You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

!"#$%#&'()*)+'<br />

Malta Business Review | SPECIAL EDITION<br />

budget <strong>2016</strong> infographic review<br />

global economic index<br />

Malta Business Review | SPECIAL EDITION<br />

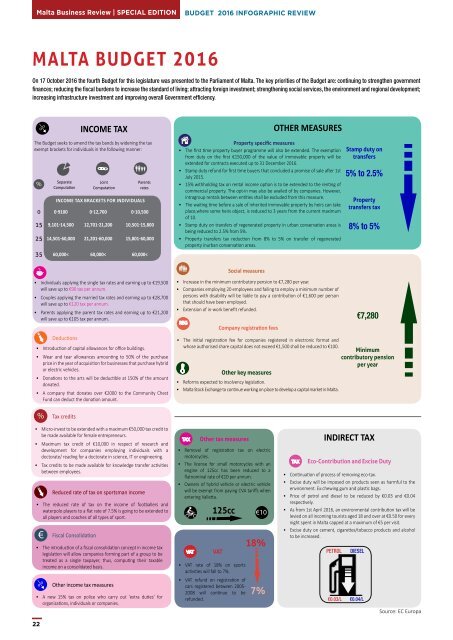

MALTA BUDGET <strong>2016</strong><br />

The Global Competitiveness Index 2015–<strong>2016</strong> Rankings<br />

On 17 October <strong>2016</strong> the fourth Budget for this legislature was presented to the Parliament of Malta. The key priorities of the Budget are: continuing to strengthen government<br />

finances; reducing the fiscal burdens to increase the standard of living; attracting foreign investment; strengthening social services, the environment and regional development;<br />

increasing infrastructure investment and improving overall Government efficiency.<br />

0<br />

0<br />

The Budget seeks to amend the tax bands by widening the tax<br />

exempt brackets for individuals in the fol<strong>low</strong>ing manner:<br />

%<br />

0<br />

15<br />

25<br />

35<br />

Separate<br />

Computation<br />

Income tax brackets for individuals<br />

0-9100<br />

0-12,700 0-10,500<br />

9,101-14,500<br />

14,501-60,000<br />

60,000<<br />

INCOME TAX<br />

Joint<br />

Computation<br />

12,701-21,200<br />

21,201-60,000<br />

60,000<<br />

Parents<br />

rates<br />

10,501-15,800<br />

15,801-60,000<br />

60,000<<br />

• Individuals applying the single tax rates and earning up to €19,500<br />

will save up to €90 tax per annum.<br />

• Couples applying the married tax rates and earning up to €28,700<br />

will save up to €120 tax per annum.<br />

• Parents applying the parent tax rates and earning up to €21,200<br />

will save up to €105 tax per annum.<br />

Deductions<br />

• Introduction of capital al<strong>low</strong>ances for office buildings.<br />

• Wear and tear al<strong>low</strong>ances amounting to 50% of the purchase<br />

price in the year of acquisition for businesses that purchase hybrid<br />

or electric vehicles.<br />

• Donations to the arts will be deductible at 150% of the amount<br />

donated.<br />

• A company that donates over €2000 to the Community Chest<br />

Fund can deduct the donation amount.<br />

%<br />

Tax credits<br />

• Micro-invest to be extended with a maximum €50,000 tax credit to<br />

be made available for female entrepreneurs.<br />

• Maximum tax credit of €10,000 in respect of research and<br />

development for companies employing individuals with a<br />

doctorate/ reading for a doctorate in science, IT or engineering.<br />

• Tax credits to be made available for knowledge transfer activities<br />

between employees.<br />

Reduced rate of tax on sportsman income<br />

• The reduced rate of tax on the income of footballers and<br />

waterpolo players to a flat rate of 7.5% is going to be extended to<br />

all players and coaches of all types of sport.<br />

€<br />

0<br />

0<br />

Fiscal Consolidation<br />

• The introduction of a fiscal consolidation concept in income tax<br />

legislation will al<strong>low</strong> companies forming part of a group to be<br />

treated as a single taxpayer, thus, computing their taxable<br />

income on a consolidated basis.<br />

Other income tax measures<br />

• A new 15% tax on police who carry out ‘extra duties’ for<br />

organizations, individuals or companies.<br />

TAX<br />

VAT<br />

Other tax measures<br />

• Removal of registration tax on electric<br />

motorcycles.<br />

• The license for small motorcycles with an<br />

engine of 125cc has been reduced to a<br />

flatnominal rate of €10 per annum.<br />

• Owners of hybrid vehicle or electric vehicle<br />

will be exempt from paying CVA tariffs when<br />

entering Valletta.<br />

125cc €10<br />

VAT<br />

• VAT rate of 18% on sports<br />

activities will fall to 7%.<br />

• VAT refund on registration of<br />

cars registered between 2005-<br />

2008 will continue to be<br />

refunded.<br />

18%<br />

7%<br />

OTHER MEASURES<br />

Property specific measures<br />

• The first time property buyer programme will also be extended. The exemption<br />

from duty on the first €150,000 of the value of immovable property will be<br />

extended for contracts executed up to 31 December <strong>2016</strong>.<br />

• Stamp duty refund for first time buyers that concluded a promise of sale after 1st<br />

July 2015.<br />

• 15% withholding tax on rental income option is to be extended to the renting of<br />

commercial property. The opt-in may also be availed of by companies. However,<br />

intragroup rentals between entities shall be excluded from this measure.<br />

• The waiting time before a sale of inherited immovable property by heirs can take<br />

place,where some heirs object, is reduced to 3 years from the current maximum<br />

of 10.<br />

• Stamp duty on transfers of regenerated property in urban conservation areas is<br />

being reduced to 2.5% from 5%.<br />

• Property transfers tax reduction from 8% to 5% on transfer of regenerated<br />

property inurban conservation areas.<br />

Social measures<br />

• Increase in the minimum contributory pension to €7,280 per year.<br />

• Companies employing 20 employees and failing to employ a minimum number of<br />

persons with disability will be liable to pay a contribution of €1,600 per person<br />

that should have been employed.<br />

• Extension of in-work benefit refunded.<br />

REG<br />

Company registration fees<br />

TAX<br />

INDIRECT TAX<br />

Eco-Contribution and Excise Duty<br />

• Continuation of process of removing eco-tax.<br />

• Excise duty will be imposed on products seen as harmful to the<br />

environment. Ex:chewing gum and plastic bags.<br />

• Price of petrol and diesel to be reduced by €0.03 and €0.04<br />

respectively.<br />

• As from 1st April <strong>2016</strong>, an environmental contribution tax will be<br />

levied on all incoming tourists aged 18 and over at €0.50 for every<br />

night spent in Malta capped at a maximum of €5 per visit.<br />

• Excise duty on cement, cigarettes/tobacco products and alcohol<br />

to be increased.<br />

petrol<br />

€0.03/L<br />

Stamp duty on<br />

transfers<br />

5% to 2.5%<br />

Property<br />

transfers tax<br />

8% to 5%<br />

• The initial registration fee for companies registered in electronic format and<br />

whose authorised share capital does not exceed €1,500 shall be reduced to €100.<br />

Minimum<br />

contributory pension<br />

per year<br />

Other key measures<br />

• Reforms expected to insolvency legislation.<br />

• Malta Stock Exchange to continue working on place to develop a capital market in Malta.<br />

diesel<br />

€0.04/L<br />

€7,280<br />

Source: EC Europa<br />

Economy Score 1 Prev. 2 Trend 3<br />

Switzerland 5.76 1<br />

Singapore 5.68 2<br />

United States 5.61 3<br />

Germany 5.53 5<br />

Netherlands 5.50 8<br />

Japan 5.47 6<br />

Hong Kong SAR 5.46 7<br />

Finland 5.45 4<br />

Sweden 5.43 10<br />

United Kingdom 5.43 9<br />

Norway 5.41 11<br />

Denmark 5.33 13<br />

Canada 5.31 15<br />

Qatar 5.30 16<br />

Taiwan, China 5.28 14<br />

New Zealand 5.25 17<br />

United Arab Emirates 5.24 12<br />

Malaysia 5.23 20<br />

Belgium 5.20 18<br />

Luxembourg 5.20 19<br />

Australia 5.15 22<br />

France 5.13 23<br />

Austria 5.12 21<br />

Ireland 5.11 25<br />

Saudi Arabia 5.07 24<br />

Korea, Rep. 4.99 26<br />

Israel 4.98 27<br />

China 4.89 28<br />

Iceland 4.83 30<br />

Estonia 4.74 29<br />

Czech Republic 4.69 37<br />

Thailand 4.64 31<br />

Spain 4.59 35<br />

Kuwait 4.59 40<br />

Chile 4.58 33<br />

Lithuania 4.55 41<br />

Indonesia 4.52 34<br />

Portugal 4.52 36<br />

Bahrain 4.52 44<br />

Azerbaijan 4.50 38<br />

Poland 4.49 43<br />

Kazakhstan 4.49 50<br />

Italy 4.46 49<br />

Latvia 4.45 42<br />

Russian Federation 4.44 53<br />

Mauritius 4.43 39<br />

Philippines 4.39 52<br />

Economy Score 1 Prev. 2 Trend 3<br />

Malta 4.39 47<br />

South Africa 4.39 56<br />

Panama 4.38 48<br />

Turkey 4.37 45<br />

Costa Rica 4.33 51<br />

Romania 4.32 59<br />

Bulgaria 4.32 54<br />

India 4.31 71<br />

Vietnam 4.30 68<br />

Mexico 4.29 61<br />

Rwanda 4.29 62<br />

Slovenia 4.28 70<br />

Macedonia, FYR 4.28 63<br />

Colombia 4.28 66<br />

Oman 4.25 46<br />

Hungary 4.25 60<br />

Jordan 4.23 64<br />

Cyprus 4.23 58<br />

Georgia 4.22 69<br />

Slovak Republic 4.22 75<br />

Sri Lanka 4.21 73<br />

Peru 4.21 65<br />

Montenegro 4.20 67<br />

Botswana 4.19 74<br />

Morocco 4.17 72<br />

Uruguay 4.09 80<br />

Iran, Islamic Rep. 4.09 83<br />

Brazil 4.08 57<br />

Ecuador 4.07 n/a<br />

Croatia 4.07 77<br />

Guatemala 4.05 78<br />

Ukraine 4.03 76<br />

Tajikistan 4.03 91<br />

Greece 4.02 81<br />

Armenia 4.01 85<br />

Lao PDR 4.00 93<br />

Moldova 4.00 82<br />

Namibia 3.99 88<br />

Jamaica 3.97 86<br />

Algeria 3.97 79<br />

Honduras 3.95 100<br />

Trinidad and Tobago 3.94 89<br />

Cambodia 3.94 95<br />

Côte d’Ivoire 3.93 115<br />

Tunisia 3.93 87<br />

Albania 3.93 97<br />

Serbia 3.89 94<br />

Economy Score 1 Prev. 2 Trend 3<br />

El Salvador 3.87 84<br />

Zambia 3.87 96<br />

Seychelles 3.86 92<br />

Dominican Republic 3.86 101<br />

Kenya 3.85 90<br />

Nepal 3.85 102<br />

Lebanon 3.84 113<br />

Kyrgyz Republic 3.83 108<br />

Gabon 3.83 106<br />

Mongolia 3.81 98<br />

Bhutan 3.80 103<br />

Argentina 3.79 104<br />

Bangladesh 3.76 109<br />

Nicaragua 3.75 99<br />

Ethiopia 3.75 118<br />

Senegal 3.73 112<br />

Bosnia & Herzegovina 3.71 n/a<br />

Cape Verde 3.70 114<br />

Lesotho 3.70 107<br />

Cameroon 3.69 116<br />

Uganda 3.66 122<br />

Egypt 3.66 119<br />

Bolivia 3.60 105<br />

Paraguay 3.60 120<br />

Ghana 3.58 111<br />

Tanzania 3.57 121<br />

Guyana 3.56 117<br />

Benin 3.55 n/a<br />

Gambia, The 3.48 125<br />

Nigeria 3.46 127<br />

Zimbabwe 3.45 124<br />

Pakistan 3.45 129<br />

Mali 3.44 128<br />

Swaziland 3.40 123<br />

Liberia 3.37 n/a<br />

Madagascar 3.32 130<br />

Myanmar 3.32 134<br />

Venezuela 3.30 131<br />

Mozambique 3.20 133<br />

Haiti 3.18 137<br />

Malawi 3.15 132<br />

Burundi 3.11 139<br />

Sierra Leone 3.06 138<br />

Mauritania 3.03 141<br />

Chad 2.96 143<br />

Guinea 2.84 144<br />

Note: The Global Competitiveness Index captures the fundamentals of an economy. Recent developments, including currency (e.g., Switzerland) and commodity price fluctuations (e.g., Azerbaijan,<br />

Qatar, Saudi Arabia), geopolitical uncertainties (e.g., Ukraine), and security issues (e.g., Turkey) must be kept in mind when interpreting the results.<br />

1 Scale ranges from 1 to 7.<br />

2 This shows the rank out of the 144 economies in the GCI 2014–2015.<br />

3 The trend line shows the evolution in percentile rank since 2007; breaks in the trend line reflect years when the economy was not included in the GCI.<br />

The Global Competitiveness Report 2015–<strong>2016</strong> | xv<br />

22 © 2015 World Economic Forum<br />

www.maltabusinessreview.net 23<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

47<br />

Advanced<br />

Economies<br />

Middle East,<br />

North Africa, and Pakistan<br />

48<br />

49<br />

50<br />

51<br />

52<br />

53<br />

54<br />

55<br />

56<br />

57<br />

58<br />

59<br />

60<br />

61<br />

62<br />

63<br />

64<br />

65<br />

66<br />

67<br />

68<br />

69<br />

70<br />

71<br />

72<br />

73<br />

74<br />

75<br />

76<br />

77<br />

78<br />

79<br />

80<br />

81<br />

82<br />

83<br />

84<br />

85<br />

86<br />

87<br />

88<br />

89<br />

90<br />

91<br />

92<br />

93<br />

94<br />

Emerging and<br />

Developing Asia<br />

Latin America<br />

and the Caribbean<br />

95<br />

96<br />

97<br />

98<br />

99<br />

100<br />

101<br />

102<br />

103<br />

104<br />

105<br />

106<br />

107<br />

108<br />

109<br />

110<br />

111<br />

112<br />

113<br />

114<br />

115<br />

116<br />

117<br />

118<br />

119<br />

120<br />

121<br />

122<br />

123<br />

124<br />

125<br />

126<br />

127<br />

128<br />

129<br />

130<br />

131<br />

132<br />

133<br />

134<br />

135<br />

136<br />

137<br />

138<br />

139<br />

140<br />

Commonwealth of<br />

Independent States<br />

Emerging and<br />

Developing Europe<br />

Sub-Saharan<br />

Africa<br />

Credit: © <strong>2016</strong> World Economic Forum