WEALTH

2c0esX1

2c0esX1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

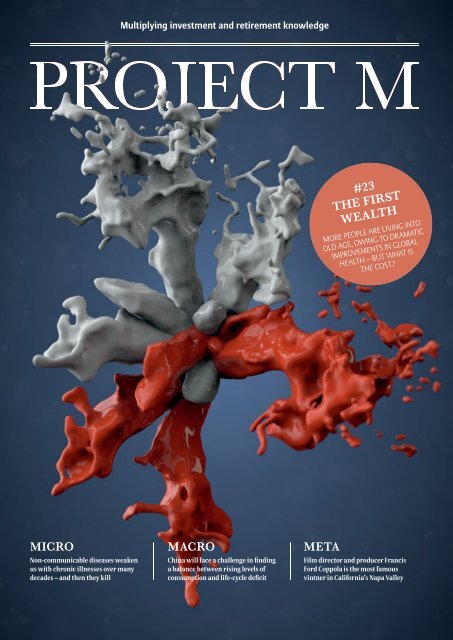

Multiplying investment and retirement knowledge<br />

#23<br />

THE FIRST<br />

<strong>WEALTH</strong><br />

MORE PEOPLE ARE LIVING INTO<br />

OLD AGE, OWING TO DRAMATIC<br />

IMPROVEMENTS IN GLOBAL<br />

HEALTH – BUT WHAT IS<br />

THE COST?<br />

MICRO<br />

Non-communicable diseases weaken<br />

us with chronic illnesses over many<br />

decades – and then they kill<br />

MACRO<br />

China will face a challenge in finding<br />

a balance between rising levels of<br />

consumption and life-cycle deficit<br />

META<br />

Film director and producer Francis<br />

Ford Coppola is the most famous<br />

vintner in California’s Napa Valley

CHART ART<br />

COMMUNICABLE DISEASES<br />

NON-COMMUNICABLE DISEASES<br />

MALE<br />

FEMALE<br />

MALE<br />

FEMALE<br />

2012<br />

2000 2000<br />

MAKING OF THE COVER<br />

PROJECT M cover art is created<br />

using special software that<br />

transforms raw data, images<br />

and figures into aesthetic<br />

clusters, using special rules<br />

and parameters.<br />

For this issue, the program<br />

was fed information showing<br />

causes of death in the<br />

Southeast Asian and Western<br />

Pacific regions, estimates for<br />

2000–2012 and projections<br />

for 2015–2030.<br />

This has been broken down<br />

into communicable and<br />

non-communicable diseases,<br />

as they affect males<br />

and females.<br />

2012<br />

2015<br />

Communicable diseases<br />

(left) are decreasing in<br />

the region, for both males<br />

and females, while<br />

non-communicable diseases<br />

(right), like cardiovascular<br />

diseases, diabetes<br />

and cancers, show<br />

a sharp increase.<br />

2015<br />

2030<br />

2030<br />

FEMALE<br />

2000 2012 2015 2030<br />

COMMUNICABLE 28.03% 18.56% 18.26 12.94%<br />

NON-COMMUNICABLE 62.97% 73.42% 74.17% 79.76%<br />

INJURIES 9.00% 8.02% 7.57% 7.30%<br />

MALE<br />

2000 2012 2015 2030<br />

COMMUNICABLE 25.84% 17.03% 16.41% 10.67%<br />

NON-COMMUNICABLE 62.24% 71.98% 72.12% 78.91%<br />

INJURIES 11.92% 10.99% 11.47% 10.42%<br />

Source: World Health Organization, Global Health Observatory data repository

OPENING BELL<br />

BRIGITTE MIKSA<br />

Head of International Pensions<br />

CHANGING DYNAMICS<br />

“The first wealth is health,” claimed American poet<br />

Ralph Waldo Emerson. It is a sentiment that many in the rapidly<br />

growing economic region of Asia can share<br />

JOIN THE<br />

CONVERSATION<br />

Want more? PROJECT M is<br />

also available online. Visit<br />

projectm-online.com or<br />

follow @ProjectMOnline<br />

on Twitter for more<br />

updates and news<br />

Despite increasing riches, many people are<br />

realizing that wealth is a poor substitute for<br />

good health. Increasingly, as Asia develops, it is<br />

adopting the disease profile of the West.<br />

Sickness and death by communicable diseases,<br />

such as cholera and typhoid, are giving<br />

way to those caused by non-communicable<br />

diseases (NCDs), such as cancers, heart disease<br />

and diabetes.<br />

This is partially a good-news story. The<br />

diseases and pestilences that killed people at<br />

an early age are being subdued, which is<br />

allowing Asians to enjoy the benefits of a ripe<br />

older age. But as societies in the region grow<br />

older, their populations are increasingly<br />

succumbing to the chronic diseases that<br />

cause so much pain, suffering and death in<br />

the developed world.<br />

The shame of it is that much of this is<br />

preventable. Unhealthy diets, lack of physical<br />

exercise, tobacco use and harmful drinking,<br />

all greatly increase the risk of NCDs. The<br />

Western world is still grappling with how to<br />

combat this growing plague, but for Asia the<br />

matter is assuming ever greater urgency. The<br />

region is aging at the fastest rate in history<br />

and, consequently, undergoing the fastest<br />

epidemiological transition as well.<br />

This will place healthcare systems still<br />

grappling with the implementation of social<br />

care under increasing pressure. Urgency,<br />

flexibility and creativity will be required to<br />

tackle NCDs, so that in the next decades<br />

billions of people can benefit through longer,<br />

higher-quality lives.<br />

Insurance will also play an important role<br />

in this. The growing Asian middle class, which<br />

will be the key driver of global consumption<br />

in the future, will see health insurance as an<br />

important purchase, along with consumer<br />

goods and education. But for it to meet the<br />

needs of clients in Asia, insurance will need to<br />

develop new models and new delivery methods,<br />

some of which we explore in this edition.<br />

Yours sincerely,<br />

Brigitte Miksa, September 2016<br />

Allianz • 3

CONTENTS<br />

FOCUS<br />

(Issues in depth)<br />

THE FIRST <strong>WEALTH</strong><br />

06 –11<br />

The first wealth<br />

Asia today is undergoing the most rapid<br />

health transformations seen in history<br />

22–25<br />

Patients without borders<br />

Medical tourism offers savings, but the business<br />

is falling short of expectiations<br />

12 –13<br />

Learning from behavioral economics<br />

Nudging diabetes patients towards<br />

healthy behavior is a complex challenge<br />

26–27<br />

How to choose a diet<br />

Personalized aging can determine which lifestyle<br />

helps ward off critical health conditions<br />

14–16<br />

The greatest gift<br />

How private insurance supports Asia’s<br />

aspiration for universal healthcare<br />

28–30<br />

Asia’s high-stakes fight against smog and heat<br />

Polluted air and heatwaves are killing millions, and<br />

Asia could suffer the most unless it acts fast<br />

17–19<br />

Weighing up the global cost<br />

Non-communicable diseases weaken us<br />

with chronic illnesses over decades<br />

31–33<br />

Hitting the sweet spot<br />

The upward mobility of the Asian middle class<br />

has the power to change the global economy<br />

20–21<br />

Health insurance based on<br />

trust and motorbikes<br />

In Indonesia, digital health coverage is<br />

being delivered by word of mouth<br />

34–35<br />

Something to smile about<br />

Thailand has created a health care system that<br />

delivers a good standard of medical<br />

coverage for its inhabitants, regardless of income<br />

THOUGHT LEADERS IN THIS ISSUE<br />

Curtis Schroeder<br />

on the international<br />

healthcare industry<br />

Page 22<br />

Chris Murray<br />

advises policymakers to invest<br />

more in prevention<br />

Page 42<br />

Alicia García-Herrero<br />

talks about the new economy<br />

that is emerging in China<br />

Page 49<br />

Wang Feng<br />

asks how long the surplus in<br />

the Chinese economy will last<br />

Page 52<br />

4 • Allianz

CONTENTS<br />

MICRO<br />

(Local knowledge)<br />

MACRO<br />

(Global opportunities)<br />

36–39<br />

Plugging the leaks of time<br />

Societies need to lend greater support to<br />

geroscience’s struggle against age-related diseases<br />

49–51<br />

China sheds its skin<br />

A dramatically different economy is emerging<br />

in China, but it still faces old challenges<br />

40–41<br />

One step ahead in the pensions game<br />

Kingfisher, the UK retail giant, has achieved the<br />

impossible, making pensions fun and interesting<br />

52–53<br />

The end of abundance<br />

Current economic troubles may only be<br />

the beginning for China<br />

42– 44<br />

A mixed blessing<br />

With increasing life expectancy, longer periods<br />

of poor health are a costly risk<br />

54–56<br />

Blindsided by history<br />

History never repeats, but it sure can rhyme,<br />

says Barry Eichengreen<br />

45<br />

Q&A<br />

Eduardo P. Banzon on how the rise of NCDs in Asia is<br />

closely intertwined with rapid aging<br />

57–59<br />

How to kick-start investments<br />

in infrastructure<br />

We need to address the big issues<br />

46–48<br />

Hitting the economic reboot button<br />

China is restructuring its industries to move up<br />

the value chain – but pain lies ahead<br />

60–61<br />

The productivity puzzle<br />

Is the current slump an aberration, or<br />

is it permanent?<br />

META<br />

(The outsider’s view)<br />

62<br />

Apocalypse wow: Coppola directs wine<br />

Francis Ford Coppola is the most<br />

famous vintner in the Napa Valley<br />

59<br />

Masthead<br />

Allianz • 5

FOCUS<br />

Issues in depth<br />

6 • Allianz<br />

China<br />

Commodity<br />

City (CCC),<br />

in Yiwu, China,<br />

is known as<br />

the largest smallcommodity<br />

wholesale<br />

market in the world

FOCUS<br />

THE FIRST<br />

<strong>WEALTH</strong><br />

Asia today is undergoing the most rapid<br />

health transformations seen in history<br />

Allianz • 7

FOCUS<br />

It is all happening so quickly. Three generations ago,<br />

Asians tended to die early of infections or parasites<br />

such as malaria or tuberculosis, in childbirth, or – at<br />

high rates – in early childhood. Today, they are increasingly<br />

living to a ripe old age and dying from heart disease,<br />

diabetes, chronic respiratory problems or cancer – all long<br />

considered rich-world problems.<br />

This should come as no surprise, says Eduardo Banzon,<br />

senior health specialist with the Asian Development Bank.<br />

“These diseases are associated with increased prosperity<br />

and longevity. As Asia is becoming richer, the health<br />

patterns of Western countries are being repeated here.”<br />

It is a demographic truism that as countries develop<br />

and become wealthier, they urbanize, and as they urbanize<br />

people live longer and fertility rates fall. When the number<br />

of elderly increases relative to the young, diseases linked<br />

to insufficient nutrition and infection give way to the<br />

degenerative problems of old age.<br />

This is what is happening in Asia. After decades of<br />

economic development and improving healthcare, deaths<br />

from communicable diseases (infectious diseases<br />

transmitted by direct contact) and maternal and prenatal<br />

conditions in the countries to the right of Pakistan on a<br />

Mercator map have fallen, while those caused by noncommunicable<br />

diseases (NCDs) have risen sharply.<br />

This is known as epidemiological transition, and Asia’s<br />

direction is clearly seen in data from the World Health<br />

Organization. Only one-fifth of all deaths in Asia and the<br />

Western Pacific region are now caused by infectious<br />

CAUSES OF DEATH IN ASIA-PACIFIC REGION, PROJECTED TO 2030<br />

As mortality rates from communicable diseases decrease, owing to economic<br />

development and better healthcare, rates for non-communicable diseases increase<br />

Female<br />

Male<br />

100% 100%<br />

90% 90%<br />

% of deaths in Asia-Pacific region<br />

80% 80%<br />

70% 70%<br />

60% 60%<br />

50% 50%<br />

40% 40%<br />

30% 30%<br />

20% 20%<br />

10% 10%<br />

% of deaths in Asia-Pacific region<br />

0% 0%<br />

2000 2012 2015 2030 2000 2012 2015 2030<br />

Communicable Non-communicable Injuries<br />

8 • Allianz<br />

Founded<br />

in 1982,<br />

the vast<br />

market spans<br />

over four million<br />

square meters and<br />

employs over 200,000<br />

people

Commodity City is made<br />

up of three market<br />

clusters: International<br />

Trade Mart,<br />

Huangyuan<br />

Market and<br />

Binwang<br />

Market<br />

FOCUS<br />

diseases, including HIV/AIDS and vaccine-preventable<br />

diseases such as polio, measles and dengue. The largest<br />

share of deaths – over 60% – come from NCDs, which is<br />

expected to increase to 71% by 2030.<br />

CHANGING HEALTH PATTERNS<br />

Today, some 900 million people in the Asia-Pacific region<br />

still have little or no access to healthcare. As governments<br />

continue to roll out immunization, tackle poor sanitation<br />

and issues such as food contamination, and improve<br />

maternal and child health services, deaths caused by<br />

communicable diseases will fall.<br />

For example, in Southeast Asia, an area of 11 countries<br />

containing a quarter of humanity, mortality among<br />

children under the age of five has dropped 75% since 1970,<br />

according to the UN 2015 World Population Prospects.<br />

In Eastern Asia, which includes China, a drop of 90% has<br />

occurred. However, the deaths of another million<br />

children a year in the region could be prevented through<br />

timely jabs in the arms.<br />

Control programs, such as those targeted at<br />

tuberculosis, will also make a difference. The Asia-Pacific<br />

region has the highest tuberculosis burden in the world,<br />

with 5 million cases of the disease recorded every year, and<br />

claiming the lives of 800,000 people annually. The WHO<br />

estimates that annual deaths could drop in Asia by almost<br />

50% by 2030.<br />

But in parallel, cancers are expected to increase<br />

rapidly, cardiovascular diseases to rise by more than 40%,<br />

and diabetes by 60% (see Oktay Atay on pages 12–13).<br />

These diseases are a result not only of population aging but<br />

– as in developed countries, says Eduardo Banzon – also of<br />

lifestyle choices.<br />

FIZZY DRINKS, BURGERS AND PIZZA<br />

In the coming decades, the Asian middle class will be the<br />

key driver of global consumption for goods such as cars,<br />

clothing, housing and technology, as well as services such<br />

as education and health insurance (see article on<br />

consumption patterns on pages 31–33). As people become<br />

wealthier, their dietary options also widen and they<br />

consume excessive salt and more calories from cholesterol<br />

and saturated fats.<br />

In China, the burgeoning middle class are eating more<br />

foods derived from livestock and wheat. Imported foreign<br />

foods are a powerful status symbol, but this comes at a<br />

price. Results of a three-decade survey recently released by<br />

the European Society for Cardiology highlighted the<br />

consequences of a preference for fizzy drinks, burgers and<br />

pizza, combined with a lack of physical activity in the<br />

eastern province of Shandong: in 2014, 17% of boys<br />

Allianz • 9

FOCUS<br />

The main purpose of<br />

Commodity City is its<br />

function as a wholesale<br />

market for business<br />

people from all over the<br />

world<br />

younger than 19 were obese and 9% of girls – up from under<br />

1% for both genders in 1985.<br />

Such shifting consumption patterns increase the risks<br />

of cardiovascular disease and strokes. These – plus cancer<br />

and cerebrovascular and chronic diseases – could be<br />

reduced by changes in diet and decreases in what the WHO<br />

describes as the “tobacco-use epidemic” in the region.<br />

ASTOUNDING SPEED<br />

While Asia is following the disease patterns of the<br />

industrialized West, where it differs is the speed of<br />

transition. As has been highlighted in PROJECT M, Asia is<br />

going through the fastest demographic shift ever recorded.<br />

Currently, South Korea is the world’s fastest-aging country,<br />

but it is heading a closely bunched pack that includes<br />

Bangladesh, China, Singapore, Thailand and Vietnam.<br />

Many Asian countries now have more working-aged<br />

people and fewer dependents than at any point in history.<br />

According to a recent report, Shaping the Future (United<br />

Nations, 2016), 68% of people are of working age and only<br />

32% dependents. This offers a unique make-or-break<br />

opportunity for rapid economic growth, but it also means,<br />

notes Eduardo Banzon, that demographic change that took<br />

up to 150 years in Europe and North America may take only<br />

five decades in many Asia-Pacific countries.<br />

This has important implications for healthcare<br />

systems. As this change takes place, the parallel shift in the<br />

causes of ill health is also occurring. “The problem<br />

emerging now is that countries are not yet rich enough to<br />

manage the aging of the population in the same way that<br />

the Europeans have done,” he adds.<br />

To be clear, the rise of NCDs in Asia is a sign of success<br />

as it is evidence that people are now living long enough to<br />

die of diseases that typically hit in old age. But, even as<br />

Asian countries prepare to meet rising rates of NCDs, many<br />

face unfinished business: the rates of communicable<br />

10 • Allianz

Over 100,000 vendors at<br />

the market represent<br />

factories from all<br />

over China and sell<br />

to both local and<br />

international<br />

customers<br />

More than 400,000<br />

different kinds of<br />

products are for sale,<br />

65% of which are<br />

exported to over 215<br />

countries and regions<br />

diseases remain high. In India, for example, two-fifths of<br />

children under five are malnourished even as obesity rates<br />

are exploding.<br />

This presents health systems with a double burden,<br />

says Irina A. Nikolic, senior health specialist in the World<br />

Bank Group Global Health Practice (pages 17–19): how<br />

to maintain and further the gains made against<br />

communicable diseases while addressing NCDs. Systems<br />

in the West have had generations to adapt to a gradual rise<br />

in NCDs. Those in Asia need to juggle an effective approach<br />

to both in a far shorter time frame.<br />

While some Asian countries, such as Japan and<br />

Singapore, have healthcare systems that are among the<br />

most advanced in the world, others – such as Indonesia –<br />

are only now extending basic health services to all citizens.<br />

Threadbare health systems will struggle with the rise of<br />

NCDs, but others designed to address acute care needs that<br />

come with communicable diseases will also need<br />

fundamental adjustments, as chronic NCDs can require<br />

decades of care and medication.<br />

Such considerations should influence policymakers<br />

in each country in prioritizing resources to deal with<br />

the current and future burden of disease. Where they<br />

can take inspiration from is in recent triumphs in<br />

tackling communicable diseases. If systems can adjust to<br />

tackling NCDs with the same vigor, then in the next<br />

decades billions of people could indeed benefit from<br />

a better quality of life, for longer.<br />

Allianz • 11

The<br />

choice is<br />

yours –<br />

can you<br />

resist?<br />

LEARNING<br />

FROM BEHAVIORAL<br />

ECONOMICS<br />

Nudging diabetes patients towards<br />

healthy behavior is a complex challenge<br />

and a key interest for insurers

FOCUS<br />

By Oktay Atay and Christian Gressner<br />

Fruit or fudge, white rice or brown? And<br />

if yes, how much? What sounds like a<br />

simple choice is actually a complex<br />

decision influenced by nutritional habits<br />

formed in childhood, environmental factors<br />

and associations such as the music playing<br />

over dinner and the size of the plate.<br />

Add to this our body’s tendency to store<br />

surplus calories in fat in case the next<br />

meal doesn’t materialize, and urbanized<br />

lifestyles with little physical exercise, and<br />

the foundations for increasing obesity<br />

figures are laid. Obesity often leads to<br />

diabetes, which is growing at an<br />

alarming rate, even when numbers are<br />

corrected for aging (as diabetes is<br />

more prevalent among older citizens).<br />

Roughly 415 million adults<br />

worldwide suffer from diabetes,<br />

especially type 2, according to the<br />

International Diabetes Federation<br />

(IDF). The IDF expects this to rise to<br />

642 million by 2040. Diabetes has<br />

caused roughly five million deaths<br />

and an estimated cost of $673–$1,197<br />

billion in global healthcare spending<br />

in 2015, the Federation reports. The<br />

majority of patients live in low- and<br />

middle-income countries.<br />

The issue is a particular challenge to<br />

Asian nations, where more than 60% of the<br />

people with diabetes live, almost half of<br />

them in China and India. Type 2 diabetes is<br />

estimated to rise by more than 150% between<br />

2000 and 2035 in South Asia, Paul Zimmet<br />

(Monash University) and colleagues write in<br />

Diabetes Care. This poses “huge social and<br />

economic problems to most nations in [the<br />

Western Pacific Region] and could impede<br />

national and, indeed, global development,”<br />

they report.<br />

GROWING IN THE WEST<br />

Diabetes is rapidly becoming a key challenge<br />

in Turkey as well. By 2035, the nation at the<br />

nexus between Asia and Europe is set to arrive<br />

among the top ten diabetes countries,<br />

according to the IDF.<br />

But the good news is that, as much as<br />

diabetes is caused by behavior, it can also be<br />

avoided by it – despite the fact that genes<br />

play their role, too. Fruit, vegetables, nuts<br />

and whole-grain products have been shown<br />

to reduce the chances of contracting<br />

diabetes by 30–50%. Sugary drinks, white<br />

rice and white bread, on the other hand, play<br />

into the hands of what Germans call<br />

Zuckerkrankheit (sugar disease).<br />

Healthier eating habits could significantly<br />

lower societies’ health care costs, yet changing<br />

behavior is easier said than done, as behavioral<br />

economists have found out (see PROJECT M<br />

#10). This is no reason to sit idle, however,<br />

particularly for insurers.<br />

With health care costs on the rise (see page<br />

42) and diabetes patients’ claims exceeding<br />

premiums by as much as factor four, the<br />

insurance industry risks pricing itself out of<br />

OKTAY ATAY<br />

A medical doctor by<br />

training, Oktay Atay is<br />

head of health claims,<br />

health provision and<br />

provider network<br />

management with<br />

Allianz Turkey<br />

CHRISTIAN<br />

GRESSNER<br />

is an editor with<br />

PROJECT M<br />

the market if it passes health’s financial burden on to clients. Smart<br />

solutions combining behavioral incentives and disease prevention with<br />

a more rigorous cost control are needed.<br />

Allianz Turkey is therefore launching a pilot project early next year. In<br />

cooperation with attending physicians, it combines apps to monitor<br />

blood sugar levels and other relevant parameters with personal coaching<br />

to help 500 diabetes patients improve their disease management and<br />

lifestyles. Once the pilot has run successfully in Turkey, it can be offered<br />

in countries around the globe – with only minor adjustments.<br />

SENSIBLE COST CONTAINMENT<br />

Ideally, approaches like these align clients’ desire to remain healthy<br />

with insurers’ need to be profitable, by reducing complications as well<br />

as costs by roughly one fifth. Ultimately, insurers need to transform<br />

themselves from claims managers to trusted partners in maintaining<br />

clients' health at an affordable price as technological innovation such as<br />

genetics (see page 26) will continue to increase the cost of health care.<br />

As insurers, we are well advised to understand and price such<br />

innovation sensibly. If this is not done, it can become a cost risk to both<br />

the insurer and the insured.<br />

Sensible cost containment does not end there. Allianz Turkey is also<br />

seeking to steer customers to high-quality, yet low-cost hospitals for<br />

follow-up examinations and laboratory testing, by covering the full<br />

amount instead of just 80% at higher cost institutions. The choice,<br />

however, remains with the patient.<br />

Frankly, these are all straightforward, commonsensical steps. It<br />

is nothing more and nothing less than putting clients and patients<br />

at the center of health insurance.<br />

Allianz • 13

FOCUS<br />

THE<br />

GREATEST<br />

GIFT<br />

Volker Stüven explains why<br />

private insurance will play an<br />

important role in better<br />

health outcomes for all Asians<br />

By Volker Stüven<br />

After an absence of 10 years, polio again<br />

hit Indonesia in 2005. It was the<br />

biggest epidemic the country had ever<br />

suffered, leaving 225 children paralyzed.<br />

When traced, the outbreak source was a village<br />

in West Java where the first infected children<br />

lived within 200 meters of a government<br />

medical clinic.<br />

Although their homes were close to the<br />

center, the children had not been vaccinated.<br />

This was not surprising, as coverage rates were<br />

low. Indeed, 125 million people – more than<br />

half the population – then lacked any type of<br />

public or private health cover. Only a rapid<br />

three-month inoculation campaign of 24<br />

million children stopped the epidemic.<br />

Despite such incidents, health throughout<br />

Asia, regardless of income and location,<br />

is improving. Most governments now recognize<br />

access to healthcare as a right and are<br />

investing in it. Some, such as Thailand, began<br />

implementing universal health systems in the<br />

early 1970s; others, like the Philippines (2004)<br />

and Vietnam (2005), are more recent.<br />

14 • Allianz

Most governments<br />

in Asia are now<br />

investing in universal<br />

healthcare systems<br />

FOCUS

FOCUS<br />

For its part, Indonesia launched the world’s<br />

largest single-payer healthcare insurance<br />

program in 2014. The aim of the program is<br />

to provide healthcare to all 247 million citizens<br />

by 2019 at an annual cost of $15 billion – about<br />

$60 per head.<br />

THE GOVERNMENT DILEMMA<br />

What is driving improvements is the economic<br />

development of low- to middle-income countries.<br />

The World Bank estimates that healthcare<br />

expenditure rose in East Asia (the countries<br />

stretching from China to Papua New Guinea)<br />

from 3.3 to 5.3% of GDP between 1995 and 2014.<br />

Although still only half the expenditure of the<br />

European Union and less than a third of North<br />

America, this will continue to rise.<br />

The reason is the further expansion of<br />

social security programs, as well as individual<br />

spending. According to the OECD, as Asia<br />

becomes more prosperous, the middle class<br />

will balloon from 525 million in 2009 to 3.2<br />

billion by 2030. As the middle class becomes<br />

more affluent, it will want better healthcare,<br />

particularly to address the multiple diseases<br />

that accompany rising life expectancies. It is<br />

then, when chronic, old-age-related conditions<br />

hit families and friends, that people realize the<br />

greatest gift we all have is good health.<br />

This poses a problem: while Western<br />

countries have had up to 100 years to create<br />

broad healthcare safety nets for citizens, Asia<br />

has only a few short decades to use its<br />

demographic bounty before it becomes old (see<br />

PROJECT M #21, “A title no country wants”).<br />

Governments still in the process to deliver<br />

basic medical services may not be able to<br />

afford to devote limited public funds to the<br />

construction of costly healthcare services<br />

along Western lines. As the Indonesian polio<br />

outbreak highlighted, even when healthcare is<br />

within reach, people may not access it. Reasons<br />

range from overcrowding to insufficient<br />

resources; some public schemes do not cover<br />

informal workers. Limited coverage and copayments<br />

mean people cannot always afford<br />

necessary medical services.<br />

The scheme in the Philippines, for example,<br />

does not cover drugs: patients must choose<br />

between paying out-of-pocket expenses and<br />

going without. Not infrequently, such costs<br />

can have severe consequences. People use<br />

savings, sell assets such as their homes, or<br />

borrow to meet medical bills. If the illness hits<br />

the head of the family, it usually means loss of<br />

income. All of this can push families into longterm<br />

financial distress. Limited government<br />

funds are better spent providing<br />

comprehensive basic universal healthcare<br />

services for all citizens. To address out-ofpocket<br />

expenses, government schemes have to<br />

balance the need for indemnity covers against<br />

the available funds by focusing on delivering<br />

core medical requirements at responsible<br />

quality standards. The target should always be<br />

to improve the health status of the population<br />

and prevent people from falling into poverty<br />

through illness.<br />

VOLKER STÜVEN<br />

is the regional head of<br />

Health Business at Allianz<br />

Asia Pacific (AZAP) based<br />

in Singapore. In his<br />

previous positions, he<br />

was general manager of<br />

Allianz Life & Pension in<br />

Turkey (2012-2014).<br />

Volker studied economics<br />

and holds a PhD from the<br />

Kiel Institute of World<br />

Economics<br />

GREATER AFFORDABILITY<br />

The healthcare demands of citizens over and above a basic layer of<br />

healthcare can be met through private insurance. Up to now, private<br />

health insurance has played a minor role in most Asian markets, with<br />

governments providing varying degrees of public healthcare.<br />

Yet experience in countries around the world shows, that as the<br />

middle class increases its buying power, people are prepared to use the<br />

risk-pooling mechanism that insurance provides to protect themselves<br />

and their families against potentially high healthcare costs, and secure<br />

broader and better coverage. This process is already taking place, for<br />

example, in Malaysia and Thailand. Both countries have developed a<br />

well-regarded healthcare infrastructure supported by public financing.<br />

Both countries are also seeing continual strong growth in private health<br />

insurance and an expanding private healthcare sector.<br />

This trend will see private insurance uptake continue to grow in<br />

Asia. Growing numbers of people will seek higher quality healthcare<br />

with ready access in preference to facing long waiting lists at public<br />

facilities. They will want insurance solutions and services to protect<br />

themselves and support their well-being throughout their longer lives.<br />

And they will seek to insure themselves against out-of-pocket expenses<br />

that can arise from special critical illnesses where treatments can<br />

devastate even prosperous, middle-class families.<br />

MULTI-PILLAR HEALTH COVERAGE<br />

The development of private health insurance is complementary with the<br />

aspiration for universal healthcare. A multi-pillar approach with a<br />

voluntary private health insurance component can provide strong<br />

support to the development of a public layer that is well-regulated and<br />

adapted to local needs. Asian governments are realizing this and are<br />

encouraging greater use of private health insurance through market<br />

liberalization. As populations grow wealthier, and become more aware<br />

of the risk pooling benefits of insurance, uptake will increase even in the<br />

mass-affluent segment.<br />

16 • Allianz

FOCUS<br />

WEIGHING UP THE<br />

GLOBAL COST<br />

“That which does not kill us, makes us stronger,” is a<br />

platitude often used in times of stress, but it’s simply<br />

untrue when it comes to non-communicable diseases.<br />

They weaken us with chronic and sometimes concurrent<br />

illnesses over many decades, then they kill<br />

Mortality rates relating to non-communicable<br />

diseases (NCDs) are rising worldwide. So are<br />

morbidity rates – that is, the incidence of<br />

disease. Most of this relates to four disease groups:<br />

cardiovascular and chronic respiratory diseases, cancer<br />

and diabetes. These diseases cause disability, suffering and<br />

loss of opportunity for many millions worldwide.<br />

Once seen as diseases of the rich world, a result of diet,<br />

sedentary lives and aging societies, today NCDs are on<br />

the rise in developing and middle-income countries –<br />

significantly so in Asia. When the region was widely<br />

impoverished, people were too busy eking out a living to<br />

become obese; cigarettes and alcohol were expensive and<br />

lifespans short. Rising living standards, along with the<br />

broader availability of medication and vaccines, mean that<br />

communicable diseases are being reduced. Yet, while far<br />

fewer Asians are dying of infectious diseases, growing<br />

numbers are living long enough to develop chronic NCDs.<br />

By 2008, NCDs had become the world’s most common<br />

cause of death, says Irina A. Nikolic, senior health specialist<br />

in the World Bank Group Global Health Practice. Lead<br />

author of Why NCDs Matter (2011), Nikolic says they<br />

accounted for 36 million deaths, or 63% of the global total,<br />

with 78% occurring in developing and middle-income<br />

countries. Some 16 million of these deaths were premature,<br />

with the vast majority again occurring in developing and<br />

middle-income countries.<br />

Since then, the trends have continued. While some highincome<br />

countries have reduced death rates related to<br />

cardiovascular disease, NCDs are becoming an ever larger<br />

portion of the global burden of disease. “By 2030, they could<br />

account for three-quarters of the disease burden in middleincome<br />

countries, up from two-thirds in 2011 and<br />

approaching the level of high-income countries.”<br />

In developing countries, NCDs will increase more<br />

rapidly, approaching the levels of middle-income countries<br />

today. Meanwhile, some countries will still be contending<br />

with significant rates of the communicable diseases that<br />

ravage the poor, such as malaria, typhoid and diarrhea.<br />

“These countries will be facing a double burden of<br />

disease,” comments Nikolic. “Tuberculosis and water-borne<br />

infections are still prominent in Southeast Asia, for<br />

example, even as the level of NCDs is growing rapidly.”<br />

ECONOMIC BURDEN OF DISEASE<br />

Further, compared to higher-income counterparts, many<br />

developing countries face high NCD levels at earlier stages<br />

of economic development. People are contracting them at a<br />

younger age, likely to suffer ill effects for longer and to die<br />

more prematurely from them. This has consequences both<br />

for individuals and entire societies.<br />

The World Economic Forum estimates that over the<br />

next 20 years, NCDs will cost more than $46 trillion,<br />

representing 48% of global GDP in 2010. The costs<br />

Allianz • 17

NCDs used to be<br />

thought of as<br />

diseases of the<br />

rich world. Now<br />

they’re on the<br />

rise in developing<br />

and middleincome<br />

countries

FOCUS<br />

include far more than the direct medical ones. They hit<br />

economies through reduced labor productivity and<br />

absenteeism, which affects company competitiveness and<br />

national growth. They strain health systems and, if the<br />

breadwinner is stricken, this can result in lost earnings or<br />

even jobs, pushing families into poverty. Family members<br />

may be forced to give up employment or forgo education to<br />

take care of the ill person.<br />

For example, there are more than nine million<br />

Indonesian adults suffering from diabetes. According to a<br />

report by McKinsey, this costs the Indonesian health system<br />

$1.6 billion a year – 40% of government spending on NCDs<br />

overall. If no effective action is taken by 2020, there could be<br />

a total of 1.2 million new cases and an overall $66 billion<br />

GDP loss attributable to diabetes alone.<br />

NO MEDIA SPOTLIGHT<br />

Such figures make NCDs one of our greatest global heath<br />

challenges, but they rarely generate big headlines.<br />

Pandemic outbreaks, new infections like the Zika virus or<br />

the growing resistance to antimicrobial drugs, grab the<br />

media spotlight. While heart disease may not rouse the<br />

same reporting passion, says Nikolic, what is lost by lack of<br />

coverage is the magnitude of the challenge.<br />

“We argued, and it is the case still, that decision-makers<br />

need to put more priority on addressing NCDs, particularly<br />

in developing countries where their rapid increase will<br />

pose dramatic challenges to economies, health systems,<br />

families and individuals.”<br />

Many health systems in developing countries are<br />

woefully ill-prepared for the challenge, as they are<br />

designed for acute rather than chronic problems. As<br />

noted, diabetes is rapidly increasing in Indonesia, yet<br />

only half of sufferers are diagnosed as equipment is lacking<br />

in many public health centers. Jim Yong Kim, president<br />

of the World Bank, has noted that analysis of universal<br />

health coverage systems in 24 countries shows coverage<br />

and implementation are weakest for NCDs.<br />

Nikolic argues that mounting evidence indicates<br />

how millions of deaths can be averted and economic losses<br />

reduced by billions of dollars. “There are concrete measures<br />

that can reduce the costs and suffering linked to NCDs,” she<br />

says, “and as NCDs have often received less focus, solutions<br />

can be effective and inexpensive.”<br />

WEIGHTY PROBLEM<br />

A 2012 World Health Organization report estimated the<br />

cost for population-based measures to reduce tobacco and<br />

harmful alcohol use, as well as unhealthy diet and physical<br />

inactivity, at $2 billion per year for all developing and<br />

middle-income countries – less than $0.40 per person.<br />

Yet while the solutions may be effective and<br />

inexpensive, the difficulty is that implementation runs<br />

into a complex overlap between food-industry practices,<br />

political priorities and established mind-sets and<br />

behaviors, says Nikolic. “Even rich countries are finding<br />

this hard to change.”<br />

Obesity, a key modifiable risk factor in NCDs, is<br />

becoming a weighty burden worldwide. Almost a third of<br />

the world’s population is overweight or obese. This has an<br />

impact on global GDP of $2.1 trillion, rivalling smoking<br />

and armed violence, war and terrorism, according<br />

to McKinsey.<br />

Public Health England has estimated that if obesity<br />

were reduced to 1993 levels, the National Health Service<br />

would save £1.2 billion a year ($1.6 trillion) by 2034, not<br />

including the large cost of treating associated diseases. Yet<br />

despite all the interventions and analysis, waistlines will<br />

continue to expand, with 36% of men and 33% of women<br />

predicted to be obese in 2030 (up from one in five today).<br />

A COMPREHENSIVE APPROACH<br />

If a wealthy nation like the United Kingdom, with a wellfunded<br />

health care system, has difficulties tackling NCDs,<br />

what chance do cash-strapped developing nations have?<br />

“The mistake is to see it predominantly as a health challenge,”<br />

responds Nikolic. “What is required is a comprehensive<br />

approach that makes NCDs everyone’s business.”<br />

The greatest impact, she explains, can be achieved with<br />

healthy public policies that promote prevention and control<br />

throughout the life cycle, while strategically adapting<br />

health systems and societies. In developing countries,<br />

existing communicable disease management channels<br />

and community worker schemes should be used to<br />

complement expensive hospital-based care. Linked to this<br />

should be a comprehensive approach that includes<br />

education and agriculture, as well as other sectors that<br />

target NCD risk factors and promote a healthy lifestyle.<br />

This will not be easy, concludes Nikolic. But if it is not<br />

attempted, NCDs could spiral out of control, significantly<br />

increase out-of-pocket costs for patients and undermine<br />

the sustainability of public health systems. “However, if we<br />

get it right, reducing diseases and deaths from noncommunicable<br />

diseases will be one of best value<br />

investments we can make to increase the health and wellbeing<br />

of people.”<br />

Allianz • 19

FOCUS<br />

HEALTH INSURANCE BASED<br />

ON TRUST AND MOTORBIKES<br />

In Indonesia, digital health coverage is being<br />

delivered by word of mouth – and on the back of a bike<br />

When faced with the nightmare snarl that is Jakarta traffic,<br />

where a two-kilometer trip becomes a 40-minute endurance<br />

test, many people reluctantly hail an ojek. These motorcycle<br />

taxis daringly wend through the gridlock, which by some measure<br />

is among the worst worldwide, to quickly deliver time-pressed<br />

passengers to their destination.<br />

The problem is that ojek drivers can be a scruffy bunch mounted on<br />

clapped-out rides that often lack both insurance and helmets to cover<br />

passengers for the perils involved. That the drivers fiercely haggle over<br />

the charge only adds to the reluctance many have about using them.<br />

Enter GO-JEK, a startup that revolutionized the industry when it<br />

burst onto the market in force in 2015. A few taps on a smartphone<br />

summons a young, green-uniformed rider to your location. Journey<br />

charges are pre-calculated, payment is made electronically and a<br />

helmet and disposable respiratory mask are provided. Both driver and<br />

passenger are insured for accidents occurring during the ride.<br />

Depending on the distance, costs can be higher than an ojek, but the<br />

efficiency, simplicity and safety has won the public over and made GO-<br />

JEK the fastest-growing and most visible startup in Indonesia. The<br />

company, which partners with more than<br />

200,000 drivers in 14 cities, including the<br />

tourist destination of Bali, now offers services<br />

such as couriers, restaurant food delivery,<br />

online tickets and grocery shopping. You can<br />

even order masseurs, hairdressers and<br />

cleaners straight to your door.<br />

TRUST IS THE PRODUCT<br />

Nadiem Makarim, CEO and founder, explains<br />

how it works. “People in Jakarta spend up to<br />

four hours a day in traffic,” he says. “GO-JEK<br />

doesn’t solve congestion, but it does provide a<br />

compelling alternative. People can use the<br />

efficiency of GO-JEK to get to destinations, or<br />

better spend their time by having services<br />

delivered directly to them.”<br />

Makarim, a graduate of Harvard Business<br />

School, says that the main selling point is<br />

Indonesia’s hottest<br />

start-up – logistics<br />

is the key to everything<br />

20 • Allianz

FOCUS<br />

» IF WE OFFER A PRODUCT<br />

THAT THE DRIVERS ARE CONFIDENT<br />

IN BUYING, THEN WE BECOME<br />

PART OF GO-JEK’S TRUST ECOSYSTEM «<br />

TODD SWIHART<br />

trust. The digital service connects the most<br />

reliable drivers directly to customers, and<br />

branding clearly identifies them. Drivers all<br />

wear a similar uniform of green jackets and<br />

helmets, while a robust android headset<br />

connects them to the GO-JEK platform. “We<br />

are actually seeing both demand and supply<br />

growing at the same time,” Makarim notes.<br />

“A lot of GO-JEK transportation users – we<br />

think the majority – are women who would<br />

never previously have thought of using an ojek<br />

because of the trust issue.”<br />

The professionalization of the industry has<br />

appealed to many drivers who have enlisted at<br />

mass recruiting sessions. The attraction is the<br />

efficient use of time. Instead of spending 75% of<br />

their 12-14 hour working day waiting on street<br />

corners, the service allows them to identify<br />

where customers are and go directly to them.<br />

Drivers have greater flexibility concerning the<br />

hours they work, and the additional highvalue-add<br />

delivery services further help<br />

increase business.<br />

“I work the graveyard shift in a hotel in<br />

Jakarta, and during the day, I work as a GO-JEK<br />

Driver. My GO-JEK income is higher than my<br />

job at the hotel,” says Nizar Amin, who started<br />

with GO-JEK in mid-2015.<br />

WITH BENEFITS<br />

Another advantage is the benefits that go with<br />

the job. With the June launch of an innovative<br />

health insurance solution, drivers and their<br />

families can now opt to take advantage of a<br />

flat-rate health protection. “The insurance<br />

product is designed and tailored to the needs<br />

of GO-JEK drivers. It offers inpatient and<br />

outpatient benefits,” says Joachim Wessling,<br />

president director of Allianz Life Indonesia.<br />

The inpatient benefits cover the cost of<br />

hospital rooms, consultation visits by general<br />

practitioners, and specialists and surgeries.<br />

Getting the green light:<br />

GO-JEK is diversifying into<br />

multiple industries<br />

Outpatient benefits include the doctor’s consultation, prescribed<br />

medicine, diagnostic tests, physiotherapy and basic immunization.<br />

“We have covered GO-JEK employees since 2015,” explains Todd<br />

Swihart, managing director of Allianz Health & Corporate Solutions in<br />

Indonesia. “The company is socially minded, so once they were<br />

established, they asked if we could provide a cost-effective health<br />

insurance for the drivers and their families as well.”<br />

Swihart explains that, unlike in western nations where pension<br />

benefits often distinguish preferred employers, it is health benefits that<br />

attract employees in Indonesia. Compared with neighboring Malaysia<br />

and Thailand, Indonesia spends relatively little on health.<br />

It has, for example, one of the lowest hospital beds-to-population<br />

ratios in the region (0.9 to 1,000 people), though the country made a step<br />

forward when it launched Badan Penyelenggara Jaminan Sosial (BPJS), a<br />

national health scheme, in 2015. Under BPJS, by 2019, all citizens will<br />

have access to a wide range of public health services. BPJS aims to cover<br />

treatment for flu and dental treatment as well as open-heart surgery,<br />

dialysis and chemotherapy.<br />

While BPJS offers comprehensive benefits, many still prefer private<br />

health insurance. Allianz has established a network of doctors and<br />

hospitals to keep premiums down and ensure clients are quickly seen.<br />

The daily premiums are paid automatically from the driver’s GO-JEK<br />

accounts; backend registrations and identification card production are<br />

triggered automatically by the app.<br />

While the future of insurance in a country like Indonesia is<br />

undoubtedly digital, the question for companies is how to reach the<br />

mass audience without a massive marketing spend. The answer,<br />

Swihart notes, is to partner with GO-JEK. “If we offer a product that the<br />

drivers are confident in buying, then we become part of GO-JEK’s trust<br />

and digital ecosystem. Word will spread and we could eventually reach<br />

out to Indonesia’s huge and growing middle-class.”<br />

Allianz • 21

22 • Allianz

FOCUS<br />

PATIENTS<br />

WITHOUT<br />

BORDERS<br />

Medical tourism offers tremendous savings<br />

to insurers and patients, but the business is<br />

falling well short of great expectations<br />

New nose? Heart bypass?<br />

Relax by the pool?<br />

Medical tourism is on<br />

the rise in Asia<br />

The Australian woman in the lobby bar of Bangkok’s<br />

five-star Hotel Muse is upfront about her reasons<br />

for visiting. “We’re here for the shopping,” she<br />

says, over her second happy hour cocktail. “For shopping<br />

and dental work.”<br />

Her 28-year-old daughter has a condition that is turning<br />

her teeth translucent and brittle. Corrective work in<br />

Brisbane would cost AUD10,000 ($7,200). That amount, she<br />

figured, could be better spent on two business class tickets<br />

to Bangkok and five days’ accommodation, plus dental<br />

treatment in a nearby clinic that is on a par with any back<br />

home. “We’ll still have change left over,” she says with a<br />

laugh, “and that may include the shopping.”<br />

This is international medical tourism in a snapshot.<br />

The business is driven by a combination of rising healthcare<br />

costs in developed countries, cheap flights and crossborder<br />

medical training. Over the past two decades,<br />

Thailand has become a thriving destination for procedures<br />

ranging from tummy tucks to heart bypasses and gender<br />

reassignments, with foreign visitors attracted by the high<br />

standard of the private healthcare industry, easy visa entry<br />

and affordable prices.<br />

Curtis Schroeder, former CEO of Bumrungrad<br />

International, the largest private hospital in Southeast<br />

Asia, believes the industry is entering a new phase. “The<br />

market has matured, the carnival barkers are gone and the<br />

business has entered round two,” he says in the office<br />

Allianz • 23

FOCUS<br />

of InterMedika, his international healthcare consultancy in<br />

downtown Bangkok.<br />

With the Internet becoming ever more prevalent and<br />

insurance premiums and co-payments increasing,<br />

Schroeder expects that patients will want more control<br />

over healthcare providers. “We may soon see something<br />

like TripAdvisor for healthcare,” he reflects. “Patients are<br />

picking up more of the bill, so inexpensive, quality, foreign<br />

alternatives are likely to become more important to them.”<br />

PLASTIC SURGERY WITH A HOLIDAY<br />

Bumrungrad is the poster child of medical tourism. It looks<br />

like a five-star hotel and has services to match. There are 21<br />

VIP suites, a Japanese restaurant, a McDonald’s, and a<br />

queue of people buying snacks from Starbucks. The hospital<br />

facilities include 19 operating rooms equipped for general<br />

surgery and surgical specialties, and 1,200 surgeons and<br />

dentists, of whom more than 200 are US board certified.<br />

Cost and quality are the key selling points for<br />

Bumrungrad, and for rivals such as Samitivej, Phyathai<br />

International and Bangkok Hospital. At Bumrungrad, a<br />

package for coronary artery bypass graft surgery costs<br />

$19,000. In the United States, an uninsured patient will be<br />

set back $80,000 at least for the same.<br />

Yet the success of Bumrungrad was accidental.<br />

Schroeder and his team re-opened the 12-storey hospital in<br />

late 1996, with 580 beds and a $60 million debt on their<br />

books. Then the 1997 Asian financial crisis hit. The Thai<br />

baht plummeted, “doubling our debt and halving our<br />

potential market overnight,” recalls Schroeder.<br />

During the crisis, squeezed middle-class Thais<br />

switched to the cheaper state-funded healthcare system.<br />

Underused private facilities, like Bumrungrad, went into<br />

survival mode and offered surplus capacity to foreigners<br />

from the region seeking medical and surgical treatments<br />

as a cost-effective alternative to providers at home.<br />

Consequently, Schroeder bristles slightly at the notion<br />

of “medical tourism,” noting the term can be misleading.<br />

“People who come for serious medical care don’t ask how<br />

close we are to the beaches. They come for quality<br />

procedures conducted at a fair price in an environment<br />

with good infrastructure.”<br />

CREATIVE ACCOUNTING<br />

The Thai industry really boomed after 9/11. Tightening visa<br />

conditions in Europe and the United States meant people<br />

from Arab countries preferred to take the seven-hour flight<br />

east to Bangkok. Today, Bumrungrad has an Islamic prayer<br />

room, a certified halal kitchen and more than 150<br />

interpreters, many of them Arabic for the benefit of Gulf<br />

Muslim patients, now one of its most important markets.<br />

Altogether, Bumrungrad serves 1.1 million patients a year,<br />

including 520,000 who visit from other nations. In 2013, it<br />

generated $477 million in revenue. However, reliable data<br />

on global medical tourism is difficult to come by and the<br />

numbers are often overblown.<br />

In 2008, Deloitte projected that annual patient outflows<br />

from the US would be 10 million by 2012 and worth $21<br />

billion a year to developing countries. It was a brave<br />

prediction, considering most Americans do not even own<br />

valid passports. The figures were revised down one year<br />

later. Only 1.6 million Americans would be seeking<br />

healthcare outside the US in 2012.<br />

“Such projections invariably overestimate demand,”<br />

says Johanna Hanefeld, senior lecturer in health policy and<br />

systems at the London School of Hygiene and Tropical<br />

Medicine. In 2010, only 167,000 medical tourists attended<br />

Thai hospitals, according to research she conducted with<br />

Thinakorn Noree and Richard Smith – far less than Deloitte<br />

and the Thai government expected. The Thai Ministry of<br />

Commerce estimated, for example, that in 2006, 1.2 million<br />

medical tourists accessed health services in Thailand.<br />

Malaysia is often touted as another medical tourism<br />

success story. The country welcomed more than 850,000<br />

global medical tourists and took in $230 million of revenue<br />

last year, according to the Malaysian Ministry of Health.<br />

Hanefeld has good reason to treat such predictions with a<br />

skeptical eye.<br />

The issue is how numbers are counted. For example,<br />

almost 30 million tourists visited Thailand in 2015. The<br />

group coming primarily for medical treatment was only a<br />

fraction. But Thailand counts every interaction with the<br />

healthcare system, from the consultation to the x-ray or CT<br />

scan, as well as the operation, as separate interactions. By<br />

this count, one person can have up to 20 treatments per<br />

visit. Such “creative accountancy” greatly inflates medical<br />

tourist numbers.<br />

Hanefeld believes that “medical tourism remains on a<br />

much smaller scale in Thailand than is promoted, so its<br />

effect on the domestic health system is limited.” She also<br />

believes it is unlikely that a global medical tourism market<br />

in Thailand, or indeed elsewhere, will develop soon along<br />

the line the boosters claim. “Most people want to be treated<br />

locally or at least in their home region when they’re sick,”<br />

she explains. There are also serious issues such as differing<br />

national judicial systems that mean there is little chance<br />

for compensation should malpractice suits arise, unless<br />

patients are prepared for a legal battle in the host country.<br />

Continuity of care can also be missing when the patient<br />

finally returns home.<br />

Based on the success of Bumrungrad and its rivals,<br />

Schroeder believes the value proposition for medical<br />

24 • Allianz

FOCUS<br />

tourism exists, but has not been developed fully. He points<br />

out that in the late 1990s, 9% of Bumrungrad revenues<br />

came from overseas: this is now at 56%. “Medical tourism is<br />

real, so the opportunity is there,” he says. And while he<br />

admits that national figures are possibly inflated, he<br />

asserts that, “until 2010, when I left the hospital, our<br />

international numbers were counted as either one<br />

outpatient visit or one admission.”<br />

NOT TO BE DETERRED<br />

Malaysia, India and South Korea have long since followed<br />

Thailand’s lead, while Cambodia is billing itself as the lowcost,<br />

high-quality dental care destination. According to the<br />

World Health Organization, there are 50 countries<br />

throughout the world involved in medical tourism, with<br />

India, Singapore and Thailand in the lead and comprising<br />

90% of the fragmented Asian medical tourism market.<br />

Steve Conway, the Singapore-based regional general<br />

manager with Allianz Worldwide Care, a provider of<br />

international health insurance, says that insurance<br />

companies could drive this. “Insurance premiums<br />

currently increase from 6–15% per year. Opportunities<br />

in medical tourism are one way for insurers to keep costs<br />

at bay.”<br />

One tale he cites to illustrate this is of a Shanghai client<br />

who needed anterior cruciate ligament treatment. The<br />

local hospital wanted $58,000, but the reasonable cost at<br />

location assessed it at $40,000, which left the client facing<br />

out-of-pocket costs of $18,000. Alternatively, a Bangkok<br />

center offered two business-class tickets, surgery and<br />

ten days’ accommodation all for $18,000, which the<br />

insurance company would completely cover. “You can<br />

imagine which way he went,” says Conway. “It was a winwin<br />

for all involved.”<br />

Conway notes that many of the medical tourists in<br />

Southeast Asia come from developing countries within the<br />

Asian region, where economies have created wealth but<br />

high-quality health infrastructure is lagging. Indonesians<br />

are said to spend $11.5 billion a year on healthcare abroad,<br />

much of it in Malaysia, which adheres to halal restrictions<br />

such as avoiding pork derivatives in medicine. Meanwhile,<br />

the Laos, Cambodians and Vietnamese prefer Thailand,<br />

while the Chinese go to Singapore or Thailand for care that<br />

is not readily available at home.<br />

Cultural similarity is an important consideration, says<br />

Conway, but the big headline is a flight to quality, as people<br />

seek access to medication, care and cutting-edge<br />

technology. “While tourists from the West may be after<br />

cosmetic surgery,” he comments, “for patients from China,<br />

medical tourism can be a high-quality solution – and this<br />

is unlikely to change any time soon.”<br />

TURKISH TRANSFERS<br />

Far west of Thailand, Turkey is seen as an up-andcoming<br />

country for medical tourism. The Health<br />

Ministry is hoping to increase visitor numbers to<br />

2 million by 2023. Many of the patients come from<br />

lraq and Libya, but expatriates returning from<br />

Germany also make a sizeable section of the<br />

business.<br />

Allianz Turkey is seeking to improve cross-country<br />

medical insurance. “Many Turkish guest workers in<br />

Germany spend their holidays back home. Merging<br />

our contracts with those of Allianz Germany could<br />

reduce the cost both for them and us when tourists<br />

seek treatment in Turkey,” says Oktay Atay, head of<br />

health claims, health provision and provider network<br />

management with Allianz Turkey.<br />

MEDICAL INSURANCE WHILE IN THAILAND<br />

Allianz Global Assistance (AGA) is seeking regulatory<br />

approval to insure non-Thai patients against<br />

unexpected complications such as hematoma, and<br />

internal and external infections while being treated<br />

in Thailand. Estimating 900,000 medical tourists<br />

annually, AGA Thailand CEO Steve Watkins hopes to<br />

win close to 500,000 of them as clients over the<br />

mid- to long-term.<br />

Allianz • 25

One man’s meat ...<br />

Gene variants<br />

determine how<br />

your body<br />

responds to<br />

different types<br />

of food<br />

HOW TO CHOOSE A DIET<br />

Personalized aging can determine which<br />

lifestyle helps ward off critical health conditions<br />

Finding out whether one is susceptible to cancer,<br />

Alzheimer’s or diabetes is just a bit of spit and less<br />

than $200 away. Or so say genetic testing companies<br />

such as 23andMe, Promethease and others, which provide<br />

details about health risks based on gene variants. Results<br />

can be viewed online a few weeks later – if you dare.<br />

The DNA tests have sparked controversy: critics say they<br />

might be too inaccurate to support health decisions.<br />

In 2013, the US Food and Drug Administration (FDA)<br />

banned 23andMe from marketing its tests in the US,<br />

claiming that the company had introduced its Saliva<br />

Collection Kit and Personal Genome Service (PGS) without<br />

marketing approval, thus violating the Federal Food,<br />

Drug and Cosmetic Act. Backed by Alphabet Inc., the<br />

company launched its health-related genetic tests in the<br />

UK and Canada instead while focusing its US offer on<br />

ancestry testing.<br />

The practice is not confined to the US. Asia Genomics<br />

offers their clients in Singapore, Malaysia and Vietnam<br />

DNA test screening for cancer, reproductive issues and<br />

cardiology, as well as genetic counselling. GenomeAsia<br />

100K, an initiative hosted at Nanyang Technological<br />

University Singapore (NTU), intends to sequence 100,000<br />

individuals from more than a dozen Asian countries from<br />

India to Japan to better understand the biology of disease<br />

in Asian populations, as previous studies were limited to<br />

people of European descent.<br />

NTU president Bertil Andersson expects the initiative to<br />

lead to better healthcare discoveries for Asian patients.<br />

“With almost all current personal genomic efforts<br />

concentrating on populations in the Western world, the<br />

new consortium will benefit the Asian population as it<br />

sheds light on the genetic fabric of Asians,” he said at the<br />

announcement of the iniative.<br />

LET’S MAKE IT PERSONAL<br />

While such transparency can seem threatening, it can also<br />

bring significant health benefits. Many prevalent modern<br />

diseases are lifestyle dependent; no two individuals<br />

experience aging in exactly the same way.<br />

26 • Allianz

FOCUS<br />

“For those with a risk of getting Alzheimer’s disease, there<br />

are measures to reduce the risk,” says Pinchas Cohen, dean<br />

of the USC Leonard Davis School of Gerontology. “Other<br />

behavior patterns help reduce the risk of diabetes or cancer.<br />

Choosing preventative measures to avoid personal highrisk<br />

diseases is the most important step in “personalized<br />

aging,” a term coined by Cohen.<br />

» OUR NEXT CHALLENGE IS EMPOWERING<br />

PEOPLE TO USE THEIR GENETIC DATA<br />

TO PROMOTE THEIR HEALTH AND HAPPINESS «<br />

PINCHAS COHEN, DEAN OF THE<br />

USC DAVIS SCHOOL OF GERONTOLOGY<br />

Health and nutritional advice abounds but is often<br />

conflicting. People need personalized advice that involves<br />

a limited number of things to do, explains Cohen.<br />

The concept of personalized aging is spreading as<br />

scientists increasingly understand genetic variations, the<br />

interaction between genes and the environment, and their<br />

correlation with specific diseases. Personal genomics has<br />

advanced over the last decade, allowing medical<br />

professionals to analyze individual’s genomes by means of<br />

single-nucleotide polymorphism (SNP) analysis chips and<br />

partial or full genome sequencing.<br />

Accessing genotypes makes it easier to identify the gene<br />

variants associated with the risk of getting certain diseases.<br />

For example, variations within the gene called Apo-E<br />

determine the risk for Alzheimer’s disease. This risk can<br />

differ by a factor of 10 from one variant to another.<br />

Other genes act as health pointers: a melanoma-risk gene<br />

variant might make you rethink your sunscreen regime,<br />

another gene variant helps determine the usefulness of a<br />

daily aspirin, or a glass of red wine.<br />

Once the individual risk is understood, various<br />

interventions are available, says Cohen. “We can sequence<br />

individual genomes quickly and relatively cheaply. Our<br />

next challenge is empowering people to use their genetic<br />

data to promote their own health and happiness.”<br />

YOU ARE WHAT YOU EAT<br />

Helping people select the best diet for them, according to<br />

their genetics and other biomarkers, such as blood lipid or<br />

cholesterol levels, comes top of the list. This remains an<br />

area of active research but emerging data indicates that a<br />

low protein diet might help people with a high risk of cancer<br />

and that certain gene variants determine the<br />

responsiveness to a low carb diet.<br />

Then comes exercise. Genetic variants determine<br />

whether certain people benefit more from high-aerobic<br />

exercise, such as running, or from low-impact workouts,<br />

such as weight lifting. Research is ongoing. “We are still at<br />

the stage where we can only tell people that physical<br />

activity is good,” says Cohen.<br />

Who knows how the practicalities of this will unfold.<br />

Clearly, healthcare professionals will need to pass on<br />

medical advice to individuals to stop them from making<br />

inappropriate decisions about their health, Cohen suggests.<br />

Already over a million people in the US have voluntarily<br />

had their genes analyzed. Not everyone chooses to delve<br />

deeply into their genome but the opportunity to do so and<br />

guarantee healthy aging is beckoning.<br />

Allianz • 27

China’s expanding<br />

deserts threaten<br />

environmental,<br />

economic and<br />

political stability<br />

ASIA’S HIGH-STAKES FIGHT<br />

AGAINST SMOG AND HEAT<br />

Polluted air and heatwaves are killing millions, and Asia could suffer<br />

the most in a hotter, dirtier future unless it acts fast<br />

Primary sources<br />

of pollutants in<br />

Beijing are exhaust<br />

fumes, coal burning and<br />

dust storms

FOCUS<br />

Outdoor air pollution, which kills an estimated 3<br />

million people every year, has grown by 8% a year<br />

globally. Unless nations take action, the global<br />

death toll is expected to double by 2050 as urban<br />

populations increase and car numbers grow – yet the topic<br />

rarely makes the mainstream media headlines.<br />

Of all the world’s regions, Asia is uniquely exposed.<br />

According to the World Health Organization (WHO),<br />

98% of urban areas in low- and middle-income countries<br />

with populations of more than 100,000 do not meet its air<br />

quality standards. Fast-growing cities in Southeast Asia,<br />

the Western Pacific and the Middle East are the worst<br />

affected, with many showing pollution levels at up to 10<br />

times WHO limits.<br />

Rapid urbanization as well as population and economic<br />

growth across the region is creating pollution from oilfueled<br />

traffic congestion, coal burning for heat and power,<br />

smoke from solid fuel cookers, and a range of pollutants<br />

from inefficient agricultural processes. A changing climate<br />

threatens to make matters worse still.<br />

Hotter towns and cities will generate more<br />

ozone-related pollution from traffic and other<br />

fossil fuel emissions sources. When it’s hotter,<br />

rainfall and wind patterns can also change,<br />

causing particulates to stay suspended in the<br />

air longer.<br />

DEADLY SMOG<br />

Then there’s the vicious circle in which hotter<br />

conditions cause those with access to air<br />

conditioning to use it more, pushing more<br />

pollutants into the air from coal-fired power plants. A<br />

hotter climate could also spark more forest fires,<br />

contributing to region-wide, health-threatening smogs,<br />

such as the 2015 Southeast Asian haze caused by illegal<br />

slash-and-burn practices that affected eight countries.<br />

A hotter climate in Asia will have impact beyond poorer<br />

air quality. As temperatures rise, so do hospital admissions<br />

for respiratory and cardiovascular illnesses. This is an<br />

experience all too familiar lately in Southeast Asia and the<br />

Indian subcontinent, where heatwaves have killed<br />

thousands and put severe pressure on health services.<br />

There are also economic impacts to hotter conditions.<br />

The region’s extensive manufacturing and agriculture<br />

sectors mean its workers face exposure not just to polluted<br />

air but also to the physiological effects of heat.<br />

“There is a lot of evidence to suggest that temperature<br />

extremes impact productivity,” says Joshua Graff Zivin<br />

at the University of California in San Diego’s Global<br />

Health Institute. “There are negative impacts for people<br />

who work in exposed sectors like manufacturing,<br />

» THERE NEEDS TO<br />

BE A TRANSITION<br />

AWAY FROM<br />

BURNING LOW<br />

QUALITY FUELS,<br />

AND MOVING UP<br />

THE ENERGY<br />

LADDER TO<br />

NATURAL GAS «<br />

agriculture and construction. People lose a couple of hours<br />

out of a workweek. Most people don’t realize that the vast<br />

majority of manufacturing is taking place in cheap tin<br />

construction sheds with process heat, lots of activity,<br />

very little cooling and exposure to the outside air from<br />

giant open truck bays.”<br />

MANAGING RISKS<br />

Success in tackling these issues has been hitherto<br />

disappointingly limited and patchy in Asia. It might be<br />

expected, for example, that as the region industrialized<br />

and became wealthier, air pollution would reverse, with<br />

stronger measures put into place to limit the worst effects.<br />

Yet this has been far from the case. Although China has<br />

until recently been the most striking example, where more<br />

than 350 cities do not meet WHO’s air quality standards,<br />

India might now lay claim to the dubious reputation of<br />

being the worst nation for air quality: four Indian cities<br />

occupy the global top 10 for sub-PM2.5 pollution. Other<br />

countries in the region, including Pakistan<br />

and Indonesia, are struggling to tackle the<br />

issue.<br />

There are signs of progress, however. In<br />

April, health, climate and weather experts<br />

from across the region gathered in Colombo,<br />

Sri Lanka, for the first Climate Services Forum<br />

for Health, to help better understand and<br />

manage the risks from heatwaves.<br />

Meanwhile, China has begun to make<br />

significant progress in cleaning up its air, and<br />

more measures are in the pipeline, says Junjie<br />

Zhang, from the University of California in San Diego’s<br />

School of Global Policy and Strategy, who has worked on a<br />

range of climate and air quality related research projects.<br />

“For China, the situation is getting better overall.”<br />

STRONGER ENFORCEMENT<br />