Necessity as the mother of invention monetary policy after the crisis

n?u=RePEc:dnb:dnbwpp:525&r=mac

n?u=RePEc:dnb:dnbwpp:525&r=mac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A dummy indicating countries hit by <strong>the</strong> financial <strong>crisis</strong>, according to <strong>the</strong> datab<strong>as</strong>e<br />

<strong>of</strong> Laeven and Valencia (2013);<br />

A dummy indicating inflation targeters, b<strong>as</strong>ed on Hammond (2012);<br />

A dummy for countries with flexible exchange rates, according to <strong>the</strong> IMF Annual<br />

Report on Exchange Arrangements and Exchange Restrictions;<br />

The level <strong>of</strong> central bank independence in 2010, according to Bodea and Hicks,<br />

(2015); and<br />

The change in <strong>the</strong>ir me<strong>as</strong>ure <strong>of</strong> central bank independence between 1995-2007 and<br />

2008-2010. 7<br />

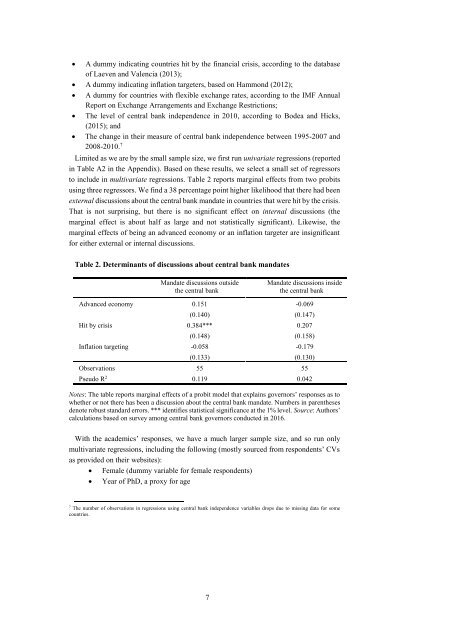

Limited <strong>as</strong> we are by <strong>the</strong> small sample size, we first run univariate regressions (reported<br />

in Table A2 in <strong>the</strong> Appendix). B<strong>as</strong>ed on <strong>the</strong>se results, we select a small set <strong>of</strong> regressors<br />

to include in multivariate regressions. Table 2 reports marginal effects from two probits<br />

using three regressors. We find a 38 percentage point higher likelihood that <strong>the</strong>re had been<br />

external discussions about <strong>the</strong> central bank mandate in countries that were hit by <strong>the</strong> <strong>crisis</strong>.<br />

That is not surprising, but <strong>the</strong>re is no significant effect on internal discussions (<strong>the</strong><br />

marginal effect is about half <strong>as</strong> large and not statistically significant). Likewise, <strong>the</strong><br />

marginal effects <strong>of</strong> being an advanced economy or an inflation targeter are insignificant<br />

for ei<strong>the</strong>r external or internal discussions.<br />

Table 2. Determinants <strong>of</strong> discussions about central bank mandates<br />

Mandate discussions outside<br />

<strong>the</strong> central bank<br />

Mandate discussions inside<br />

<strong>the</strong> central bank<br />

Advanced economy 0.151 -0.069<br />

(0.140) (0.147)<br />

Hit by <strong>crisis</strong> 0.384*** 0.207<br />

(0.148) (0.158)<br />

Inflation targeting -0.058 -0.179<br />

(0.133) (0.130)<br />

Observations 55 55<br />

Pseudo R 2 0.119 0.042<br />

Notes: The table reports marginal effects <strong>of</strong> a probit model that explains governors’ responses <strong>as</strong> to<br />

whe<strong>the</strong>r or not <strong>the</strong>re h<strong>as</strong> been a discussion about <strong>the</strong> central bank mandate. Numbers in paren<strong>the</strong>ses<br />

denote robust standard errors. *** identifies statistical significance at <strong>the</strong> 1% level. Source: Authors’<br />

calculations b<strong>as</strong>ed on survey among central bank governors conducted in 2016.<br />

With <strong>the</strong> academics’ responses, we have a much larger sample size, and so run only<br />

multivariate regressions, including <strong>the</strong> following (mostly sourced from respondents’ CVs<br />

<strong>as</strong> provided on <strong>the</strong>ir websites):<br />

Female (dummy variable for female respondents)<br />

Year <strong>of</strong> PhD, a proxy for age<br />

7<br />

The number <strong>of</strong> observations in regressions using central bank independence variables drops due to missing data for some<br />

countries.<br />

7