Canada

MER-Canada-2016

MER-Canada-2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHAPTER 3. LEGAL SYSTEM AND OPERATIONAL ISSUES<br />

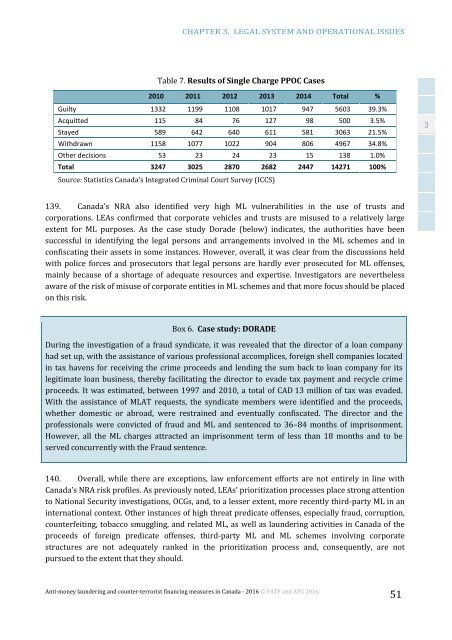

Table 7. Results of Single Charge PPOC Cases<br />

2010 2011 2012 2013 2014 Total %<br />

Guilty 1332 1199 1108 1017 947 5603 39.3%<br />

Acquitted 115 84 76 127 98 500 3.5%<br />

Stayed 589 642 640 611 581 3063 21.5%<br />

Withdrawn 1158 1077 1022 904 806 4967 34.8%<br />

Other decisions 53 23 24 23 15 138 1.0%<br />

Total 3247 3025 2870 2682 2447 14271 100%<br />

Source: Statistics <strong>Canada</strong>’s Integrated Criminal Court Survey (ICCS)<br />

3<br />

139. <strong>Canada</strong>’s NRA also identified very high ML vulnerabilities in the use of trusts and<br />

corporations. LEAs confirmed that corporate vehicles and trusts are misused to a relatively large<br />

extent for ML purposes. As the case study Dorade (below) indicates, the authorities have been<br />

successful in identifying the legal persons and arrangements involved in the ML schemes and in<br />

confiscating their assets in some instances. However, overall, it was clear from the discussions held<br />

with police forces and prosecutors that legal persons are hardly ever prosecuted for ML offenses,<br />

mainly because of a shortage of adequate resources and expertise. Investigators are nevertheless<br />

aware of the risk of misuse of corporate entities in ML schemes and that more focus should be placed<br />

on this risk.<br />

Box 6. Case study: DORADE<br />

During the investigation of a fraud syndicate, it was revealed that the director of a loan company<br />

had set up, with the assistance of various professional accomplices, foreign shell companies located<br />

in tax havens for receiving the crime proceeds and lending the sum back to loan company for its<br />

legitimate loan business, thereby facilitating the director to evade tax payment and recycle crime<br />

proceeds. It was estimated, between 1997 and 2010, a total of CAD 13 million of tax was evaded.<br />

With the assistance of MLAT requests, the syndicate members were identified and the proceeds,<br />

whether domestic or abroad, were restrained and eventually confiscated. The director and the<br />

professionals were convicted of fraud and ML and sentenced to 36–84 months of imprisonment.<br />

However, all the ML charges attracted an imprisonment term of less than 18 months and to be<br />

served concurrently with the Fraud sentence.<br />

140. Overall, while there are exceptions, law enforcement efforts are not entirely in line with<br />

<strong>Canada</strong>’s NRA risk profiles. As previously noted, LEAs’ prioritization processes place strong attention<br />

to National Security investigations, OCGs, and, to a lesser extent, more recently third-party ML in an<br />

international context. Other instances of high threat predicate offenses, especially fraud, corruption,<br />

counterfeiting, tobacco smuggling, and related ML, as well as laundering activities in <strong>Canada</strong> of the<br />

proceeds of foreign predicate offenses, third-party ML and ML schemes involving corporate<br />

structures are not adequately ranked in the prioritization process and, consequently, are not<br />

pursued to the extent that they should.<br />

Anti-money laundering and counter-terrorist financing measures in <strong>Canada</strong> - 2016 © FATF and APG 2016<br />

51