Canada

MER-Canada-2016

MER-Canada-2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

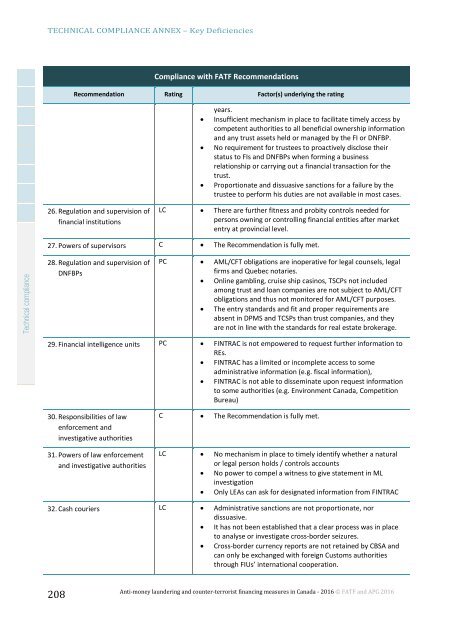

TECHNICAL COMPLIANCE ANNEX – Key Deficiencies<br />

Compliance with FATF Recommendations<br />

Recommendation Rating Factor(s) underlying the rating<br />

years.<br />

• Insufficient mechanism in place to facilitate timely access by<br />

competent authorities to all beneficial ownership information<br />

and any trust assets held or managed by the FI or DNFBP.<br />

• No requirement for trustees to proactively disclose their<br />

status to FIs and DNFBPs when forming a business<br />

relationship or carrying out a financial transaction for the<br />

trust.<br />

• Proportionate and dissuasive sanctions for a failure by the<br />

trustee to perform his duties are not available in most cases.<br />

26. Regulation and supervision of<br />

financial institutions<br />

LC • There are further fitness and probity controls needed for<br />

persons owning or controlling financial entities after market<br />

entry at provincial level.<br />

27. Powers of supervisors C • The Recommendation is fully met.<br />

Technical compliance<br />

28. Regulation and supervision of<br />

DNFBPs<br />

PC • AML/CFT obligations are inoperative for legal counsels, legal<br />

firms and Quebec notaries.<br />

• Online gambling, cruise ship casinos, TSCPs not included<br />

among trust and loan companies are not subject to AML/CFT<br />

obligations and thus not monitored for AML/CFT purposes.<br />

• The entry standards and fit and proper requirements are<br />

absent in DPMS and TCSPs than trust companies, and they<br />

are not in line with the standards for real estate brokerage.<br />

29. Financial intelligence units PC • FINTRAC is not empowered to request further information to<br />

REs.<br />

• FINTRAC has a limited or incomplete access to some<br />

administrative information (e.g. fiscal information),<br />

• FINTRAC is not able to disseminate upon request information<br />

to some authorities (e.g. Environment <strong>Canada</strong>, Competition<br />

Bureau)<br />

30. Responsibilities of law<br />

enforcement and<br />

investigative authorities<br />

31. Powers of law enforcement<br />

and investigative authorities<br />

C • The Recommendation is fully met.<br />

LC • No mechanism in place to timely identify whether a natural<br />

or legal person holds / controls accounts<br />

• No power to compel a witness to give statement in ML<br />

investigation<br />

• Only LEAs can ask for designated information from FINTRAC<br />

32. Cash couriers LC • Administrative sanctions are not proportionate, nor<br />

dissuasive.<br />

• It has not been established that a clear process was in place<br />

to analyse or investigate cross-border seizures.<br />

• Cross-border currency reports are not retained by CBSA and<br />

can only be exchanged with foreign Customs authorities<br />

through FIUs’ international cooperation.<br />

208<br />

Anti-money laundering and counter-terrorist financing measures in <strong>Canada</strong> - 2016 © FATF and APG 2016