Cybersecurity Market Review

2elXGia

2elXGia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

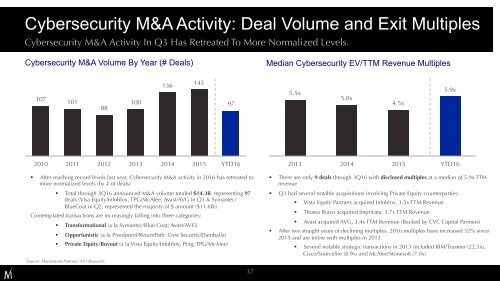

<strong>Cybersecurity</strong> M&A Activity: Deal Volume and Exit Multiples<br />

<strong>Cybersecurity</strong> M&A Activity In Q3 Has Retreated To More Normalized Levels.<br />

<strong>Cybersecurity</strong> M&A Volume By Year (# Deals)<br />

Median <strong>Cybersecurity</strong> EV/TTM Revenue Multiples<br />

107<br />

101<br />

88<br />

100<br />

136<br />

143<br />

97<br />

5.5x<br />

5.0x<br />

4.5x<br />

5.9x<br />

§<br />

2010 2011 2012 2013 2014 2015 YTD16<br />

After reaching record levels last year, <strong>Cybersecurity</strong> M&A activity in 2016 has retreated to<br />

more normalized levels (by # of deals)<br />

§ Total through 3Q16 announced M&A volume totaled $14.3B, representing 97<br />

deals (Visa Equity/Infoblox, TPG/McAfee, Avast/AVG in Q3 & Symantec/<br />

BlueCoat in Q2, represented the majority of $ amount ($11.6B))<br />

Contemplated transactions are increasingly falling into three categories:<br />

§<br />

§<br />

§<br />

Transformational (a la Symantec/Blue Coat; Avast/AVG)<br />

Opportunistic (a la Proofpoint/ReturnPath; Core Security/Damballa)<br />

Private Equity/Buyout (a la Vista Equity/Infoblox, Ping; TPG/McAfee)<br />

Source: Momentum Partners, 451 Research.<br />

37<br />

§<br />

§<br />

§<br />

2013 2014 2015 YTD16<br />

There are only 9 deals through 3Q16 with disclosed multiples at a median of 5.9x TTM<br />

revenue<br />

Q3 had several notable acquisitions involving Private Equity counterparties:<br />

§<br />

§<br />

§<br />

Vista Equity Partners acquired Infoblox, 3.5x TTM Revenue<br />

Thoma Bravo acquired Imprivata, 3.7x TTM Revenue<br />

Avast acquired AVG, 3.4x TTM Revenue (Backed by CVC Capital Partners)<br />

After two straight years of declining multiples, 2016 multiples have increased 32% since<br />

2015 and are inline with multiples in 2013<br />

§<br />

Several notable strategic transactions in 2013 included IBM/Trusteer (22.5x),<br />

Cisco/Sourcefire (8.9x) and McAfee/Stonesoft (7.0x)