Canada

MER-Canada-2016

MER-Canada-2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

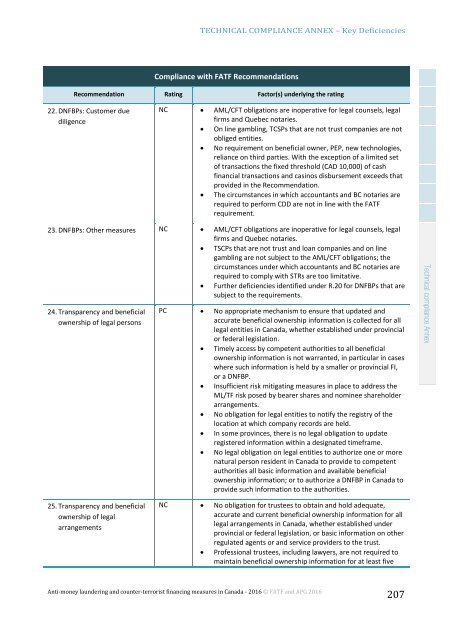

TECHNICAL COMPLIANCE ANNEX – Key Deficiencies<br />

Compliance with FATF Recommendations<br />

Recommendation Rating Factor(s) underlying the rating<br />

22. DNFBPs: Customer due<br />

diligence<br />

NC • AML/CFT obligations are inoperative for legal counsels, legal<br />

firms and Quebec notaries.<br />

• On line gambling, TCSPs that are not trust companies are not<br />

obliged entities.<br />

• No requirement on beneficial owner, PEP, new technologies,<br />

reliance on third parties. With the exception of a limited set<br />

of transactions the fixed threshold (CAD 10,000) of cash<br />

financial transactions and casinos disbursement exceeds that<br />

provided in the Recommendation.<br />

• The circumstances in which accountants and BC notaries are<br />

required to perform CDD are not in line with the FATF<br />

requirement.<br />

23. DNFBPs: Other measures NC • AML/CFT obligations are inoperative for legal counsels, legal<br />

firms and Quebec notaries.<br />

• TSCPs that are not trust and loan companies and on line<br />

gambling are not subject to the AML/CFT obligations; the<br />

circumstances under which accountants and BC notaries are<br />

required to comply with STRs are too limitative.<br />

• Further deficiencies identified under R.20 for DNFBPs that are<br />

subject to the requirements.<br />

24. Transparency and beneficial<br />

ownership of legal persons<br />

PC • No appropriate mechanism to ensure that updated and<br />

accurate beneficial ownership information is collected for all<br />

legal entities in <strong>Canada</strong>, whether established under provincial<br />

or federal legislation.<br />

• Timely access by competent authorities to all beneficial<br />

ownership information is not warranted, in particular in cases<br />

where such information is held by a smaller or provincial FI,<br />

or a DNFBP.<br />

• Insufficient risk mitigating measures in place to address the<br />

ML/TF risk posed by bearer shares and nominee shareholder<br />

arrangements.<br />

• No obligation for legal entities to notify the registry of the<br />

location at which company records are held.<br />

• In some provinces, there is no legal obligation to update<br />

registered information within a designated timeframe.<br />

• No legal obligation on legal entities to authorize one or more<br />

natural person resident in <strong>Canada</strong> to provide to competent<br />

authorities all basic information and available beneficial<br />

ownership information; or to authorize a DNFBP in <strong>Canada</strong> to<br />

provide such information to the authorities.<br />

Technical compliance Annex<br />

25. Transparency and beneficial<br />

ownership of legal<br />

arrangements<br />

NC • No obligation for trustees to obtain and hold adequate,<br />

accurate and current beneficial ownership information for all<br />

legal arrangements in <strong>Canada</strong>, whether established under<br />

provincial or federal legislation, or basic information on other<br />

regulated agents or and service providers to the trust.<br />

• Professional trustees, including lawyers, are not required to<br />

maintain beneficial ownership information for at least five<br />

Anti-money laundering and counter-terrorist financing measures in <strong>Canada</strong> - 2016 © FATF and APG 2016<br />

207