, the<br />

IMF shared the widely-held “Europe is<br />

different” mindset that encouraged the<br />

view that large imbalances in national<br />

current accounts were little cause for<br />

concern and that sudden stops could<br />

not happen within the euro area”. The<br />

report, “The IMF and the crises in<br />

Greece, Ireland, and Portugal: an evaluation<br />

by the independent evaluation<br />

office” can be read at: http://www.<br />

ieo-imf.org/ieo/files/completedevaluations/EAC__REPORT%20v5.PDF<br />

and<br />

it is strongly recommended that officers<br />

of all Finance Ministries and Central<br />

Banks in the <strong>Caribbean</strong> should read it.<br />

The authors of the report stated unequivocally<br />

that: “The IMF’s handling<br />

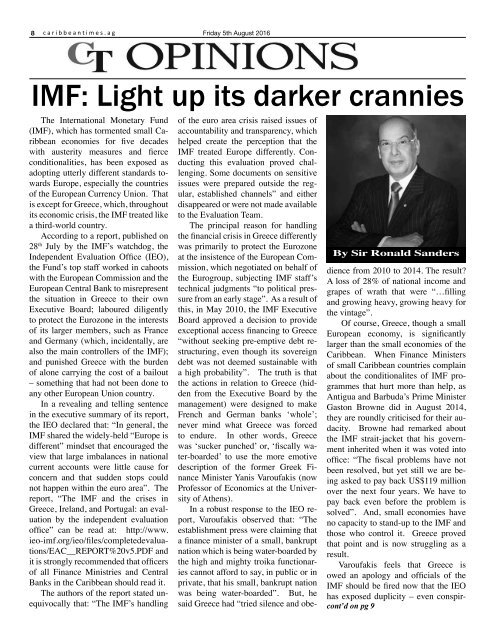

By Sir Ronald Sanders<br />

of the euro area crisis raised issues of<br />

accountability and transparency, which<br />

helped create the perception that the<br />

IMF treated Europe differently. Conducting<br />

this evaluation proved challenging.<br />

Some documents on sensitive<br />

issues were prepared outside the regular,<br />

established channels” and either<br />

disappeared or were not made available<br />

to the Evaluation Team.<br />

The principal reason for handling<br />

the financial crisis in Greece differently<br />

was primarily to protect the Eurozone<br />

at the insistence of the European Commission,<br />

which negotiated on behalf of<br />

the Eurogroup, subjecting IMF staff’s<br />

technical judgments “to political pressure<br />

from an early stage”. As a result of<br />

this, in May 2010, the IMF Executive<br />

Board approved a decision to provide<br />

exceptional access financing to Greece<br />

“without seeking pre-emptive debt restructuring,<br />

even though its sovereign<br />

debt was not deemed sustainable with<br />

a high probability”. The truth is that<br />

the actions in relation to Greece (hidden<br />

from the Executive Board by the<br />

management) were designed to make<br />

French and German banks ‘whole’;<br />

never mind what Greece was forced<br />

to endure. In other words, Greece<br />

was ‘sucker punched’ or, ‘fiscally water-boarded’<br />

to use the more emotive<br />

description of the former Greek Finance<br />

Minister Yanis Varoufakis (now<br />

Professor of Economics at the University<br />

of Athens).<br />

In a robust response to the IEO report,<br />

Varoufakis observed that: “The<br />

establishment press were claiming that<br />

a finance minister of a small, bankrupt<br />

nation which is being water-boarded by<br />

the high and mighty troika functionaries<br />

cannot afford to say, in public or in<br />

private, that his small, bankrupt nation<br />

was being water-boarded”. But, he<br />

said Greece had “tried silence and obedience<br />

from 2010 to 2014. The result?<br />

A loss of 28% of national income and<br />

grapes of wrath that were “…filling<br />

and growing heavy, growing heavy for<br />

the vintage”.<br />

Of course, Greece, though a small<br />

European economy, is significantly<br />

larger than the small economies of the<br />

<strong>Caribbean</strong>. When Finance Ministers<br />

of small <strong>Caribbean</strong> countries complain<br />

about the conditionalites of IMF programmes<br />

that hurt more than help, as<br />

Antigua and Barbuda’s Prime Minister<br />

Gaston Browne did in <strong>August</strong> 2014,<br />

they are roundly criticised for their audacity.<br />

Browne had remarked about<br />

the IMF strait-jacket that his government<br />

inherited when it was voted into<br />

office: “The fiscal problems have not<br />

been resolved, but yet still we are being<br />

asked to pay back US$119 million<br />

over the next four years. We have to<br />

pay back even before the problem is<br />

solved”. And, small economies have<br />

no capacity to stand-up to the IMF and<br />

those who control it. Greece proved<br />

that point and is now struggling as a<br />

result.<br />

Varoufakis feels that Greece is<br />

owed an apology and officials of the<br />

IMF should be fired now that the IEO<br />

has exposed duplicity – even conspircont’d<br />

on pg 9