INTRODUCTORY SPECIAL INTRODUCTORY ... - PHOTON Info

INTRODUCTORY SPECIAL INTRODUCTORY ... - PHOTON Info

INTRODUCTORY SPECIAL INTRODUCTORY ... - PHOTON Info

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

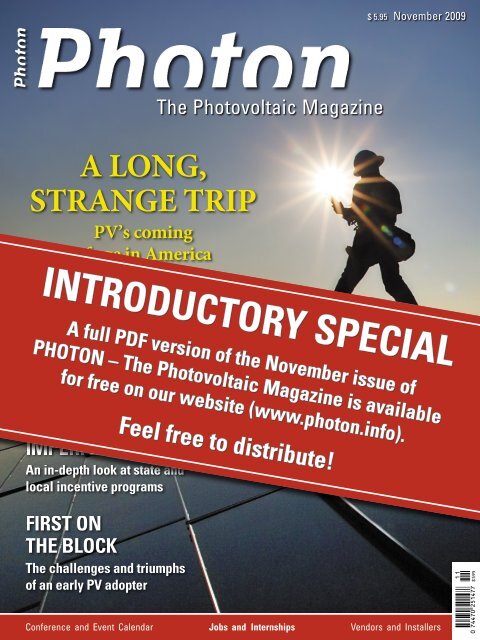

A LONG,<br />

STRANGE TRIP<br />

SOUTHERN<br />

EXPOSURE<br />

PV’s coming<br />

of age in America<br />

We cruise down to Anaheim<br />

for Solar Power 2009<br />

IMPERFECT UNION<br />

An in-depth look at state and<br />

local incentive programs<br />

FIRST ON<br />

THE THE BLOCK BLOCK<br />

The challenges and triumphs<br />

of an early PV adopter<br />

The Photovoltaic Magazine<br />

$ 5.95 November 2009<br />

<strong>INTRODUCTORY</strong> <strong>INTRODUCTORY</strong> <strong>SPECIAL</strong> <strong>SPECIAL</strong><br />

A A full full PDF PDF version version of of the the November November issue issue of of<br />

<strong>PHOTON</strong> <strong>PHOTON</strong> – – The The Photovoltaic Photovoltaic Magazine Magazine is is available available<br />

for for free free on on our our website website (www.photon.info).<br />

(www.photon.info).<br />

Feel Feel free free to to distribute!<br />

distribute!<br />

Conference and Event Calendar Jobs and Internships Vendors and Installers<br />

#74470-CFBEHh:L;L

Gainesville<br />

is the start<br />

On the surface, the challenge<br />

of satisfying US electricity<br />

needs and eliminating CO emis-<br />

2<br />

sions from electricity generation<br />

can be solved with a small dot<br />

on the map. The current electricity<br />

consumption in the US is approximately<br />

3,900 terawatt hours<br />

annually. In order to produce this<br />

amount of electricity from sunlight,<br />

it would be necessary to<br />

have a photovoltaic installation<br />

measuring about 18,000 square<br />

miles – that is equal to the small<br />

yellow square in the accompanying<br />

map of Arizona. That is<br />

all that is needed to reduce the<br />

greenhouse gases resulting from<br />

US electricity production to virtually<br />

zero.<br />

Of course, such a simple solution<br />

is unrealistic to address the<br />

complex issues of US electricity<br />

supply and CO emissions. Real-<br />

2<br />

ity is much more complicated,<br />

especially because PV will not be<br />

centralized in one corner of Arizona<br />

but is being deployed across<br />

the entire country, from Hawaii<br />

to Florida. Integrating a large volume<br />

of PV will require significant<br />

upgrades to the electricity grids,<br />

integration of PV with operation<br />

of other fuel sources including<br />

wind and biomass, and perhaps<br />

implementation of electricity storage.<br />

For PV to become a significant<br />

portion of US electricity supply, it<br />

would require much more than<br />

just a dot on the US map.<br />

Perhaps PV’s biggest challenge<br />

is the financing. In order for photovoltaics<br />

to really get rolling in<br />

the US, financing questions need<br />

to be answered. At first glance, it<br />

seems that PV will make financial<br />

sense for a broad set of customers.<br />

The electricity tariffs are high in<br />

EDITORIAL<br />

many states where there is a lot of<br />

good sunshine. A decent return<br />

is within easy reach. But whoever<br />

wants a good return from such an<br />

investment will need to dip into<br />

many pots – tax rebates, subsidies<br />

from energy suppliers, municipalities<br />

and states, access to net<br />

metering. After being confronted<br />

with such a complex investment,<br />

some investors are sure to lose<br />

their appetite.<br />

This is the mixed-message of<br />

PV across the US: While the economics<br />

may make sense for many<br />

customers, the financing and<br />

policies are still too complicated.<br />

We are dedicating a large share of<br />

this first issue of <strong>PHOTON</strong> USA<br />

to the various incentive programs<br />

available in the US.<br />

And we couldn’t have found<br />

a better example of a policy on<br />

the right path than Gainesville,<br />

which has both the US’s first feedin<br />

tariff and the common challenges<br />

that face implementation<br />

of these types of programs. This<br />

actually did not surprise us at all.<br />

It is no coincidence that the German<br />

edition of <strong>PHOTON</strong>, started<br />

in 1996, is headquartered in the<br />

German city of Aachen, which<br />

itself is something of a European<br />

Gainesville. In the early 1990s,<br />

the magazine’s founders-to-be<br />

were active in a political movement<br />

demanding a feed-in tariff<br />

for solar electricity. With the<br />

success of what became known<br />

as the »Aachen Model,« the first<br />

trial balloons for what would become<br />

Germany’s Renewable Energy<br />

Law were released. And this<br />

law is the most important reason<br />

that Germany is today the number<br />

one solar country worldwide.<br />

More and more, the feed-in<br />

tariff system has been paying for<br />

itself. The mass installation of solar<br />

electricity systems has reduced<br />

their cost dramatically – and will<br />

continue to do so. That means we<br />

do not have to wait for a cheaper<br />

technology. Through massive<br />

economies of scale, solar will become<br />

ever cheaper – and so will the<br />

task of reconciling our need for energy<br />

with climate protection.<br />

Gainesville is a shining light<br />

in the US. It provides a model of<br />

a simple-to-understand feed-in<br />

tariff policy. And it also illustrates<br />

the importance of adjusting any<br />

policy over time to meet the needs<br />

of customers and policy makers.<br />

Let this solar movement be the<br />

start of a mass movement. Then<br />

this century will begin looking<br />

sunny indeed.<br />

Philippe Welter, Publisher<br />

November 2009 3

4<br />

Under the Sun<br />

National Renewable Energy Laboratory (NREL)<br />

Politics Business<br />

PV history Solar friendly states Buying programs<br />

14 28 54<br />

After predictions that the Bell Labs-<br />

invented solar battery would transform<br />

the world in the 1950s proved wildly off<br />

the mark, the PV industry has survived<br />

for decades as a niche market, sustained<br />

by unlikely patrons such as the space program,<br />

Big Oil and pot growers. With the<br />

promise of PV more real than ever today,<br />

<strong>PHOTON</strong> looks back at the people and<br />

events that have shaped the industry.<br />

14 ! PV history<br />

The unlikely, and still unfi nished,<br />

story of PV in America, and what it<br />

says about the future<br />

<strong>PHOTON</strong><br />

November 2009<br />

cover picture:<br />

Technicians from PowerLight install solar<br />

panels atop roofs of houses that are part<br />

of a 600 home solar powered community<br />

being built in Roseville, California.<br />

Photo: Charles Chipman /<br />

photon-pictures.com<br />

For most Americans interested in in-<br />

stalling PV on their homes, one of the<br />

fi rst things they ask is: is going solar a<br />

good investment? Given the prevalence of<br />

this question, we would be remiss in not<br />

trying to answer it in our inaugural issue<br />

of <strong>PHOTON</strong> USA. But before we answer<br />

the question, we have to acknowledge up<br />

front: homeowners in the US won‘t fi nd<br />

it easy to fi gure out whether a home PV<br />

system is a good investment.<br />

28 ! Solar friendly states<br />

<strong>PHOTON</strong> investigates the factors<br />

driving the economics of residential<br />

PV in 13 US states<br />

34 San Francisco<br />

How San Francisco managed<br />

to transform from a solar no-gozone<br />

to a PV hotspot – at least<br />

for the time being<br />

40 Stimulus package<br />

The Obama Administration’s<br />

stimulus package is huge, ambitious,<br />

and has a big focus on renewable<br />

energy. Just what does it mean for<br />

the PV industry?<br />

Rolf Schulten / photon-pictures.com<br />

From San Diego to New Orleans, Denver<br />

to Sonoma County, communities in<br />

the U.S. are banding together to go solar.<br />

Community buying programs educate<br />

homeowners about solar, help them get<br />

discounts off their PV systems, and vet<br />

installers. It’s grassroots solar power, and<br />

the trend is gaining momentum.<br />

46 Thin-fi lm production<br />

Solyndra breaks ground on a 500 MW<br />

thin-fi lm module production facility in<br />

Fremont, California<br />

50 U.S. PV market<br />

The U.S. PV market will grow next<br />

year. Just how much depends on<br />

whom you ask<br />

54 Buying programs<br />

A new trend of grassroots-style community<br />

buying programs in the US<br />

is expanding the residential market,<br />

and educating new audiences about<br />

solar<br />

96 Test Lab<br />

97 Statistics<br />

99 Events<br />

105 Education & Training<br />

107 Internships<br />

109 Ask the Editors<br />

111 Industry Registry<br />

112 Classifi eds<br />

Service<br />

F1 Online digitale Bildagentur GmbH<br />

November 2009

Science & Technology Architecture<br />

Nearing the end of a turbulent year, the<br />

Solar Power International (SPI) conference<br />

and expo provides us with a moment to refl<br />

ect on how the industry has changed since<br />

the last gathering a year ago. More than<br />

900 exhibitors will be at the Anaheim Convention<br />

Center for SPI covering more than<br />

200,000 ft2 of space, twice the territory at<br />

last year‘s expo in San Diego. A preview<br />

on new products especially interesting for<br />

home owners and system integrators.<br />

59 ! The Magic Kingdom awaits<br />

60 PV monitoring and more<br />

61 Panel wiring with Parallux vBoost<br />

62 Ceramic-backed modules<br />

63 Small single-axis tracker for<br />

standard modules<br />

64 Japanese company introduces<br />

T-Junction; PowerBox replaces<br />

module’s standard junction box<br />

65 Extra-low-voltage power inverters;<br />

power optimizers use selective<br />

installation<br />

66 Attractive modules for the US market;<br />

inverters from Italy; monitoring<br />

systems – and technical crews to<br />

operate them<br />

67 Power optimizers for any module; new<br />

inverter with backup battery power<br />

68 Little product, big comeback<br />

69 Microinverters<br />

An old idea shuffl es off its stale<br />

reputation and makes a comeback<br />

in a new package<br />

Frederic Neema / photon-pictures.com<br />

A former training center near a European<br />

Space Agency (ESA) ground station<br />

underwent elaborate reconstruction,<br />

transforming it into a business park for<br />

aerospace companies. Installing a PV system<br />

as part of this complex came naturally<br />

to an industry that historically has<br />

been one of the fi rst to employ PV in any<br />

sustained way.<br />

78 Belgium<br />

An aerospace business park runs on<br />

solar electricity – well, what else?<br />

In Practice<br />

Exhibition Belgium My PV system<br />

59 78 90<br />

!<br />

Lead article<br />

additional pictures:<br />

www.photon-pictures.com<br />

November 2009 5<br />

Guido Schiefer / photon-pictures.com<br />

Rick Elkus is self-admittedly attracted<br />

to projects that tend to increase in scale<br />

from the initial plan. Take, for instance,<br />

the 3,000 gallon fi sh tank in his backyard.<br />

But when the Elkus’s decided to get<br />

a PV system installed, the scope of the<br />

project went far beyond anything they<br />

could have imagined. And far beyond the<br />

small town in which they live.<br />

84 Proposals<br />

PV veteran Bill Brooks’ nine steps to<br />

fi nding the right system integrator<br />

90 ! My PV system<br />

The Elkus’ PV system started as a<br />

challenge and ended in a safety code<br />

nightmare<br />

Rubriken<br />

3 Editorial<br />

6 Picture of the month<br />

10 Readers‘ letters<br />

113 List advertisers<br />

113 Imprint<br />

114 Preview<br />

Rolf Schulten / photon-pictures.com

6<br />

Photo of the month<br />

The garden of earthly lights:<br />

A remarkable new species of sunflower sprouted this summer on the site of the former Austin, Texas municipal airport. You might call it<br />

Helianthus photovoltaicus. Instead of producing tiny seeds and brilliant yellow petals, these 18-to-24 ft plants generate energy by day, and cast<br />

an electric glow at night. These 15 sunflowers were installed on a public pathway near the I-35 freeway running north to Dallas and Fort Worth.<br />

The entire installation uses 105 trapezoidal modules supplied by Sacramento, California-based Atlantis Energy Systems, and has a nominal power<br />

rating of 15.1 kW, about as much as a private rooftop systems. In this case, beauty comes at a price – the $595,000 project cost more than five<br />

times as much as a typical system this size in the US. It was funded by Catellus Development Co., Applied Materials, Inc., and the City of Austin‘s<br />

solar rebate program. The PV sunflowers were designed by the Harries/Héder Collaborative, based in Cambridge, Massachusetts. mh<br />

Photo: Rolf Schulten<br />

November 2009

November 2009 7

May we introduce ourselves?<br />

The <strong>PHOTON</strong> US editorial team is part<br />

of the internationally active <strong>PHOTON</strong><br />

Group with 150 employees worldwide.<br />

Our publishing house was founded in<br />

1996 with the aim of publishing Ger-<br />

many’s first PV magazine – »<strong>PHOTON</strong><br />

– das Solarstrom-Magazin.« Over the<br />

years, we have added additional pub-<br />

lications, the first of which was PHO-<br />

TON International in 1998, our English<br />

edition for the international PV indus-<br />

try, followed by Spanish and Italian<br />

editions. Now, we have launched a<br />

magazine for the US market – the first<br />

issue of which, November, you’re hold-<br />

ing in your hands. We will continue to<br />

thwart any attempts by investors, other<br />

companies, or lobby groups to exert in-<br />

fluence on our editorial work. Our core<br />

team of writers, Chris Warren, Melissa<br />

Bosworth, Mike Matz, and Matthew<br />

Hirsch, together with the editorial<br />

teams from our other magazines, and<br />

8<br />

Graphic: <strong>PHOTON</strong><br />

Christopher Warren<br />

Chris has worked as an associate editor<br />

at Los Angeles Magazine, as well as a<br />

freelancer for publications such as Na-<br />

tional Geographic Traveler, Forbes and<br />

The Los Angeles Times. And even when<br />

not working as a journalist, he was busy<br />

forging words, most notably as a wri-<br />

ter at The White House during Presi-<br />

dent Bill Clinton‘s first term in office.<br />

Not surprisingly, his interest in solar is<br />

focused on policies and politics around<br />

the growth of solar in the US, as well<br />

as the entrepreneurs who are working<br />

to develop businesses here.<br />

Melissa Bosworth<br />

Melissa is kind of a senior at <strong>PHOTON</strong><br />

USA – she joined during the develop-<br />

ment stage in May, a month before her<br />

colleagues. She has worked in municipal<br />

finance, as a freelancer and as editor-in-<br />

chief of etc. Magazine in San Francisco.<br />

What she likes most about her new job is<br />

telling people about photovoltaics – rea-<br />

ders, friends, family, cab drivers, grocery<br />

store clerks or anyone else who will li-<br />

sten. Melissa also likes finding out about<br />

new innovations and meeting the peo-<br />

ple who make them, as well as getting<br />

to know installers and owners.<br />

our in-house test laboratory, promise to<br />

bring you the highest quality journal-<br />

ism possible.<br />

Rolf Schulten / photon-pictures.com (4)<br />

Today, <strong>PHOTON</strong> Group operates branches and offices<br />

in 10 locations worldwide. The <strong>PHOTON</strong> US editorial<br />

team is based in San Francisco.<br />

Michael Matz<br />

Michael declares »laughing« as one<br />

of his hobbies. But that doesn‘t mean<br />

he isn‘t taking his work seriously. »I<br />

see solar as a critical part of addres-<br />

sing global climate change,« he says,<br />

»the gravest global threat of our<br />

time.« The professional experience<br />

he brings to the <strong>PHOTON</strong> staff is »a<br />

combination of green journalism, en-<br />

vironmental policy advocacy, and sci-<br />

ence writing« – three reasons why he<br />

is a perfect fit to the team.<br />

Matthew Hirsch<br />

Before joining <strong>PHOTON</strong> in June, Matt<br />

wrote for The Recorder, a daily news-<br />

paper on the legal industry in Califor-<br />

nia and worked as a staff writer at the<br />

San Francisco Bay Guardian. He has<br />

also been a contributor for Bloomberg<br />

News, among several other publica-<br />

tions. When asked about his area of<br />

focus for <strong>PHOTON</strong> USA, Matt cites the<br />

questionable business practices in the<br />

photovoltaic industry. He also has an in-<br />

terest in the guerilla solar movement.<br />

But that‘s nothing to worry about; Matt<br />

is absolutely good-natured.<br />

November 2009

November 2009 9

10<br />

Readers‘ letters<br />

<strong>PHOTON</strong>, welcome to the US, we love<br />

you and read you all the time. We are very<br />

happy to hear you are joining us stateside.<br />

Wishing you great success.<br />

Fida Hossain<br />

CEO and President, E2Logicx Solar and AIRE Inc<br />

<strong>PHOTON</strong> Magazine is excellent. I have<br />

one suggestion: make all the articles avail-<br />

able electronically to print subscribers as<br />

soon as the magazine comes out, even if<br />

you charge a premium for the electronic<br />

option. Electronic copies of articles are<br />

valuable for two reasons: first, I file them<br />

(organized by company) on my PC and<br />

reference them later, generally while<br />

away from the office. Second, I forward<br />

key articles to colleagues.<br />

Bob Conner<br />

VP, Photovoltaics, Semprius, Inc.<br />

You should include one-page fact<br />

sheets that can be ripped out and hung<br />

on the wall for students, media, and poli-<br />

cymakers – with pictures and prose. These<br />

fact sheets could cover: concentrated PV,<br />

PV types (thin-films, polycrystalline,<br />

nano, etc), energy balance for PV, etc.<br />

You should also have a series of USA<br />

Today-like statistical charts on sales (US<br />

and global); deployment by state and<br />

country; stocks (on several global ex-<br />

changes); aggregated MWs, and employ-<br />

ment, etc.<br />

And a timely critical issues column fo-<br />

cusing on: the glut and price points for PV<br />

over the next 5 years; upcoming mergers<br />

acquisitions; the global feed-in-tariff pic-<br />

ture; and whether state RPS really drive<br />

PV, and if so in market niches, etc.<br />

Basically, <strong>PHOTON</strong> should be a refer-<br />

ence publication offering timely analy-<br />

sis of issues.<br />

Scott Sklar<br />

President, The Stella Group, Ltd<br />

November 2009<br />

Colourbox Deutschland GmbH

November 2009 11

12<br />

Readers‘ letters<br />

So why are so few homes outfitted<br />

with solar generation capability? For a<br />

long time the answer has been: cost.<br />

The key to cost reduction is innovation.<br />

Most often innovation comes from<br />

smaller organizations with a close-knit<br />

and dedicated employee base that share<br />

a more common goal/philosophy than<br />

a large organization. Red-tape has put<br />

an end to brilliant innovation more<br />

times in history then I’d care to count.<br />

I suggest you include a »spotlight on in-<br />

novation« section in your magazine to<br />

focus on individuals and small busi-<br />

nesses that are innovating, rather than<br />

the products of huge corporate research<br />

budgets and projects. This personalizes<br />

the industry in a way that will get the<br />

target audience (those end-customers<br />

in the US interested in building a PV<br />

system) excited about the technology.<br />

This will help people understand that<br />

solar power is NOT a large corporate<br />

gimmick designed to take their money,<br />

or a political ploy catering to recent<br />

global climate change realizations.<br />

There are multitudes of regular, grass-<br />

roots enthusiasts pursuing innovation<br />

and who believe in the future of this<br />

technology’s benefit to mankind.<br />

Dustin Charamut<br />

Mechanical Design / Systems R&D, Aerospec Inc.<br />

I hope you are planning to track solar<br />

stocks as an index and individual securi-<br />

ties, as has been the case in <strong>PHOTON</strong><br />

International.<br />

Jeff Shaddock<br />

Project Manager, MA Properties<br />

I think something that might be<br />

valuable is to have a map of the states<br />

outlining some key stats about the<br />

current incentives within a state – like<br />

a cheat sheet, if you will. Then, when<br />

something changes in that state, it<br />

will be highlighted, so that people no-<br />

tice. I think one of the biggest areas of<br />

confusion (especially for people com-<br />

ing from other countries that have a<br />

unified solar incentive program) is re-<br />

membering which state has what in-<br />

centive and if that knowledge is cur-<br />

rent. Maybe you can even make a<br />

something that people can tear out of<br />

the magazine each month and post on<br />

their bulletin board.<br />

Lee Johnson<br />

Vice President, Stellaris Corporation<br />

If you can combine PV-specific news<br />

with up-to-date hands-on installation<br />

and regulatory information as well as<br />

national and global political PV news,<br />

you will have a hit.<br />

Mark McCain<br />

Austin, TX<br />

Case studies always garner interest<br />

from readers. I think people want to<br />

know about actual installations, from<br />

the folks who went through the struggle<br />

themselves. Especially in a relatively<br />

new and exploding marketplace, it’s<br />

critical for people to be able to read about<br />

the challenges they may encounter, and<br />

innovative ways that others have over-<br />

come them.<br />

Joanne Lowy<br />

Director of Marketing, AlsoEnergy<br />

If I was going to create a magazine<br />

about solar I would really like to see a<br />

strong emphasis on solar from start to<br />

finish. Whether it’s a story related to the<br />

first silicon crystal forming in a factory,<br />

a piece of legislation in congress, or a<br />

story about the last bolt being put in<br />

place on a solar system. My description<br />

F1 Online digitale Bildagentur GmbH<br />

is fairly vague, but I think you probably<br />

understand what I’m getting at.<br />

I would also like to see »<strong>PHOTON</strong>«<br />

add open editorials, along with a power-<br />

fully matched internet based networking<br />

site. The web site would be a great source<br />

for documenting advances. It could be a<br />

great forum for scientists, government ad-<br />

vocates, contractors and many others to<br />

voice their opinions and ideas. I also think<br />

it would be great, if some of the better fo-<br />

rums and their highlights could be posted<br />

in the magazine. That would bring further<br />

attention to these topics and cause others<br />

to voice their thoughts, in editorials, on-<br />

line, or publicly. I think it would be really<br />

neat, if both (magazine and web content)<br />

could inform people about social meet-<br />

ings in the real world. Whether this meet-<br />

ing is at a local bar, or with their congress-<br />

man. All of these different ideas for how<br />

<strong>PHOTON</strong> could connect people would be<br />

a great way to promote solar and raise in-<br />

terest in the topic, rather than just being a<br />

magazine they read once to pass the time.<br />

I hope these ideas have been useful.<br />

Chase Drum<br />

Competitive Solar<br />

This year we installed a 3.7 kW rooftop<br />

solar array – everything’s working per-<br />

fectly. It’s fun watching the meter run<br />

backwards. The problem we’d like to see<br />

your magazine address is called »TRue-<br />

Up,« a phenomenon in which PG&E takes<br />

the excess electricity we generate and feed<br />

into the gird, and then keeps a record for<br />

each month that shows a progressive in-<br />

crease in the amount of power we »sell«<br />

to them. However, at the end of each cal-<br />

endar year, if we’ve generated more pow-<br />

er than we’ve used, rather than send us a<br />

check for the excess power, or giving us a<br />

credit for our natural gas usage, PG&E just<br />

starts the meter at zero, effectively steal-<br />

ing any extra electricity we’ve generated<br />

beyond consumption. If we use MORE<br />

power than we generate, PG&E would bill<br />

us for the extra power. We don’t think<br />

this is fair, and apparently it’s not the<br />

same in all areas of the US.<br />

Jack Reineck<br />

reineckandreineck.com<br />

November 2009

Some topics I would like to see covered: US inverter tests; Month-<br />

ly update on PV installations (divided in on/off-grid) in the US and<br />

in Canada, and a forecast; Updates on incentives and feed-in tariffs<br />

(states and federal); Case studies of PV installations in the US.<br />

Peter J. Zisterer<br />

Manager New Business Development NAFTA,<br />

Photovoltaics, Diehl Controls North America<br />

Congratulations on the start of your new magazine. I have been<br />

involved in the solar energy industry for almost 25 years, and in that<br />

time I have rarely seen any clear and concise literature about the US<br />

market. Knowing the work of <strong>PHOTON</strong> International, I am sure you<br />

and your magazine will prove to be a great asset to photovoltaics.<br />

Jeff Szczepanski<br />

Applied Photovoltaics, LLC<br />

Since I haven’t seen the first edition yet, the following may be<br />

moot, but my primary concern is that the US edition maintain<br />

the very high quality of research, testing, and articles found in<br />

the German edition. I fear (based on the price), that you will go<br />

the way of so many other European magazines and dumb it down<br />

for the US audience.<br />

Paul Wolf<br />

Consultant<br />

We have noticed the following business dynamics in the solar<br />

(PV) industry: Danger of outright killing solar industry by cap-<br />

ping installations in California (like in Spain), instead of increas-<br />

ing levels; Influx of German, Spanish, Japanese, Chinese compa-<br />

nies competing for medium, large scale projects – sometimes with<br />

US Government funding!<br />

Danger of deluge of unqualified, unskilled, unlicensed, unin-<br />

sured, unbonded, unregulated bands of roving »solar installers«,<br />

i.e., every two people with a truck and a magnetic sign booking<br />

residential solar jobs, Publicly subsidized companies like Solyn-<br />

dra and privately funded ones like Enphase, who have innovative<br />

technologies but won’t make them available to qualified, experi-<br />

enced installers with established businesses.<br />

There is such tremendous potential for solar to remake the econ-<br />

omy, our state, our country, and the world, but it is being strangled<br />

in the cradle by greed, ignorance, stupidity, and outright criminal<br />

behavior in many areas. Big Electric is worse than Big Oil.<br />

Tom Taylor<br />

VP, Sales & Marketing, Pacific Sun Technologies, Inc.<br />

<strong>PHOTON</strong>‘s editorial team welcomes any letters from its readers. Please send your letters to:<br />

<strong>PHOTON</strong> USA Corp.<br />

Editorial Department<br />

514 Bryant St.<br />

San Francisco, California, 94107<br />

Or send an email to: readersletters@photon-magazine.us<br />

Please provide your complete name and address. We reserve the right to shorten letters.<br />

The content expressed in the letters does not necessarily reflect the opinion of <strong>PHOTON</strong>.<br />

November 2009 13

14<br />

Under the Sun<br />

History<br />

A long,<br />

November 2009

strange trip<br />

The unlikely, and still unfinished, story of PV<br />

in America, and what it says about the future<br />

Don’t let the buzz fool you. While photovoltaics may be a hum of activity these days<br />

– with big and small companies scrambling to grab a slice of the growing domestic<br />

market and governments spending big to help solar expand – that hasn’t always<br />

been the case. After predictions that the Bell Labs-invented solar battery would<br />

transform the world in the 1950s proved wildly off the mark, the PV industry has<br />

survived for decades as a niche market, sustained by unlikely patrons such as the<br />

space program, Big Oil and pot growers. With the promise of PV more real than ever<br />

today, <strong>PHOTON</strong> looks back at the people and events that have shaped the industry<br />

and what guidance those experiences provide for the future.<br />

An unlikely champion: Despite lingering suspicions that the oil and gas industry has been out to kill PV, the truth is that Big<br />

Oil was one of the largest early markets for solar. Even today, as can be seen at this Wamsutter, Wyoming BP gas field, PV<br />

is used to generate a current that prevents well and pipe corrosion and to operate monitoring equipment<br />

November 2009 15<br />

»<br />

Rolf Schulten / photon-pictures.com

16<br />

Under the Sun<br />

The headquarters of SunPower Corp.<br />

are, to be blunt, unremarkable. Located<br />

off a busy highway in San Jose, Cali-<br />

fornia, in the heart of Silicon Valley, Sun-<br />

Power – one of America’s largest suppliers<br />

of solar panels to homes, businesses and<br />

utilities – is housed in a one-story office<br />

park on the campus of its former parent<br />

company, Cypress Semiconductor. Chock<br />

full of small cubicles and modest executive<br />

offices, it’s the sort of utilitarian building<br />

A m i x t u r e o f ideAlism A n d p r A c t i cA l i t y: dr A w n to northern cAliforniA, w h e r e l A n d w A s<br />

c h e A p A n d p l e n t i f u l, ideAlistic c o m m u n e s f o r m e d in t h e 1960s A n d 1970s to c r e A t e<br />

c o m m u n i t i e s detAched f r o m m o d e r n s o c i e t y. so m e o f t h o s e people t u r n e d to pV<br />

favored by Corporate America and global<br />

multinationals alike; indeed, just across<br />

the street is the technology company, No-<br />

vellus Systems; not far away Sony Ericsson<br />

and Microsoft Corp. have set up shop.<br />

The similarities SunPower shares<br />

with its large corporate neighbors don’t<br />

end with its choice of headquarters, ei-<br />

ther: perhaps most importantly, it has<br />

its shares traded on a stock exchange (in<br />

SunPower’s case, Nasdaq), meaning that<br />

it has its business and its prospects con-<br />

tinuously pored over and dissected by<br />

Wall Street analysts. In all of this, Sun-<br />

Power – along with other publicly trad-<br />

to p o w e r t h e i r h o m e s<br />

ed photovoltaic companies, like Tem-<br />

pe, Arizona-based First Solar Inc. and<br />

Massachusetts’ Evergreen Solar Inc. –<br />

is decidedly in the mainstream.<br />

And for the American photovoltaic in-<br />

dustry, this is a remarkable position to be in.<br />

In fact, the history of photovoltaics,<br />

or PV, in the United States has been –<br />

and in many ways, continues to be – one<br />

spent on the fringes, as a tiny, niche in-<br />

dustry dependent at various times on<br />

the military, off-grid communes, Big Oil<br />

and even marijuana growers for survival<br />

(more about all of that later). These days,<br />

it’s an industry with a decidedly Jekyll<br />

and Hyde-like personality.<br />

For one thing, despite spawning in-<br />

numerable start-up companies and at-<br />

tracting billions of dollars in investments<br />

from venture capitalists, large investment<br />

banks and American corporate behe-<br />

moths like DuPont and Dow Corning<br />

Corp., PV in the United States is still an<br />

industry dependent on subsidies and in-<br />

centives from individual states and the<br />

federal government. And despite the fact<br />

Rolf Schulten / photon-pictures.com<br />

»<br />

that mainstream publications like »The<br />

New York Times« and »Fortune« consider<br />

PV worthy of regular, sometimes breath-<br />

less coverage, the amount of energy in the<br />

United States generated via solar panels<br />

converting the sun’s rays into electricity<br />

remains infinitesimal, far less than one<br />

percent, the vast majority of it occurring<br />

in just one state – California.<br />

Still, by many accounts, PV looks to<br />

be on the cusp of unprecedented growth<br />

in the United States. Last year, for in-<br />

stance, 356 megawatts (MW) – enough<br />

to power around a quarter of a million<br />

homes – were installed in America, an<br />

increase of 70 percent over 2007. This<br />

year, in the midst of the worst econom-<br />

ic downturn since the Great Depres-<br />

sion, the amount of solar panels being<br />

incorporated into businesses, homes<br />

and as part of large power plants will<br />

undoubtedly rise, with some analysts<br />

expecting a doubling, or more, of last<br />

year’s number (see article, page 50).<br />

Almost every week there are new an-<br />

nouncements of plans for utility-sized<br />

projects. And with the price of solar en-<br />

ergy creeping closer to energy provided<br />

by fossil fuels like oil, gas and coal – a sit-<br />

uation known as grid parity, which solar<br />

advocates describe as being something<br />

akin to Xanadu – many believe that the<br />

United States will not only soon become<br />

the largest world market for PV, but that<br />

America will ultimately turn to the sun<br />

to meet a substantial amount of its pow-<br />

er needs. »There’s nothing stopping us<br />

now,« says Paul Maycock, who headed<br />

up the Department of Energy’s (DOE) PV<br />

program under President Jimmy Carter<br />

in the 1970s, and later started and ran<br />

»PV News«, an industry newsletter.<br />

Which brings us back to the topic of his-<br />

tory. If, as so many historians insist, past is<br />

indeed prologue, then it’s worthwhile to<br />

revisit the evolution of PV in America. It’s<br />

a story of sometimes too exuberant opti-<br />

mism and promise, dogged personalities,<br />

and unlikely alliances. An interesting yarn,<br />

it’s also, hopefully, a tale that can provide<br />

guidance and a measure of caution as the<br />

industry moves forward. Just ask Maycock,<br />

who, 30 years ago, in 1979, wrote a best-<br />

November 2009

»ıı<br />

November 2009 17

Under the Sun<br />

selling book, »A Guide to the Photovoltaic<br />

Revolution.« »It was a bit of a farce in a<br />

way because I still believed we would be<br />

fully economic by 1986,« he says. »I really<br />

thought we were going to make it.«<br />

18<br />

As <strong>PHOTON</strong> launches its coverage<br />

of the American market, we decided<br />

to journey back along the twisty, usu-<br />

ally lonely, road PV has traveled in this<br />

country to reach the point where its<br />

promise as an industry, although no-<br />

where near realized, has at least moved<br />

beyond the abstract. With history as<br />

our teacher, here are some lessons that<br />

we’ve learned on our trip.<br />

Lesson one: Beginnings are messy<br />

The most romantic recounting of<br />

how an invention or an industry is born<br />

goes a little like this: a misunderstood<br />

genius toils in obscurity, obsessed with<br />

an impossible idea until, after a color-<br />

ful »a-ha« moment, a magical break-<br />

through – think Christopher Lloyd in<br />

the movie »Back to the Future.«<br />

Reality is less simple, of course, and<br />

it’s no exaggeration to say that the inven-<br />

tion of the solar cell was the result of a<br />

combination of hard work, luck and ri-<br />

valry. In 1950s America, like today, some<br />

of the most important centers of scien-<br />

tific innovation were sponsored by com-<br />

panies looking for products to take from<br />

the lab to the marketplace. One such<br />

company was Western Bell Telephone,<br />

whose Bell Labs had, in 1947, famously<br />

developed the transistor, one of the es-<br />

sential components for the microproces-<br />

sor that would eventually be created –<br />

and arguably change the world with its<br />

incorporation into personal computers<br />

– a couple of decades later.<br />

With this commercial bent to its sci-<br />

entific inquiries, Bell Labs in the mid-<br />

1950s was looking to develop a device<br />

that could power telephone repeater<br />

stations in remote areas; long telephone<br />

lines needed repeater stations every 50<br />

miles or so to ensure that a signal could<br />

get through and those devices needed<br />

a reliable source of power. The work of<br />

three Bell scientists – Daryl Chapin,<br />

Calvin Fuller and Gerald Pearson – co-<br />

alesced to produce a product the phone<br />

company could use: a so-called »solar<br />

battery,« or the first silicon solar cell.<br />

But it almost never happened. First of<br />

all, Chapin, Fuller and Pearson weren’t<br />

working as a team, at least not initially,<br />

to invent a silicon solar cell. For his<br />

part, Chapin, tasked with solving the<br />

repeater dilemma, was intrigued with<br />

the possibility of tapping sunlight for<br />

ch A n g e d t i m e s: sunpo w e r f o u n d e r<br />

ri c hA r d sw A n s o n, s h o w n here At<br />

c o m pA n y heAdquArters in sAn Jo s e,<br />

belieVes the pV i n d u s t r y is experiencing<br />

A clAssic »l e A r n i n g curVe,« w h i c h is<br />

d r iV i n g d o w n c o s t s A n d h e l p i n g the<br />

i n d u s t r y g r o w m o r e. this, he s Ay s, hA s<br />

neVer hAppened b e f o r e w i t h pV.<br />

power. But his initial attempts using a<br />

selenium cell were fruitless, yielding<br />

not nearly enough electricity for his<br />

purposes. Meanwhile, Fuller and Pear-<br />

son were working together to probe the<br />

electronic possibilities of silicon as a<br />

way to improve transistors; an exten-<br />

sion of earlier work Fuller had done at<br />

Bell in which, by doping silicon with<br />

tiny amounts of lithium, he had cre-<br />

ated a p-n junction, an essential dis-<br />

covery allowing for the creation of<br />

electrical fields in semiconductors.<br />

Then, one day in 1953, the work of<br />

Frederic Neema / photon-pictures.com<br />

the three scientists converged, thanks to<br />

a little bit of luck. After Pearson had laid<br />

out some of the materials he was testing<br />

on his laboratory desk, he noticed some-<br />

thing unusual. The sunlight streaming<br />

in through the lab window hit some of<br />

the experimental silicon lying on his<br />

desk and, because the silicon was hooked<br />

up to a measurement device, registered a<br />

relatively significant electrical current.<br />

Pearson hadn’t expected this reaction<br />

and, frankly, didn’t really believe it. So<br />

he called Morton Prince – who would<br />

later help refine and improve the silicon<br />

cell his colleagues invented – into his of-<br />

fice to make sure he wasn’t seeing things.<br />

He wasn’t, and Pearson soon let Chapin,<br />

whom he knew was struggling, know<br />

about his unexpected silicon discovery.<br />

At first, Pearson, Chapin and Fuller, now<br />

working together, were unable to boost<br />

the efficiency of their silicon solar cell<br />

beyond 4 percent – it needed to be closer<br />

to 6 percent to be a viable power source –<br />

and Bell executives seemed on the verge<br />

of forcing the trio to move on to other,<br />

more commercially promising things.<br />

That is, until a rival lab, RCA, the re-<br />

search arm of the Radio Corporation of<br />

America, scored a major publicity coup –<br />

complete with a presentation at New York’s<br />

Radio City Music Hall – when it unveiled its<br />

so-called nuclear silicon cell, which relied<br />

on highly radioactive strontium-90 instead<br />

of the sun for <strong>PHOTON</strong>s to turn into elec-<br />

tricity. »RCA took out a big ad and splashed<br />

it in the paper,« recalls Morton Prince. »The<br />

management at Bell Labs said what RCA<br />

did with their device is nonsense.«<br />

»<br />

Determined to one-up its rival, Bell<br />

Labs’ managers leaned on the scientists<br />

to fully develop their silicon solar cell.<br />

Ultimately, the Bell solar battery – with<br />

efficiency improvements yielded by<br />

adding boron and arsenic to the sili-<br />

con – generated a stunning fifty million<br />

times more power than its nuclear coun-<br />

terpart. The Bell solar battery was rolled<br />

out to the public over two days, first at<br />

a press conference at Bell’s New Jersey<br />

headquarters, where the solar arrays were<br />

used to turn a 21-inch high Ferris wheel,<br />

and then at Washington, DC’s National<br />

November 2009

Our sister publications<br />

New<br />

Chinese Spanish English German German Italian<br />

Get your free sample copy online or contact us at:<br />

info@photon-international.com<br />

prueba@photon.com.es<br />

info@photon-international.com<br />

probeheft@photon.de<br />

omaggio@photon-online.it<br />

www.photon.info

Under the Sun<br />

Academy of Sciences, where solar power<br />

was employed to play music for the as-<br />

sembled crowd.<br />

Times saw it as important enough to<br />

place on page one, lauding the scientists<br />

for possibly ushering in a new era, »lead-<br />

ing eventually to the realization of one of<br />

mankind’s most cherished dreams – the<br />

harnessing of the almost limitless energy<br />

of the sun for the uses of civilization.«<br />

Lesson two: Don’t believe the hype<br />

20<br />

As John Perlin recounts in »From<br />

Space to Earth: The Story of Solar Elec-<br />

tricity,« the reaction to Bell’s discovery<br />

was nothing short of rapturous. One of<br />

the scientists who had worked on RCA’s<br />

nuclear battery equated the development<br />

with »when aircraft went from propeller<br />

speeds to jet velocities.« The New York<br />

on the bAttlefield: when the u.s. militAry rAn the s pA c e p r o g r A m in the 1950s, it b e c A m e<br />

o n e o f the first big c u s t o m e r s f o r pV, w h i c h helped p o w e r c o m m u n i cA t i o n equipment o n<br />

sAtellites. mo r e recently, the militAry hA s utilized pV, like this system f r o m un i t e d so l A r,<br />

If there’s one timeless lesson to be<br />

learned from the earliest days of the<br />

silicon solar cell, perhaps it’s this: be<br />

exceedingly wary of anybody, whether<br />

a journalist or some other self-described<br />

to p o w e r c o m m u n i cA t i o n s o n the bAttlefield<br />

expert, loudly proclaiming the beginning<br />

of a new era in civilization. Very quickly,<br />

the issue that has dogged PV right up<br />

to this day became all too apparent. It<br />

turned out that electricity produced by<br />

these magic little silicon cells cost way<br />

too much to be anything but a novelty,<br />

let alone be used as a power source for<br />

America. In fact, as Perlin notes, despite<br />

developments at Bell Labs that fairly<br />

quickly doubled the efficiency of solar<br />

cells, Chapin calculated that – with a<br />

one-watt cell costing $286 – it would<br />

cost a 1956 homeowner over $1.4 mil-<br />

lion to power their home with the sun.<br />

This harsh economic reality quickly<br />

tempered any enthusiasm Bell Labs<br />

managers had for their highly publi-<br />

cized new device. After setting up a pi-<br />

lot line to make enough cells to actually<br />

produce some panels, the lab’s foray into<br />

solar came to a rather abrupt end. »They<br />

ran that for about half a year and then<br />

cut it off because it was too expensive to<br />

make these devices,« says Prince.<br />

United Solar Systems Corp.<br />

That very well might have been the<br />

end of PV in America. That is, if another<br />

customer, one not exactly known as a<br />

bargain hunter, hadn’t come along. In<br />

the late 1950s, the Cold War moved be-<br />

yond just a geopolitical chess match on<br />

terra firma to become a duel thousands<br />

of miles above Earth when the Soviets<br />

launched their Sputnik satellite in 1957.<br />

Determined not to be outdone, the Unit-<br />

ed States government accelerated its own<br />

space program, quickly developing a<br />

fleet of rockets and satellites. What these<br />

devices lacked – a lightweight, reliable<br />

and long-lasting source of power to run<br />

communication equipment – presented<br />

the first substantial market for PV.<br />

By that time, Prince had left Bell Labs<br />

to join Hoffman Electronics, one of the<br />

first companies to actually make solar<br />

cells, and he made the pitch to military<br />

brass, who ran the space program before<br />

NASA was created. Later on, the military<br />

would employ PV to help supply power<br />

to communication devices used by sol-<br />

diers, and special forces even utilized PV<br />

during the Vietnam War to power heat-<br />

sensitive metering gadgets to count foot<br />

traffic on the Ho Chi Minh Trail. But be-<br />

fore all that was possible, Prince had to<br />

give them the hard sell. »I showed them<br />

what we were able to do and convinced<br />

them to use PV for satellites,« he recalls.<br />

On St. Patrick’s Day of 1958, the Van-<br />

guard satellite was launched, carrying<br />

with it electronic equipment powered<br />

by Hoffman solar cells. »PV made the<br />

space program possible, really,« he says.<br />

»And the space program made PV pos-<br />

sible, too.«<br />

»<br />

While the space race may have thrown<br />

PV a lifeline – by 1972, 1,000 U.S. and<br />

Soviet satellites used it for power – it did<br />

very little to bring the price down in a<br />

way that would allow for use closer to<br />

home, a fact that was highlighted by a<br />

visit Prince and his boss, Leslie Hoff-<br />

man, paid to the newly formed NASA in<br />

1960. Prince remembers visiting Wash-<br />

ington, DC with the hopes of convinc-<br />

ing a NASA official to standardize solar<br />

cells; up until then, every cell Hoffman<br />

made was specially built, and expensive,<br />

November 2009

November 2009 21

Under the Sun<br />

made to uniquely fit each new satellite,<br />

a process that required training new<br />

workers with every order. »We suggested<br />

that they standardize solar cells and we<br />

would make them continuously and<br />

have them in inventory,« he says. »But<br />

they wouldn’t buy that.«<br />

Lesson three: No gets you nowhere<br />

22<br />

If one still relevant guiding principle<br />

from the early days of PV is to be skepti-<br />

cal of too much hype, another is that<br />

when most people see dim prospects of<br />

success there are always a few who see<br />

opportunity. Such was the case with<br />

two scientists, Peter Varadi and Joseph<br />

Lindmayer, who were working in the<br />

early 1970s at COMSAT, the Communi-<br />

cation Satellite Corp.’s research lab.<br />

COMSAT was one of the few busi-<br />

nesses involved in developing PV for<br />

space and both Lindmayer and Varadi<br />

earned a good living improving solar<br />

cells and managing the company’s phys-<br />

ics and chemistry labs, respectively.<br />

Things were running smoothly enough<br />

at COMSAT, so Varadi and Lindmayer,<br />

maybe a little bored, figured it was time<br />

to do something new. As 1972 came to<br />

a close, Varadi, a Hungarian native who<br />

escaped the country before the Soviets<br />

invaded in 1956, suggested to COMSAT<br />

managers, a bunch of retired Air Force<br />

generals, that the lab should investigate<br />

ways to utilize PV on earth.<br />

Nothing doing, the generals told Vara-<br />

di and Lindmayer. Rather than settle back<br />

into their cushy jobs, the duo, fortified by<br />

Lindmayer still moved ahead with their<br />

plans. Or at least they tried. Convinced<br />

that their idea to bring down the cost<br />

of PV and make it suitable for so-called<br />

terrestrial applications was patently bril-<br />

liant, Varadi says he figured all they had<br />

to do was send their business plan to<br />

venture capitalists and the money would<br />

start flooding in. Twenty presentations<br />

later, Solarex remained penniless. »If we<br />

were very successful, they learned how<br />

to spell photovoltaic,« says Varadi, who<br />

attributes their failure to raise much<br />

money to their complete lack of business<br />

experience and the fact that the venture<br />

capitalists had never even heard of PV.<br />

Still undeterred, Varadi and Lind-<br />

mayer managed to scrounge enough<br />

money from friends and relatives, un-<br />

derstanding that it meant they would<br />

have to make Solarex a viable business<br />

quickly. And they did, turning a profit<br />

in just eight months, while also validat-<br />

ing their hunch that, yes, PV did, in fact,<br />

have a place on earth.<br />

And just who on earth was buying the<br />

PV that Solarex was making? There were<br />

small markets, Varadi says, which were at-<br />

tracted to solar for its economics, strange<br />

as that may sound to an industry whose<br />

perpetual bugaboo has been cost. For So-<br />

larex, those earliest commercial markets<br />

were not of the grid-tied commercial,<br />

residential and utility type so focused<br />

on these days: customers were businesses<br />

and institutions that saw in PV a cheaper,<br />

more reliable alternative to batteries.<br />

Meeting the telecommunication<br />

»A g u y fr o m l.A. c A m e up in A po r s c h e wi t h pV in th e bA c k«: th At’s ho w Jo h n schAeffer, seen he r e, t h e fo u n d e r of re A l go o d s, A<br />

n o r t h e r n cAliforniA instAller, f i r s t be g A n selling mo d u l e s to of f-gr i d us e r s bA c k in th e 1970s. to d A y, 95 percent of hi s business is<br />

a few glasses of champagne, decided on<br />

New Year’s Eve in 1973 to take a stab at<br />

bringing PV down to earth. »We decided<br />

that to hell with the generals, we were go-<br />

ing to do it ourselves,« Varadi said. Still at<br />

the party, they settled on a name for their<br />

still fictitious company: Solarex.<br />

Even after the euphoria of the New<br />

Year’s celebration wore off, Varadi and<br />

s o l A r, m o s t of it gr i d-tied<br />

needs of government institutions like<br />

the United States Forest Service and the<br />

Bureau of Land Management and police<br />

departments brought in a lot of initial<br />

business, Varadi says. »They were the<br />

first serious customers we went after,« he<br />

says. »For police in Arizona, they could<br />

get no communications from repeater<br />

stations in the mountains so they put in<br />

solar.« Lights on navigational buoys also<br />

needed power and it was a lot cheaper<br />

to use PV – even at $20 per watt -than it<br />

was to outfit a boat to go swap out a non-<br />

rechargable battery every time it died,<br />

which could add up to a bill of around<br />

$6,000. Varadi, who outfitted buoys in<br />

the Suez Canal with PV systems in the<br />

mid-1970s, also found willing custom-<br />

November 2009

ers in telecommunications companies,<br />

who needed equipment in remote areas<br />

to function with as little hands-on main-<br />

tenance as possible.<br />

Lesson four: Your enemies<br />

may be your friends<br />

It has been axiomatic in the PV<br />

industry that when oil prices rise,<br />

interest in solar goes up; as prices<br />

fall, so too does enthusiasm for solar.<br />

But oil and PV have had a more direct<br />

relationship than that for a long time.<br />

After the space program was ratcheted<br />

back in the 1970s, in fact, big oil compa-<br />

nies became one of the main customers<br />

for the few PV companies around. Bill<br />

Yerkes knows this from experience. Like<br />

Varadi, Yerkes is one of the pioneers of the<br />

American PV industry, who also got his<br />

start in PV via the space program when<br />

he worked at Spectrolab, another sup-<br />

November 2009 23<br />

»<br />

plier of panels for satellites and rockets.<br />

After Spectrolab was sold in 1975, Ye-<br />

rkes was ousted as president of the com-<br />

pany, giving him one of those rare op-<br />

portunities to redirect his life. »I was out<br />

of a job and I decided I knew a lot about<br />

solar panels and had a lot of ideas about<br />

how to do it,« he says. Yerkes leased a<br />

4,000 square foot garage in Chatsworth,<br />

California, bought some wafers, built his<br />

very own laminator and started trying<br />

Rolf Schulten / photon-pictures.com

Under the Sun<br />

to figure out how to make low-cost solar<br />

cells and panels. For help, he hired six<br />

of his daughter’s high school classmates,<br />

who, once the processing line was up and<br />

running, would take 1,000 3-inch diam-<br />

eter wafers and assemble them into 33<br />

panels every week, selling them for about<br />

$300 apiece. »By Friday, we had the UPS<br />

truck come and take the boxes away, that<br />

was our production method.«<br />

24<br />

In the mid- to late 1970s, in particu-<br />

lar, Yerkes found willing customers in<br />

companies like Exxon, ARCO, Amoco,<br />

and Shell because PV supplied an an-<br />

swer to very specific problems they<br />

faced. In particular, offshore oil rigs,<br />

which were sprouting all around the<br />

Gulf of Mexico because of new discov-<br />

eries, needed blinking lights and fog-<br />

horns to avoid boat collisions. PV got<br />

an additional boost in 1978 when the<br />

Environmental Protection Agency out-<br />

lawed the standard practice of dump-<br />

ing batteries into the ocean when they<br />

ceased functioning.<br />

Oil and gas producers also found a<br />

use for PV in keeping their well casings<br />

and pipelines free of corrosion, which<br />

was accomplished by generating a cur-<br />

rent that broke down any corrosion that<br />

might stop up their flow. Again, because<br />

oil and gas fields tended to be in remote<br />

spots, far from cheap grid power, PV be-<br />

came a relatively inexpensive solution.<br />

»Mostly it was businesses that had to get<br />

something done and were doing it with<br />

primary batteries,« says Yerkes. »It was<br />

not romantic. Screw the cause. It was a<br />

cheaper way to do something.«<br />

Eventually, oil companies became<br />

more than just customers of PV com-<br />

panies – they became their owners. In<br />

1983, Solarex was bought by Amoco; Ye-<br />

rkes sold his company to ARCO in 1977,<br />

becoming ARCO Solar; Exxon and Mo-<br />

bil, too, had their own solar arms, and<br />

they collectively invested millions in ef-<br />

forts to lower the price of PV and make it<br />

a more mainstream power source.<br />

Why? For one thing, they could afford<br />

to lose money. The price of oil had hit<br />

unprecedented highs following the 1973<br />

OPEC oil embargo and the companies<br />

had plenty of cash to invest in promis-<br />

ing technologies. »Companies had dif-<br />

ferent thinking about it, but generally it<br />

was, well, if this stuff really works, we<br />

want to be a part of it,« says Bill Rever,<br />

an almost three-decade veteran of the PV<br />

industry, who got his start at Solarex and<br />

now works for BP Solar. »It was a hedge,<br />

a pretty insignificant hedge by oil com-<br />

pany standards.«<br />

But what was petty cash by the<br />

standards of the oil companies was big<br />

money for PV. It ultimately resulted in<br />

some of the first large-scale solar pow-<br />

er developments in the United States,<br />

such as ARCO Solar’s 5 megawatt plant<br />

on California’s Carrizo Plain. It also led<br />

to suspicions that oil companies were<br />

trying to snuff out the PV industry in<br />

its infancy and, like the space program,<br />

actually kept it alive. »I must say the oil<br />

companies were very much interested<br />

and Amoco was a marvelous investor,«<br />

says Varadi. »They say oil companies<br />

tried to kill solar. No, I can testify it was<br />

a pleasure to deal with them.«<br />

Lesson five: What the government<br />

makes, it can also destroy<br />

Oil can also be credited with the first<br />

real government push – a precursor to<br />

the Obama administration’s efforts to-<br />

day – to make PV an important part of<br />

the country’s energy mix. Just as the<br />

Cold War presented an opportunity for<br />

PV, the OPEC oil embargo, and subse-<br />

quent gas lines and shortages, was yet<br />

another geopolitical event that briefly<br />

benefited the industry because it had<br />

America scrambling for ways to wean<br />

itself off foreign oil. »It was driven by<br />

energy security,« says Neville Williams,<br />

author of »Chasing the Sun,« who served<br />

as an official promoting solar energy<br />

during the Carter administration. »A<br />

bunch of us on the inside of DOE and<br />

energy policy felt it was a bad thing to<br />

be so reliant on foreign oil.«<br />

Determined to break that depen-<br />

dence, Carter, who famously urged<br />

Americans to turn their thermostats<br />

down in winter and wear warmer<br />

clothes to save energy, gave a speech to<br />

Congress about solar and set a goal of<br />

generating 20 percent of the country’s<br />

energy from the sun and hydropower<br />

by the year 2000. Paul Maycock was<br />

brought in to run the PV program at<br />

DOE and succeeded in growing the bud-<br />

get to around $150 million per year.<br />

Maycock had an ambitious agenda,<br />

one that included focusing on research<br />

and development as a way to bring<br />

down costs and, during his tenure,<br />

funded 50 megawatts in solar demon-<br />

stration projects. These government-<br />

funded installations were large for the<br />

time and included the world’s first 100<br />

kilowatt array in Natural Bridges, Utah.<br />

This flurry of activity prompted a good<br />

deal of optimism that PV was on the<br />

cusp of an explosion. »The industry has<br />

gone through phases of optimism,« says<br />

Timothy Ball, who was one of install-<br />

ers of the Utah array and is now presi-<br />

dent of Mainstream Energy in San Luis<br />

Obispo, California, a firm that invests<br />

in and advises PV companies mostly on<br />

the downstream end of the business.<br />

»Around the end of the 1970s, the in-<br />

dustry was in one of those phases of op-<br />

timism and there was a lot of discussion<br />

around how the cost of PV could drop to<br />

where markets could expand.«<br />

But it’s worth remembering that, at<br />

least in a democracy, policies come and go<br />

with elections. And when Ronald Reagan<br />

defeated Jimmy Carter in 1980 to become<br />

president, the days of major government<br />

support were shelved. »His people said,<br />

who needs solar? Put it on the shelf like a<br />

good wine and wait until we need it,« says<br />

Maycock, who recalls the pain he felt at<br />

having to slash funding for work going on<br />

at the Jet Propulsion Lab to try and get the<br />

cost of PV down to $2 per watt by 1986.<br />

»I resigned in March of 1981 when the<br />

budget numbers came through.«<br />

As funding for government projects<br />

and research dried up, so too did interest<br />

from large companies, like Bechtel, who<br />

had entered PV and successfully landed<br />

contracts for the largest DOE develop-<br />

ments. By the mid-1980s, they were all<br />

gone, says Ball. »It was no longer the<br />

equivalent of building the Space Shuttle<br />

November 2009

A m o d e s t b e g i n n i n g: in t e n s e m e d iA c o V e r A g e s w i r l e d A r o u n d the i nV e n t i o n o f the first silicon s o l A r c e l l At bell lAbs, i n c lu d i n g A f r o n t pA g e s t o r y<br />

in »the new yo r k ti m e s«. Am o n g the w A y s bell d e m o n s t r At e d it w A s by p o w e r i n g this 21-i n c h tAll ferris wheel<br />

or something like that,« he says. »It was<br />

more like standard business and their<br />

cost structure was better suited for much<br />

larger projects, which didn’t exist.«<br />

Lesson six: Customers come from the<br />

strangest places<br />

The area a few hours north of San<br />

Francisco, in Humboldt and Mendocino<br />

counties, has long been a place where<br />

people flock to get away: sometimes<br />

for a weekend respite from the crowded<br />

city, sometimes for a lifetime away from<br />

modern society. In the early 1970s, after<br />

graduating from the University of Cali-<br />

fornia at Berkeley, John Schaeffer made<br />

what was then a familiar pilgrimage for<br />

a small number of young people disaf-<br />

fected by tumultuous events like the<br />

Vietnam War and 20th century life in<br />

general, taking up residence on what he<br />

terms an »archetypal hippy commune«<br />

on 290 acres in Mendocino.<br />

There, he and his fellow New Age<br />

pioneers lived off the grid, with no<br />

electricity, no phone and no running<br />

water. That is, until Schaeffer, in 1976,<br />

discovered some 12-volt batteries in a<br />

hardware store and hooked them up to<br />

a car battery. »All of a sudden, in the<br />

November 2009 25<br />

»<br />

middle of the woods, in a commune of<br />

Luddites who hated technology, there<br />

was light,« he says. »It was very contro-<br />

versial, nobody wanted electricity.«<br />

Well, not quite everyone eschewed<br />

electricity. Schaeffer soon discovered<br />

that there were quite a few folks who<br />

were tired of using candles and kerosene<br />

for light, enough for him to launch a<br />

company, Real Goods, in 1978, to pro-<br />

vide fellow off-grid rural dwellers prod-<br />

ucts that could bring power and conve-<br />

nience to their Spartan existence.<br />

A chance visitor to his store – which, to<br />

this day, sells composters, solar hot water<br />

National Renewable Energy Laboratory (NREL)

Under the Sun<br />

heaters and books to aid remote living –<br />

got Schaeffer into the business of selling<br />

PV. »A guy from L.A. came up in a Porsche<br />

with PV in the back of his car, he said he<br />

was coming from the space industry,«<br />

says Schaeffer. Intrigued at the possibil-<br />

ity of using PV to charge batteries to power<br />

homes, Schaeffer bought 100 9-watt mod-<br />

ules to test if he could sell them.<br />

26<br />

In the late 1970s into the 1980s, then,<br />

as Reagan came into office and elimi-<br />

nated funding for DOE demonstration<br />

projects, and as the oil companies tried,<br />

and failed, to make solar profitable, a<br />

new market emerged to help keep PV<br />

alive. Off-grid denizens of a particular<br />

sort were especially enthusiastic about<br />

deriving power from the sun. »It was a<br />

good fit because there were thousands of<br />

people living off the grid who had money<br />

because they were growing marijuana,«<br />

says David Katz, president of AEE Solar in<br />

Humboldt County in northern Califor-<br />

nia. »That’s how they financed it.«<br />

Pot growers in northern Califor-<br />

nia and elsewhere didn’t typically use<br />

PV for cultivation of their cash crops<br />

– regular sunlight was good for that –<br />

but instead as a source of electricity for<br />

their homes. Bringing in grid power<br />

would have necessitated lots of unwel-<br />

come visitors, any one of whom might<br />

have noticed the illegal farming opera-<br />

tions and tipped off the authorities. PV<br />

didn’t have that problem and pot farm-<br />

ers quickly became a significant mar-<br />

ket. »That’s how we got our start,« says<br />

Schaeffer. »Thank God for those early<br />

growers who really built the industry.«<br />

Even the manufacturers of PV took<br />

notice. One day a Learjet from ARCO<br />

Solar landed at a tiny airport in Wil-<br />

lits, California. »I think it was the first<br />

jet that had come to the airport,« says<br />

Schaeffer. »They wanted to come into<br />

the store first hand and find out why<br />

all their photovoltaics were selling to a<br />

little store called Real Goods.«<br />

Lesson seven: Faraway events matter<br />

Had nothing changed, PV would like-<br />

ly have remained a relatively obscure in-<br />

dustry, supplying tiny, niche markets.<br />

Even Schaeffer says that, at the begin-<br />

ning, 95 percent of his business was<br />

non-solar and that virtually every bit of<br />

PV he sold was for off-grid applications.<br />

Certainly, there were blips of demand<br />

for PV, driven, as in the past, by major<br />

events, like the fear of what would hap-<br />

pen when the world hit the year 2000.<br />

»We’d get Mormons or survivalists in<br />

Idaho that wanted 20 PVs Fed-Ex’d to<br />

them and they had to arrive by Friday be-<br />

pV h i g h: mAriJuAnA fArmers, like this o n e in northern cAliforniA, h AV e l o n g been big<br />

purchA sers o f pV (n o t i c e the r o o f t o p system) b e c A u s e it A l l o w s them to liVe discretely o f f<br />

cause the apocalypse was on Saturday,«<br />

he says. »It didn’t matter what it cost.«<br />

Today, though, 95 percent of Real<br />

Goods’ business is with PV and virtually<br />

all of it is grid-tied. And in many ways,<br />

the transformation of Real Goods, now<br />

part of Gaiam Inc., a publicly traded<br />

company, is a microcosm of an indus-<br />

try that has matured. What happened?<br />

In short, the industry got real, thanks<br />

to a host of different factors, many of<br />

which originated far, far away. In the<br />

early to mid-1990s, Germany and Japan<br />

got serious about boosting the amount<br />

of energy they generated from the sun,<br />

and launched attractive incentives to<br />

encourage people to install PV on their<br />

homes.<br />

the g r i d A n d still e n J o y m o d e r n c o n V e n i e n c e s<br />

This created a new market for Ameri-<br />

can manufacturers of PV, who had been<br />

satisfying the small off-grid domestic<br />

demand and exporting more to devel-<br />

oping countries that used solar to sup-<br />

ply electricity to light their homes. »It<br />

was a lot of exporting out of the United<br />

States,« says Rever of BP Solar, who<br />

says other little market segments, like<br />

powering highway traffic signs, added<br />

up to something, although not much.<br />

»Dribs and drabs added up to a modest<br />

market.«<br />

The ripples from overseas eventually<br />

reached American shores. In 1998, Cali-<br />

fornia launched an incentive program<br />

to encourage PV installations, one that<br />

has been expanded and added to ever<br />

since. Then in 2005, as part of the Ener-<br />

gy Policy Act, the federal government’s<br />

investment tax credit (ITC) launched a<br />

subsidy that has helped drive demand<br />

for PV from individuals, businesses<br />

November 2009

and, these days, utilities and investors.<br />

»It was like a little plant in the desert. It<br />

didn’t have the spring rain until it got<br />

the 30-percent tax credit,« says Rever.<br />

»Then we got the credit and all of a sud-<br />

den you have a big bush.« In addition<br />

to the tax credit, there are now a raft of<br />

state subsidies and incentives to encour-<br />

age PV installations as well as renew-<br />

able energy portfolio standards, which<br />

mandate that utilities generate a certain<br />

amount of energy from wind, solar and<br />

other renewables.<br />

Taken together, these initiatives<br />

– along with concerns about climate<br />

change and hopes that renewable ener-<br />

gy can boost economic growth – have<br />

done what past efforts haven’t: create a<br />

real American market. »So much capi-<br />

tal and production capacity has gone<br />

into the industry that it did what we<br />

all said needed to be done, which is get<br />

real and get big,« says Mike Stern, who<br />

got his start working for ARCO Solar<br />

and is now chief operating officer of<br />

Woodland Hills, California-based proj-<br />

ect developer Solar Electric Solutions.<br />

All of this, Stern insists, has helped the<br />

industry reach the critical mass it needs<br />

to capture economies of scale and drive<br />

down prices. »That is the fundamental<br />

difference and that is why this time it’s<br />

for real.«<br />

Lesson eight: Don’t predict the future<br />

Back at SunPower headquarters, R ich-<br />

ard Swanson, the company’s founder<br />

winces in pain. It may be due to the fact<br />

that he’s contending with a broken rib<br />

from a sailing accident. But then again,<br />

for a guy whose office is adorned with<br />

a drawing of Don Quixote, it may just<br />

be a reflexive response to hearing that<br />

plenty of people are so confident about<br />

the industry’s prospects. »That’s kind of<br />

ominous,« he says.<br />

Swanson has lived through enough<br />

of this history that his caution is un-<br />

derstandable. Swanson first got into PV<br />

after finishing up his PhD in semicon-<br />

ductor devices in the 1970s and figur-<br />

ing, wrongly, it turns out, that the truly<br />