Cybersecurity Market Review

2elXGia

2elXGia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

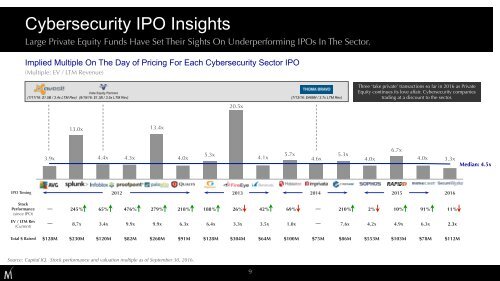

<strong>Cybersecurity</strong> IPO Insights<br />

Large Private Equity Funds Have Set Their Sights On Underperforming IPOs In The Sector.<br />

Implied Multiple On The Day of Pricing For Each <strong>Cybersecurity</strong> Sector IPO<br />

(Multiple: EV / LTM Revenue)<br />

(7/17/16: $1.5B / 3.4x LTM Rev) (9/19/16: $1.3B / 3.5x LTM Rev) (7/13/16: $488M / 3.7x LTM Rev)<br />

20.5x<br />

Three ‘take private’ transactions so far in 2016 as Private<br />

Equity continues its love affair. <strong>Cybersecurity</strong> companies<br />

trading at a discount to the sector.<br />

13.0x<br />

13.4x<br />

3.9x<br />

4.4x 4.3x<br />

4.0x<br />

5.3x<br />

4.1x<br />

5.7x<br />

4.6x<br />

5.3x<br />

4.0x<br />

6.7x<br />

4.0x 3.3x<br />

Median: 4.5x<br />

IPO Timing 2012 2013 2014 2015 2016<br />

Stock<br />

Performance<br />

(since IPO)<br />

EV / LTM Rev<br />

(Current)<br />

─ 245% 65% 476% 279% 218% 188%* 26% 42% 69% ─ 210% 2% 10% 91% 11%<br />

─ 8.7x 3.4x 9.9x 9.9x 6.3x 6.4x 3.3x 3.5x 1.0x ─ 7.6x 4.2x 4.9x 6.3x 2.3x<br />

Total $ Raised $128M $230M $120M $82M $260M $91M $128M $304M $64M $100M $75M $86M $553M $103M $78M $112M<br />

Source: Capital IQ. Stock performance and valuation multiple as of September 30, 2016.<br />

9